Gold/USD risk prediction | 31 October 2021

Gold Price Forecast relative to

Long Term Monthly (LT-M) - Medium Term Weekly (MT-W) - Short Term Daily (ST-D) - and Hourly (not shown) data.

GOLD FORECAST

(Previous update in brackets)

| Gold/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1782 (1792) |

||||||

| Au Trend | ↓ (↓) | ↑ (↑) | ↓ (↑) | |||

| Au % Risk Weight |

30 (30) | 60 (55) | 70 (65) | |||

| Total PM Portfolio allocation 40% (40%) breakdown: |

Pt:14% | Ag:14% | Au:12% | |||

Physical Gold: Nature's currency

31 October: Friday's close also marks the end of October and again the metals had trouble holding their levels on this Friday October 29. The long term consolidation in the $1700-$1900 range since 1 year show a similar pattern as the consolidation and corrective period in 2008. We expect Monthly risk weight to follow Weekly risk upward. Whilst the short term technical picture is inconclusive the key is patience, because the world monetary system is potentially explosive.

50 years of excessive money printing in ever larger quantities is the primary reason why crypto tokens are so popular today. National authorities appear to not yet see this danger and if they do, have no response to the massive economic risk that lies ahead. That risk is a parabolic further divide between 'rich and poor'. The risk that the crypto market will also grow much faster than currently forecast at roughly 2X in 6 or 7 years. There are different forecasts floating, but what if this market grows by 10X in 2 or 3 years. What if SHIBA UNI overtakes Bitcoin Market Cap, currently at 1.2 trillion dollars, in 'no time', simply because it is the smallest penny crypto around and 1 Billion newcomers in the crypto space decide to buy, amongst other tokens? Is it possible? This would create serous speculative havoc in financial markets and also drive hyperinflation due to widespread opportunity consumer expenditures. Broad Tulip mania. Central Banks and G20 will need to respond with a hard reset to restore trust in fiat. And since they only own gold that represents any value, we stay with precious metals as the core investment insurance.

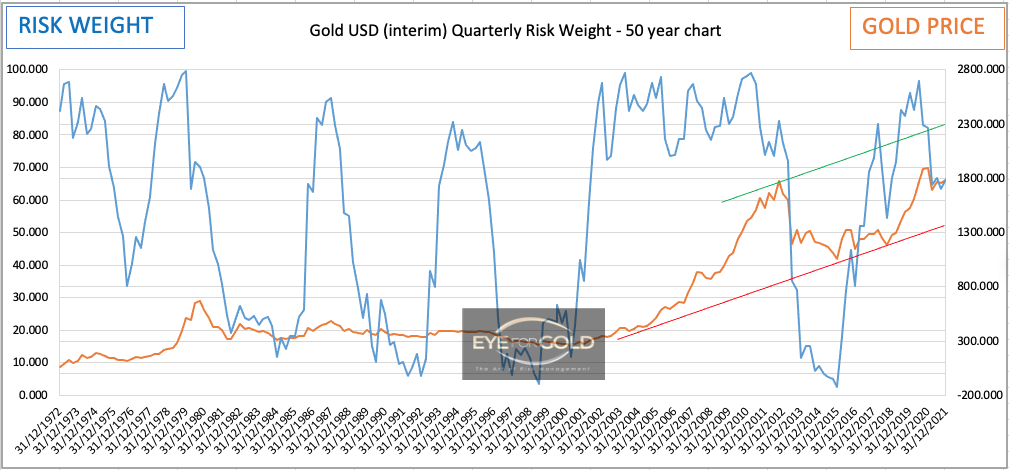

22 October: Another week and another shaky Friday price action. The technical picture is far from clear short and medium term, whilst the long term quarterly print still favors upside with an initial target close to the parallel upper trendline at around $2300. Inflation fears and data confirmation can easioly take Gold into steep log scale territory. And the necessity to log scale Gold;'s price chart means inflation! Monthly risk weight is down but at the slightly higher 30% level. This is a mild bullish signal for a poitential long term trend change to 'up'. No Change to our Long term Hold.