Gold rallies 3.5% pre-Easter | 02 April 2021

Gold Price Forecast relative to

Long Term Monthly (LT-M) - Medium Term Weekly (MT-W) - Short Term Daily (ST-D) - and Hourly (not shown) data.

GOLD FORECAST

(Previous week in brackets)

| Gold/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1735 (1732) |

||||||

| Au Trend | ↓ (↓) | ↑ (↑) | ↑ (↑) | |||

| Au % Risk Weight |

48 (54) | 20 (16) | 45 (69) | |||

| PM Distribution Portfolio allocation 40% (50%) |

Pt:35% | Ag:30% | Au:35% | |||

Physical Gold: Nature's currency

02 April close: Physical Gold has been underperforming and attention amongst small and larger investors is more focussed on Crypto and (fractional) equity trading. Dull markets tend to slip and Gold is no different and may even see some further weakness before the long term trend turns interim bullish again. Technically the metals still look bullish medium and long term. Our total metals portfolio has been adjusted to 35% due to a stronger increase of the crypto portfolio. Also check Quarterly Gold/USD risk comment below. Our original metals position with sufficient cushion remains largely unchanged. A hedge against a monetary pandemic.

26 March close: The past week Gold and in particular Silver continued to suffer from a much greater interest in crypto and equities. There is a growing tendency that precious metals are not that sexy anymore as inflation hedge. For us an incentive to be even more contrarian. We have seen some spectacular moves in all asset classes with many crypto tokens showing a few sharp moves down and up and down and up during the week. We increased our gold balance to 35% of total metals on Monday at the expense of Silver which we moved to 30% from 35%. No big deal but feels like a better balance as the ratio shows intermediate bottoming action. Now with the IMF suggesting a 650 Billion SDR airdrop which is yet to be officially decided and most probably approved come June, this is a signal of MMT is now being broadly adopted by more even the more conservative authorities. This and further helicopter fiat distribution and the continued surge in wealth from crypto trading could turn inflation into a fast upward spiral or a straight hyperbolic move. The very buoyant housing market benefits from still very low rate long term mortgages in most countries and adds to chances of sudden market changes. If that happens the move will very hard to stop and we shouldn't be surprised. As markets move to trigger a reset we anticipate a strong re-alignment of the Bitcoin/Gold ratio in the process and in favor of gold. Demand for gold should be expected to increase. It makes no sense predicting future levels. Holding Gold is a necessary condition for preserving one's assets. No Change.

02 April comment

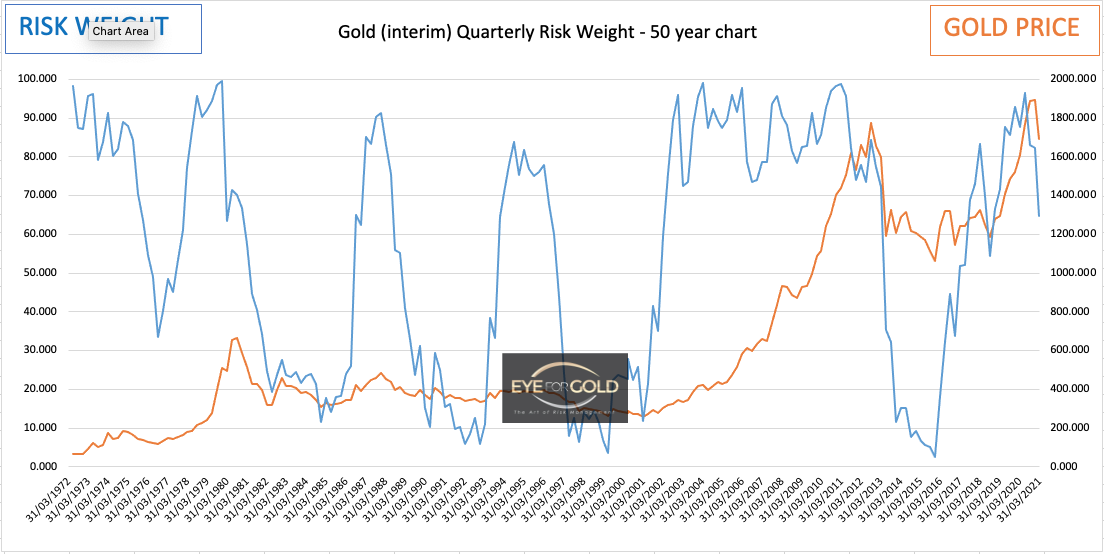

Comment 02-April: The picture looks very bullish even though the risk trend is down. We see a price and risk picture developing which more similar to that during the 1st decade of the 21st century. Yet impossible to say how long uncharted MMT will survive, but central banks appear very accommodative as regards the major spending programs being announced. Hence a continued heavy weighting on precious metals whilst seeking potential in promising digital ventures outside of the traditional equity market.

Comment 26-March: As discussed before, this quarterly chart shows a risk weight downtrend in a supercycle uptrend that should develop bearish divergence at some point in the future. That could be a near or more distant future with an impossible to predict and to be associated price level. All things being equal that price against US dollars will be north of 20,000, simply because that is the level where 120 years of trust in gold backed US$ public debt has averaged. 120 year That average could be calculated around 23% and has dropped from 100% to 3% since 1900. A Bitcoin and altcoin share in this equation will make some difference but not significant as the longer term wealth protection created from digital currency participation and diversification will be limited to just a few million people. And they may be taxed in the billions where Trillions are required.

Gold/Euro live price

2 April 2021: Gold performed relative strong vs Euro due to a slightly stronger US dollar the past week. The narrative is very much the same based on a very similar technical picture. Gold is building a longer term bottom again and also remains a strategic fundamental hold with a safe 35% cushion since entry.

26 March 2021 close: Daily risk weight is a bit overbought with GoldEUR closing the week at 1468 and 87% risk weight. Medium and long term time frames are resp. up and neutral. If a realignment of Gold is going to be part of a global debt reset Europe may have a reasonably strong position relative to the USA, but in the end there needs to be an agreement between the major economies of the world.

Gold/British Pound live price

2 April 2021: Even though GBP remains strongere than expected in the currency space the technical picture is the same as against USdollar. Daily Risk trend Up from deeper level, Weekly risk trend up from deeper, low risk, level and Monthly down into lower risk territory. Gold is a strong hold having started the current major uptrend in October 2018.

26 March 2021 close: This weeks close is just one pound per troy ounce lower than last week's close. Daily shows some bearish divergence at 84% risk weight versus weekly at at 15%. Fridays setback may indicate that gold isn't ready to be embraced again, but patience will be rewarded for GBP tax based investors.

19 March 2021 close: Gold vs GBP looks to develop its strongest monthly close in 8 Months. We consider this a possible supporting signal that GBP's advance against most other currencies is coming to an end. Yet the same structural Gold market technical analysis applies. No Change holding a strong core Gold allocation for GBP tax based investors.