BEST follows shakeout but broad market likely to be weaker longer term

08 Jan 2022 close: The start of 2022 showed stable medium term uptrends for BEST and many other native coins. The largest crypto currencies still looked vulenarable though. After a 4-day sideways consolidation pressure build up on Thursday bringing the entire Crypto space into high risk territory this weekend. We not only see that risk in our preferred analysis tools, but also in basic chart risk formation, besides our preferred Elliott wave count, and this applies to all majors.

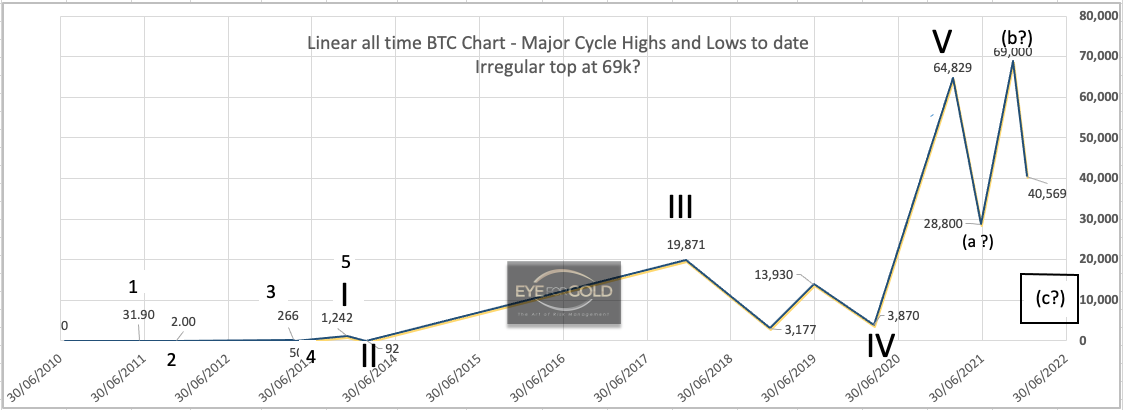

It is Bitcoin again that seems to lead that risk profile as this market is flooded with speculative positions whatever people are led to believe. Positions will need to be adjusted downward for anyone who has bought say at or higher than 40% below current fresh lows. If the market closes around current levels this weekend basic chart risk for the larger number of tokens, not all, is to potentially drop between 40 and 80% from current levels. Early adopters should have already sold and secured a multiple of the initial investment and have insurance in place with precious metals and possibly other high demand commodities. Other asset classes simply do not offer a good alternative, whilst cash is only a temporary choice. Investors that came in at 40% or higher below today's lows must be aware of a potential risk debacle for which is plenty historic evidence. See BTC below.

31 Dec 2021 close: 2021 closed quietly for most crypto's with BEST holding well into the €0.90 to €0,99 range and closing 2021 at €0.96679, 461% higher than the 2021 opening at €0,17236. Although 20% of all crypto's gained (much) more than 1,000% during 2021, BEST did well on average outperforming all of the traditional majors like BTC, ETH, LTC. BEST has not disappointed in terms of being a value investment with a very good potential yield and which should improve during 2022 as the BEST 2.0 conditions get awareness amongst the many new Bitpanda account holders. We still consider a fully regulated exchange space the most promising even though many European small retail and larger (business) investors prefer the freer unregulated environment. Anything 2 or 3X the 2021 closing price for BEST would be spectecular whilst we cannot exlude 10x on a longer term time interval as partly explained below. As usual BEST may experience some short term pressure as the month-end trading/holding rewards, which are paid out in full the next trading day (today) are being exchanged for fiat, other tokens or physical precious metals at the turn of the month. Small technical hickups and service delays are unfortunately part and parcel of a faster growing company, but Bitpanda has made it a priority to deliver a large number of tradeable assets during 2021 which is likely to increase again substantially during the next few quarters. The next BEST burn is scheduled for Jan 27, 2022. No change.

BEST/EUR Risk Weight Position relative to Monthly, Weekly and Daily interval data

(Previous week in brackets)

| Bitpanda - BEST/EUR | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 0.8350 (0,9679) | ||||||

| Trend | ↓ (↑) | ↓ (↑) | ↓ (↑) | |||

| % Risk Weight |

33 (34) | 50 (58) | 20 (46) | |||

| Portfolio allocation at current value |

Invested | 55% (55%) | ||||

BITCOIN: Starts 2022 with increased risk profile

08 Jan 2021 close: BTC is leading the live crypto road map and that map looks dangerously weak if the price closes 3 days below the neckline of the ,kind of, head and shoulders formation with a left shoulder peak early Sept, a crown at $69k in November and a right shoulder around Christmas. This formation merely adds to the risk profile that we've painted based on our preferred simple technical analysis tools, Stochastic, RSI and MACD, with suppoprt from a almost textbook Elliott Wave irregular top formation. This is not a forcast on how to trade any of these markets, merely a risk profile that has become very visible and has been building up for a while already. If the $41,600 neckline level breaks on 3 consecutive closes one might expect a stronger correction followed by an unexpected return to that neckline before. The larger risk picture based on pure Elliott and Head and shoulders correction puts price risk medium/longer term at $14,500 and rather anywehre in that (c?)box below on the Bitcoin Major highs and lows chart since 2010.

We are surprised that several of the major influencers with decades of experience seem to ignore these highly visible risk patterns. It doesn't mean we are right. It just means we simply recognize the risk at a time that greed for more or just for anything from nothing look to be a dangerous game. Today most crypto's are down between 30 and 60% from their recent or all time highs already. Some even much more. If the market decides to go lower from here several large wallets will be rethinking their overall position. Watch the exchanges. That's when they may not find enough size to absorb even a small hedge leading to extended price drops.

31 Dec 2021 close: Bitcoin is not released from every day price pressure as long as Medium term weekly and Long term Monthly time intervals remain in a down trend. With crypto it is hard to say sometimes which time interval is leading due to the speculative and whale intervention nature of the crypto market. This aspect increases the risk factor by a large factor. Right now there are no signals that justify taking a long position. This means that longs should lighten up, no matter the entry level.