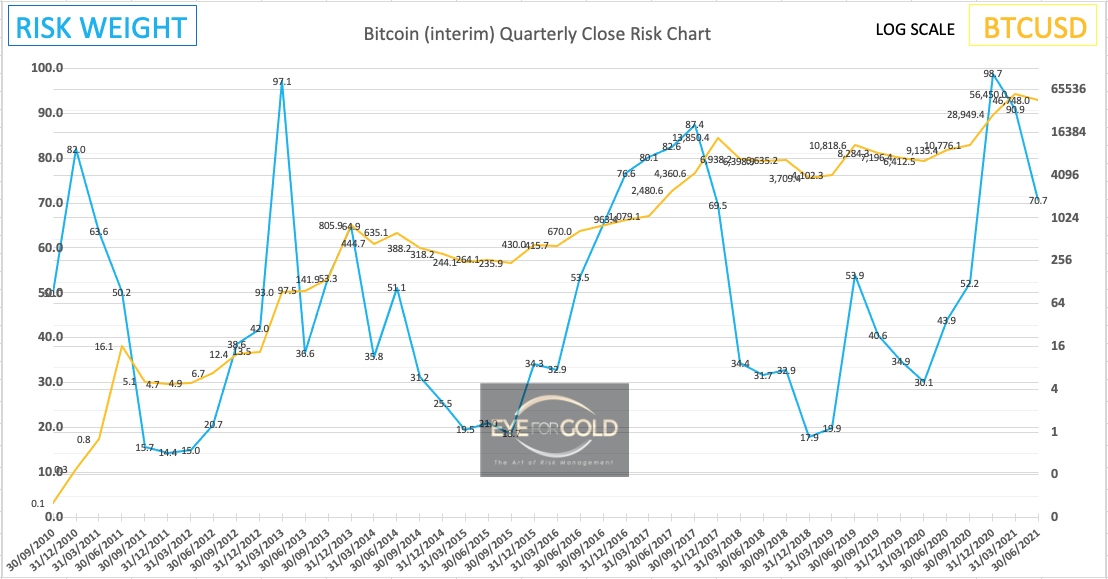

Crypto markets getting a little nervous - healthy corrections are due | 17 May

BTC Bitcoin Price, Bitcoin Price Risk Analysis

(Previous week in brackets)

| BITCOIN BTC/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 46,775 (58.580) ↓ 20.1% |

||||||

| Trend | ↓ (↑) | ↓ (↓) | ↓ (↑) | |||

| % Risk Weight |

83 (86) | 65 (73) | 22 (83) | |||

| Allocation Limit(0%) | Invested | 0% (0%) | ||||

16 May: Never mind the influencer narratives on social and mainstream media. We can't really call two word EM tweets a narrative. Bitcoin lost 20% in one week and was the main driver behind the overall market setback during the past two weeks. This time also Ethereum paused in a tight range versus BTC but strongly outperformed BTC during the entire month. The technical picture for BTC is still as described last week although short term Daily risk weight has now moved into lower risk percentage range. Medium term however is now in a strong downtrend removinbg the chance of a low risk divergence play whilst also interim monthly risk is now pointing mildly south.

This picture tells us there is potentially more in store with a possible initial objective of 31,500-36,000. I.e. any bottom picking would be nice if it works but not sound trading action. Still high risk and no Change.

8 May: This past week we continued to notice the swap from BTC to ETH, at least it looks like this is what's beeen going on for 2 weeks now as BTC always took a dive followed by an Ethereum up and hold move. As clearly profits have soared for many participants during the past 6 months, it will become ever riskier for every day traders and new investors to hold any fresh positions entered at these elevated levels. The market is controlled by a small group of major early (enough) investors which increases the speculative risk for most. Unlike what some are saying though, Crypto does respond well to our short term 'one hourly', '4 hourly' and 'daily' technical indicators and almost always if divergence conditions are met. That is a positive take from possibly building a small diversified crypto portolio away from our core BEST position. High volatility and high trading risk however in most of these tokens keeps us away from the major crypto currencies that have no proven long term Beta economic relationship. No Change.

Bitpanda Pro - BEST Token Price Risk Analysis

(Previous week in brackets)

| Bitpanda - BEST/EUR | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1.56.79 1.8800) ↓16.6% |

||||||

| Trend | ↓ (↓) | ↓ (↓) | ↑ (↑) | |||

| % Risk Weight |

74 (77) | 70 (78) | 25 (17) | |||

| Allocation Limit(variable) | Invested | 100% (100%) | ||||

BEST token live price

Bitpanda BEST analysis 17 May

Our core and preferred long term hold crypto BEST token again lost nearly 17% during the week (which we end on Saturdays) having experienced continued pressure during the week with a shakeout on Friday towards the 1.31 handle before recovering rapidly to 1.68. Continued pressure across the crypto space also has affected a few larger early holders of BEST which is still a relatively low volume asset and a junior amongst its peers. Large selling pressure has now faded it seems and BEST should trade more in line with general market sentiment. The technical outlook is similar as the major altcoins with exception of ETH perhaps. BEST Rewards concept from this very profitable and fast growing exchange have been and still are the prime reason for holding on to the core position. We only sell monthly rewards for cash or swap into a low risk alternative amongst just some of the many tokens traded from our market watchlist page. Our 'friends and family' group which came in early to this proposal are advised to 'HOLD'. Traders can wait as, like BTC and many other altcoins, we are now in a secondary downtrend and should first see an important bullish divergence before a (much) lower risk entry can be made into these markets. It means BEST is also at higher risk of revisiting last week's lows, unless the market turnes around with good technical prospects. No Change to the fundamental core position which is still up 1600% this year.

8 May 2021:BEST lost 10% during from Saturday May 1st to Saturday May 8th close. Significant enough to consider how to design long term protection of the core position. BEST is still over double the value increase versus BTC since December. BEST token Daily risk weight is currently diverging for an upward correction versus weekly and monthly although we see a 4 hourly risk weight that puts resistance to a move. BEST actually looks firmer against Bitcoin than against Euro or dollar. This means that the crypto space as a whole is probably in a higher risk condition. BEST could easily get a further setback with this short term technical scenario but we consider this an opportunity to slightly improve the original investment level if entry at a lower level can be achieved. The BEST market does not lend well for finding support levels for bottom picking as volume is unpredictable. BEST, just like Binance's BNB, offers strong reward benefits and remains full medium term hold.

S&P, Stock Indices, Equities, High Risk, No Limits

S&P 500 Standard & Poor's 500 Price Risk Analysis Forecast

(Previous week in brackets)

| Standard & Poor 500 | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 4174 (4235) | ||||||

| Trend | ↑ (↑) | ↓ (↓) | ↑ (↑) | |||

| % Risk Weight |

98 (99) | 94 (96) | 30 (70) | |||

| Max Allocation 20% (20%) | Invested | 0% (0%) | ||||

14 May 2021 close: The S&P started the week towards the All Time High, now at 4245, and subsequently fell 5% into Thursday. We have not been able to read true market power even though techical sentiment has always been one of high risk. That is still the case today and our favourite portfolio hedge is precious metals and a few crypto's of which BEST has a core role, simply because Fintech is here to stay and only large regulated exchanges can survive because the world's monetary authorities will embrace them to retain control. As Central banks have adopted a policy of not raising rates whilst inflation takes off, these markets could go anywhere anytime. High risk, no Change in our book.

07 May 2021 close: The minor correction last week followed by a stronger close is creating a lot of potential for bearish risk weight to price divergence in the Daily timeframe whilst weekly and monthly risk weight are at absolute extremes. It simply means very high risk for the S&P index and confirms our High Risk No Investment approach.

Brent Crude oil Brent Crude Oil Price Risk Analysis Forecast

(Previous in brackets)

| Brent | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 68.75 (68.21) | ||||||

| Trend | ↑ (↑) | ↑ (↑) | ↓ (↓) | |||

| % Risk Weight |

89 (89) | 75 (71) | 66 (75) | |||

| Allocation Limit(10%) | Invested | 0% (0%) | ||||

14 May 2021 close: Brent sits in the middle of a broad 6 year trading range with one very wild collapse in March 2020. There will still be (ever fewer) countries expanding use of fossil energy sources but long term demand, 5-10 years, will drop significantly as other energy sources like sun, wind and hydrogen will become dominant for most transport and heating purposes. At least this is what most major oil companies are driving towards, so it will happen. In the meantime it is hard to predict the medium term economic outlook post Covid. Maybe a temporary recovery and maybe not as so many fundamental factors weigh in that can break the current buoyant market temperature. No Change.

7 May 2021 close: Strong performance mid week followed by a correction towards the weekend. All technical tools remain in higher risk positions with bearish divergence potential in all short to long term time scales. Crude remains too speculative as an investment under hard to predict medium term economic conditions with bubbles in almost every financial asset class. We don't do Copper but follow it with interest and as mentioned before copper could double again this year as it did last year o the back of very strong EV developments. No Change.