Platinum weekly close pushed Medium term risk negative | 15 Jan 2021

Platinum Price Forecast relative to Long Term Monthly (LT-M) - Medium Term Weekly (MT-W) - Short Term Daily (ST-D) - and Hourly (not shown) data.

PLATINUM FORECAST

(Previous week in brackets)

| Platinum USD | LT-M | MT-W | ST-D | |||

|---|---|---|---|---|---|---|

| 1068 (1063) |

||||||

| PT Trend | ↑ (↑) | ↓ (↑) | ↓ (↓) | |||

| Pt % Risk Weight |

85 (86) | 80 (83) | 65 (78) | |||

| PM Distribution Total allocation 55% (50%) |

Pt:30% | Ag:40% | Au:30% | |||

Platinum / USD live price

Platinum comment

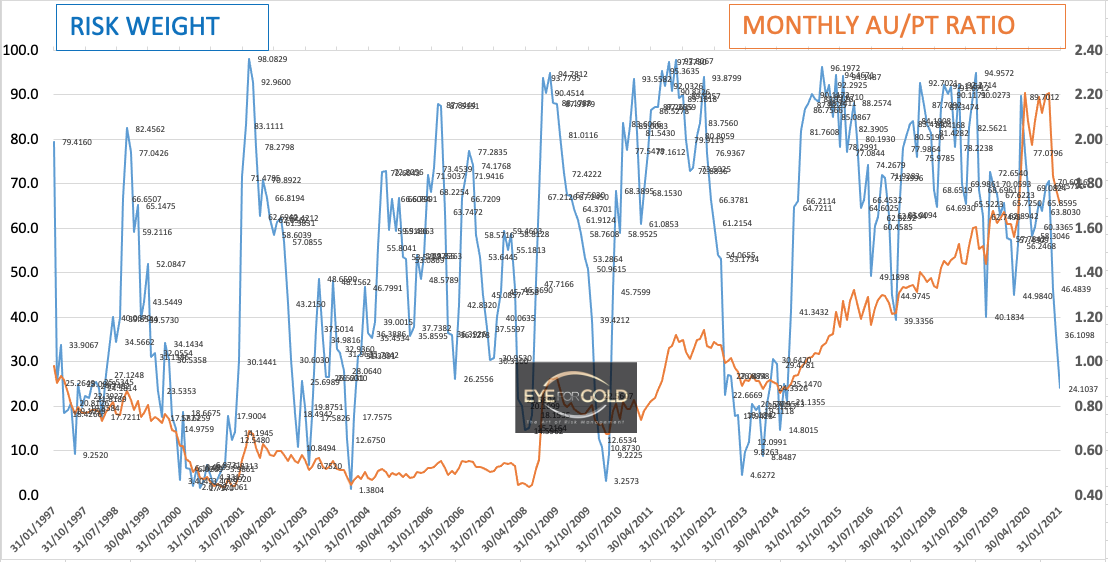

15 January 2021 close: The Gold/Platinum ratio analysis below is critical for comfort with our long Platinum position. Since we initiated our position at just under $900 after 13 years of correction with the Gold to Platinum ratio around 2.15, Platinum every time recovered earlier and stronger during any of the recent precious metals retracement periods. In order to protect our long term physical precious metals holding we may well increase our Platinum allocation as the ratio closes in on its long term equilibrium with gold at just under 1:1. No Change.

8 January 2021 close: Platinum had a strong performance going into the new year and appears to be developing a flat correction on the hourly chart. Daily risk weight turned down as a result of the steep drop on Friday 8th Jan which may last a little while longer. The Longer term time scales are at higher risk levels, but have yet to produce a bearish signal. This short term reversal could mean a little pause as almost all attention is on crypto at the moment. Slow moving assets like precious metals are not in favor with speculators. These speculators pay no attention to longer term risk, so it shouldn't worry us. No Change.

GOLD/PLATINUM Ratio Price Risk Charts & Analysis

(Previous week in brackets)

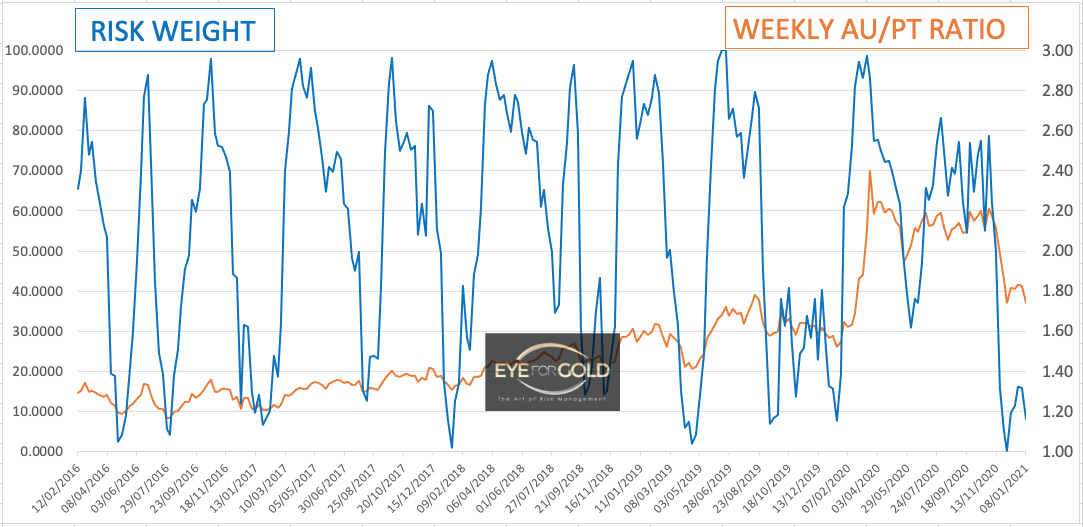

| Gold Platinum ratio | LT-M | MT-W | ST-D | |||

|---|---|---|---|---|---|---|

| 171 (174) | ||||||

| Trend | ↓ (↓) | ↑ (↓) | ↑ (↑) | |||

| % Risk Weight |

24 (26) | 10 (8) | 23 (10) | |||

| PM Distribution Total allocation 55% (50%) |

Pt:30% | Ag:40% | Au:30% | |||

Gold / Platinum Ratio Charts

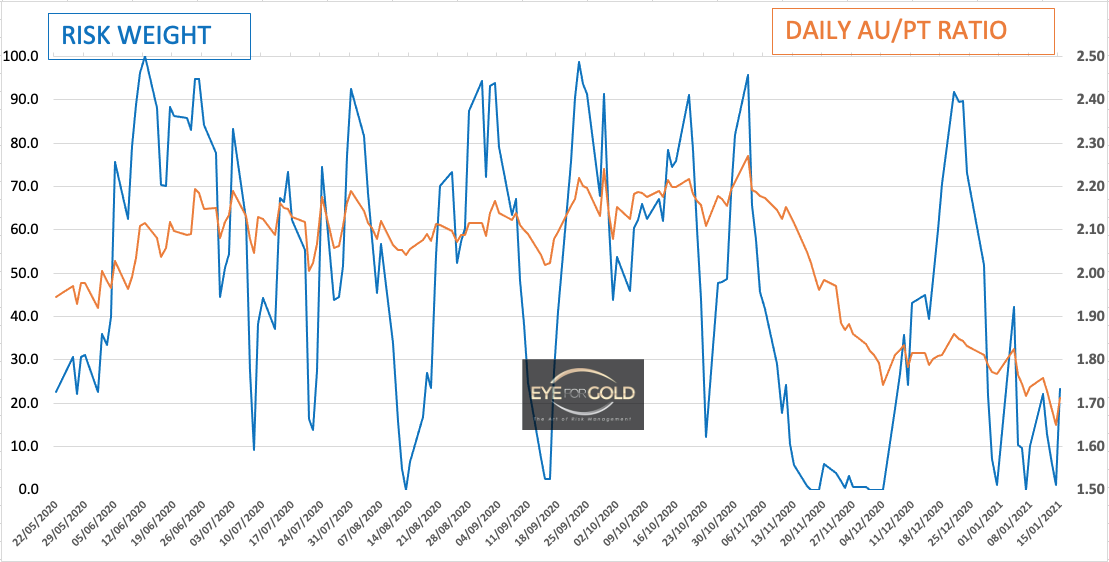

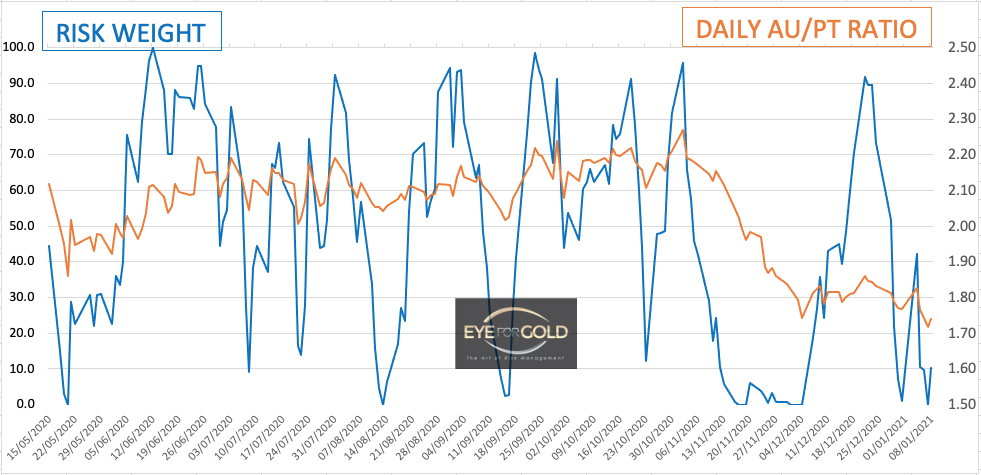

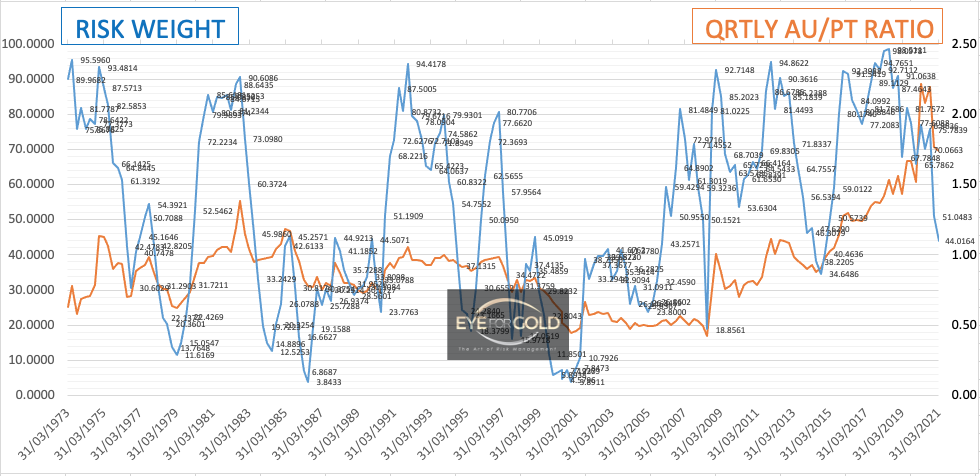

A healthy reaction to the steady downtrend in force since early November. A few days of upward correction in the Gold/Platinum ratio can quickly develop bearish divergence between short en long term timescales. With Monthly and Quarterly in strong downtrends we stay with our slightly favoured Platinum allocation with a view to see this through towards Gold/Platinum 1:1 equilibrium.

Monthly risk weight is half way the period has dropped to 24 and is likely to reach a sub 10 level aty the time of an interim price bottom. This is one indicator to watch closely unless we see bearish divergence developing in the meantime between short term and long term risk weight.

8 January comment:

The correction in Precious Metals has not affected the Gold Platinum ratio much which dropped a mere 2 points from 176 to 174. Our general entry level at around 2.10 and additional net Platinum around 940 still looks a very solid position. The Daily close this week may again drive the ratio somewhat higher but isn't a signal for a long term trend change.

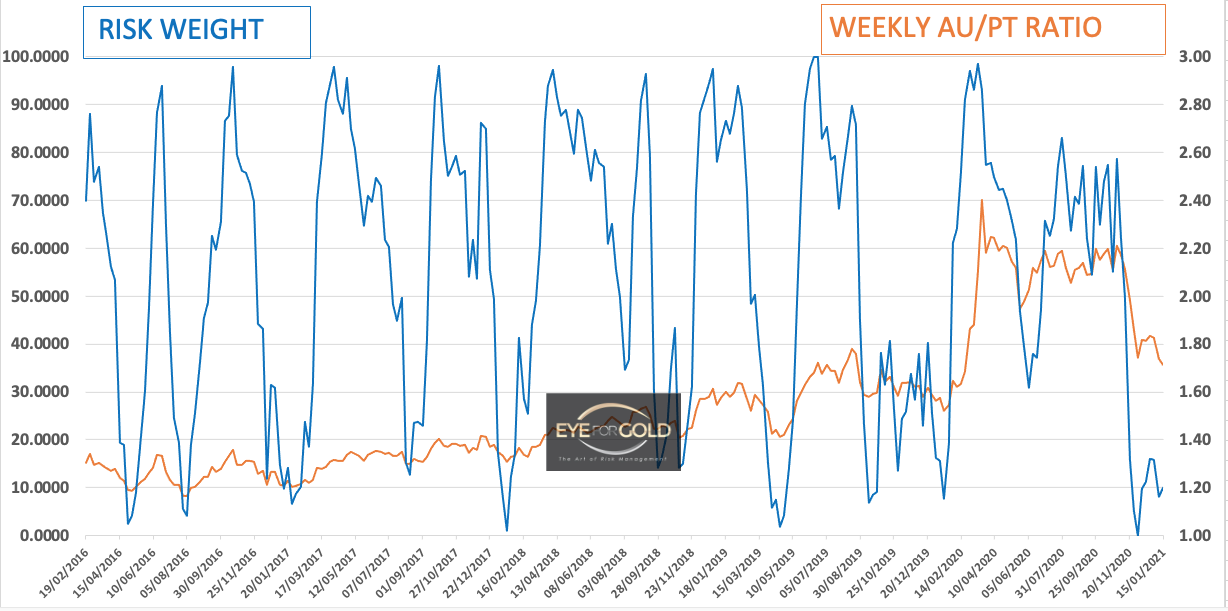

This weeks metals correction makes the very short term outlook slightly uncertain. The weekly could move higher following the Daily trend on some range volatility or an outright correction up of the Gold Platinum ratio towards 1.85-1.90. Platinum is known to get hit harder as metals turned down in recent years, but has performed very strongly in recent months. We give preference to both Longer term risk trends, Monthly and Quarterly, that have yet to finish the move. No Change.

Monthly risk weight is now only offering an interim indcation. The risk downtrend is still in force supported by the longer term Quarterly risk trend which is strongly down as well. The technical picture allows for several reversals and we could easily see a fairly sizeable advance of Platinum vs Gold. This now remains difficult to forecast because short term indicators are bottoming which usually means a milder correction against the long term trend.

Quarterly risk weight dropped 5 points from 51 to 46 and has some way to travel. Because short term indicators are turning up with Monthly getting into lower risk area we could see an interim bottom before the summer. That signal will come from shorter term indicators. The Long term correction towards our target equilibrium of 1:1 however has not yet finished.