Further Bitcoin and peer corrections remain high risk | 14 July

BTC Bitcoin Price, Bitcoin Price Risk Analysis

(Previous week in brackets)

| BITCOIN BTC/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 32,840 (34,682) |

||||||

| Trend | ↓ (↓) | ↓ (↓) | ↓ (↑) | |||

| % Risk Weight |

54 (55) | 15 (17) | 25 (70) | |||

| Allocation Limit(0%) | Invested | 0% (0%) | ||||

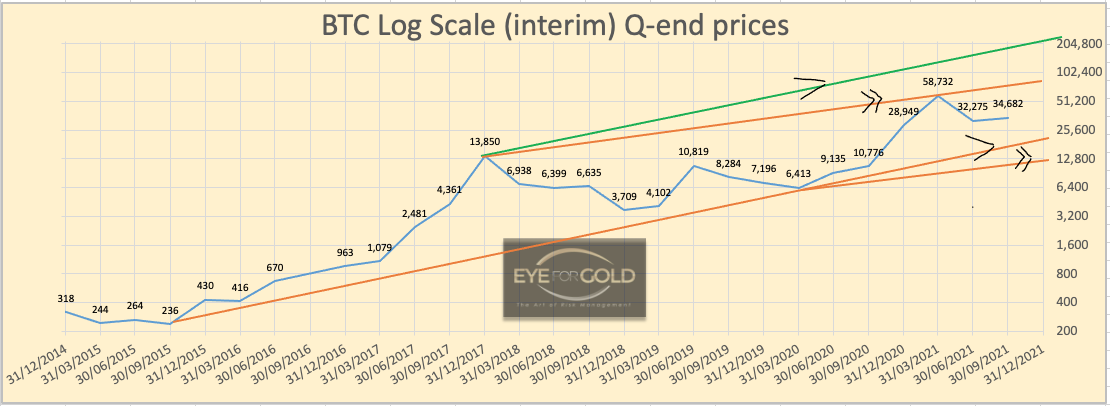

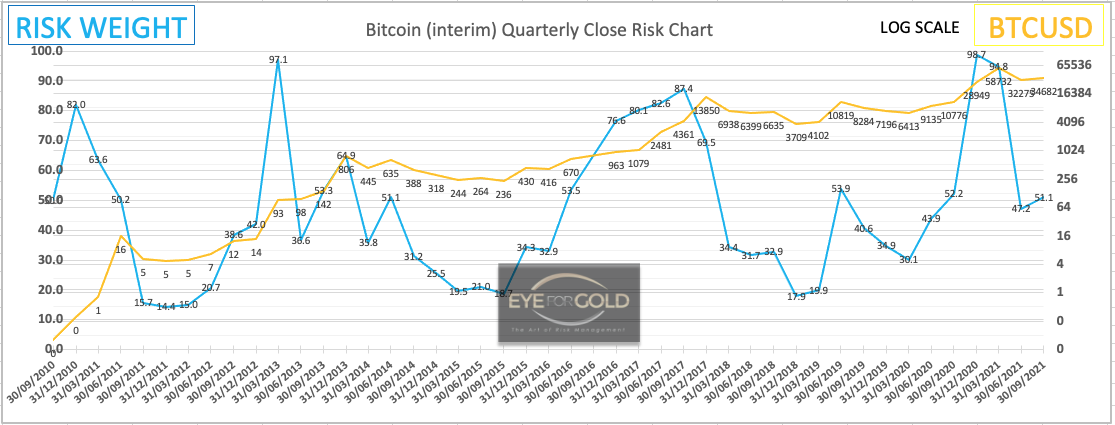

14 July print: The broad narrative on BTC remains fairly bullish whilst we see no technical evidence of this. This means the narrative is a lot more speculative with a great deal of wishful thinking going on. Major trends are clearly down across the broader range of crypto's. Risk of downside acceleration exists as long as monthly risk weight is in a strong downtrend. Most crypto's show a similar long term pattern many following BTC hour by hour. On the basis of current trend signals, many cryptos may still erase another 25 to 50% from current levels. The highest risk is not knowing, with a wide margin of error, where these markets eventually bottom and early bottom picking. Crypto markets feel like this is going on right now which typically leads to a high degree of unease amongst speculators. Staying sidelined would be the safer coursed of action. Limited risk chart updates during holidays. No change.

3 July close: The most relevant chart patterns for Bitcoin at the start of Q3 is a continuation of a stong Monthly downtrend and Daily risk quickly moving into 70% risk on a relatively small rally.

Not sure whether this is on purpose, probably, but this well known and easily recognized suit belonging to one of the most brilliant financial market entertainers and a huge BTC supporter has been wearing the Bitcoin Broche upside down since a few weeks. That says it all. Some Crypto whales say technicals don't matter in Bitcoin or crypto. Well, maybe not until they do and not just with hindsight, technical tools when applied within a proper financial risk management approach do tell a major story. The title is 'BE CAREFUL' Some people will be right and most will be wrong, as always. Right now risk remains high until some of these crypto markets really signal a bottom. As avoiding risk is in our system at least, Bitcoin doesn't look attractive. We shouldn't listen to screamers telling us why Bitcoin is digital gold. Because it isn't. It's Bitcoin and yes maybe it will go to 220k or much higher. The quantum leap that crypto devs are driving though is extremely exciting and will lead to many new solutions, but 'the powers that be' will eventually determine the outcome and what is accepted. No point speculating on the ultimate solution or what is a hype and what is not. This is one financial market that, right now, still looks high risk. It did that already in January 2021 and pushed through the roof during Q1. Huge gains have been made and partly lost again. Some lost their shirt in the recent correction or are about to. Bitcoin was a bubble in Q1 and corrected 55% thusfar currently at -48%. Someone bought that top and Bitcoin traded above 60,000 for 5 consecutive days and another few weeks above $55,000. If this is the Columbus Egg, why scream it off rooftops? Why? Whales make more money that way and that is the ONLY reason. Tghe idea of owning a basket of startup tokens with great potential makes total sense though and Bitcoin surely can have a slice of that pie, but when greed rises beyond belief something will give. 'BE CAREFUL'

Not sure whether this is on purpose, probably, but this well known and easily recognized suit belonging to one of the most brilliant financial market entertainers and a huge BTC supporter has been wearing the Bitcoin Broche upside down since a few weeks. That says it all. Some Crypto whales say technicals don't matter in Bitcoin or crypto. Well, maybe not until they do and not just with hindsight, technical tools when applied within a proper financial risk management approach do tell a major story. The title is 'BE CAREFUL' Some people will be right and most will be wrong, as always. Right now risk remains high until some of these crypto markets really signal a bottom. As avoiding risk is in our system at least, Bitcoin doesn't look attractive. We shouldn't listen to screamers telling us why Bitcoin is digital gold. Because it isn't. It's Bitcoin and yes maybe it will go to 220k or much higher. The quantum leap that crypto devs are driving though is extremely exciting and will lead to many new solutions, but 'the powers that be' will eventually determine the outcome and what is accepted. No point speculating on the ultimate solution or what is a hype and what is not. This is one financial market that, right now, still looks high risk. It did that already in January 2021 and pushed through the roof during Q1. Huge gains have been made and partly lost again. Some lost their shirt in the recent correction or are about to. Bitcoin was a bubble in Q1 and corrected 55% thusfar currently at -48%. Someone bought that top and Bitcoin traded above 60,000 for 5 consecutive days and another few weeks above $55,000. If this is the Columbus Egg, why scream it off rooftops? Why? Whales make more money that way and that is the ONLY reason. Tghe idea of owning a basket of startup tokens with great potential makes total sense though and Bitcoin surely can have a slice of that pie, but when greed rises beyond belief something will give. 'BE CAREFUL'

Bitpanda Pro - BEST Token Price Risk Analysis

(Previous week in brackets)

| Bitpanda - BEST/EUR | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 0.8719 (0.8875) | ||||||

| Trend | ↓ (↓) | ↓ (↓) | ↓ (↑) | |||

| % Risk Weight |

59 (58) | 15 (16) | 23 (28) | |||

| Allocation Limit(variable) | Invested | 100% (100%) | ||||

BEST token live price

Bitpanda BEST analysis

14 July 2021: BEST looks equally weak and seems to have suffered from an exit by a few larger early investors in what is generally a fairly thin market and giving the Bitpanda broker a reason to lower bids for larger trades. BEST has now lost 70% from its peak and may lose substantially more of pressure persists. A BTC average majorf correction of close to 90% is not an unlikely scenario. We would be looking to re-invest free credit in BEST and other tokens on our market watch list at (much) lower levels if reached. Otherwise no change to our basic strategy of running the BEST portfolio for its monthly rewards. We believe Bitpanda and BEST can benefit from central banks and government authorities leaning towards more regulation in this industry.

No Change.

03 July 2021: Bitpanda's BEST is no different than Bitcoin when it comes to managing financial risk. Our portfolio has suffered but risk has been reduced to subzero, which allows taking a wider view to other potential crypto investment vehicles. Our existing portfolio earns a monthly reward which is guided every month towards still very low inflation fiat to be either re-invested or distributed. At the same time we are slowly building a small portfolio of high potential altcoins and native tokens from our watchlist and beyond representing some of the early and more recent crypto startups. Cross border exchange and Defi related products are on our watchlist. All investments will be small enough to never drive high risk wealth depreciation. Precious metals however remain our core protection at 50%. For now. No Change.

Even though Bitpanda, like many of their peers, seems to have experienced growth pains and an apparent slowdown of some early promise high potential business development products, the Bitpanda exchange's technical features and mobile usability seem to be working very well and we look forward to some interesting company news in coming months.

S&P, Stock Indices, Equities, High Risk, No Limits

S&P 500 Standard & Poor's 500 Price Risk Analysis Forecast

(Previous week in brackets)

| Standard & Poor 500 | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 4376 (4350) | ||||||

| Trend | ↑ (↑) | ↑ (↑) | ↓ (↑) | |||

| % Risk Weight |

98 (99) | 96 (91) | 90 (98) | |||

| Max Allocation 20% (20%) | Invested | 0% (0%) | ||||

14 July 2021 close: The S&P 500 index and other global equity markets simply remain beyond any realistic market expectation.

As major central banks seem to have found enough excuse to keep rates down, since they have no administrative choice, equities may just continue higher, yet showing the highest possible caution scenario. Happy to not participate and having lost an opportunity for nothing more than a reasonable financial gain if managed to run the course and get out in time. Few professional, let alone ordinary, investors people can achieve this under the weight of many different influencer opinions. No Change.

02 July 2021 close: We would never invest at risk levels that are beyond imagination. We are out for 3 years come October. Did we lose a massive opportunity. You bet! Did we lose sleep over it. Not a second. Do equity markets signal any change to the near perpetual high risk situation. No, they don't. Investors that can hold out till they die are best enjoying life and not worry about opportunities lost. The world wide response to and effects of Covid-19 certainly should have taught us something.

Having said this; next week We will remove S&P from our comment list until further notice. Our risk analysis model is unlikely to change until something triggers the unavoidable. What goes up, comes down.

25 June 2021 close: The bullish short term divergence (Daily vs Weekly) last week pushed the market back up as it has done for the past 2 years. We are back in high risk mode for all timescales at this week's close. Interim Monthly risk weight trend did turn back up with 4 days to go till end of June. Next week's update will show a fresh monthly direction. No Change and staying away from this equity index.