Precious Metals anchor portfolio stability

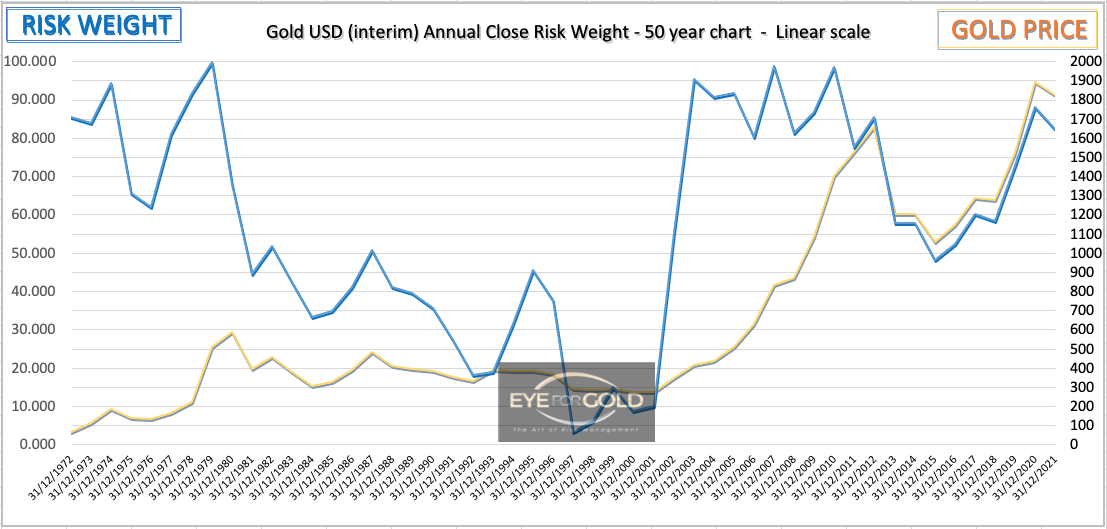

25 Febr 2022 close: Geo-politics has taken control of financial markets. The invasion by Russia of Ukraine, a sovereign state, put nations around the world on high alert and sent markets tumbling and precious metals up sharply last Thursday. It shows the immense financial risk that is always around the corner besides the immense human suffering in case of war. That war is now on our own doorstep and we strongly follow our asset protection strategy to remain fully committed to precious metals. At time (Sunday 27/2/2022 15:00 CET) of writing this short note the latest news is Russia ordering activation of nuclear armor. Speculation with financial assets has truly become a matter of secondary importance. We are surprised that gold sold off sharply again within 24 hours of reaching a intermediate peak of $1974 on Thursday morning. Our PM portfolio nevertheless will remain at least 50% of total. The long term picture on risk weight remains positive for Gold and in uptrends. Daily is down but has not yet reached a reading of negative divergence. The present cycle uptrend which started on Jan 28 is still in play. Present gold weakness, if still on when Monday markets open, is a reason to switch more to Gold insurance. Logically, the gold market is more likely to open (much) higher on Monday, whilst Russia only has one counterparty left to trade Gold.

21 Jan 2022 close: Our Precious metals portfolio allocation has increased as logical consequence from weaker crypto and higher metals prices. Gold was higher ($1834) but not particularly strong last week with more attention leaning on Silver, Platinum and Palladium. Typical for a Friday gold sell off from the highs going into the weekend but the yellow metal still ended about 1% higher for the week. We strongly sense the importance of Precious metals serving a real purpose to better balance portfolio risk. Gold technical indicators do not show extreme risk weight either way. The broader financial market feels and mainstream media also voices geo-political and financial tension which, in our simple risk management approach, traditionally favors holding precious metals. The agressively promoted alternative media narrative that digital money will supersede gold is possibly a very long term potential, but it does not help anyone in today's market as long as wee see volatility building up in all asset classes. To the point even that we no longer follow any of the YouTube hype which is getting very confusing with most influencer journalism just playing the advertising market for short term gains. A crazy world that doesn't serve much purpose anymore. No Change to our above average gold allocation.

Gold/USD risk position relative to

Quarterly, Monthly, Weekly and Daily risk weight data.

(Previous update in brackets)

| Gold/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1888 (1831) |

||||||

| Au Trend | ↑ (↑) | ↑ (↓) | ↓ (↑) | |||

| Au % Risk Weight |

50 (42) | 73 (52) | 74 (81) | |||

| Total PM Portfolio allocation 50% (40%) breakdown: |

Au:12% | Ag:14% | Pt:14% | |||