Bitcoin weaker against altcoins

BTC Bitcoin Price, Bitcoin Price Risk Analysis

(Previous week in brackets)

| BITCOIN BTC/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 45,172 (49,991) |

||||||

| Trend | ↑ (↑) | ↓ (↑) | ↓ (↑) | |||

| % Risk Weight |

61 (63) | 88 (86) | 30 (76) | |||

| Allocation Limit(0%) | Invested | 0% (0%) | ||||

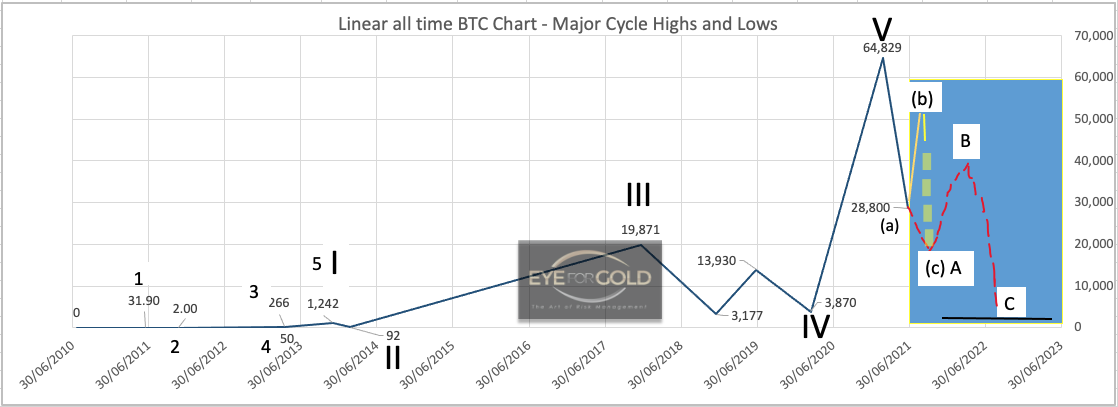

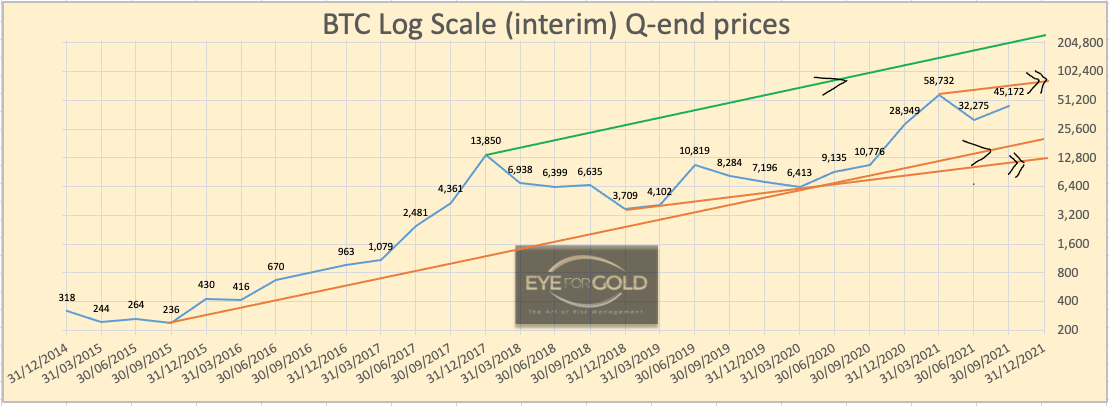

11 September close: Bitcoin fell 14% on Sept 7 taking the entire market with it, but many altcoins would even more strongly recover from their loss than BTC did. Weekly Medium term risk weight is turning every so slightly down, but at the absolute higher risk level of 88%.This is why against the many influencer calls this asset remains high risk. We again show the All Time absolute cycle trends highs and lows below indicating what we may expect. Last week's drop from $52k to $43k shows the risk environment we have to deal with as investors. The stronger Altcoins, including Ethereum Cardano and Polkadot to name a few are, and rightly so probably, being diversified into. Total Crypto Market Cap ended the week at 2.1Tup from 1.2T just one month ago, showing an incredible reslience. Yet the Medium term technicals for Total market cap also shows high risk. We will be looking to add to our crypto portfolio if the market does move in the expected direction with a much longer term period of reversals and consolidation.

04 September close: Total market Cap finished this weekend very strong approaching the all time high set in May with Bitcoin finding more competition throughout the past weeks from all of its peers. Yet 'total crypto' especially and to lesser extend Bitcoin are showing signs of potential correction wiuth risk weight moving into high risk ranges. We use a Saturday weekly cut off for practical purpose but as we publish BTC is getting close to 52k and seemingly on a roll again. Volumes are not huge which smells FOMO speculation. A new high would trigger a change of outlook which for now remains that we should expect a new low before reaching a new high. No Change

Bitpanda Pro - BEST Token Price Risk Analysis

(Previous week in brackets)

| Bitpanda - BEST/EUR | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 0.7091 (0.8250) | ||||||

| Trend | ↓ (↓) | - (↑) | ↑ (↑) | |||

| % Risk Weight |

27 (27) | 42 (42) | 4 (8) | |||

| Allocation Limit(variable) | Invested | 100% (100%) | ||||

BEST token live price

Bitpanda BEST analysis

11 September 2021 close: BEST is still under relative severe price pressure from one or two parties seeking to diversify into lower risk assets. We technical picture indicates that the elastic move as compared to many if not most altcoins will be reversed forcefully once the selling pressure dries up. As mentioned last week, this could easily be a 100-150% relative correction of ratio's or even nominal in favor of BEST if the crypto market holds its broader high level. We will be looking to add cash to this position if another shakeout opportunity arises, say if price lands between €0,30 and €0.50. This may happen more easily if the broader crypto market also suffers in coming days. Anything is possible in these markets which are also exciting in may ways. Our take is that a fully regulated crypto environment like the Bitpanda exchange is more likely to survive the day, with the knowledge that Bitpanda is working hard on industry wide centralized and decentralized market trading software solutions, just like TESLA does besides making vehicles.

04 September 2021 close: BEST is one of the very few tokens not producing a strong Beta price action. Price is down 5% whilst the total market is up some 10% last week. With over 3 million users (a 50% increase in 6 months) and a strong incentive to hold BEST we predict a very strong contra reaction (100% price increase) once the selling pressure vanishes. That would be perfectly acceptable as smaller crypto peers have already performed in that direction. The potential for this contra reaction is already visible looking at the BEST/BTC ratio which is visibly becoming low risk. But these markets can behave in a very irrational fashion whilst liquidity can be very poor at times.

Bitpanda's company valuation has increased substantially following the last round of funding led by Peter Thiels Valar ventures with other major investors involved in the deal. Pricing could go anywhere in the very short term possibly leading to a fresh opportunity to re-invest some earlier exit. Long term hold and now saving monthly rewards.

S&P, Stock Indices, Equities, High Risk, No Limits

S&P 500 Standard & Poor's 500 Price Risk Analysis Forecast

(Previous week in brackets)

| Standard & Poor 500 | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 4464 (4535) | ||||||

| Trend | ↓ (↓) | ↓ (↓) | ↓ (↓) | |||

| % Risk Weight |

97 (98) | 93 (95) | 55 (93) | |||

| Max Allocation 20% (20%) | Invested | 0% (0%) | ||||

10 September 2021 close: The strong overbough and high risk levels from last week did result in a relatively minor correction of this broader index. Experience tells that this market is likely to be boiught again on this dip although it does not change larger risk to has been around the corner for a very long time now. If the medium and long term risk weight start pushing down anything can develop and, just like crypto, the correction may be extremely nervous and troublesome for smaller investors especially. Tough market hence No Change.

03 September 2021 close: Risk weight across time scales is still at extremes which must lead to an S&P price correction which again is most likely to produce a BTFD event in the wake of continued monetary expansion. No Change in this perpetual high risk environment.