Physical Gold is a fundamental HOLD | 12 Febr 2021

Gold Price Forecast relative to

Long Term Monthly (LT-M) - Medium Term Weekly (MT-W) - Short Term Daily (ST-D) - and Hourly (not shown) data.

GOLD FORECAST

(Previous week in brackets)

| Gold/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1823 (1813) |

||||||

| Au Trend | ↑ (↑) | ↑ (↓ ) | ↓ (↓) | |||

| Au % Risk Weight |

64 (64) | 31 (30) | 59 (22) | |||

| PM Distribution Total allocation 50% (55%) |

Pt:35% | Ag:35% | Au:30% | |||

Gold/USD live price

Hodl Physical Gold

12 February close: Our existing Gold position is just over 2 years young with some assets established back in early 2016. This position is fundamental to protect against the risk of MMT adoption, Crypto regulation and Fiat currency flooding in general. We expect Gold to advance strongly and the event of some very strong price action feels closer than ever. Silver and Platinum would benefit exponentially in this scenario. Most investors/traders can be easily blinded by parabolic income generated from near zero finance funding and hyperspeculation in crypto. The primary reason for owning physical gold, silver and platinum is that risk of major undesired financial consequences from unprecendented Central Bank intervention policies to control money supply and inflation in this present-day scenario of exponentially increasing government spending by all major economies, now largely influenced by Covid-19 expenses.

5 February close: Physical Gold looks and feels very strong inside a manipulated paper market. Manipulation is a reality that is driven by a large US component. There are so many questions that haven't been answered with the number question being: How much Gold does the USA really own from its own trading book? The USA will be able to drive a hard bargain with countries still keeping Gold in storage on US soil and if there is indeed a shortage of physical LBMA 99,5% purity gold at their end. And they surely do know. The US Treasury only need a very very small inner circle to keep track of this. We would expect the physical gold to paper gold disconnect to materialize sooner rather than later which is partly due to what is happening in this new world of fiat for crypto world. Whilst crypto is more likely to stay within the crypto space. That can and prabably will be seen by offical bodies as the virus that must be killed. The problem is that it can't. The crypto world is on an unstoppable journey and precious metals will do catchup as a major monetary reset begins to rumour in ernest and unfolds at a time we cannot predict. Silver and Platinum will see prices soar due to their much lower level of liquidity combined with huge acquisition margins. A modern day mining rush will also unfold. No Change to the larger fundamental precious metals wealth protection allocation. Hodl Physical Gold, Silver and Platinum.

Jan 31 comment

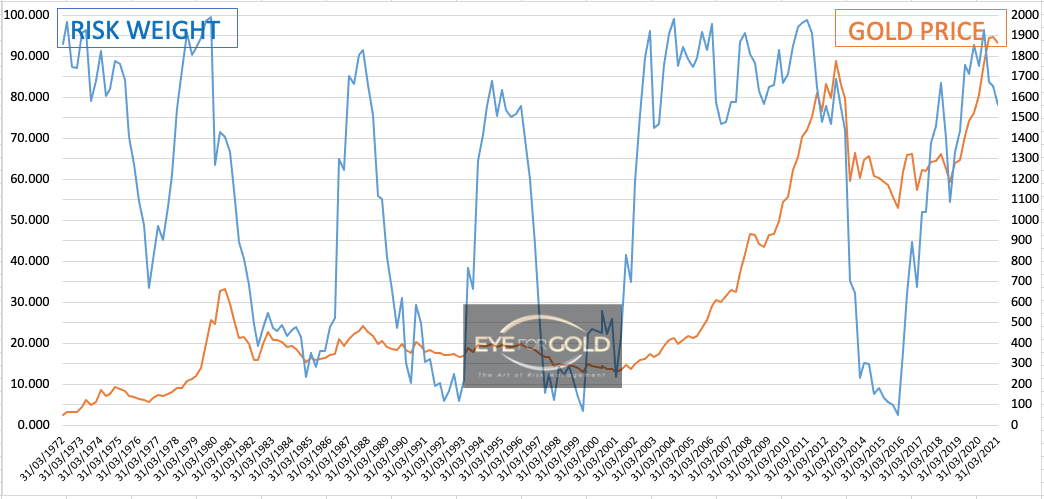

The Quarterly risk to price chart above shows risk dropping to 78 with minimal price change. This is an interim quarterly Gold risk position at the close of January 2021.

This chart cannot be used for timing investment decisions or trading. The observation is that we may well see several peaks during a much larger price advance, similar to longer periods in history.

Gold/Euro live price

12 February 2021 close: The short term picture of where the Gold price versus Euro will move is not certain. We could easily see further weakness for instance of the dollar gets a knock. The long term picture still looks very favourable technically as risk weight on Weekly and Monthly time scales have come down substantially with relatively little price change. As Gold/Euro is still 50% above the late 2018 level that cushion looks pretty safe besides the same fundamental reasons to maintain a sizeable physical gold for Euro based investors.

5 February 2021 close: In the larger scheme currency fluctuation is not going to make muuch difference. One week the dollar will be strong and weak the next. Gold we be significantly stronger vs Euro as the international fight for a monetary solution unfolds. Euro based investors simply must own physical gold, silver and platinum. Given a chance, the precious metals will strengthen soon enough to re-allocate into other hard assets to pass on to a next generation before a major inflationary cycle gets underway. Gold Euro Monthly and Weekly risk weight are below 25 and offer a chance to add. Europeans are best using the Bitpanda exchange facility to park any excess bank balances in Precious Metals, Fiat and crypto. No leverage.

Gold/British Pound live price

12 February 2021 close: The current long term cycle of Gold vs Sterling started around 700 in 2015. The technical picture is very much the same for Gold vs all major currencies which means that the effect of exchange rate movements on the gold price is likely to be less relevant than a movement of potential role of gold as an asset class in the bigger macro economic picture. No Change. GBP based investors 'HODL GOLD'. The present relatively depressed price level looks attractive to establish or re-establish a core position with physical gold. Today physical gold can still be bought at paper prices plus a small margin.

5 February 2021 close: Opportunity still knocks to invest even more in physical gold, silver and platinum as fiat GBP continued its relatively strong performance last week. UK tax based wealth preservation investors should sit tight. Your time will come as it always has the past 50 inflation years.