Platinum to stay as first amongst equals | 12 March 2021

Platinum Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

PLATINUM FORECAST

(Previous week in brackets)

| Platinum USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1203 (1127) ↑6.8% |

||||||

| PT Trend | ↓ (↓) | ↓ (↓) | ↑ (↓) | |||

| PT % Risk Weight |

84 (84) | 65 (72) | 48 (8) | |||

| PM Distribution Total allocation 50% (55%) |

Pt:35% | Ag:35% | Au:30% | |||

Platinum / USD live price

Platinum comment

12 March 2021 close: Platinum has come out of a very deep valley where we have taken a contrarian view to build an equal position to Silver and Gold. This now results in a technical picture that could and will lead to several corrections along that road to recovery. That recovery has already come a long way and should take Platinum to levels that we have been more used to over many decades. PT is the Rolls Royce metal for reasons of scarcity, store of value and commercial use. The price is still too low and we remember the fundamental arguments why Platinum should be the weaker metal only 9 months ago. The key here too is patience as we need to see bearish divergence developing in long term time frames. The high Monthly risk reading at 85% therefore is of no real concern.

5 March 2021 close: The rapid drop of Platinum was to be expected given the sharp reversal of Silver following continued gold weakness. Daily risk is in deep oversold condition but not yet finish. Divergence between Weekly and Monthly is evident. Medium Term Weekly and Long term Monthly risk weight haven't yet developed bearish risk to price divergence in their own timescale. This is the most likely scenario before Medium or Long term price peak for Platinum can be called. Olatinum is our favored metal at this point and we may look to re-allocate a bit of gold and silver into platinum. Largely keep the precious metals portfolio balanced.

GOLD/PLATINUM Ratio Price Risk Charts & Analysis

(Previous week in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 143 (151) ↓ 5.5% |

||||||

| Trend | ↓ (↓) | ↓ (↑) | ↓ (↑) | |||

| % Risk Weight |

9 (13) | 17 (22) | 32 (97) | |||

| PM Distribution Total allocation 50% (55%) |

Pt:35% | Ag:35% | Au:30% | |||

Gold/Platinum Ratio Charts

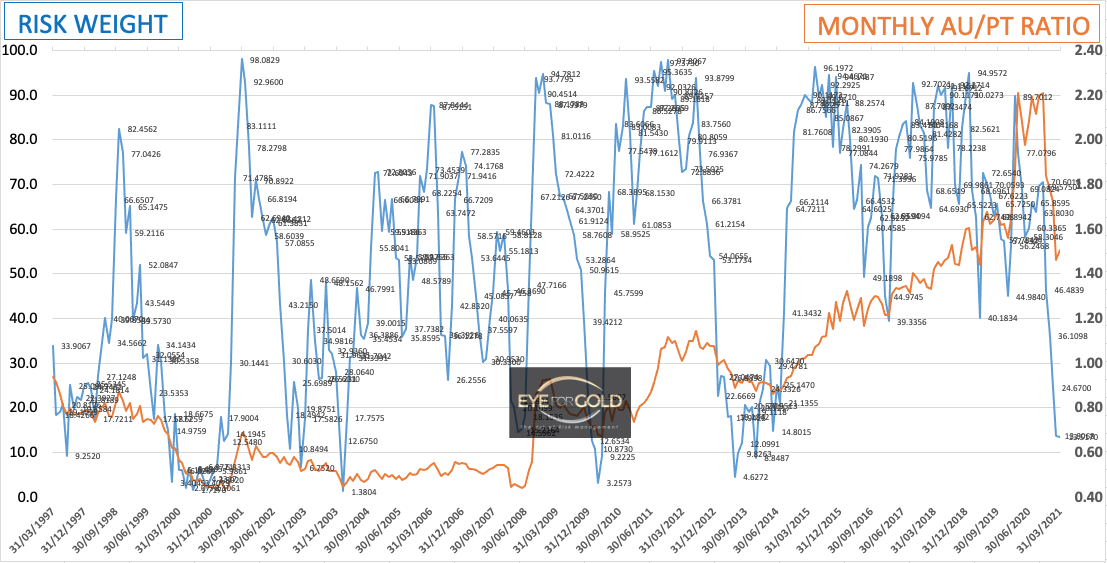

The bearish divergence between short and medium/long term risk resulted in a very decent correction pushing Platinum some 3.5% higher versus gold last week. This pair may be seeking a bit more space before the next move in favor of PT unfolds.

Monthly risk weight is coming into a low risk danger zone but isn't finished. We may expect more pressure in coming months with a few more corrections as we have seen in recent weeks.

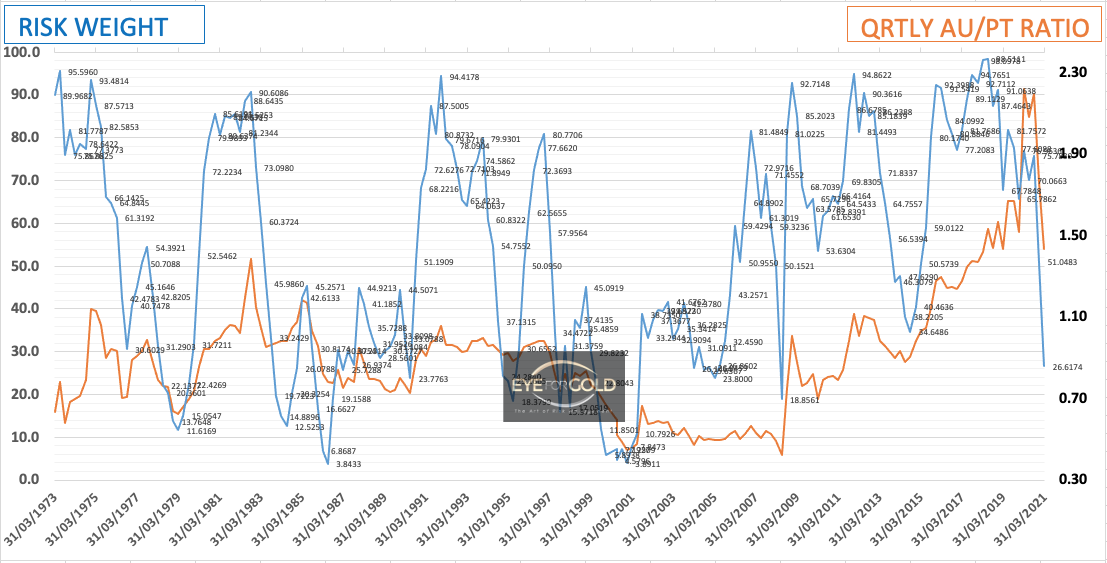

In this major Platinum correction since March 2020 we should expect quarterly risk weight to turn into a much lower risk zone. It is impossible to forecast how that translates to price. We could as easily see some serious fireworks before the summer holidays or a lackluster development with Platinum reaching an interim peak closer to current levels. For now PT continues to look stronger in the precious metals space.

The correction of Platinum versus Gold the past week creates bearish divergence. We expect the ratio to make up a few percent of the recent rise in line with the main long term trend. We may use this rally to re-allocate a small percentage of gold towards Platinum and adding a bit more Patinum weight to the precious metals portfolio. The ratio will surely reach a level much close tot 1:1 in the foreseeable future.

Weekly risk weight pushed a little higher which could drive the ratio higher if it were the only risk indicator. With Daily showing bearish divergence vis a vis its longer term timescales and with Monthly still strongly down we stay fully committed to Platinum moving higher in due course.

Monthly risk weight is slightly lower at 13. 49 versus 13.80 last week. Even though the ratio price is up, monthly risk weight on a relative strength basis is still in its primary down trend with quarterly risk weight now being the main trend driver.

The interim quarterly risk weight has created even more space for a further weakening of the ratio given the Interim price rally. Risk weight price is now back up to 30 from 25 last week and still showing a net strong and leading downtrend. We expect risk weight of the Gold to Platinum ratio to drop into a deep oversold range with a matching price moving closer to our forecast target of 1:1 and before a more serious price reaction. Our tchnical analysis is a matter of odds which weigh in favor of Platinum. In case all precious metals continue moving lower initially, we will get better odds on a reallocation opportunity, which still looks more in favor of owning physical Platinum.