Gold rallies into wealth protection comfort zone | 7 May 2021

Gold Price Forecast relative to

Long Term Monthly (LT-M) - Medium Term Weekly (MT-W) - Short Term Daily (ST-D) - and Hourly (not shown) data.

GOLD FORECAST

(Previous week in brackets)

| Gold/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1831 (1768) (unch) |

||||||

| Au Trend | ↓ (↓) | ↑ (↑) | ↑ (↓) | |||

| Au % Risk Weight |

47 (48) | 54 (45) | 80 (70) | |||

| PM Distribution Portfolio allocation 30% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Physical Gold: Nature's currency

7 May close: The Gold rally during the latter half of the week is technically significant. All our direct critical analysis tools favor the long side and importantly supported by a positive turn of moving avg converge diverge in medium term time frame. In addition we can clearly count an Elliott ABC completed correction into early March followed by a brief rally with a near 100% abc correction into March 31. Confirmation from different relevant technical analysis angles provides comfort to the fundamental wealth management need to own physical gold. What ever happens in the next few weeks, the current gold price is a buy level again, and for those already invested an opportunity to consider adding a bit more inflation protection. First objective is a simple clean reach of horizontal resistance at $1960 and then an attempt to break the $2075 high in August 2020. 'Risk on' and Hold!

30 April close: Friday Gold was weak again with only a mildly lower close. Our primary investment focus has been on Precious metals since early 2016 and on Bitpanda's Ecosystem token since 2019. The heavy promotion for crypto makes us wonder why that bully narrative approach would be necessary. Somehow it makes the Precious metals investment portfolio feel as secure as ever. Shorter term risk weight charts still show pressure but long term Monthly risk weight has been consistently down since the August 2020 peak. As we are in a primary and unfinished advance the medium and long term market outlook for gold would be for bearish divergence risk weight to develop against a much higher price level. No Change.

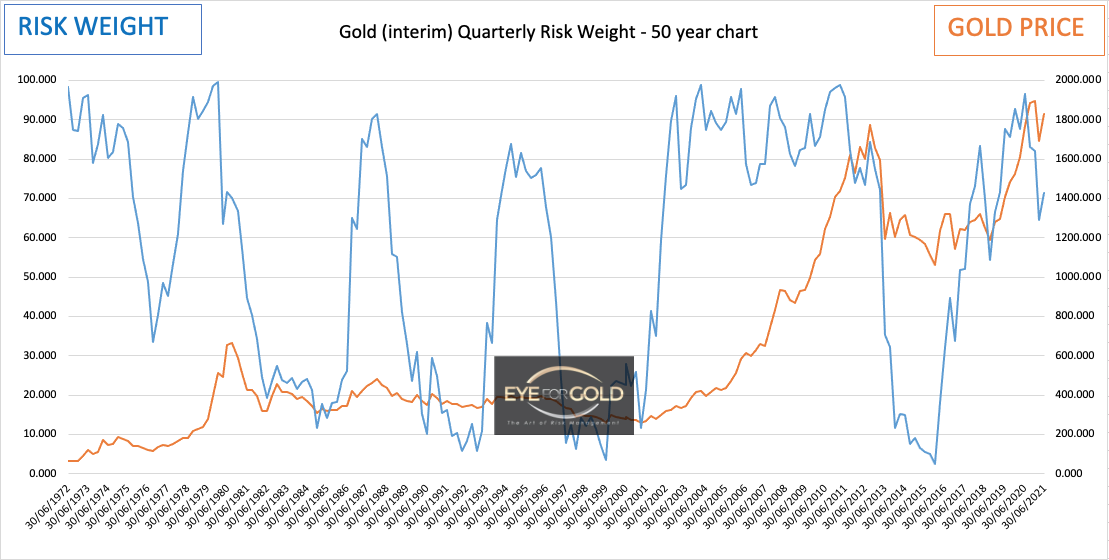

7 May comment Q-risk

We would expect to expand the price range to $2200 fairly soon. Quarterly risk strongly confirms the general short term analysis with a picture above that offers huge potential upside risk weight for a strong price move north of $2,000.

Comment 30 April:April month end on the Quarterly Gold risk chart supports the long term view for developing bearish divergence. Risk weight therefore traditionally should be expected to maker a second lower high just like it did in December 1979, just prior to the January 1980 price peak.

Gold/Euro live price

7 May 2021: Last weeks rally and close above €1500 represents the strongest weekly advance since the €1405 bottom on March 4. That is up 7% in 2 months and our tools confirm confirm a fresh uptrend in the making. Hold!

30 April 2021: A slightly stronger dollar towards the end of last week is pushing Gold vs Euro in a solid hold with patience technical position.

Gold/British Pound live price

7 May 2021: GBP relative forex strength has pushed long term risk weight down to a much lower percentage risk level. This looks to create a base for a much stronger gold price vs the British Pound possibly coinciding with our long expected weaker Pound in the international currency space. Hodl!

30 April 2021: Gold vs GBP is showing the lowest risk weight percentage across time scales. No Change.

23 April 2021: GBP still looks the potentially weaker currency versus gold even though it has kept a fairly strong position in the overall currency space. Where Gold clearly is one of the heavily managed currencies that is now dancing round the floor, we believe it is just a matter of time before Gold spikes hard again versus GBP. Monthly is down still but doesn't feel like that's where it wants to go. It may still do temporarily, however Gold must be a stronger Hold than Bitcoin.