Is El Salvador the BTC Butterfly Effect? Maybe - or Maybe NOT?

BTC Bitcoin Price, Bitcoin Price Risk Analysis

(Previous week in brackets)

| BITCOIN BTC/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 49,747 (57,838) |

||||||

| Trend | ↑ (↑) | ↓ (↓) | ↓ (↑) | |||

| % Risk Weight |

77 (73) | 60 (66) | 36 (41) | |||

| Allocation Limit(0%) | Invested | 0% (0%) | ||||

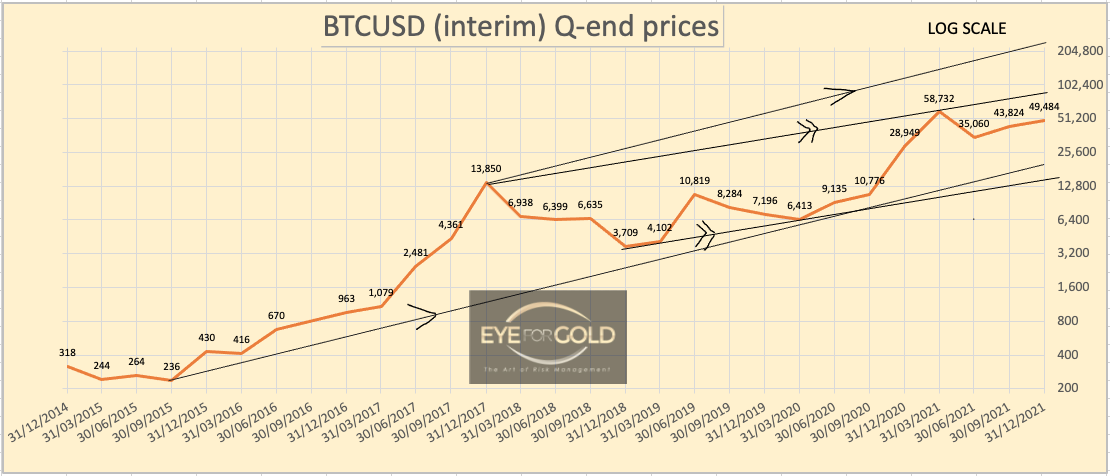

06/12: 05 December 2020 close: Bitcoin stats are absolutely fascinating:

- $100 invested in 2010 at $0.10 (BTC 1,000) and held to date yields a whopping 10.20% per month which is the equivalent of 229+% per annum

- $100 in 2010 values at $ 49,000,000 on Dec 5 2021

Many early adopters have invested a lot more and wisely collected some significant profits along the way. They are safe having created generational wealth.

The narrative around El Salvador with its Bitcoin legal tender and Vulcano bond is pretty determined and lead by Max Keiser/Stacy Herbert & Friends. All very bright people that may be right in this respect.

And just maybe, this tiny state, with 0.02% of world GDP will become the trigger for global Bitcoin adoption. But what if they are wrong? which is why they also own gold and silver etc. They are safe, remember. Average Joe isn't safe but they love the gamble, until maybe they don't anymore. Late adopters that have come in with corporate cash pushing this asset higher and higher may also experience a very serious setback. And since the advance rate of Bitcoin is slowing who knows what will happen.

During a single hour around midnight New York time on Dec 4 Bitcoin crashed taking almost all crypto tokens along with it with an average peak to bottom drop of 22%. Looking at volume the big seller probably released somewhere between 4,000 and 5,000 BTC which is ginormous at that very early Saturday morning hour. A few hours later El Salvador announces the purchase of 150 Bitcoin. Wow! It could have been a manipulated move as well and if it was... pretty irresponsible vis a vis the community. Total crypto market cap is down 10% since Friday evening having recovered from down 22% at the bottom.

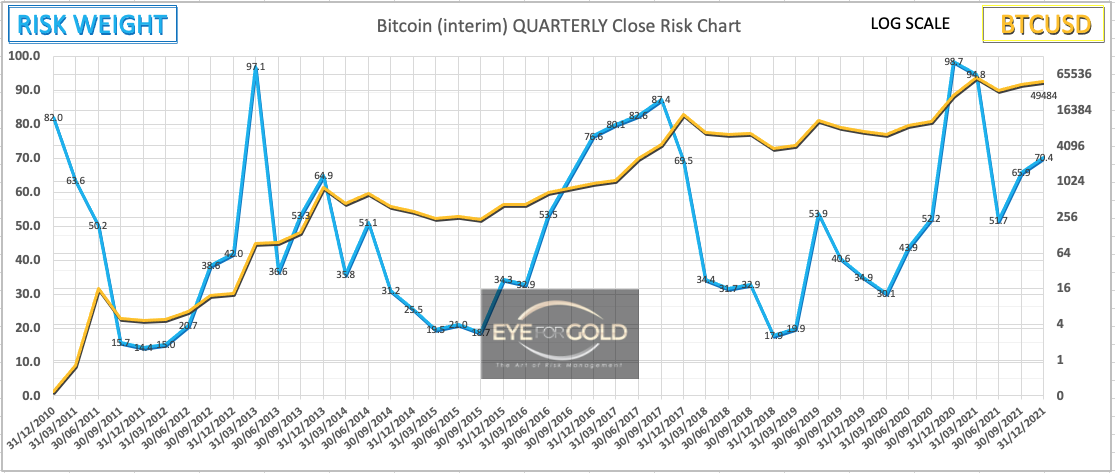

Since nobody really knows what will happen to the Bitcoin price looking marginally forward, except for a happy few :), we can but look at long term technical indicators and as so many millions of people around the globe have now taken the Bitcoin gamble, BTC price is more likely to respond to momentum and relative strength type technical indicators.

Fundamentally we happen to be more in the Michael Burry camp as there is a real risk that Bitcoin and a few other major crypto currencies will correct substantially for whatever valid reason, with the benefit of hindsight of course.

Technically the charts below say 'risk should be off ' for late adopters whilst we stick, for now, with our strong corrective and possible ABC scenario.

30/11: 29 November close: Bitcoin had a mixed week, losing ground into the weekend setting reaching a post ATH new low of $53,327 on Sunday 28 Nov and a strong recovery that same day to $57,317, currently trading around 59k. Daily time interval has produced a double bullish divergence risk weight pattern thus seeking price recovery whilst weekly has opposite technical pressure being in a downtrend after a double bearish divergence. Monthly risk weight is still up, but fading. Anything can happen but risk is still against seeking new wealth north of 60k. This will require some bulky investment into the Bitcoin crypto currency, which doesn't seem very likely as most wel known large hodlers and whales may be on the sidelines here whilst still sitting on a significant unrealized profit. It is end of month today and a close below 60k on Nov 30 after opening the month at $61,345 may initially push monthly risk weight into a downtrend for December. The most likely technical scenario is now for Bitcoin to struggle finding enough renewed speculative support to get anywhere near the early year forecasts of $200k and much higher. This would require serious price manipulation which at these levels involves massive risk. The technical picture however is more favourable as this time 2020 when all time intervals were at high risk as BTC reached 30,000 in an unstoppable uptrend. This is one of the reasons why we think we may be in for an irregular Nov 2021 top leading to a large correction into the new year.

21 November close: Almost every single day the number of youtube advertiser 'specialists' in the financial and crypto space grows. Most of the information these days is 'old news' and 'stolen' from official earlier releases. Rubbish so to speak, but if we permanently hide those channels and stick with the originals we see a pattern that also these 'influencers' are increasing the frequency of their widely followed narrative now reaching a status of sending a daily dosis of Bitcoin and other coins 'pump' competition talk. Because the influencers are so wildly bullish, every day, again and again, because they can afford to be, this entire market is getting scary. Market behavior is no different that the Covid protests that seem to always end with Police clashes the past few weeks. Meaning the infinitely large number of pure speculative pump and dump Crypto traders will be getting their day in court, in other words thet will meet the real managers of this super inflation pool and can get hurt badly in the process. Let's hope everyone benefits and inflation will be tempered. But is that the most likely scenario? It doesn't mean this market cannot go 5X or more. Who can tell anyway what will happen these days. Technically almost all crypto tokens look they may still suffer a huge correction before the market settles down. Hence our own reluctance to follow the perma bulls and applying a serious level of risk reduction in our simple wealth management approach. The charts and tools of total market cap show the exact same pattern as Bitcoin but it shouldn't, realising that BTC indeed represents 40% of that Total market cap index. All normal intervals like Daily, Weekly, Monthly and Quarterly are predicting a high(er) risk of price vulnerabilty. The lower risk approach therefore is to simply not be 'all in, unless you can afford to be (= 'Sit through a potential 90%+ correction without sweat').

Bitpanda Pro - BEST Token Price Risk Analysis | 1 Nov

(Previous week in brackets)

| Bitpanda - BEST/EUR | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 0.9000 (0,9500) | ||||||

| Trend | ↑ (↑) | ↓ (↓) | ↓ (↑) | |||

| % Risk Weight |

30 (30) | 62 (64) | 22 (23) | |||

| Allocation Limit(variable) | Invested | 100% (100%) | ||||

BEST token live price

Bitpanda BEST analysis

06/12: 05 Dec 2021 close: BEST to a slightly smaller dive at the weekend but with more follow through on Monday whilst BTC recovered towards $49k.

We are following our technical picture having allocated idle cash for possible re-investment in different crypto at much lower levels. Some of the more interesting startup tokens lost as much as 40% during the weekend crash and they are too young still for individual technical analysis. Litecoin for example lost 44% peak to bottom last week and still down 32% at this moment.

BEST, or rather Bitpanda, also triggers attraction as we can swiftly move between different asset classes and especially the precious metals space which gives much comfort and even a lot less price volatility. If the crypto market suffers a serious blow in the coming year we would expect precious metals to be the ultimate safehaven. The Gold to Bitcoin ratio as shown on this page indicates a very potential longer term correction in favor of Gold with a few weekend gaps yet to be filled at much higher ratio prices.

30/11: 29 Nov 2021 close: BEST has been fairly uneventful. As Nov 30 23:59:59 is reward time again, the token may be under some pressure relative to the majors or even drop sharply if the Majors turn south again. BEST Daily risk weight looks more positive today on Stochastic, RSI and MACD so maybe we will see the Crypto Cap moving up. COIN is also one to watch as is can indicate broader direction for the entire crypto space. It needs just a few native tokens to really start from a fresh impulse.

BEST remains a long term hold collecting unique monthly rewards up to 1% depending on trading level. BEST is also still a young limited liquidity asset, which is fully controlled by Bitpanda who are in the business to also protect their employees interest within a fully regulated financial framework and the PANTOS development group (PAN token) that promise to deliver a Multi-Blockchain Token system. Part of our calculated gamble is the expectation of a Launch platform (Business finance or business initial exchange offering through issuance blockchain tokens) to be announced in the near future, but this much depends on regulatory issues to be resolved. Unfortunately there cannot be much news on this front until they are ready to go live for their account holders under guidance of the Austrian Financial Authority. Hold.

21 Nov 2021 close: We've lightened up just a little by selling some of the reward tokens as the same applies to BEST as it does to most other crypto tokens. Our choice to largely stay with BEST after the 2000%+ rally since last year is one we've analysed every week and we still expect some good news on future developments. Having sufficiently protected the original investment ay higher levels we can handle a major correction and are looking to diversify in crypto on a still small but slightly larger scale as there will be triggers with potential greater long term benefit. No doubt that the entire crypto is exciting and crazy enough to stay on high alert.

13 Nov 2021 close: Our BEST holding was also shaky after a good start on the Month but held its own with a similar loss as the majors coming into Sunday 14 November. As Bitpanda's BEST tokens offer an strong incentive with their monthly rewards, which in our case vary between 0.9% and 1% every month, we can simply ignore large medium and short term price fluctuations or even a major drop until the entire market settles into a state of economic maturity. No Change.

06 Nov 2021 close: BEST started the week in line with the crypto market as a whole but then found fresh local European demand on Wednesday which took the Bitpanda native token up by 15% before settling around €1.0750. We took the opportunity to release the October monthly reward into fiat with a view to reinvest in an altcoin of some sort. As all major crypto assets have continued very strong into the new week, we may well take a punt in one or two Bitcoin alternatives if they reach a technical condition that justifies the risk. Such risk would not be more than 1 or 2 percent of total portfolio.

Bitpanda's BEST token does not show the same technical high risk weight levels as other very strong crypto performers do coming into the new week, including Bitcoin which already today almost reached its all time high of $66,999. As we also trade 100% physically backed precious metals through the Bitpanda exchange, BEST is still the fundamental choice of preference due to the monthly reward, 20% lower trading commissions if using BEST tokens for that purpose, and the regulated status of this Austrian crypto industry leader. BEST probably would perform better with added liquidity from non European countries but that Europe only crypto, stocks and metals exchange limitation however is unlikely to be changed anytime soon due to the international regulatory requirements. Strong HOLD on the core BEST position.