Crypto trading is 99% speculative and still a fiat currency event | 27 March

BTC Bitcoin Price, Bitcoin Price Risk Analysis

(Previous week in brackets)

| BITCOIN BTC/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 56,450 (58,079) ↓ 2.8% |

||||||

| Trend | ↓ (↓) | ↑ (↑) | ↑ (↓) | |||

| % Risk Weight |

83 (85) | 87 (85) | 25 (73) | |||

| Allocation Limit(0%) | Invested | 0% (0%) | ||||

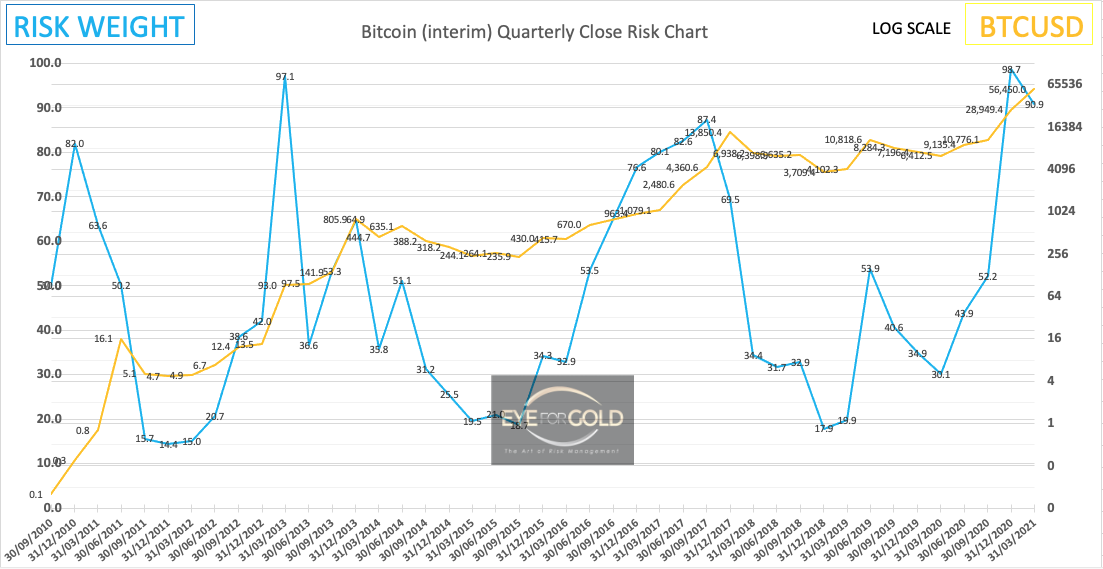

27 March 2021 close: BTC looks to be ending fairly strong this quarter and also appears to be struggling past 60k. We follow this market with great interest of course, yet all our tools still give high risk signals. Bitcoin has been leading most of the large and also smaller market cap altcoins most of the time and the current picture is quite mixed. Many new derivative blockchain techonologies are extremely exciting and there are many well funded companies creating a completely new world of banking and investing. But we have to remember that 99% of Crypto trading is purely speculative with near 100% of that trading related and referenced to legal tender fiat money. Even if Bitcoin is accepted by national authorities as money, they will always exchange immediately into their national legal tender, i.e Dollars and Euro etc. Bitcoin, in our opinion, will never be legal tender simply because it cannot be controlled even via Ethereum wrapped options, it is expensive and very slow to operate compared with SWIFT and SEPA. We follow many influencers in this space but not at all convinced by their popular narrative. Bitcoin is a rare commodity that is invisible which makes it highly speculative and cannot be an alternative to physical Gold. The good thing about Bitcoin is that is has created an enormous wealth basis for massive investment in startups creating new jobs in a rapidly developing and necessary industry. So, we only stay away from Bitcoin and concentrate on other altcoins connected to companies with very good potential.

Note: For the purpose of technical analysis we have chosen to end each week on Saturday at 24:00 hours Zurich time. Most online chart services are US based and ending the week on Sunday with weekdays ending at 24:00 in their own time zones. For the purpose of technical analysis using different time zones have near zero impact on the result, provided there is consistency.

20 March 2021 close: Bitcoin hasn't had a down month since September 2020; that's a 6 months historically long period if BTC indeed closes above 45,100 this month. Anything can happen if markets show strong signs of overbought condition. A down month is a period where the close is lower than the open. We are in a dot io bubble which probably has some way to go if retail and institutional investors apply more of a diversification strategy into non-scam well researched company tokens and altcoins. There are definitely scams out there as investors appear to just about enter any new offer without blinking twice. To concentrate on Bitcoin, as the only safe haven, which now represents about 60% of the total crypto market ca is also a potentially unhealthy situation and can prove counter productive if that market suddenly tanks and then hurts most later entries in this asset class. Having said that, BTC Daily and Weekly risk swapped places showing a potential bearish divergence in Weekly time scale if that tool turns down again. The chance of driving BTC up another 100% is possible but diminishing whilst many other tokens also offer a good or better chance to participate profitably in the parabolic rise in blockchain based market solutions for Decentralized Finance using different platforms. For now the $60,000 handle appears to be building a ceiling.

Bitpanda Pro - BEST Token Price Risk Analysis

(Previous week in brackets)

| Bitpanda - BEST/EUR | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1.1223 (0.9373) ↑ 19.7% |

||||||

| Trend | ↓ (↑) | ↑ (↑) | ↓ (↓ ) | |||

| % Risk Weight |

85 (87) | 90 (84) | 75 (85) | |||

| Allocation Limit(30%) | Invested | 100% (100%) | ||||

BEST token live price

Bitpanda BEST analysis

27 March 2021: We started our crypto journey in Q2 2019 with some friends (average investors) checking out what on earth is going on in this new paradigm shift high tech financial industry. We did dabble a bit in BTC since 2014, very small but we never understood Bitcoin. We still don't even though that hugely volatile crypto currency wasn't to be ignored. We followed the news about Bitpanda since a few years and felt there is a very good chance that this company which had been on a strong and very focussed path of development could stand out. It now seems they even have a hard time keeping up with the operational and user interface service needs of their clients. This is to be expected if annual growth exceeds 100%. The BEST token has for the first time rallied past €1.00 with a 20% weekly gain outpacing most of its peers. This week's close means a 1200% increase over launch. This weeks rapid advance was clearly fuelled by the additional $170M funding round, allowing necessary accelerated investment in human resource. The April 2021 launch of fractional stock trading will immediately make Bitpanda a key player in the European investment industry and we eagerly await that launch. Besides, Bitpanda is a profitable enterprise. The BEST monthly rewards and commission discounts are a strong incentive and are likely to attract more investors as awareness grows. As many of the most interesting crypto currencies have seen strong price rallies since Q3 2020, any price corrections which can be huge into the 60 or 70%, often become technical buys. We already see several tokens maturing and react as expected to deeper analysis using basic charting techniques. To this end, we are diversifying very slowly into a number of high potential altcoins. Our BEST allocation remains largely unchanged where only the minimum 0.5% to maximum 1% per month BEST rewards are being re-invested. The markets we follow are listed here. We are aware that all these coins may and will at times suffer from substantial price corrections. No Change.

20 March 2021: Bitpanda's BEST token showed another very strong week ending up 18% against the broader trend which ended the week flat. BEST' rise was triggered by a major announcement early in the week that Bitpanda has secured a $170 million funding facility via Valar Ventures, the same company, backed by Peter Thiel and others, that provided a Class A facility of $52 million last year. Valar of course is also an investor in Robin Hood and this major funding round announcement comes just after Bitpanda's announcement to introduce commission free fractional stock trading in April 2021. We can be confident that Bitpanda rolls out a strong campaign for growth driven by a unique combination of asset classes on offer through a single exchange. This will be a world 1st for a major regulated exchange platform to offer a rapidly increasing choice of crypto, fiat, precious metal and stock wallets. In spite of Medium and Longer term technical high risk conditions, the BEST token is still young and developing. We'd like to see BEST mature further and volume increase before considering trading with our core holding. BEST is one of the best performing crypto assets in the industry. It helps that a relatively small amount (€10,000) of broker trading through the Bitpanda exchange generates a flat 0.9% of BEST token trading rewards each month. €50,000 trading volume would carry the reward up to 1% per month. The minimum loyalty reward BEST holders receive is 0.5% per month with a minimum single trade of just €100. In addition, Bitpanda offers BEST holders a commission discount if they pay with BEST tokens, which is an additional benefit, especially as the €Euro value continues to move up. This loyalty reward system, i.o.o., is still undervalued and can attract much larger investors over time driving the value higher. The total number outstanding of issued BEST tokens will be limited to 500 million tokens. No Change.

S&P, Stock Indices, Equities, High Risk, No Limits

S&P 500 Standard & Poor's 500 Price Risk Analysis Forecast

(Previous week in brackets)

| Standard & Poor 500 | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 3974 (3908) ↑ 2% |

||||||

| Trend | ↓ (↓) | ↑ (↑) | ↑ (↓) | |||

| % Risk Weight |

94 (96) | 84 (76) | 70 (80) | |||

| Max Allocation 20% (20%) | Invested | 0% (0%) | ||||

26 March 2021 close: S&P looks technically strong on Daily and Weekly charts. Risk weight has turned up and we should normally expect a new ATH the coming week. Long term risk weight is high as ever and as shorter term time scales meet up with Monthly this market is still at risk against all ods of starting a major downtrend. Equity indices simply do not offer a strong incentive. A little boring even. The broader market is supported by unlimited QE which is still the only safety net in our opinion. And that is high risk. No Change.

19 March 2021 close: The S&P index closed slightly lower again by just 1%. Stocks and this index as well as government bonds are still defying technical gravity as freely printed or just very cheap money is brought into the economy. With just about every asset class on a roll, this incredible financial market experience can be genuinely called the ultimate in popular delusions and madness of crowds. It just doesn't stop and it is scary. Hence our continued investment limitation to Precious metals and just a few promising crypto tokens. Crypto of course is also driving precious metals with relatively boring results into a position of lower investment interest. Today's high and ever increasing risk financial market is precisely the reason for keeping the vast majority of available funds in Gold, Silver and Platinum and the strong growth Bitpanda exchange. Smaller and higher risk investment in individual stocks and crypto tokens can be an attractive proposition only if a downside cushion has been established for the core portfolio of assets. We simply cannot see the upside for the S&P index as long as the technical tools in all time scales continue to develop bearish divergence as we move along. That is a risk that we must never take and it is 'only' an opportunity loss. Besides, the paper and real return on metals and crypto outweighs that equity market risk. No Change.

Brent Crude oil Brent Crude Oil Price Risk Analysis Forecast

(Previous in brackets)

| Brent | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 64.37 (64.52) | ||||||

| Trend | ↑ (↑) | ↓ (↓) | ↑ (↓) | |||

| % Risk Weight |

76 (75) | 80 (87) | 25 (48) | |||

| Allocation Limit(10%) | Invested | 0% (0%) | ||||

26 March 2021 close: Brent has a week searching for direction trading most week between 60 support and 64 resistance ending at the highs. With Monthly in strong uptrend, weekly at 80% Risk and Daily turning up at 25% from a clear bullish divergence level it could be interesting to have a small interest. What stops us is Hourly being overbought and turning down at the close on Friday. This risk requires waiting for hourly to come in line with Daily somewhere between 30 and 60% risk level and turning up to get involved. Therefore No change at this moment.

19 March 2021 close: Brent crude started the week a little unsettled which ended on Thursday with a major drop of nearly 15% from the earlier peak, closing at 64.50 on Friday. The drop was caused by a US report of continued and significant inventory build. However, such a move only develops if major market players are over exposed nearing the end of a financial quarter. Whilst international pressure for less use of fossil fuels keeps mounting, old style commodity markets interesting to monitor. Oil still looks heavy and higher risk as we have seen this week. No Change.

12 March 20212 close: Price action has gone way beyond our expectation and seems to confirm a very strong economic recovery as the world tries to start afresh after one year of lockdowns. Brent ias running into heavy resistance around the 70 handle combined with massive bearish risk weight to price divergence in the medium term time scale. This just isn't worth the risk especially without any fundamental evidence that fossil fuels will remain a primary source of energy.