Crypto getting all the attention in a hot kitchen | 16 January

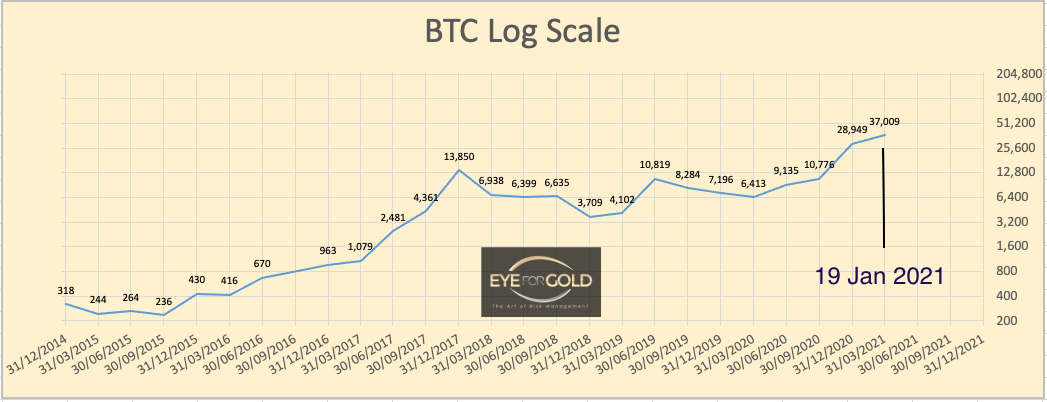

BTC Bitcoin Price, Bitcoin Price Risk Analysis

(Previous week in brackets)

| BITCOIN BTC/USD | LT-M | MT-W | ST-D | |||

|---|---|---|---|---|---|---|

| 35250 (40667) ↓ 13%! |

||||||

| Trend | ↓ (↑) | ↓ (↑) | ↓ (↓) | |||

| % Risk Weight |

94 (97) | 88 (92) | 58 (94) | |||

| Allocation Limit(0%) | Invested | 0% (0%) | ||||

16 January 2021: Standard risk analysis would have called for a continuation of the correction possibly into the low 20's (k). Intervention to prevent this purely speculative crypto currency has led to extreme volatility. Down 25%, up 30%, down 15%. The kitchen is clearly very hot fuelled by extreme bullish sounds from the biggest stakeholders. This is the kind of high risk market that leaps beyond our style. Many asset classes have risen up to a standard of behavior that has become difficult to grasp.

Observation: We have been calling for a gap fill at $2,878.50 at some point in the future. We are leaving that view even though this is a continous 24/7 market with the odd crazy print. We believe there was a clear $100+ gap that day, 5 August 2017, but it appears hard to ascertain the exact short term Bitcoin price track in the early hours of that Saturday in August 2017.

Bitcoin technical could easily call for a major drop right now as all time frames are in downtrends from extreme high risk levels. But as we have seen in recent years, those calls don't always work, hence staying away from any of that risk.

Our focus is on Bitpanda's BEST, which in our view has more solid underlying credentials and which has not even underperformed BTC much in recent months.

8 January 2021: Bitcoin lead the way from the week before Christmas into last blasting a paper return of some 92% at the peak before shading 5% to close at 40k.The high risk situation remains although we stay on full paricipation with our BEST position. The events in Washington appeared to have little bearing on markets generally. The risk for small retail investors, read speculators, is very high because they tend come in late at much elevated prices. We've read about the recent trend of larger investors moving out of slow appreciating assets like general index equities and precious metals (ETF's) into the top crypto currencies, BTC, ETH and Litecoin plus TESLA. And for one reason only; 'sky is the limit'. In order to participate in this type of market there needs to be some kind of fundamental cushion. There isn't in any of the crypto currencies except Monero perhaps. Crypto tokens that are backed by hard assets or other real financial benefits or rewards are in a different and more acceptable risk space. We saw Max Keiser being interviewed on Jan 8, who calls for BTC at $220,000 towards year end 2021. Well, draw a Bitcoin log chart and play with a few channels between lows and highs and one finds upper channel objectives of between 60,000 and 300,000. It only needs a stronger correction for that objective to become 'just a dream again'. This is why good risk management principles must be applied when getting in at elevated high risk levels, meaning only to invest funds one can afford to loose. The crypto super millionaires and billionaires did just that 5,6,7 and 8 years ago, or they still have a 1000% return even if the price drops 80%. Crypto currencies will however remain an exciting market to follow, although Bitcoin, which is slow and expensive to maintain, cannot really be used for anything other than speculation. We would expect these markets to eventually settle down with lower volatility due to increasing institutional participation. Right now the technical models cannot forecast a price or time of an intermediate peak until we get one that generates enough fear of losing. That peak may well be imminent. No Change.

Bitpanda Pro - BEST Token Price Risk Analysis

(Previous week in brackets)

| Bitpanda - BEST/EUR | LT-M | MT-W | ST-D | |||

|---|---|---|---|---|---|---|

| 0.2668 (0.2650) ↑ 0.7% |

||||||

| Trend | ↓ (↓) | ↓ (↓) | ↓ (↓) | |||

| % Risk Weight |

82 (83) | 80 (85) | 45 (78) | |||

| Allocation Limit(10%) | Invested | 100% (100%) | ||||

BEST token live price

Bitpanda BEST token

16 January 2021: In Crypto we have adopted the Week to start on Sunday in our European timezone. At weekends we observe that trading may be fairly continuous with varying volumes and often a gap of 2 or more hours on a Saturday or Sunday. BEST outperformed most of the major crypto currencies with exception of a few tokens like Polkadot, that showed an impressive advance, becoming the 4th largest MCap crypto this weekend. BEST actually has a wider interest coming up in that same blockchain net work protocol space. Being part of what may become the largest crypto exchange in Europe we are commited to this token. It is technically possible that BTC and Ethereum alike correct further into the 20,000's which could have a negative herd effect on crypto prices across the board. Irrespective of where crypto currencies halt their corrections a fresh technical oversold indication would be a strong signal to consider increasing our BEST position. No Change for now.

8 January 2021: At the 8 Jan close BEST has recorded its strongest week since the token broke its base target value of €0,0850. That was at the end of October and the BEST token followed Bitcoin and other crypto currencies with similar speed to finally explode towards a high of €0,3750 on 7 January, 350% above the level from 3 months earlier before closing its 24/7 trading session at €0,2650 on 8 Jan. A very strong performance by any standard with a first 2021 weekly advance of 53%, therewith being one of the strongest tokens in the crypto space coming into 2021. BEST offers some real tangible benefits that other tokens don't as we explained in previous updates. This makes BEST, in our opinion, a preferred and lower risk asset over BTC and other crypto currencies. We could do some simple math. BEST will eventually have a maximum 500 million tokens outstanding or 23.8 times the number of Bitcoins. BEST tokens of course do not benefit from a worldwide usage potential yet and that would bring its value down by a certain factor. Arguably, the potential must be at least 1/10 of that of Bitcoin. If BTC were to drop to €2000 ($2450) then BEST could be 2,000/10/23.8 = €8,40 or 3,170 times! its current value of €0,2650 and still offer substantially better benefits than BTC. We could do unlimited what if's with different parameters. What if BTC is $200,000 or more? The answer is impossible to predict due to the many fast moving parameters in international trading. And that is not why we are in BEST. It is because it is trust in the rapidly growing crypto powerhouse Bitpanda, becoming the leading regulated crypto exchange in Europe that is on the road to develop and deliver a range of products that create that technical quantum leap in years to come. And because we strongly believe that crypto and blockchain will by our future bread and butter of banking, investing and eventually everything else where data is being managed. Never to be reversed. No Change.

S&P 500 Standard & Poor's 500 Price Risk Analysis Forecast

(Previous week in brackets)

| Standard & Poor 500 | LT-M | MT-W | ST-D | |||

|---|---|---|---|---|---|---|

| 3762 (3817) ↓ 1.4% |

||||||

| Trend | ↑ (↑) | ↓ (↑) | ↑ (↑) | |||

| % Risk Weight |

95 (95) | 97 (98) | 78 (92) | |||

| Allocation Limit(30%) | Invested | 0% (0%) | ||||

15 January 2021: S&P closed 1.4% lower on the week. Half way January our interim Monthly risk weight is still trending up but looking vulnerable. Unfortunately this index remains high risk in our conditions for allocation. No Change.

8 January 2021: Equities continue their race to a new top every week, whilst the risk pattern hardly ever changes. Every little short term contraction is almost immediately being drawn back into line with the Long term overbought condition. It is better to be a risk averse spectator in this unprecedented financial theater. As Crypto is slowly eating into traditional asset classes, anything can happen whilst major market events typically hurt most retail investors and thus most institutional investors. No Change.

Brent Crude oil Brent Crude Oil Price Risk Analysis Forecast

(Previous in brackets)

| Brent | LT-M | MT-W | ST-D | |||

|---|---|---|---|---|---|---|

| 54.80 (56.25) ↓ 2.5% |

||||||

| Trend | ↑ (↑) | ↓ (↑) | ↓ (↑) | |||

| % Risk Weight |

59 (60) | 92 (96) | 82 (90) | |||

| Allocation Limit(10%) | Invested | 0% (0%) | ||||

15 January 2021: Brent Oil lost 2.5% for the week with Daily and Weekly risk frames turning down. Oil may be pushed a little higher again due to winter related increasing gas prices, but overall risk remains in favor of standing on the sidelines. No Change

8 January 2021: Brent up 10% in the first week of the year. A larger than expected increase based on...? From the March 2020 low Brent has risen no less than 250%. We expected this to happen and took a mangeable loss our small position at 45.00. The outlook for world economic activity, if anything, confirms the relative high risk position if our technical tools, although the Long term Monthly turned bullish in neutral territory. No Change.