Owning Platinum is as good as Gold | 26 Feb 2021

Platinum Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

PLATINUM FORECAST

(Previous week in brackets)

| Platinum USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1188 (1270) ↓6.5% |

||||||

| PT Trend | ↑ (↑) | ↓ (↑) | ↓ (↓) | |||

| PT % Risk Weight |

87 (90) | 84 (87) | 52 (75) | |||

| PM Distribution Total allocation 50% (55%) |

Pt:35% | Ag:35% | Au:30% | |||

Platinum / USD live price

Platinum comment

26 February 2021 close: Platinum had its first more serious correction since the long awaited bottom was reached in March 2020. Between then and today Platinum has recoved 30% versus Gold where gold is the best reference to determine relative market strength. Our initial target was 1037 and our next target is $1500. Long term risk weight has come into the higher risk zone which may last for a long period during major uptrends expecting long term time scale bearish divergence before the trend ends. This is a long term play. No Change.

19 February 2021 close: Our timely entry into physical Platinum last year still looks solid reaching a new 5 year monthly high of 1337 just this past week. Between 1915 and 1920, Platinum prices soared from 2x gold to 5x gold before precious metals regulation put a stop to this steep divergence. The average gold/platinum ratio since August 1971 = 0.88. Having seen sub 0.40 in 2009 and 2.20 in 2020. We believe that precious metals are likely to survive the onslaught from crypto and will lead Platinum back to that more recent long term equilibrium of nearer 1.00 or slightly below. A favourfed slight overweight of Platinum in the substantial portfolio allocation of precious metals. We like to see long term bearish divergence in the medium term and long term time scales before considering an exit. Besides trading physical is relatively expensive and their is a storage cost of 0.5% per annum, depending on provider, to be considered. We use the Bitpanda exchange for Platinum and a Swiss provider for physical gold and Silver. Storage location for all metals is Switzerland.

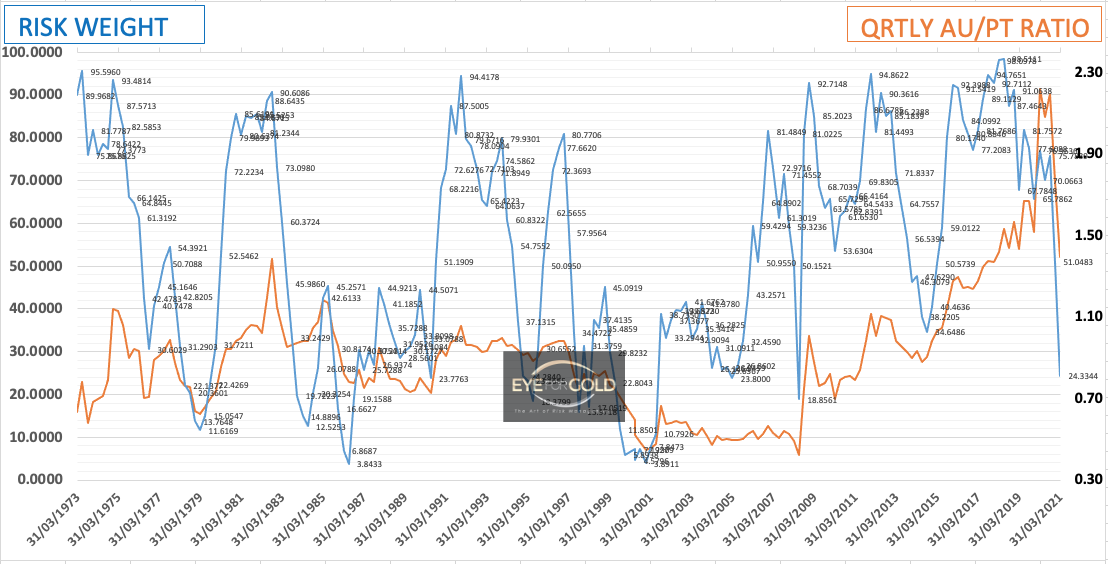

GOLD/PLATINUM Ratio Price Risk Charts & Analysis

(Previous week in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 146 (139) ↑ 5% |

||||||

| Trend | ↓ (↓) | ↑ (↑) | ↑ (↑) | |||

| % Risk Weight |

14 (9) | 12 (3) | 43 (10) | |||

| PM Distribution Total allocation 50% (55%) |

Pt:35% | Ag:35% | Au:30% | |||

Gold/Platinum Ratio Charts

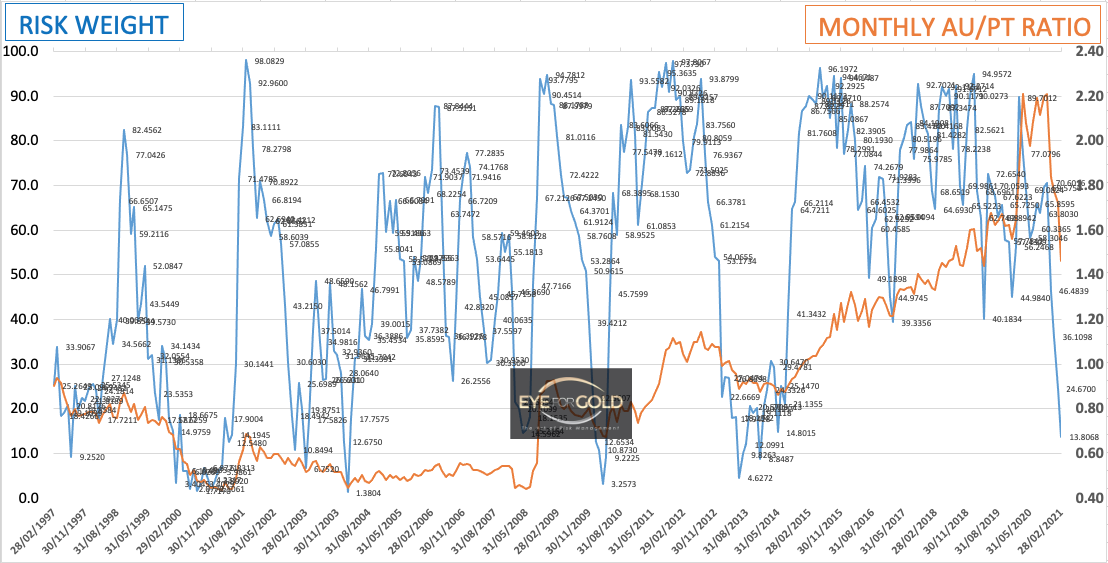

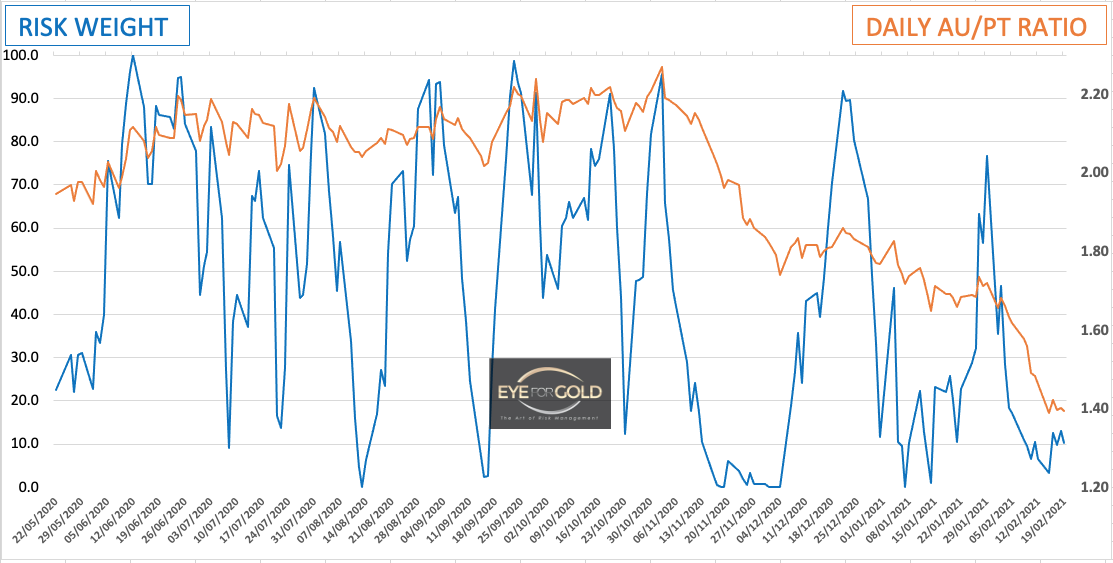

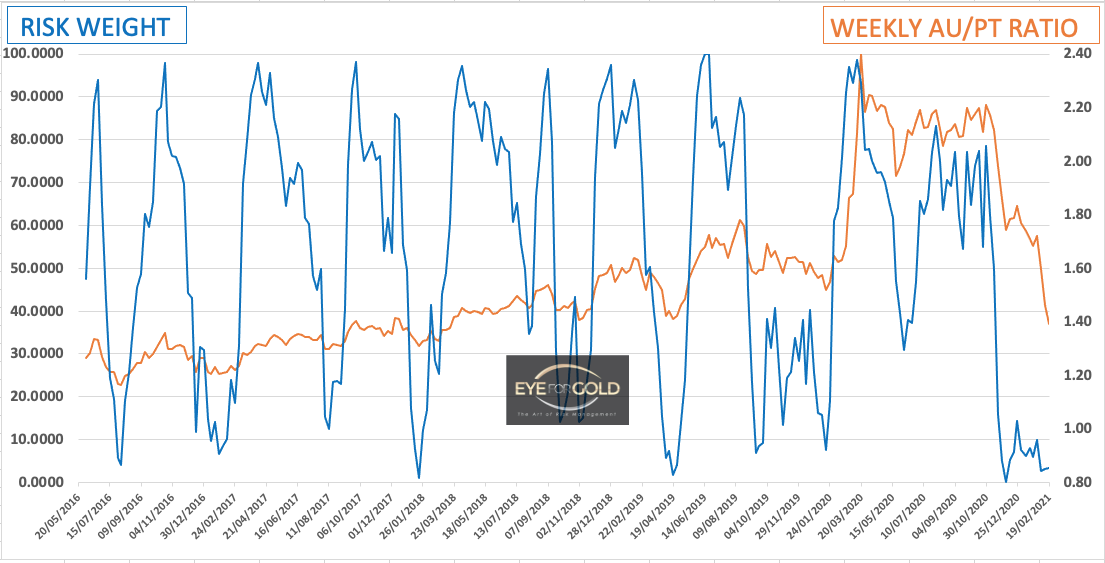

Platinum paused the steady recovery from 9 years of weakness for most of last week. Platinum fell to an all time low of 2.46 x less than gold and reached 1.36 the previous week. A 44% recovery from peak to bottom thusfar. The apparent rapid advance of Daily risk weight llke this is a pause reaching for bearish divergence between Short and longer time scales. Physical Platinum is a solid low risk hold in the present economic regime.

26/2: Monthly risk weight dropped to 9% last week and is now at 14%. This is not a change of trend interestingly enough as the 9% was an interim monthly reading. This trend is still down and has more room to bottom at a lower level before a longer correction may take place. There will not be a straight line to par and beyond with gold, although it is theorectically possible. Let's see how March develops. For now it looks as if Platinum can hold its relative strenght for a few more months.

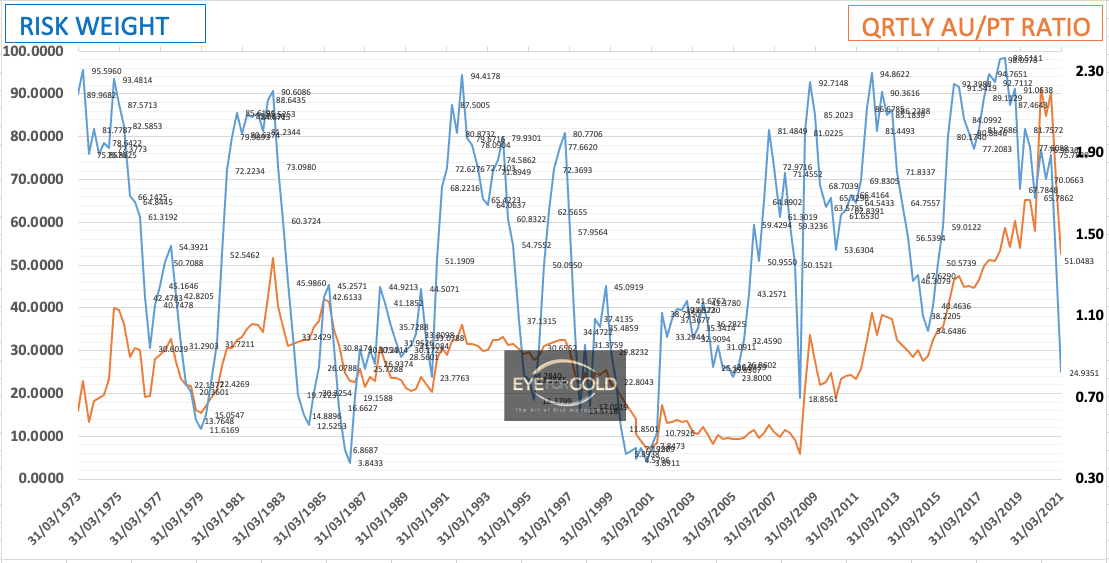

26/2: The Interim quarterly risk weight reading is slightly higher than last week (25 vs 24) which is the result of a higher close this week relative to a larger price range. This trend is down and will pause at some point, which may even be soon. The direction is for Risk weight to need much more time to bottom which requires the ratio to continue its recovery towards par during 2021 and beyond.

Major trends in important traditional asset classes can be identified by the simple observation that they are correcting from an outside trange price level into equilibrium. This is happening with Platinum and with Silver via a vis gold. 50 year equilibrium (1971-2021) is now at 0.88. Or AU at 1800 and PT at 2000. The corrective move we now experience will need time to complete. The most likely scenario is for this ratio to sweep through the equilibrium before finding its speculative bottom.

Weekly risk trend turned up at same level, which produce some upward price pressure, i.e gold to recover somewhat from its relative weakness in coming weeks. Considering all timescales, the ratio can expect further pressure as short versus long timescale bearish divergence will determine the medium term and long term future. This is the kind of scenario that develops in nearly 100% of all fast moving markets.

19/2: Monthly risk has dropped to 9%. This is low, but fast moving markets seeking their natural equilibrium may pause but not stop until such balanced price point has been achieved. Markets will typically shoot beyond those balance price points and experience some serious and increasing volatility in the process. Only active traders with physical longs should trade or hedge with short term derivatives, but not more than 30% of the physical position. Leveraged portfolio's are outside of our risk management parameters.

12/2: Looking at the Gold/Platinum monthly chart we notice a strong price trend south and equivalent risk weight closing in on oversold. The chart also shows how past monthly risk weight levels, up or down, often took one year or more before the primary trend tops or bottoms out. We should expect the same. It is a strong trend and we have a substantial cushion to allow for any medium term reversal and a major extension towards and beyond the 1:1 ratio. At the present level of Gold, platinum has another $600 dollars to go and we expect to see that happening sooner rather than later due to a much more limited market liquidity in physical platinum.

19/2: Of course the interim figures are showing further decline and the current level is at 24%. This major downtrend of the Gold to Platinum ratio historically should take several more quarters before the shorter term timescales signal a potential bottom exit. The base wealth preservation position is a substantial 50% with a fairly evenly diversified precious metals portfolio where Platinum rates at 35%. If Pt moves substantially closer towards its 50 year equilibrium, the Platinum share of total precious metals will increase and may need to be rebalanced to remove speculative risk.

12/2: Interim Quarterly risk weight closed the week of 8-12 Febr at 28 versus 37 last week. This rapidly dimishing risk weight is pretty common after a market has lost 35% of its value from the March 2020 peak. The current ratio at 1.46 is still well above the average ratio price based on a quarterly close for the past 50 years. That average 200 quarter Gold/Platinum ratio is 0.88. We have also seen Pt trade at a ratio of 0.5 on extension just like the totally unreal pump to 2.26 last March. 0.5 ratio means Platinum would need to gain another $2,400 relative to gold. It has happened before.