Platinum price returns buying opportunity again | 03 December

Platinum Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

PLATINUM FORECAST

(Previous week in brackets)

| Platinum USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 931 (954) | ||||||

| PT Trend | ↓ (↓) | ↓ (↓) | ↑ (↓) | |||

| PT % Risk Weight |

28 (32) | 30 (50) | 5 (16) | |||

| Total PM Portfolio allocation 40% (40%) breakdown: |

Pt:14% | Ag:14% | Au:12% | |||

Platinum / USD live price

Platinum comment

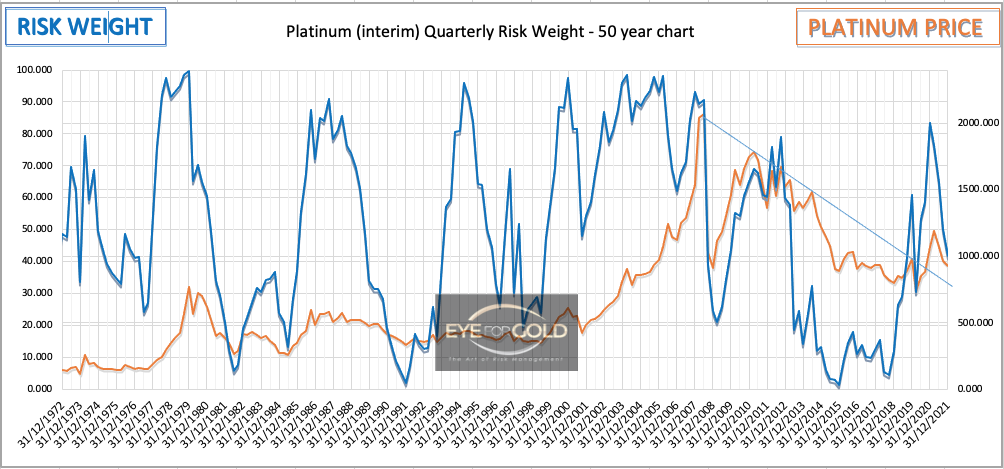

03 December 2021 close Platinum is showing a similar technical picture as for Silver. As we mentioned several weeks ago, Platinum will find itself at the mercy of increased industrial demand. This rarest and the heaviest of all precious metals historically trades above gold. Hence our long term slight overweight allocation also in response to still very positive technical readings in all time intervals at this moment. Support is 900 give or take a few dollars but even it slips below this likely produces a very low risk opportunity. This will be confirmed by the Gold to Platinum ratio. 'HOLD'

26 November 2021 close Also with our beloved Platinum, since 2020, we're back in the waiting room. Whilst the position is still well above the original weighted entry level, current price action is somewhat frustrating but here too, nothing indicates a major trend change from the 2020 low, besides the still strong outlook for Platinum versus Gold in the anaylsis of the Gold to Platinum ratio. The two week 11% price fall actually makes Platinum look quite interesting again relative to Gold but current price action calls for 'hold' rather than adding at these levels whilst we cannot exclude another price drop in coming days or even weeks. We were down to 900 only 2 months ago, rallied 20% to $1100/oz, and now back in consolidation range. We still expect that major breakout to come since we have yet to see technical bearish divergence in the longer term time intervals. And this applies to our primary tools Relative Strength Index, MACD and Stochastic analysis. These bearish divergence indications always arrive, almost without exception.