Gold USdollar risk position | close 16 July

Gold Price Forecast relative to

Long Term Monthly (LT-M) - Medium Term Weekly (MT-W) - Short Term Daily (ST-D) - and Hourly (not shown) data.

GOLD FORECAST

(Previous update in brackets)

| Gold/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1810 (1814) |

||||||

| Au Trend | ↓ (↓) | ↑ (↑) | ↓ (↑) | |||

| Au % Risk Weight |

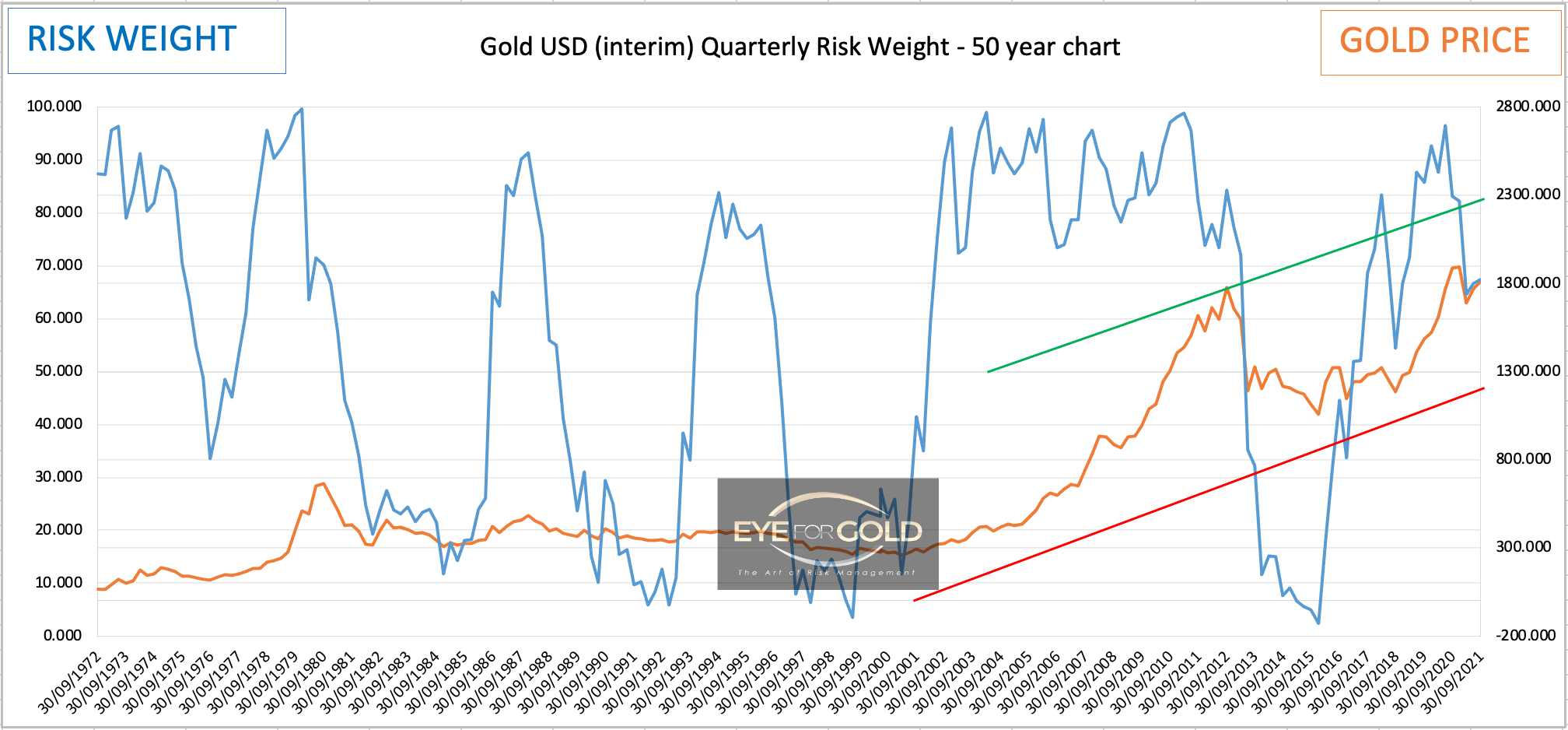

44 (45) | 43 (44) | 88 (85) | |||

| PM Distribution Portfolio allocation 50% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Physical Gold: Nature's currency

16 July close: Gold's weaker close, after the decent rally during the first half of this week just confirms the scenario below. Metals appear to be negatively influenced by relative weakness of other asset classes. There is no fundamental nor technical reason to change our medium and long term bullish outlook.

14 July close: Weekly risk weight of the primary uptrend continuation that started in March 2021 has yet to produce bearish divergence. Until that happens and even when that happens we only start looking at a possible lightening of the position. Daily would be the first to signal a short term correction from what could develop as a fairly strong intermediate advance. Monthly is in a narrowing downtrend and should also produce a double or triple overbought condition before the primary trend finishes. The objective would be the top of the 20 year channel now offering initial resistance at just below 2600. No Change.