Bipanda crypto exchange makes important announcement | Token space outlook uncertain | 13 Dec

BTC Bitcoin Price, Bitcoin Price Risk Analysis

(Previous week in brackets)

| BITCOIN BTC/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 48,200 (49,747) |

||||||

| Trend | ↑ (↑) | ↓ (↓) | ↑ (↓) | |||

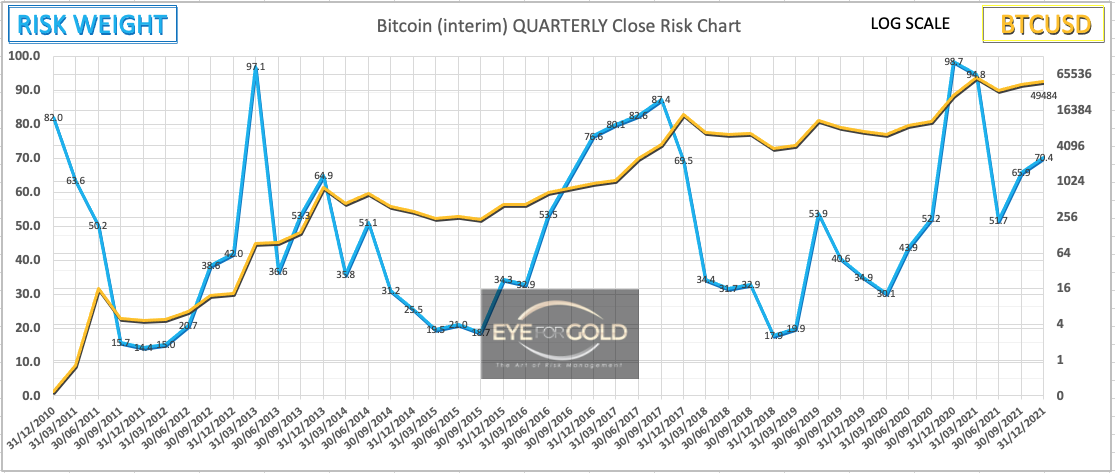

| % Risk Weight |

77 (77) | 40 (60) | 38 (36) | |||

| Allocation Limit(0%) | Invested | 0% (0%) | ||||

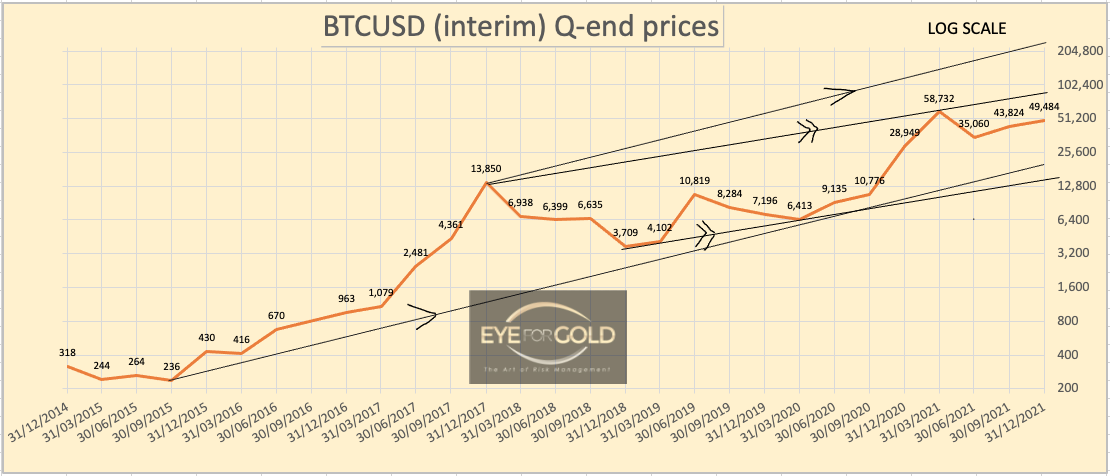

13 December 2020 close: Bitcoin remains high risk based on the Long term risk picture whereas Monthly risk show bearish divergence and quarterly turning down. There could be a battle of giants in the making or going on in this space. Shouldn't we be at 150k or higher at this moment according to so many influencers? Applying same technical to Total Market Cap shows a very similar picture which means that the BTC Beta to total is very much in play and still indicative of a more speculative participant attitude towards the crypto space as a whole. BTC risk weight indicates potential contrarian price development against influencer narrative. Longs, stay very alert or rather be sidelined.

See Major BITPANDA CRYPTO EXCHANGE ANNOUNCEMENT BELOW

06/12: 05 December 2020 close: Bitcoin stats are absolutely fascinating:

- $100 invested in 2010 at $0.10 (BTC 1,000) and held to date yields a whopping 10.20% per month which is the equivalent of 229+% per annum

- $100 in 2010 values at $ 49,000,000 on Dec 5 2021

Many early adopters have invested a lot more and wisely collected some significant profits along the way. They are safe having created generational wealth.

The narrative around El Salvador with its Bitcoin legal tender and Vulcano bond is pretty determined and lead by Max Keiser/Stacy Herbert & Friends. All very bright people that may be right in this respect.

And just maybe, this tiny state, with 0.02% of world GDP will become the trigger for global Bitcoin adoption. But what if they are wrong? which is why they also own gold and silver etc. They are safe, remember. Average Joe isn't safe but they love the gamble, until maybe they don't anymore. Late adopters that have come in with corporate cash pushing this asset higher and higher may also experience a very serious setback. And since the advance rate of Bitcoin is slowing who knows what will happen.

During a single hour around midnight New York time on Dec 4 Bitcoin crashed taking almost all crypto tokens along with it with an average peak to bottom drop of 22%. Looking at volume the big seller probably released somewhere between 4,000 and 5,000 BTC which is ginormous at that very early Saturday morning hour. A few hours later El Salvador announces the purchase of 150 Bitcoin. Wow! It could have been a manipulated move as well and if it was... pretty irresponsible vis a vis the community. Total crypto market cap is down 10% since Friday evening having recovered from down 22% at the bottom.

Since nobody really knows what will happen to the Bitcoin price looking marginally forward, except for a happy few :), we can but look at long term technical indicators and as so many millions of people around the globe have now taken the Bitcoin gamble, BTC price is more likely to respond to momentum and relative strength type technical indicators.

Fundamentally we happen to be more in the Michael Burry camp as there is a real risk that Bitcoin and a few other major crypto currencies will correct substantially for whatever valid reason, with the benefit of hindsight of course.

Technically the charts below say 'risk should be off ' for late adopters whilst we stick, for now, with our strong corrective and possible ABC scenario.

Bitpanda Pro - BEST Token Price Risk Analysis | 13 Dec

(Previous week in brackets)

| Bitpanda - BEST/EUR | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 0.9200 (0,9000) | ||||||

| Trend | ↑ (↑) | ↑ (↓) | ↑ (↓) | |||

| % Risk Weight |

33 (30) | 55 (62) | 62 (22) | |||

| Allocation Limit(variable) | Invested | 100% (100%) | ||||

Bitpanda BEST analysis

13 Dec 2021 close: Today Bitpanda has come with a major and eagerly awaited announcement.

The introduction of BEST 2 point zero.

Read the Bitpanda announcement here: https://blog.bitpanda.com/en/introducing-best-20-best-way-get-most-out-bitpanda

- Bitpanda will soon introduce the token launch platform. This is very big news for the European investment community as it facilitates a low cost fundraising and stakeholder opportunity for many small to medium sized crypto related businesses.

All BEST token holders, from as little as 10 BEST will receive a minimum reward of 0.10% per week. - There will be 5 BEST levels from the current 3 with the highest level 3 reduced from BEST 500,000 to the new level 5 = 50,000. A huge incentive for many account holders.

- The total maximum cash benefit with maximum loyalty (= compound return by holding BEST without selling) is raised from 12 to 15% per annum and depends on the amount of BEST tokens held in secure wallet and the total trading volume in the account each week.

- From Jan 1, 2022, the reward programme will be available on a weekly basis rather than the present monthly reward, again based on the amount of BEST held at the close of the previous week. This should increase and smooth liquidity for trading BEST via Bitpanda PRO.

- Finally and equally interesting is Bitpanda’s proposal to burn an additional 50% of BEST tokens up to a total of 750,000,000 from the previous 500,000,000 BEST. We expect this to eventually provide strong long term price support.

BEST has performed relatively well following this announcement and we now need to be patient for the market to fully appreciate this potential value booster. This means BEST could or rather should perform (very) well relative to the broader crypto space. This announcement should boost the rate of inflow of new accounts.

06/12: 05 Dec 2021 close: BEST to a slightly smaller dive at the weekend but with more follow through on Monday whilst BTC recovered towards $49k.

We are following our technical picture having allocated idle cash for possible re-investment in different crypto at much lower levels. Some of the more interesting startup tokens lost as much as 40% during the weekend crash and they are too young still for individual technical analysis. Litecoin for example lost 44% peak to bottom last week and still down 32% at this moment.

BEST, or rather Bitpanda, also triggers attraction as we can swiftly move between different asset classes and especially the precious metals space which gives much comfort and even a lot less price volatility. If the crypto market suffers a serious blow in the coming year we would expect precious metals to be the ultimate safehaven. The Gold to Bitcoin ratio as shown on this page indicates a very potential longer term correction in favor of Gold with a few weekend gaps yet to be filled at much higher ratio prices.