Today's Gold to Platinum ratio is invitation for new Platinum investors

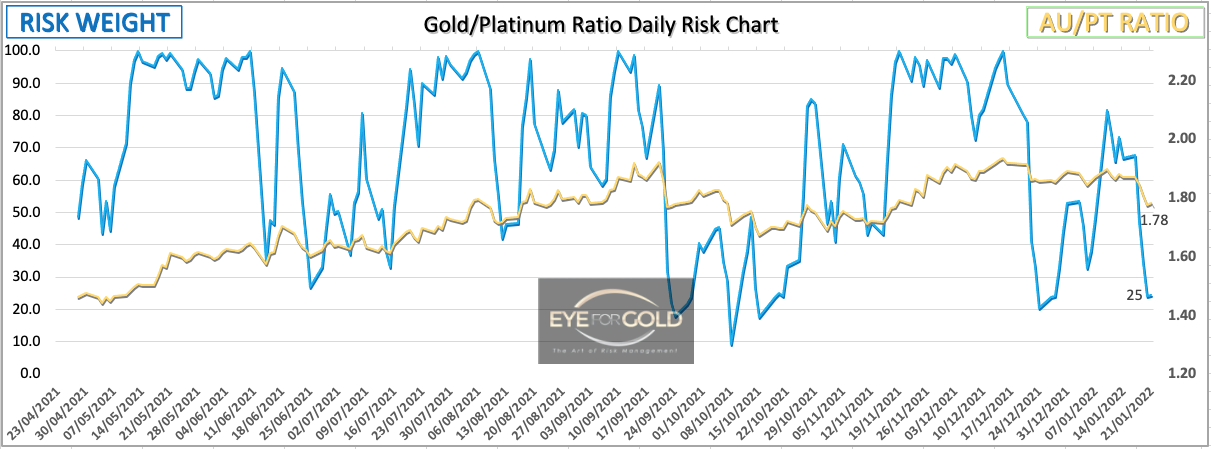

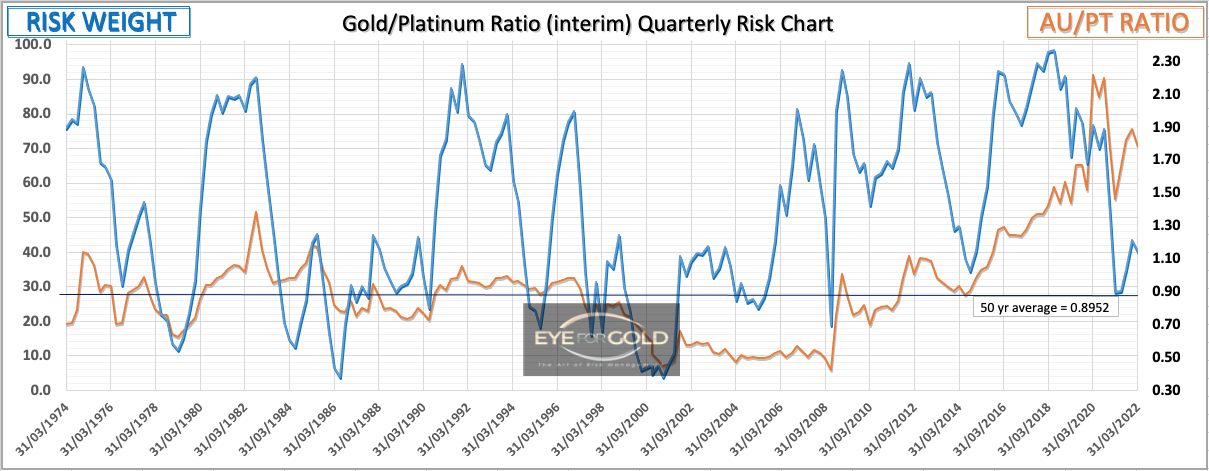

21 January 2022 close: January thusfar has produced a more positive signal for Platinum versus Gold with both short and medium term risk weight turning down whilst Monthly risk weight is still up at 66%. This picture in our experience is clearly positive for Platinum and supports our Year end for incestors to consider Platinum as part of a wider precious metals wealth insurance and safety net. Quarterly risk weight has also turned down at 40% and could trigger a serious advance towards that 50 years equilibrium of 0.8950.

31 December 2021 close: At the close of 2021, Platinum still appears slow out of the gates again whilst traditional investors avoid the metal or simply shy away. This may create a further sense of unjustified negative investment climate and taker longer again to recover from its deep price levels in recent years. We see no immediate technical reason to go along with this weaker Platinum scenario in spite of risk weight trends pointing upward. We remain very optmistic for a strong recovery towards and possibly beyond equilibrium which we define, for now, as the 50 year average price of 0.8950 for the Gold to Platinum ratio.

Gold/Platinum Ratio Charts

GOLD/PLATINUM Ratio risk position

relative to Quarterly, Monthly, Weekly and Daily risk weight intervals

(Previous update in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1.7800 (1.8900) |

||||||

| Trend | ↑ (↑) | ↓ (↑) | ↓ (↑) | |||

| % Risk Weight |

66 (55) | 51 (77) | 25 (52) | |||

| Total PM Portfolio allocation 40% (40%) breakdown: |

Au:12% | Ag:14% | Pt:14% | |||