GOLD/PLATINUM Ratio Price Risk Trend

(Previous update in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1.9150 (1.8777) |

||||||

| Trend | ↑ (↑) | ↑ (↑) | ↑ (↑) | |||

| % Risk Weight |

57 (53) | 84 (65) | 99 (97) | |||

| Total PM Portfolio allocation 40% (40%) breakdown: |

Pt:14% | Ag:14% | Au:12% | |||

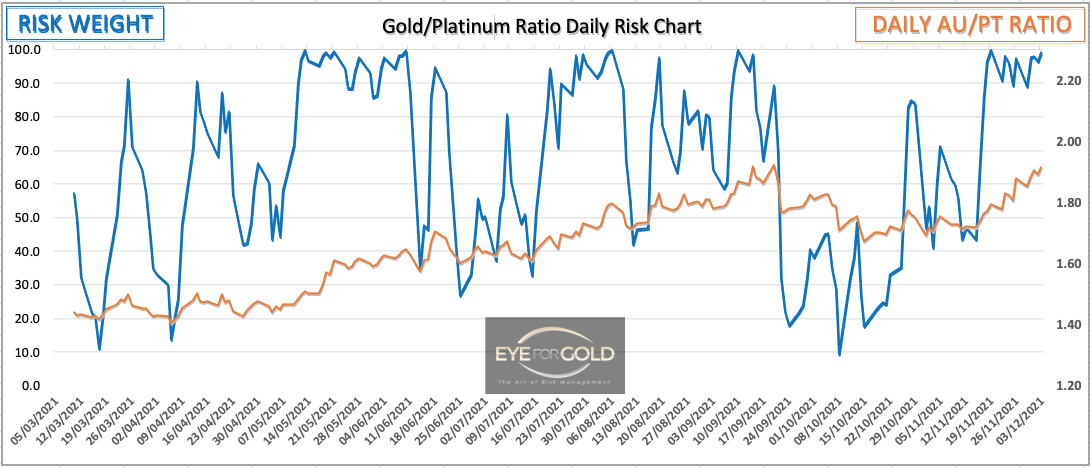

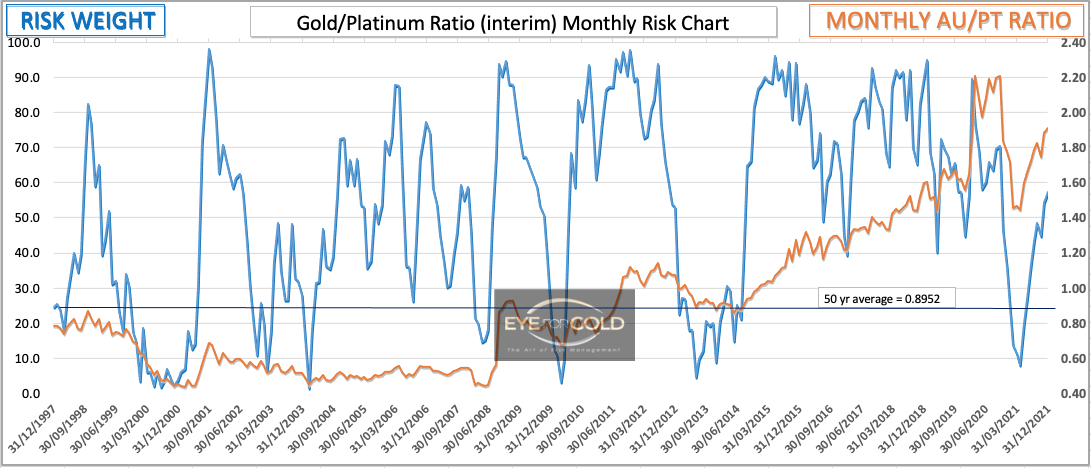

Gold/Platinum Ratio Charts

03 December close In spite of Platinum's return to 'risk off', The metal still looks as bullish or even more bullish than its bottom in March 2020. All Time Intervals of the Gold to Platinum ratio looks to develop bearish divergence in favor of Platinum. hence our slight overweight of physical Platinum to Gold as a strong 'hold' within the metals portfolio. For retail type traders <€5 million and especially the lower value accounts we recommend the regulated Bitpanda crypto, stocks and precious metals exchange as it is favourably priced and the only exchange to offer secure 100% physical precious metals wallets for Gold, Silver, Platinum and Palladium which is great when quickly diversifying away from stocks or crypto or vice versa. All major crypto tokens are traded on Bitpanda which still only accepts European passport clients. 26 November close Platinum took another hit this week with Gold holding fairly stable following fresh Covid mutation, Fed chair and worsening Inflation news as well as a strong US Dollar The Gold to Platinum ratio ended the week nearly 4.7% higher at 1.8777. This is against our expectation based on short term high risk weight levels being reached already last week. As we see on the Daily chart below the price rally to 1.88 is clearly showing a bearish divergence pattern having developed with an absolute risk weight in overbought territory. Also weekly looks like the tools are not confirming price action and this should at least trigger a correction or short term trend change of some magnitude. Risk weight formation, since the trend change in March 2020, in all time intervals must be expected to first reach a deep oversold condition which should also develop the expected price action towards and beyond long term equilibrium at 1:1. Patience therefore with the balanced allocation between precious metals.

19 Nov 2021 close The tables turned again at the end of last week in favor of Gold. Our Daily risk weight exploded towards 100% risk which should put pressure on Gold early this week at least.In terms of timing trend cycles, weekly risk weight should return to a real oversold position in the near future. How this translates to prices remains to be seen, but the risk weight is on Gold weakening further once it has set an intermediate peak.

The way the precious metals are behaving as a result of a strong dollar, a strong equity market and relatively strong crypto market means that the portfolio remains very much on hold. The Gold/PLatinum ratio stays on the same longer term outlook (1:1) as long as we get no indication of an imminent change of trend. We stay with a small Platinum (14%) to Gold (12%) overweight in the portfolio.