BEST follows broader crypto market moves

27 Febr 2022: The situation in Ukraine has put crypto markets on high alert. This can go either way. Protection against monetary uncertainty and non-availability of banking facilities may see a flight into key crypto assets like Bitcoin, Ethereum and others or the opposite may happen. Our BEST portfolio is still performing well with little change the past month, but we've decided to reduce about 8%, spread over the past two weeks, into cash and possibly into more precious metals soon or even back into crypto at any moment if the market shows further significant weakness. Some very small postion in alt coins and other native tokens have been released prior to the events of last Thursday just to reduce the speculative risk. We are still strong on the future of fully regulated crypto exchanges where Bitpanda still has a more advantageous proposition vis a vis several of the much larger crypto service companies. But just like Bitcoin, this token may tank if the market so chooses. For late adopters therefore it would be a consideration to release a bit more crypto in favor of cash and precious metals. This leaves us with a crypto portfolio allocation of around 40% which is still high but with the benefit of a attractive monthly yield close to 1%.

22 Jan 2022: Crypto, hardly any token excluded, was hit hard following the Bitcoin lead into fresh lows for the year. BEST followed the broader crypto pack (-21%) with a 13% loss for the week into today. BEST however looks more promising as medium and longer term risk show a lower percentage risk. BEST 2.0 will go live soon, which we expect to strongly develop interest in holding and collecting BEST to the extend that BEST can 10x on a relative basis at least. Despite a weaker outlook the original position can remain unchanged and even increase by collecting rewards from trading a minimum desired EURO volume. For late adopters risk clearly remains high and diversification into traditional hard assets is the right approach to partially eliminate that shorter term downside risk profile.

16 Jan 2022: BEST again suffers from low volume trading although the up and down volatility is relative mild compared with the large crypto currencies. Our position remains unchanged accumulating rewards and cashing for reasonable yet equally speculative alternatives.

Bitpanda's PAN token had a strong, relatively very high volume, rally last week. Maybe someone knows something. Other crypto's also remain largely subdued following the intitial new year shakeout. No Chart updates as very little changes medium and long term.

BEST/EUR Risk Weight Position relative to Monthly, Weekly and Daily interval data

(Previous week in brackets)

| Bitpanda - BEST/EUR | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 0.7410 (0.7465) | ||||||

| Trend | ↓ (↓) | ↓ (↓) | ↑ (↓) | |||

| % Risk Weight |

31 (32) | 15 (28) | 45 (07) | |||

| Portfolio allocation at current value |

Invested | 40% (45%) | ||||

Geo politics puts full weight on Bitcoin and other tokens/h2>

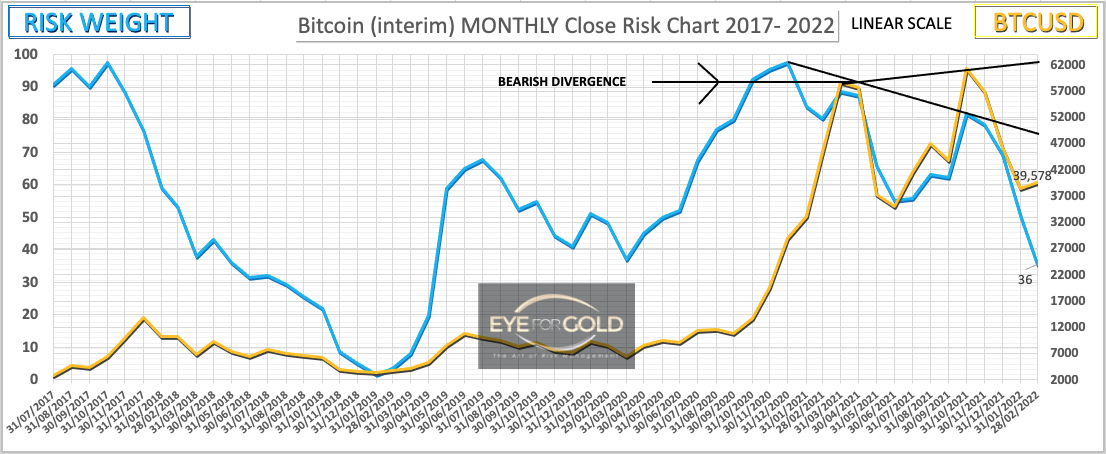

27 Febr 2022 price print: Following on our previous blog, Bitcoin performed well reaching a high of 45k but below its new resistance level over $46k, being the H&S neckline that broke on Jan 5 2022. We've since witnessed a move to a fresh, post all time high, low of 32,900 (see chart), then the recovery into the 45,000 handle followed by a managed drop towards 34,400 on the day of the Russian invasion from where BTC quickly recovered towards present levels around $39,000. The smaller and even more speculative coins dropped as much as 40% from recent intermediate highs and most have not recovered to the same extend as BTC into this weekend. That bigger downside risk is still on the cards if shit really hits the fan. A low risk approach for late adopters is therefor the smarter approach with nothing more than smaller unleveraged speculative positions with a short horizon. As long as Bitcoin does not break the old support, and new resistance, at 46k on 3 consecutive closings we stand by our longer term outlook of further price erosion into the 10's k. It is however entirely possible that the corrective pattern since the April 2021 orthodox peak has finished at 32,900. Weighing against this possibility is the ongoing downtrend of Monthly and Quarterly risk weight. If they decide to properly finish in very low risk territory, this market is in for further downside extremes. Right now Bitcoin is 43% below its maximum priced print from last November.

22 Jan 2022 price print: The leading technical indicators time intervals are Monthly and quarterly risk weight with are both trending down with plenty more downside room. As Bitcoin has now lost 50% against USDollar in less than 10 weeks with no less than 5 new lows recorded in 2022, the speculative game, which this clearly is for the vast majority of investors, may lead to extreme FOMO activity by even the strongest of stomachs. FOMO equally applies to downturns and whilst the trend is clearly down it is and remains difficult to time a(n) (partial) exit. Leveraged long positions will already have been forced to exit whilst it probably only requires one whale to get wet feet for this market to further tumble into the next few target levels at $29k, $25k, $18k and $15k. With that in mind one cannot exclude the possibility of extreme volatility again with a potential price crumbling back to the start of the assumed Wave 5 on December 15, 2018. That low was $3,177. The price pattern how we may get there is not relevant as long as that risk remains. For now we can see an intermediate bottom relatively soon but that print may still be 20 or 30% below current level. And as the crypto market has turned into more of a short term trading style event we can expect volatility to increase dramatically in coming weeks and months. If that indeed happens some people in El Salvador will not like it. The worlds regulators should not be underestimated in times of crisis. Exciting times nevertheless.