Crypto Market Cap down 15% in 3.5 hours | 18 April

BTC Bitcoin Price, Bitcoin Price Risk Analysis

(Previous week in brackets)

| BITCOIN BTC/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 60,059 (59,812) |

||||||

| Trend | ↑ (↑) | ↓ (↑) | ↓ (↑) | |||

| % Risk Weight |

84 (86) | 86 (88) | 69 (71) | |||

| Allocation Limit(0%) | Invested | 0% (0%) | ||||

18 April: In the red-eye hours of Sunday 18 April Crypto lost some 15% in a matter of hours. Bitcoin fell from 60k to $50,700 and is consolidating around 55k at time of writing. This is the 2nd largest nominal Bitcoin price drop. #1 was on 22 Febr, 2021 with 11k, and the #3 correction was 11 Jan 2021 with an 8k drop peak to bottom.

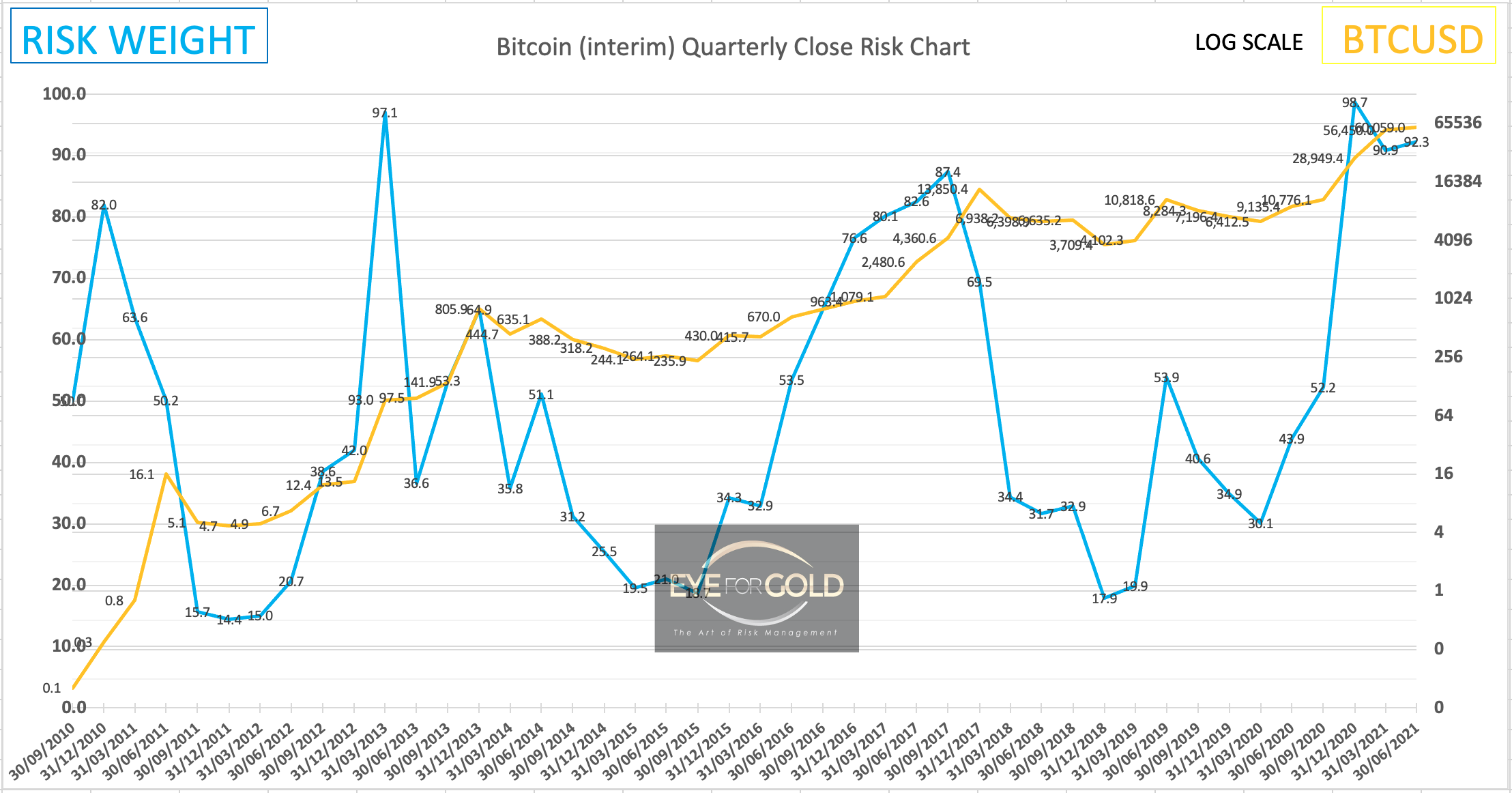

This sharp Bitcoin correction came with large volume trades and a quick observation learns that it may be one leg of a multi billion dollar swap from BTC to Ethereum and further smaller diversification. Sounds like a smart move and insiders will hopefully find the players behind it. Could even be concerted action. This shows the enormous price risk for especially smaller speculators. Those first time buyers for instance who bought at 64,000 of which there are quite a few. A strong correction healthy development in many respects. The Quarterly charts below show the interim Risk weight level with just 7 hours difference and could become a late bearish divergence chart pattern. We are in a short term downtrend that could turn into a longer term correction.

The size of the correction could be anything from the present (64,896-50,700)/64,896 = 21.9% to the kind of Bitcoin/USD corrections we saw in 2011, 2014, 2017 and 2019 which were all between 72% and 94%. These high volatility moves should already be rare with a mature asset like Bitcoin but it isn't and shows why markets that are psychologically strongly hyped by an ever increasing number of hyperwealthy influencers should be treated with respect and much care.

Today we are still happy not to participate. But we do love crypto and the quantum leap that Fintech offers for broader investment opportunities. We prefer to stick to placements with pan investment related industries. COINBASE may well be one of those in the near future just like our Bitpanda portfolio below.

As we mentioned in our Gold update yesterday, this shaky Crypto move today is very well timed with this BTC-Gold debate between Michael Saylor and Frank Guistra coming up on Wednesday 21 April via Stansberry Research. Looking forward to that although it is unlikely to impact our wealth preservation approach.

Where the Bitcoin herd buys into a strong inflation related narrative, without any element of greed of courser, Gold will catch up at some point. Where Bitcoin is a big bet with massive, yet decreasing, short term fiat currency profit potential, Gold is much less of a bet when it comes to finding equilibrium again. A huge switch from Crypto (Bitcoin) to Gold and Silver is maybe not imminent yet, but 'when', not 'if' it happens the move in favor of precious metals will be huge. Copper should continue to appreciate strongly. Not our play but we could see another 100% advance within 2 years.

If today's move proves to have been part of a single large swap the market is likely to remain more volatile for some time as others will follow in coming days and weeks even. If prices remain suppressed Gold and other metals are likely to benefit on Monday morning already.

No Change.

10 April close: Bitcoin closed 5% higher on the week, which is a solid but not spectacular performance. New wave online products and Crypto have become a serious billionaires led industry where early (2011-2015) Bitcoin brilliance has already created enormous wealth for many and continues to do so today. The whales will not have a problem when the bubble bursts as they will be sufficiently diversified. The danger comes for millennials and many much older late adopters who are not otherwise diversified and protected with precious metals and a few more different commodities with a strong future. Crypto in Q1 and especially from March into April has shown explosive value enhancement with many fast growing tokens and altcoins performing in the >100% return category.

Crypto investment can be managed very profitably if greed remains in the background. This is very difficult however and at some point there will be competition as to who is first to unload. There doesn't appear to be any risk at this moment, at least not for Bitcoin as it is a trillion $ market, but one day someone with a very large position may want to switch some into fiat or another asset class. Right now, most non productive financial assets are changing hands at ever higher prices. Believe it or not, but this is 'Tulip Mania' and it will last until it doesn't anymore. Since Q3 2020 millions of new crypto exchange accounts are being opened every quarter worldwide and the direction is clear. UP and only UP as everyone starts buying into the whole spectrum of hot tokens . ..... Until the music stops. The message is simply don't be too greedy, take enough off the table and own some gold. Bitcoin remains much higher risk in our view than some of the newer coins based on a strong product led business. No Change.

Bitpanda Pro - BEST Token Price Risk Analysis

(Previous week in brackets)

| Bitpanda - BEST/EUR | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 2.1419 (1.7137) ↑ 25% |

||||||

| Trend | ↓ (↓) | ↓ (↓) | ↓ (↑) | |||

| % Risk Weight |

80 (82) | 80 (88) | 78 (53) | |||

| Allocation Limit(variable) | Invested | 100% (100%) | ||||

BEST token live price

Bitpanda BEST analysis 18 April

Last week was another top performer with a 30% advance to peak at €2.2490 finally closing 25% higher at €2.1490. Today's broad crypto market correction in the early hours did trigger a few large sales of BEST taking it down under €2.00 again, briefly touching 1.60 even and followed by a quick spike above €2.00 again. Bitpanda's Ecosystem token remains our favorite in this crypto space and we will stay with our full initial position looking to possibly add if the market drops towards €1.50 again. This is not just an early investor strategy and should work well if our short term technical indicators show low risk weight and bullish divergence vs long term. Technical tools, if applied conservatively, do work with many crypto tokens but only with long trades. BEST trading rewards were executed against fiat last week well above €2,00 and that is now the 'best' protection strategy for long term investors. The option is to reinvest the monthly rewards at choice or await new opportunity. We are likely to slowly increase our precious metals portfolio further.

Eagerly awaiting the Bitpanda announcements regarding fractional stock trading, a token development platform and multi exchange arbitrage possibility perhaps, any of which should take Bitpanda into the top league of a 'one stop shop' exchange.

Here too, a BEST price correction would be very healthy and offers potentially very profitable opportunities for a growing new population of BEST investors. No Change.

10 April 2021: This weeks BEST performance was pretty strong with an 8% advance. BEST by the way, since its introduction in 2019 has outperformed Bitcoin by 250% to date.

The Coinbase online IPO and Nasdaq listing will be an exciting event to watch and already seems to be driving many token prices higher. Will it be 'buy the rumour sell the fact' or an unprecedented one way street to the moon. Fact is that this event alone will create enormous (paper) wealth relative to each individual situation, directly or indirectly, for many market participants and besides the existing Coinbase shareholders who will benefit beyond imagination. BEST, being the monthly 'rewards earning' token of this rapidly growing european crypto exchange should also benefit from this listing event as did BNB already last week gaining no less than 33%.

We remain fully committed with a virtually unchanged initial holding since H2 2019. Even though Weekly and Monthly risk weight are high, Daily risk is neutral and leaning bullish again. As we have seen so many times in different asset classes the past year, some markets simply ignore gravity and we need to be aware of those dangers. No Change.

3 April 2021: Bitpanda's Eco System Token (BEST) ended Q1 in style at €1.6001 compared with €0.1733 on 31 Dec 2020. A gain of 823% and as such becoming one of the absolute top performers in the entire crypto space. It did briefly touch €2,00 during a 2 minute low volume spell but that seems like an error almost. This strong performance also enhanced influenced our overall portfolio allocation to the extend that the crypto holdings have become a majority allocation pushing the precious metals down from 50 to 35%.

During the quarter we reallocated some paper profits into several smaller positions including, Polkadot, NEM, Stellar, Pantos (Bitpanda's Blockchain interoperability development token), MIOTA ETH and AVAX. Most of these tokens can now be traded based on our Short term, Medium term and Long term tools.

BEST's strong rally has also created a rapidly increasing fiat income stream from the rewards based on monthly volume trading, varying from 0.5 to 1% per month for investors. The basic strategy has been to take some rewards off the table every month for the past year at a Euro return equivalent to the BEST price received and to continue holding the core position.

The Crypto market as a whole is still a highly speculative environment and the aim of 'EyeforGold' is to allocate funds into crypto's with a strong business formula. Bitpanda is now the largest exchange in Europe with very strong financial backing. Primary markets we follow are listed here

April should be a very interesting month with at least 2 influencer events. One is the launch of Coinbase mid April where the latest target valuation has risen from 60 Billion to over 100 Billion dollars. That is staggering and as interest in this Public offering with a direct listing. Provided the listing is SEC approved a few things can happen. Existing shareholders may sell stock and benefit from the initial opportunity. The other is a massive interest and reallocation of broader Altcoins into Coinbase. BEST tokens can certainly benefit from a successful Coinbase launch whether immediately or later in the development cycle.

The second big influencer market event is Bitpanda's launch of fractional stock trading sometime in April as announces a few weeks back and making Bitpanda one of the very few pan-investment exchanges worldwide. For now Bitpanda's exchange is only open for accounts from European passport holders who need to be fully verified.

The PANTOS token PAN has seen 2 hikes out of the blue in March resulting in a monthly gain of nearly 200%. It almost suggests that someone has a hunch. The nature of investing in PAN is to support the development program and thus speculative although Bitpanda seems to be seeking a future monetary role for PAN as an instrument used to trade across blockchains. A small low risk punt if entered at current levels around €0,25 or lower. PAN briefly touched 0,31 last week.

S&P, Stock Indices, Equities, High Risk, No Limits

S&P 500 Standard & Poor's 500 Price Risk Analysis Forecast

(Previous week in brackets)

| Standard & Poor 500 | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 4182 (4122) ↑ 1.5% |

||||||

| Trend | ↑ (↑) | ↑ (↑) | ↓ (↑) | |||

| % Risk Weight |

98 (98) | 96 (95) | 95 (98) | |||

| Max Allocation 20% (20%) | Invested | 0% (0%) | ||||

16 April 2021 close: The S&P index remains very high risk as do many or even most of the underlying stocks. Technically it looks like we are at a tipping point given the extreme high risk weight levels, but nothing should surprise us as the unlimited flow of credit still pushes many larger listed companies to execute stock buy backs. No Change.

9 April 2021 close: S&P is one of those markets, like all equity indices that defy gravity. Technical analysis Risk turns out to remain extremely high which is why we cannot participate. This doesn't apply to individual stocks like Amazon and Netflix but the picture is still difficult to accept. There is also a fundamental reason which is a low growth economy coupled with a massive money supply increase most of which has gone into non-producing financial assets like stock buy backs which benefit only very few people. Again all time frames are now in very high risk territory and the picture of late has been that only minor bullish divergence from shorter term timescales versus their longer term bro's is a reason to call another rally. The Robin Hoods of this world also put fuel on the fire and the outlook becomes truly unpredictable. With much more public engagement in financial products, serious inflation, which wasn't much an issue before with all this hot air money creation, will be coming into the picture this year. It is already in crypto, real estate and equities. No Change.

2 April 2021 close: There is no doubt that we have missed this entire market and unfortunately we are dealing with highly unusual monetary circumstances that keep moving massive amounts of dollars and equivalents into company equitiy. It is a totally free ride, yet our tools kept telling a different story. The beginning of the new month is no different. Everything is in overbought territory building another bearish divergence case in most most individual time scales. A mild short term bullish divergence between short and medium pushed S&P index prices higher by 1.6%, which in itself isn't very eventful either. It is the same with Precious metals which we own to protect, but becoming almost boring to own whilst the attention is on Crypto and with Non-Fungible tokens becoming the hottest tradeable items in the industry. Very hard to understand for most people.

An entirely new financial world is being created that has become near impossible to regulate because it takes even more years for national and international authorities like Central Banks to put all this into perspective.

As MMT is officially embraced by the power players, the outlook and timing of changes for our monetary system are impossible to predict. Our party line remains Precious Metals and the primary choice for protection whilst embracing the world of Blockchain which develops at the speed of light, with strong security and privacy protocols. It is unstoppable.

26 March 2021 close: S&P looks technically strong on Daily and Weekly charts. Risk weight has turned up and we should normally expect a new ATH the coming week. Long term risk weight is high as ever and as shorter term time scales meet up with Monthly this market is still at risk against all ods of starting a major downtrend. Equity indices simply do not offer a strong incentive. A little boring even. The broader market is supported by unlimited QE which is still the only safety net in our opinion. And that is high risk. No Change.

Brent Crude oil Brent Crude Oil Price Risk Analysis Forecast

(Previous in brackets)

| Brent | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 66.69 (63.02) | ||||||

| Trend | ↑ (↑) | ↓ (↓) | ↑ (↑) | |||

| % Risk Weight |

85 (84) | 67 (68) | 85 (42) | |||

| Allocation Limit(10%) | Invested | 0% (0%) | ||||

16 April 2021 close: The B leg of the correction up did develop appears to be well underway. The strong advance last pushed Daily risk weight into high risk range again. Not a position to even contemplate a long position again. No Change.

9 April 2021 close: The Brent Daily chart seems to develop some kind of ABC correction and may hover in a 60-70 handle range for a few weeks. There is some short and medium term upside still whilst long term Monthly risk is reaching an overbought condition. So, the bias is more towards the upside short term, but this market is now less predictable and therefore less attractive to participate. Only very clear divergence signals can trigger fresh participation. Short term tight stop trading is a better option but not for longer term risk-on participation. No Change.