Crypto just had an amazing week with few exceptions | 20 Febr

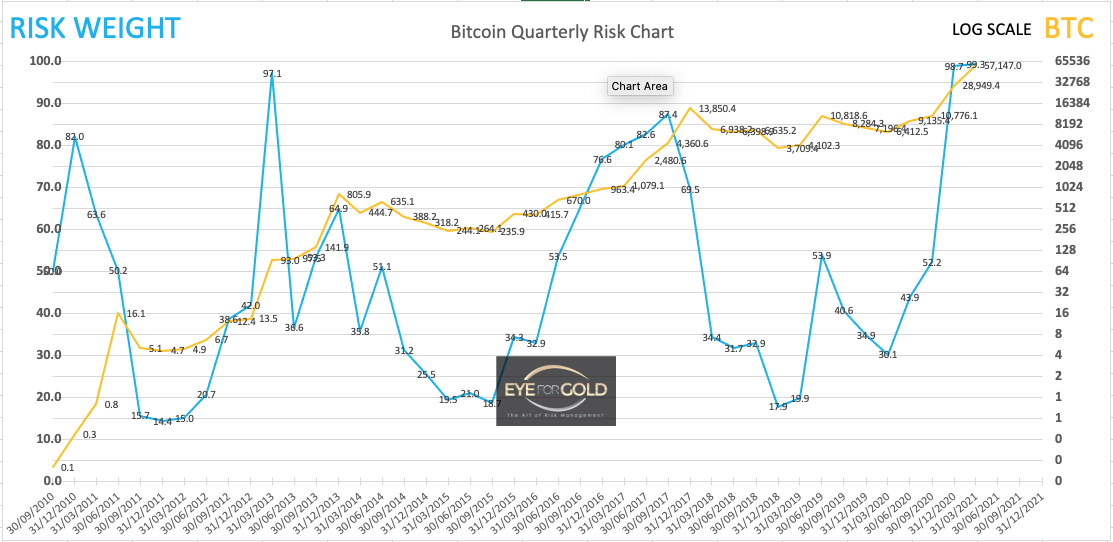

BTC Bitcoin Price, Bitcoin Price Risk Analysis

(Previous week in brackets)

| BITCOIN BTC/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 55,777 (46,800) ↑ 19.2% Price print Saturday 6 Feb 21:00 CET |

||||||

| Trend | ↓ (↓) | ↑ (↑) | ↓ (↑) | |||

| % Risk Weight |

93 (92) | 90 (80) | 95 (91) | |||

| Allocation Limit(0%) | Invested | 0% (0%) | ||||

20 Febr 2021 close: Just watching the markets on our price page we have witnessed some spectecular moves. Binance probably beat them all with a 200% bottom to peak rally and holding up. Bitcoin of course was very strong again with another 19% plus rally into Saturday night and continuing on Sunday. We stay away from the established crypto coins and altcoins as the risk profile is and remains increasingly adverse. Some of the price behavior we witness just feels like an inverse pyramid scheme, meaning a pyramid with the peak pointing downward and where smaller and large recent participants can drop away from the top or early adopters removing from the bottom and decide short term direction. A pyramid because the narrative is loud and clear in all media these days to get everyone to participate.

With all that free Covid money and not spending it due to lockdowns with interest rates at zero percent, Crypto looks the perfect alternative. Bitcoin may not have been designed to achieve this, but it is happening as we watch these incredible events unfold. And the higher this goes the more nervous governments will be on how to ever control this newly found and dangerous wisdom. Massive wealth tax may be the only solution as tax is the only instrument left to control the existing fiat money monopolies. In addition, there will need to be some form of trust established away from the money spinning crypto markets. Possibly using precious metals or at least gold. The danger is also that millions of small investors stand to loose big time or they all become relatively wealthy which leads to massive inflation. The majority of people on the planet however will never be able to participate in these FOMO markets. And they won't like it. Nevertheless a very exciting development from financial market perspectives.

13 Febr 2021: So much fresh input about crypto and major Bitcoin adoption in particular is hitting the news wires. BTC closed the week (Saturday) at 46.800 and has already reached a new high following th BNY Mellon report. We are aware that any news of major new funding for Bitcoin will give the price a significant boost and larger and small traders will frontrun this new round of billion dollar investments. Regulatory issues as well as the extremely promotional narrative still represents a major risk. What is going on is of course extremely interesting and we start to hear from very small investors who are only now alerted to Bitcoin and seeking to invest. Coming in at these elevated levels is probably not a good idea for small investors and one has to wonder against which reference Bitcoin will ne measured in future. Even the biggest influencers in the crypto space measure everything against the USD, whereas the idea of investing in a decentralized currency is lack of trust in the fiat system. So where will this end and what if crypto currencies will continue to be measured against a relative vlaue of fiat currencies? What if one of the big players wants to sell 500 BTC? Will there be a market for them? This requires more than a crystal ball. Absolute belief that BTC is the juwel in the crypto crown is one thing and the attention clearly makes it grow. But...?

Blockchain has a massive future no doubt and anything 'Smart' ethereum based will make quantum leaps in the immediate future. This is why we look for some solid interest in crypto, away from traditional assets, most of which are in bubble territory and technically unsound for investment. Some Individual punts can still be interesting with a high risk portion of the portfolio.

Bitpanda Pro - BEST Token Price Risk Analysis

(Previous week in brackets)

| Bitpanda - BEST/EUR | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 0.6856 (0.7363) ↓ 6.9% |

||||||

| Trend | ↓ (↑) | ↓ (↑) | ↓ (↓) | |||

| % Risk Weight |

86 (87) | 86 (86) | 67 (84) | |||

| Allocation Limit(30%) | Invested | 100% (100%) | ||||

BEST token live price

Bitpanda BEST analysis

20 February 2021: BEST was one of the crypto tokens to take breather dropping 7% following last weeks 91% increase. This is still a fairly young and thin market and the price behavior completely logical, since this token only came to fruition for the first time in Q3 of 2020. As BEST has several important reward values from a rapidly growing exchange the potential is really no less than the Binance altcoin on a smaller relative scale. As this market matures we would look for an opportunity to add to the position if prices correct further into a bullish divergence condition. This hasn't happened yet and it may not happen for while either as we have seen with Bitcoin, Binance, Litecoin and other which just keep pumping. Technical systems will thus alway be overidden. We are watching and even participating on a small scale in a few other tokens. Polkidot, PAN and NEM are seen as potential candidates for strong advance and they have already shown that potential in recent weeks. BEST remains the primary allocation as it has a low risk profile with a minimum guaranteed value to pay fees. The monthly trading reward premium paid in BEST tokens makes it, in our opinion, a nicer long term risk proposal against the established high market cap currencies.

13 February 2021: We've increased our portfolio allocation to 30 percent due to price development. BEST, after an 80% increase the week before, has another very strong week of 90% from that higher level. BEST was amongst several of top performers in the crypto space which included Ripple, Polkadot, Litecoin, Binance and others. Bitpanda's BEST has some very specific benefits that make it a more likely candidate for long term hold and reward. Again this coin is priced in Euro and as long as CP inflation is not shooting up the chance of further price increases is quite high. It could even spike, just like BNB (Binance) has done and many others.

Technically risk weight is high but we see that even very brief Hourly and Daily reversals can make this make these crypto markets just race ahead. This is not traditional technical analysis and anything based on simple or complex moving averages along is likely to become major disappointment.

Fact is that BEST is now racing towards 500 million market cap and in terms of European investor interest this could go 10x or more as Bitpanda, which is still relatively small, grows into its role as the future in banking and investing. The number of listings will grow, but only those that meet certain credit criteria. The introduction of the Debit card under the VISA label is a no brainer for Bitpanda account holders. With the likes of Revolut and N26 developing into full blown retail banking services, one wonders how long traditional retail banking will exist or why anyone would be bothered to even look and bank stocks except the larfgest investment banking institutions.

On Friday BEST rallied to an all time high of €0,8750 before retacing some quick 20% towards €0,70 and closing at €0,7363 on Saturday 13 Febr.

We do own some PAN tokens, which is finance vehicle for a joint development project with the University of Vienna to bring decentralized blockchains closer together. We have yet to see live implementation, but as a regulated institution Bitpanda is likely to also make this a successful project for the various participants and the token holders. Many tokens listed on different exchanges are very high risk even though some have increased 1000% or more. And this is what drives so many new investors into this space. For wealth preservation purpose, late entry into a crypto project is usually to high a risk but making certain well judged investments for 10% of total portfolio could be the start of a completely new way of looking at new and traditional asset classes.

S&P 500 Standard & Poor's 500 Price Risk Analysis Forecast

(Previous week in brackets)

| Standard & Poor 500 | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 3902 (3940) | ||||||

| Trend | ↑ (↑) | ↑ (↑ ) | ↓ (↓) | |||

| % Risk Weight |

95 (97) | 93 (90) | 83 (95) | |||

| Allocation Limit 20% (30%) | Invested | 0% (0%) | ||||

19 February 2021 close: The high risk daily position seems to have caused some profit taking this time, but we may again expect bullish divergence to develop for a fresh run into new highs. Higher long term treasury yields are potentially indicating higher inflation and we can't predict how markets will react on these developments short term. Technical look like more downside should be expected although hourly risk is racing down. Anything can happen including the start of a longer term downtrend. As MOnthly risk is still up but 2 points lower, this could be an indication that the long term market is seeking a turn. We watch this from the sidelines.

12 February 2021 close: Unfortunately we cannot but stay on the sidelines in this very high risk market. No leverage and no investment cannot create massive losses, only a loss of opportunity. Our S&P approach is a directive towards the broad equity space and has much less bearing on certain individual stocks which cannot being to cover. As money keeps pouring into corporate coffers and near zero funding rates, buy back programs are still the name of the game. Whilst many world economies are in serious trouble the interest in equities seems to concentrate on ever lesser individual stocks. This makes equity investing high risk for any individual. Needless to say that it has reaped many benefits for pensioners controlling their own portfolio's. No Change.

Brent Crude oil Brent Crude Oil Price Risk Analysis Forecast

(Previous in brackets)

| Brent | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 62.69 (62.59) | ||||||

| Trend | ↑ (↑) | ↑ (↑) | ↓ (↓) | |||

| % Risk Weight |

68 (68) | 95 (94) | 88 (93) | |||

| Allocation Limit(10%) | Invested | 0% (0%) | ||||

20 February 2021 close: Popular commmodities which are used in the EV space have been strong and so has Brent crude although the market finished barely changed. Technicals look indecisive although the long term Monthly risk weight trend remains strongly up. With weekly and Daily risk still and elevated levels and hourly at this week's close racing down the most likely scenario is a short term rally into the new week. This speculative and not a good enough reason to participate in risk size. No Change.

13 February 2021 close: Whilst long term risk remain in an uptrend it is a weak one with Medium term now very overbought but still up and Daily turning down on the close. This market is reacting to lots of conflicting news and still appears to favor the long side. This is a high risk asset, but the industry always finds a strong reason to support price action, up or down. Technically no interest to risk even a small portion and our early exit last year was unfortunate with hindsight perhaps, but would be repeated under similar unsual circumstances.

Covid certainly has done some serious damage across the globe which is now causing accellerated introduction of low CO2 of even zero carbon energy solutions. Not a recipe for major decisions in the Oil refinery space.