No Change to 1/3rd Platinum within total PM allocation

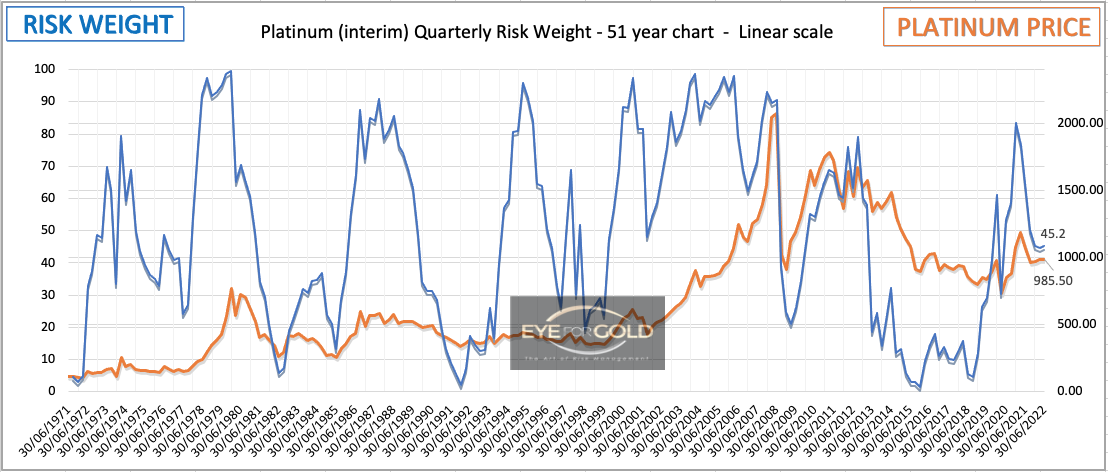

01 April 2022 close Platinum leading indicators are the low risk readings for Platinum versus Gold and Silver. The core USD market appears to have lost it completely with investors, yet this strongest peer within the precious metals space is holding its own trading with sharp corrections around the $1000 mark. A positive sense of direction can be found in nthe monthly risk reading where price is now 50% above the March 2020 covid low whilst risk weight has dropped to around 25%. With Daily already in low risk ground and weekly falling into support too, this is a reading that shouldn't worry us. No Change to our 1/3rd platinum metal allocation.

25 February 2022 close Platinum actually performed slightly better this year with a 10% gain thusfar since the start of 2022 rallying from 950 to 1050, beating both Gold and Silver performance after a longer stint of underperformance. The charts tell us that the price pressure in Platinum appears to building momentum for a larger future advance. Our alloction is still slight overweight relative to Gold and we intend to maintain this ratio until further notice as explained in this week's Gold/Platinum and Platinum/Silver ratio blogs.

Platinum/USD live price

see full page chart

Platinum/USD risk position relative to Quarterly, Monthly, Weekly and Daily risk weight data.

(Previous update in brackets)

| Platinum USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 986 (1058) | ||||||

| PT Trend | ↓ (↑) | ↓ (↑) | ↑ (↓) | |||

| PT % Risk Weight |

27 (29) | 43 (70) | 26 (68) | |||

| Total PM Portfolio allocation 40% (40%) breakdown: |

Au:12% | Ag:14% | Pt:14% | |||