Platinum investment low risk versus Gold

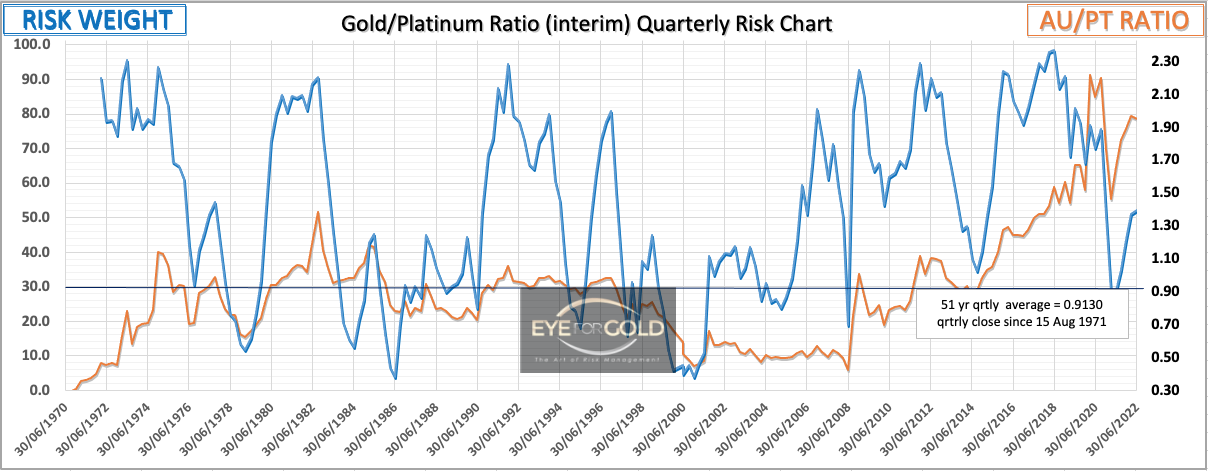

01 April 2021 close: Our Platinum allocation had a bit of the bumpy ride the past few weeks. Whilst Pt rose sharply in the early days of the Russian invasion, the subsequent metals pullback against caused Platinum to lose all of its gains again and more to settle above the 1.90 level versus gold. In the process all time intervals have begun to look high risk and that is where we are today. This is a longer term play which should find Platinum on much higher ground in coming months and quarters. The Platinum solution has regain trust from investors seeking more protection away from other high risk assets. The technical picture actually looks more solid than it did 1 1/2 years ago as we first started to re-allocate. Our 1:1 equilibrium is very much on the horizon. A patient wait.

25 February 2021 close: No change since last month with Gold/Platinum at 1.79. Risk weight across time intervals is in fairly neutral risk territory with a tendence of developing bearish risk to price divergence. Risk weight appears to going up whilst price remain fairly static. This is made very visual on the Monthly risk chart. A strong rally of risk against a regular 50% correction. Platinum may not be quite ready yet to continue the uptrend that started in 2020 but any change of trend can also be imminent, hence no reluctance to hold our full Platinum allocation within the precious metals portfolio.

Gold/Platinum Ratio Charts

GOLD/PLATINUM Ratio risk position

relative to Quarterly, Monthly, Weekly and Daily risk weight intervals

(Previous update in brackets)

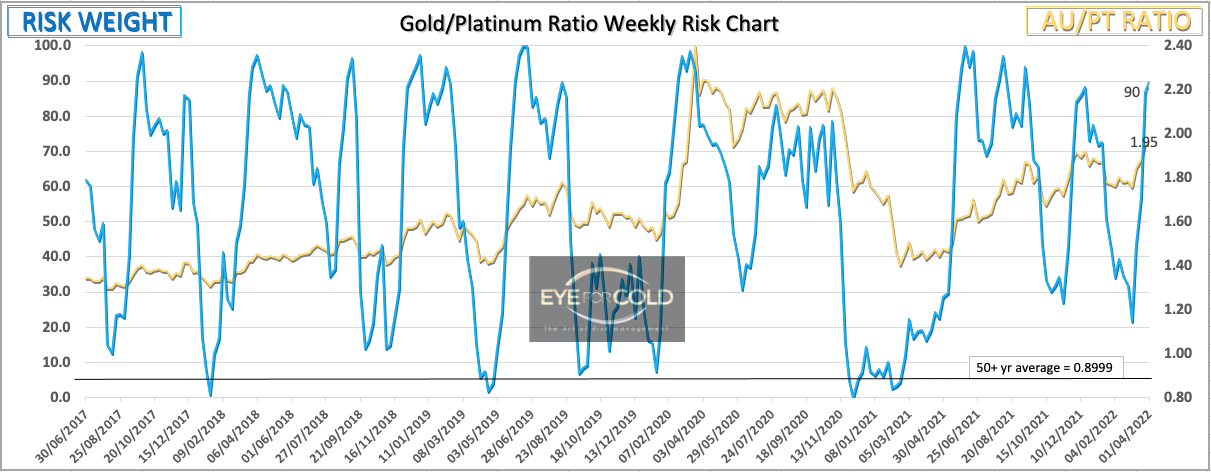

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1.9520 (1.7900) |

||||||

| Trend | ↑ (↑) | ↑ (↓) | ↓ (↑) | |||

| % Risk Weight |

94 (68) | 90 (32) | 90 (60) | |||

| Total PM Portfolio allocation 40% (40%) breakdown: |

Au:12% | Ag:14% | Pt:14% | |||