Low risk crypto strategy is difficult, so... | 1 June

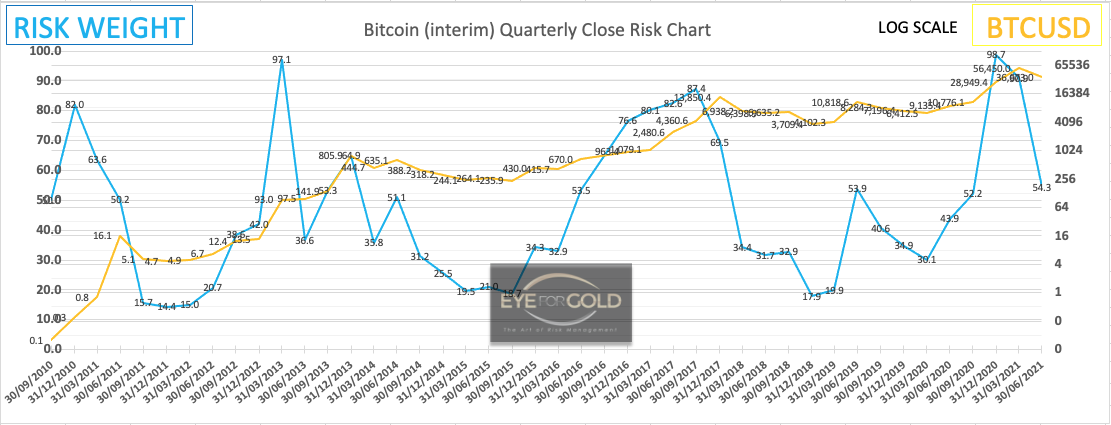

BTC Bitcoin Price, Bitcoin Price Risk Analysis

(Previous week in brackets)

| BITCOIN BTC/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 37,673 (37.476) ↓ 19.9% |

||||||

| Trend | ↓ (↓ ) | ↓ (↓) | ↑ (↓) | |||

| % Risk Weight |

70 (79) | 22 (52) | 48 (25) | |||

| Allocation Limit(0%) | Invested | 0% (0%) | ||||

Bitpanda Pro - BEST Token Price Risk Analysis

(Previous week in brackets)

| Bitpanda - BEST/EUR | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1.1340 1.2109) ↓22.7% |

||||||

| Trend | ↓ (↓) | ↓ (↓) | ↑ (↓) | |||

| % Risk Weight |

62 (70) | 32 (58) | 30 (15) | |||

| Allocation Limit(variable) | Invested | 100% (100%) | ||||

BEST token live price

Bitpanda BEST analysis 01 June

BEST actually looks equally worrysome for late entries, i.e current level and higher. No change for our friend's portfolio's having cushioned the original and just reaping monthly rewards benefits. This still makes BEST one of the most attractive tokens in today's market, but for late investors it would be high risk to gamble on serious upside until at least our medium term risk weight shows a potential bottom confirmed by short term bullishness. Speculative longs may well see a 10% or more advance from current level which would offer an opportunity to reflect (square up) on a medium term outlook. We could eventually see this market bottom out, just like BTC at a 50% lower level. Extremes however should not be underestimated. Several native crypto tokens would appear highly attractive if they can be acquired at 70 or 80% below current level. A fairly common panic move could trigger those levels becoming reality. Remember we were there only 5 months ago and that is the risk and opportunity on the table today.

22 May 2021: BEST has equally suffered and the correction is dramatic looking at opportunity loss. But the situation is different from Bitcoin and most other altcoins like Ethereum and Litecoin, because BEST is the only token offering a real minimum value with an attractive up to 1% per month reward system backed by a strong growth, well capitalized and regulated exchange. One can only hold on to Bitcoin and altcoins through major bull runs and full corrections if the entry point is far enough in the past that the minimum value is likely to remain above entry level. And that would have to be some 85% below the peak level at any time. That is guaranteed in the case of BEST and since we've secured our original investment during the bull run last month,'holding' is very safe and still generates a real cash return every month even though that value goes down with the price of the asset. We are now watching out for an opportunity to diversify some cash into several of the tokens on our watchlist if the opportunity presents itself. There are some very attractive propositions building for tokens isued by true quantum leap technical innovation companies. Jittery markets can see sudden deep throughs. Bids at low unexpected levels may get filled.

BEST looks technically stronger than BTC, but this too can be a false positive as is the situation with all crypto’s, none excluded at this moment. See BITPANDAPRO-BESTBTC

As a result of the large drop in the value of BEST this month, our precious metals portfolio has risen to 50% of total which feels very safe at this moment in time. A fall can only mean that crypto is back onto recovery, but this may take several quarters or even years, because Crypto is still hyperinflation price territory.

S&P, Stock Indices, Equities, High Risk, No Limits

S&P 500 Standard & Poor's 500 Price Risk Analysis Forecast

(Previous week in brackets)

| Standard & Poor 500 | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 4202 (4161) | ||||||

| Trend | ↓ (↑) | ↑ (↓) | ↓ (↑) | |||

| % Risk Weight |

98 (97) | 90 (92) | 87 (50) | |||

| Max Allocation 20% (20%) | Invested | 0% (0%) | ||||

01 June 2021 close: The first trading day in June is now indicating a potential downturn of monthly risk whilst 31 May close is still pointing up. The absolute level of 98% high risk says enough whilst the current price of the S&P index is beyond normal price discovery given the very steady and near uninterrupted 100% advance since the March 2020 bottom. Our long term economic outlook since many years is a period of stagflation. What that means for equities remains to be seen and it has now become a historically less predictable asset class than precious metals, in our opinion.

21 May 2021 close: Equities are still a matter of 'when' not 'if' they will correct. As long the bearish divergence in long term risk weight persists, that risk is always imminent. An economic recovery may be on its way, but nothing is certain especially given the amount of capital needed, worldwide, to saignificantly reduce the carbon footprint. If public sentiment turns in favor of that transition even the best performing stocks could see substantial pressure. No Change.