Platinum USD intermediate forecast is $1600 | 21 May

Platinum Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

PLATINUM FORECAST

(Previous week in brackets)

c

| Platinum USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1167 (1225) |

||||||

| PT Trend | ↓ (↑) | ↓ (↓) | ↓ (↓) | |||

| PT % Risk Weight |

80 (82) | 43 (57) | 12 (47) | |||

| PM Distribution Total allocation 50% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Platinum / USD live price

Platinum comment

21 May 2021 close: Platinum has been the strongest metals since the Black Swan event of March 2020 into 2021 and consolidating until now in a broad $150 range. The low of that range is $1125 which cannot be excluded short term, but even though all time scales are trending down, a serious technical top has yet to be produced. Our interim objective of $1600 stands firm.

14 May 2021 close: Platinum risk turned mildly positive last week and mildly weaker this week with some late consolidation Wed to Fri. Long term trend is definitely up and we expect a more visible break towards our next resistance at 1337 fairly soon. Our position is 16% above acquisition price, hence a comfortable wealth preservation hedge to hold on to.

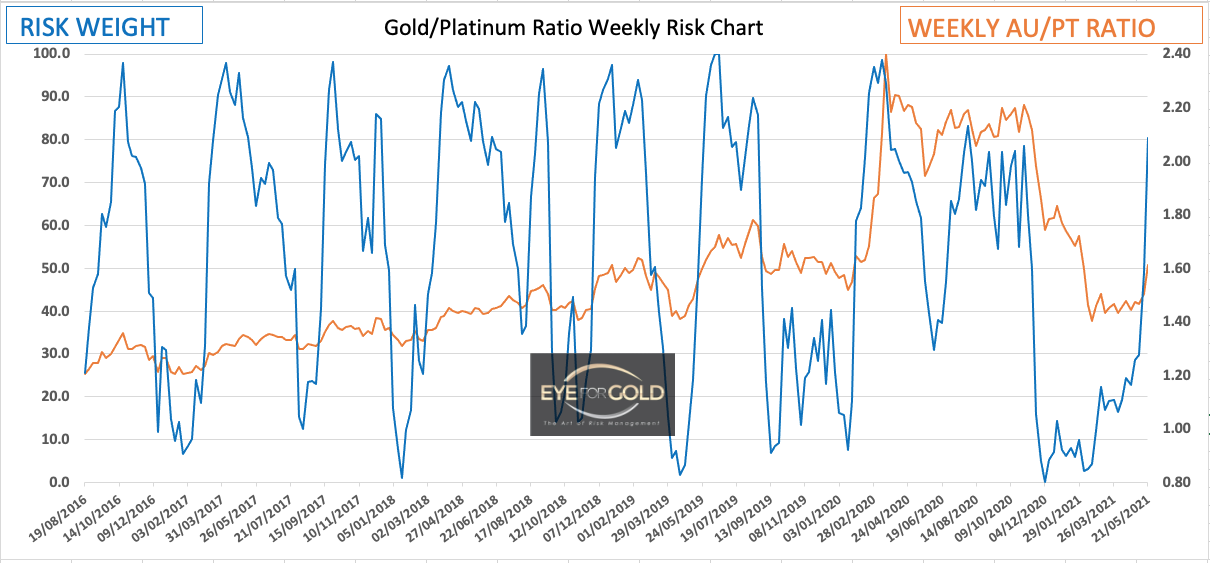

GOLD/PLATINUM Ratio Price Risk Charts & Analysis

(Previous week in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1.5034 (1.5034) |

||||||

| Trend | ↑ (↑) | ↑ (↑) | ↑ (↑) | |||

| % Risk Weight |

13 (13) | 80 (49) | 99 (96) | |||

| PM Distribution Total allocation 50% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

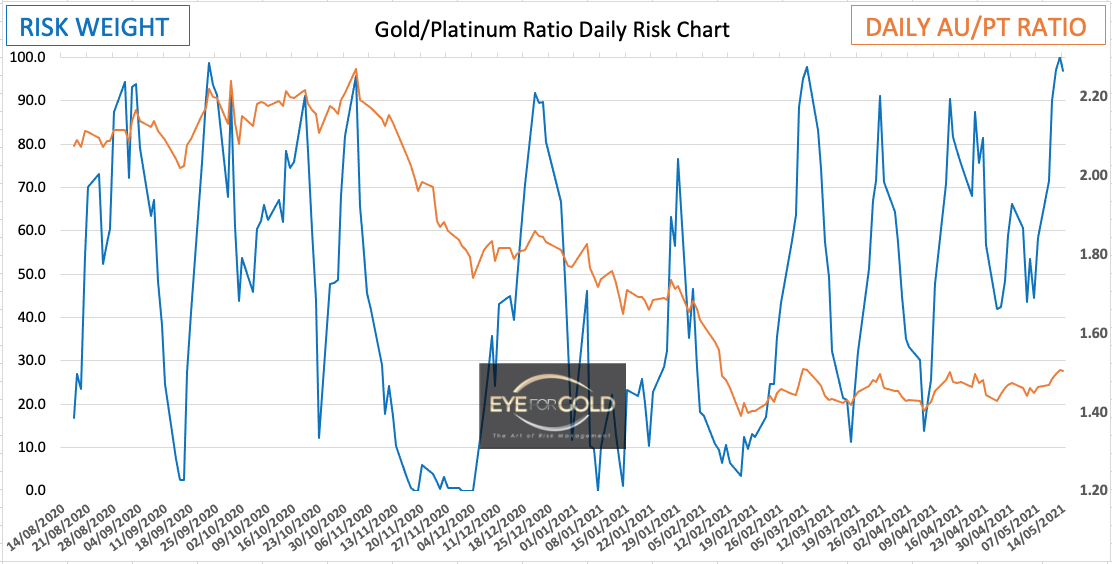

Gold/Platinum Ratio Charts

Daily risk weight is now showing potential bearish divergence in extreme risk territory. We would expect Platinum to end this short term correction versus gold within a few days.

The below comment was made two weeks ago and still stands

The mild correction that has been developing since February has caused this blip up in risk weight which again could easily last a bit longer although we are looking at an interim monthly chart reading. We expect the Gold/Platinum ratio price to fall into the 1.20 to 1.30 range that was recorded in 2015-2016. We are in the early stages of a major reversal cycle trend and that always develops bullish divergence near the end of the cycle before a major potential turn can be expected. That has yet to materialize.

Daily risk weight rushed up to 100% and turned down at 96% whilst well up on last week. Completion of the short term Platinum correction may take another week or 2 even in order bring Weekly risk weight into

We simply repeat last week's comment in this longer term chart:

The mild correction that has been developing since February has caused this blip up in risk weight which again could easily last a bit longer although we are looking at an interim monthly chart reading. We expect the Gold/Platinum ratio price to fall into the 1.20 to 1.30 range that was recorded in 2015-2016. We are in the early stages of a major reversal cycle trend and that always develops bullish divergence near the end of the cycle before a major potential turn can be expected. That has yet to materialize.

The correction in the current trend is now pushing risk weight to 20% from 18% last week. The trend from last Quarter is still strongly down and thus more room to process a larger price adjustment during the next few quarters. That next few quarters Gold/Platinum ratio downtrend could materialize anywhere from Q4 2021 into 2023.

Quarterly Risk weight increased from 16% to 18% this week versus 30 April and versus 28% on March 31. The Quarterly risk trend is strongly downward and needs shorter term time scale confirmation to be broken. We suspect this is many quarters into the future so we stay with the leading long term trend.