Bitcoin stalls at 50k. Will it break again? | 28 August 2021

BTC Bitcoin Price, Bitcoin Price Risk Analysis

(Previous week in brackets)

| BITCOIN BTC/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 48,943 (47,084) +10% |

||||||

| Trend | ↑ (↑) | ↑ (↑) | ↑ (↓) | |||

| % Risk Weight |

58 (56) | 72 (55) | 65 (84) | |||

| Allocation Limit(0%) | Invested | 0% (0%) | ||||

28 August close: Check this internal link to view the crypto total market capitalization chart including our base technical tools. Bitcoin is about 45% of that total crypto market cap which makes the technical indicators look very similar for both markets. Both show Daily risk having completed multiple bearish divergence instances whilst both Medium Term weekly and Long term Monthly can easily turn down in a regular fashion with a lower price and lower risk weight top. Another maybe bigger concern in today's crypto market is the story about Tether. Or rather the controversy that this so called unregulated USD backed stablecoin has created. Tether (USDT) is involved in about 50% of all Bitcoin transactions. Check out this article on TheVerge.com (safe link) to learn more. This kind of risk does not fit a risk aware portolio very well as it could do a lot of damage which could last for a long time, hence our preference to stay away from this unregulated space. As Tether can be traded against many fiat and the other major crypto currencies, Tether volume is much larger than Bitcoin.

Yet, If great visionaries like Michael Saylor fully expect Defi to play a critical future role in our lives, us simple minds should not ignore. But the order in which the next major (crypto) market events will take place may still surprise us as it is stil largely dominated by get rich quick specs and long time influencers and early adopters. No Change.

14 August close: Saturday's close at 47k+ meant a 10% weekly advance. Very strong and last the entire crypto market followed suit. The Crypto market cap figure has now risen from a low of 1.128T to the recent high of nearly 2.058. A massive 82% against BTC's 66% from the low. Some crypto's managed to more than double in value whilst others followed the general trend and all rallied 60% or more from their recent lows.

We are somewhat startled by the force of these moves as there was clear bearish divergence visible for many tokens between short and medium term. The current rally has now brought the medium weekly into a much stronger bullish position which makes risk of medium term correcting down much greater. Interim Risk, from a technical perspective, therefor remains high for most crypto's.

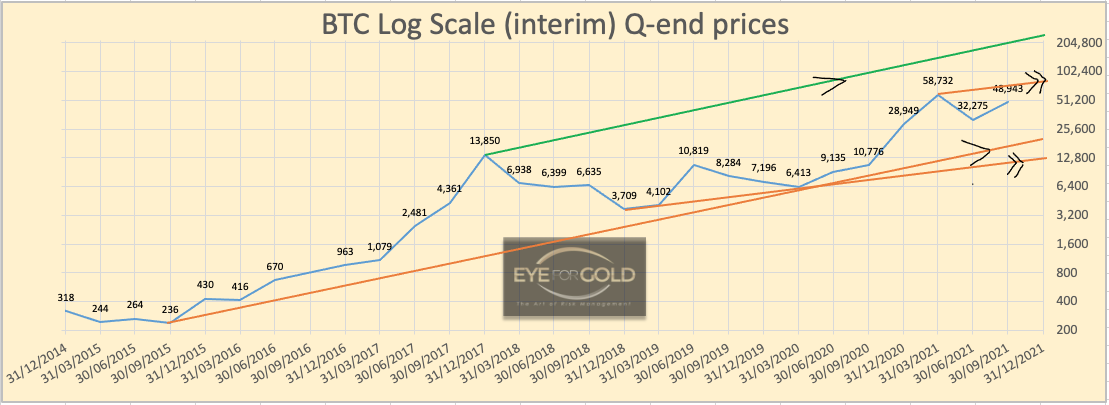

The quarterly log and risk charts below show the relative performance and how neutral BTC can look on a log scaled chart in this volatile market.

4 days can be a long time in Crypto. It took 4 days to move BTC from 32k to 40k just 3 weeks ago. Now we've been hovering around current level for days.

A lot is still happening in the world of DeFI and facilitating speculation between blockchains with smart bridges. We will remain very cautious until the dust settles, which it will do some day in the not too distant future.

Bitpanda Pro - BEST Token Price Risk Analysis

(Previous week in brackets)

| Bitpanda - BEST/EUR | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 0.8650 (0.9164) | ||||||

| Trend | ↓ (↓) | ↑ (↑) | ↓ (↓) | |||

| % Risk Weight |

33 (33) | 12 (12) | 96 (96) | |||

| Allocation Limit(variable) | Invested | 100% (100%) | ||||

BEST token live price

Bitpanda BEST analysis

28 August 2021 close: BEST has met with significant resistance as it neared the 1 Euro handle and after a strong performqance 2 weeks ago has dropped back into the 0.80's. One of the reasons is a lack of interest as little development or company performance news comes out of Bitpanda. Yet the platform apps work flawlessly and have superior technical features making trading a breeze. Our interest remains with a great deal of patience because Bitpanda represents one of the few larger

- regulated

exchanges.

We do still anxiously await any reports about the early (pre 2019) idea to develop a launch platform for equity type private tokens. Bitpanda is strongly backed by a few major modern financial industry names and therefor likely to develop a more interesting forward looking statement that could propel Bitpanda and BEST into the next gear. Building BEST value, rather than selling, by holding the monthly rewards into 2022 may well be the better strategy waiting for price pressure to diminish. If it does BEST can easily perform like it did early this year and follow or even exceed the broader crypto market.

14 August 2021 close: From being the weakest in the space, BEST picked up steam and rallied into the 0.91 handle for a nearly 40% price increase. This in itself has lifted our portfolio value to the extend that our precious metals total allocation declined towards 40% from 50% and crypto increased to 40%. BEST remains our core token and we stick with our strategy to earn monthly rewards from trading mainly smaller amounts in short term precious metals which are 100% physically backed.

We do have several tokens on our wishlist and were nearly filled on some during the recent downturn but will not act against any high risk reading, especially if many of the moves are social media driven and not necessarily seen as the ultimate quantum leap into certain crypto high flyers.

We believe that the regulated crypto space will be the dominant force and that the world's largest regulated exchanges shall benefit most from the fast growing wholesale and retail crypto and blockchain participation.

S&P, Stock Indices, Equities, High Risk, No Limits

S&P 500 Standard & Poor's 500 Price Risk Analysis Forecast

(Previous week in brackets)

| Standard & Poor 500 | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 4511 (4467) | ||||||

| Trend | ↑ (↑) | ↓ (↑) | ↓ (↓) | |||

| % Risk Weight |

99 (99) | 96 (96) | 93 (97) | |||

| Max Allocation 20% (20%) | Invested | 0% (0%) | ||||

27 August 2021 close: The 100% S&P increasde since March 2020 is nothing short of spectecular. Still very few industry people feel comfortable trading this risk. The equity space is completely dominated by the FAANGs and a larger than ever string of equity repo programs funded by cheap fiat money. Is this a healthy development? We don't hink so, and force ourselves to not participate in these unprecedented market forces. The No Guts, No Glory, principle is beyond what is happening right now. Weekly risk has turned down at very high risk with all other time frames remaining at very high risk levels. Any time a major time scale turnes down it can be the start of something big. We cannot risk that 'big' event to become detrimental. No Change.

13 August 2021 close: Fortunately we are not alone in leaving this market alone. The equity space just remains overbought as long as there is no correction of any size and that won't happen until it does. It is an insider market and deeply manipulated. Riding the trend has been great even though the flavour isn't anymore. Very high risk dominates all technical tools except a few moving averages of course. Actually trading this market would be a nightmare unless it is from strength of long term holding some of the darlings like FAANG. No Change to No position.