Bitcoin benefits from spec rallies across the space

BTC Bitcoin Price, Bitcoin Price Risk Analysis

(Previous week in brackets)

| BITCOIN BTC/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 47,658 (42,706) |

||||||

| Trend | ↑ (↑) | ↓ (↓) | ↑ (↑) | |||

| % Risk Weight |

63 (60) | 73 (74) | 60 (42) | |||

| Allocation Limit(0%) | Invested | 0% (0%) | ||||

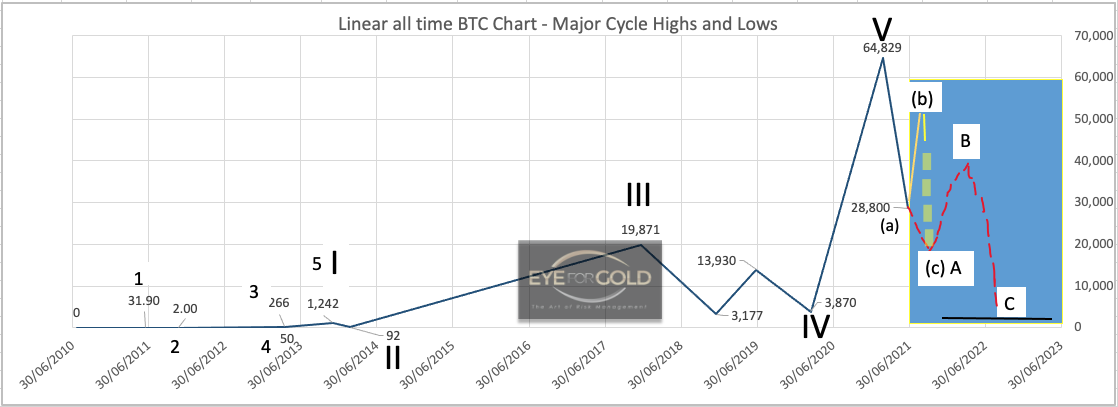

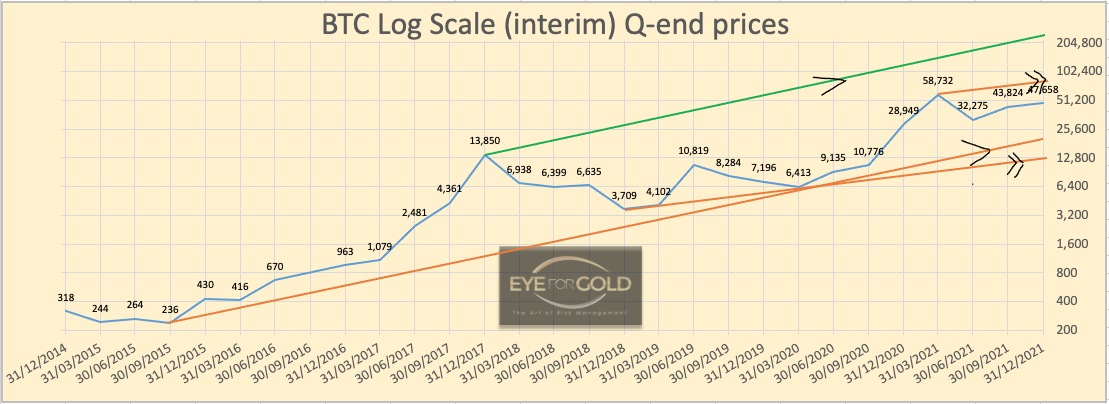

02 October close: Bitoin rallied strongly into the weekend from the early week lows and at the same time piushing risk weight higher. Technically this move doesn't look finished. Although many peer currencies have performed well following the BTC lead, the rally is clearly an attempt to build trust in making new highs. On the long term log scale charts price is just sitting in the middle of a range and must still be considered high risk unless the May high is taken out. That would require another 30% up from the current BTC level and a tall order. Given that sports betting annually has a 1.7 Trillion! footing, the established blockchain and general crypto industry will attract a much larger interest keeping this market very much alive. Yet it does not tell anything about price performance, although some crypto's will benefit from guaranteed many more quantum leaps in technology applications. Market prediction range from anywhere higher than the current level to a very bold 1 million dollar value for Bitcoin. The narrative for any of these predictions cannot easily be played down given past performance, but pure speculative tulip bulb type markets should be approached with care and only with funds that can be fully drowned and without really harming the original wealth position.

25 September close: Bitcoin lost ground during the week following a series of published events and primarily China related. The drop came on Monday and Tuesday taking the market along with it from $48k to $40k. From Wednesday we saw some recovery but inconclusive. BTC will need to either make serious attempts to advance to new highs or suffer as markets always do if holding an asset no longer pays off for investors. The risk is that a push well below 40k brings the most recent major low of 29k into the picture again. Short ter risk weight (Daily) and Medium term (weekly) look weakish with Monthly fairly neutral. Being long is a big bet that we aren't willing to take simply because BTC isn't a penny asset anymore. The price of Bitcoin in particular represents a level that simulates a fiat currency system down the tube and out of control. We don't think that is going happen yet.

What may happen is Bitcoin losing substantial share against other defi and general crypto industry tokens representing a technological paradigm shift. I.e maybe Bitcoin, which has been the lead crypto in mainstream media, has just gone too far too fast. Who's to tell?

Bitpanda Pro - BEST Token Price Risk Analysis

(Previous week in brackets)

| Bitpanda - BEST/EUR | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 0.7450 (0.7128) | ||||||

| Trend | ↑ (↓) | ↑ (↓) | ↑ (↑) | |||

| % Risk Weight |

28 (28) | 38 (37) | 65 (36) | |||

| Allocation Limit(variable) | Invested | 100% (100%) | ||||

BEST token live price

Bitpanda BEST analysis

01 October 2021 close: Our BEST allocation was initiated in 2019 and has thusfar outperformed Bitcoin during the period middle of 2019 to date. This allocation, as discussed before, is a calculated risk position based on the attractive terms offered by a fast growing real business that now starts to develop more critical mass with 3million+ accounts. Whilst the Bitpanda broker still rules pricing they seem to have a very responsible approach to bid - offer pricing whilst having to deal with certain irratic volume trades from larger participants. BEST this week, for the first time in many months, has started to come away from recent depths but hasn't yet made the kick start catch up rally that we expect to happen with or without a broader crypto market rally. A quick move above 1 Euro is now more likely. The European Bitpanda exchange is probably the most secure regulated entity in the crypto space as we believe that regulated more centralized use of crypto trading is the direction that authorities can best live with. Authorities are greatly concerned with the decentralized nature of certain exchanges and crypto products with still uncontrollable AML risk as well as general retail risk management concerns. We do not necessarily endorse how authorities behave, but it is the direction we think is the safest to follow. Many crypto's, away from the primary currencies like BTC, ETH and LTC look to potentially very strong. BEST is just one of them and also offers a unique incentive with lower cost trading and monthly rewards allowing to build a larger diversified porfolio. Bitpanda has voiced in various comments this year that the strategy is to build mass market API's allowing traditional financial service companies, like banks, to offer local customers all the benefits from a large range of new application without having to go it alone based on too little knowledge and experience. We are very much aware that a complete crypto crash is also possible before these new asset classes find a natural financial equilibrium. No Change.

25 September 2021 close: BEST did slightly better last week relative to the broader market for the first time in 5 months. A relative recovery phase could develop lifting the price by some 20 or so percent relative to BTC.

Our full position is a 'hold' waiting for an opportunity to add crypto tokens to the portfolio if the market decides to seek new lows. That isn't happening yet whilst our broader technical indicators still signal potential weakness ahead.

Monthly trend is still down, Weekly risk weight looks fairly undecided and could easily fill another price low with bullish divergence, Daily risk very similar to Weekly, yet the broader crypto market could also edge up again and making new quarterly highs. A chart of total market cap actually looks a lot weaker and it is undeniable that there is serious hidden risk as so profoundly mentioned by Michael Burry (Youtube link), whilst many many other influencer names like Simon Dixon, Michael Saylor, Raoul Pal, Max Keiser, Cathy Wood and many other make the same profound opposite calls all of which are widely featured on Youtube as well.

Just in the last few days we have witnessed that some of the more popular altcoins have lost some of the ground that was gained earlier.

If Michael Burry is right, and if so after a long wait, one needs the insurance of owning precious metals as well.

S&P, Stock Indices, Equities, High Risk, No Limits

S&P 500 Standard & Poor's 500 Price Risk Analysis Forecast

(Previous week in brackets)

| Standard & Poor 500 | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 4360 (4464) | ||||||

| Trend | ↓ (↓) | ↓ (↓) | ↓ (↑) | |||

| % Risk Weight |

95 (97) | 65 (80) | 25 (40) | |||

| Max Allocation 20% (20%) | Invested | 0% (0%) | ||||

01 October 2021 close: Broad equity markets as they very much aligh with the S&P index remain high risk. If long term risk decides it is time to take on the new direction for a longer period there will probably be a non-proportional shakeout. We are still not willing to assume that great a risk if lower short term risk, as is the case today, has proven to be a 'Buy The Dip' event during the past 3 years.

24 September 2021 close: The S&P fully recovered from an early loss on Monday pushing the index down to 4300 and ending the week 1% higher at 4464. Because Medium and Long term risk weight remain very high risk we cannot recommend a major hold. For the record, we've be out of this market since late 2018 and clearly lost opportunity. The only safe wealth management markets right now are Precious metals and some Crypto, besides some of the major monopoly names also in Nasdaq, some of whom do not meet the integrity conditions we would favor. In other words, it is not just about money or ROI, but enjoying markets whilst trying to preserve the value of one's assets at the same time.

17 September 2021 close: The risk weight distribution across the different time scales, daily | weekly | monthly, is showing continued high risk even though short term risk weight is obviously running down into lower risk territory, which typically leads to a BTFD scenario. Unfortunately and despite having been proven 'way too early' that higher long term and medium term risk is unacceptable as a wealth preservation strategy. Besides continued geo political tensions and growing public distrust in a system of crony politics, the financial markets can and probably will react in a very negative way if the World Ecomic Forum decides that change is necessary. That will already be too late and we can see equity markets losing much of its value in a short period of time. Risk is high hence No Change.