Gold USDollar risk position | close 13 August

Gold Price Forecast relative to

Long Term Monthly (LT-M) - Medium Term Weekly (MT-W) - Short Term Daily (ST-D) - and Hourly (not shown) data.

GOLD FORECAST

(Previous update in brackets)

| Gold/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1760 (1812) |

||||||

| Au Trend | ↓ (↓) | ↓ (↓) | ↓ (↑) | |||

| Au % Risk Weight |

32 (45) | 30 (39) | 35 (52) | |||

| PM Distribution Portfolio allocation 50% (35%) |

Pt:33% | Ag:33% | Au:33% | |||

Physical Gold: Nature's currency

13 August close:The widely published flash crash from the previous weekend causing the market to drop $100 and involving a possible several billion dollar set of transactions was not market manipulation. Manipulators would be more organized and not sell into a totally illiquid market. More likely that it was fed into the market for several days and then given a push at Far east open in order to trade the other side. It may have been a well prepared switch from paper to physical even or a mere market test by a long term hold over several days allowing a small loss. A margin call is possible but unlikely given the time of the price drop. It is conceivable that the price will make another attempt south, but more likely to confirm the technical bullish case. The almost immediate 50 dollar recovery shows bullish divergence in both daily and weekly time scales on all our preferred market tools. No Change to our long term physical allocation.

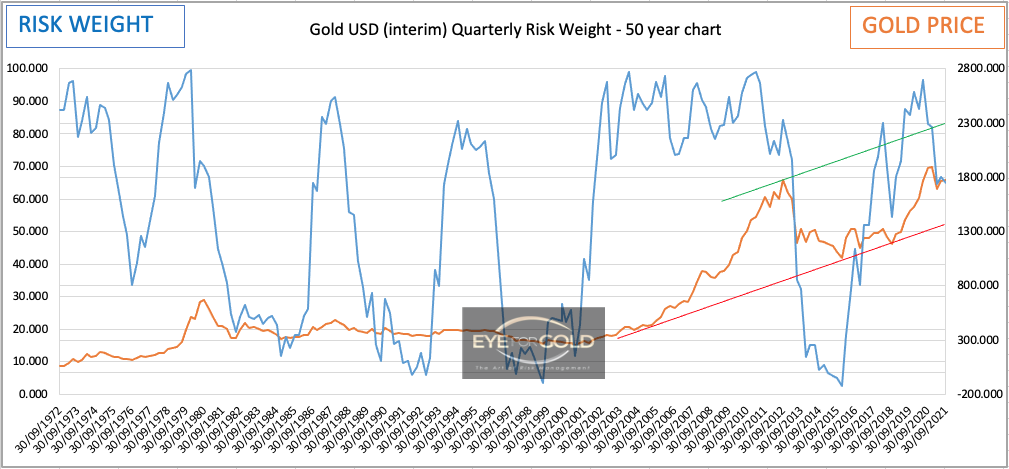

06 August close: Our long term hold is established at a bull market primary intervention level, i.e nearer the 2015 low in Euro. Present market weakness of all precious metals does not give any technical desired indication of a long term peak having been reached. All risk weight time frames do look weakish still but if we look at the long term price chart (Quaterly) Gold risk chart below), gold is just consolidating at a much higher level. A drop to 1700 or 1650 would not deter from patiently waiting for that much higher price print to develop and stick with it. Fundamentally, central banks are trapped and this is causing most traditional financial invesment assets to maintain their 'risk on' status. This has been going on for much longer than most expected, but we are happy to stay with the long term position and possibly adding to that metals position if our techical tools indicate a short and medium term hard oversold. That isn't the case yet, so no change.