PLATINUM/SILVER Ratio Price Risk Trend

(Previous update in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 41.28 (41.88) |

||||||

| Trend | ↓ (↓) | ↓ (↓) | ↓ (↓) | |||

| % Risk Weight |

49 (52) | 36 (44) | 11 (4) | |||

| Total PM Portfolio allocation 40% (40%) breakdown: |

Pt:14% | Ag:14% | Au:12% | |||

Platinum/Silver Ratio Charts

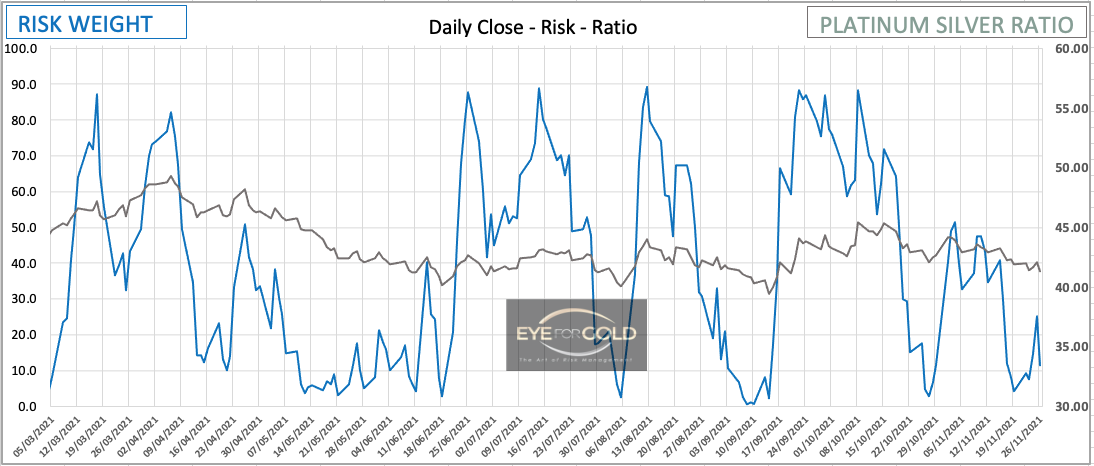

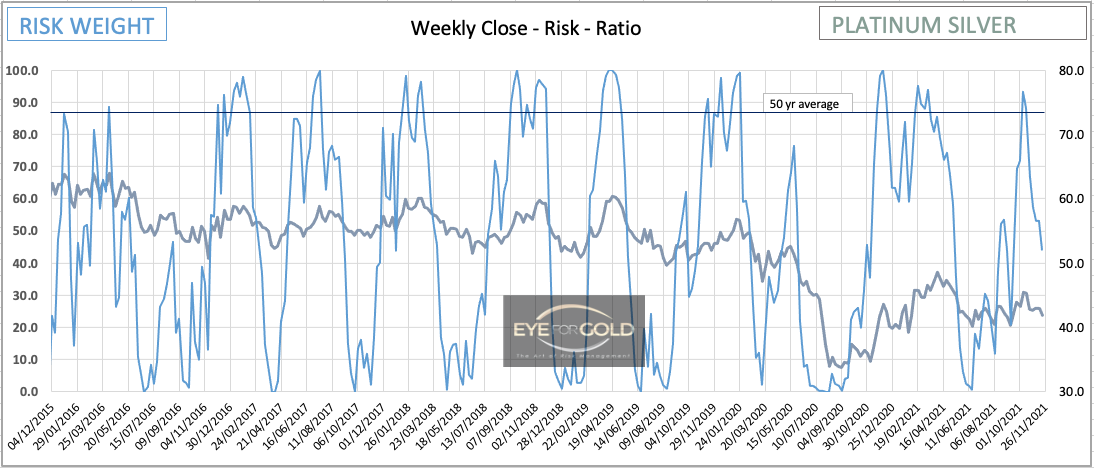

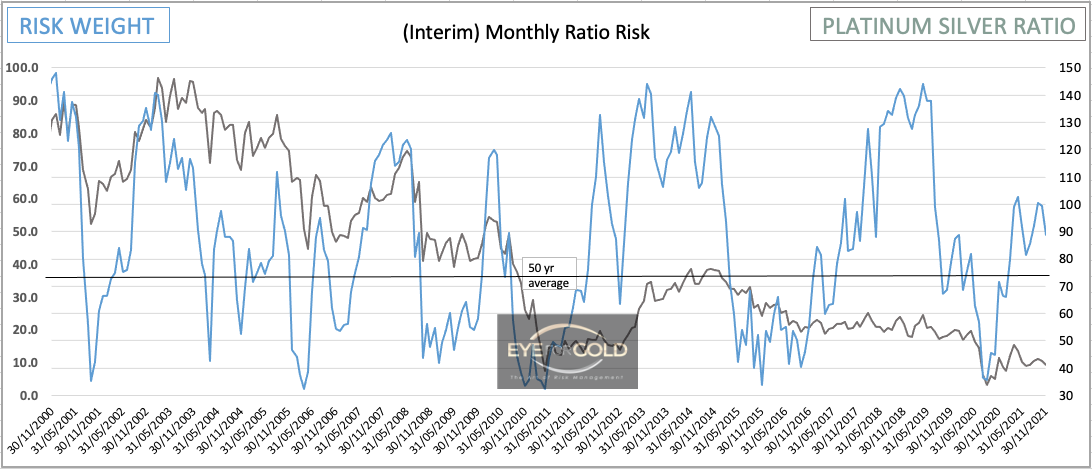

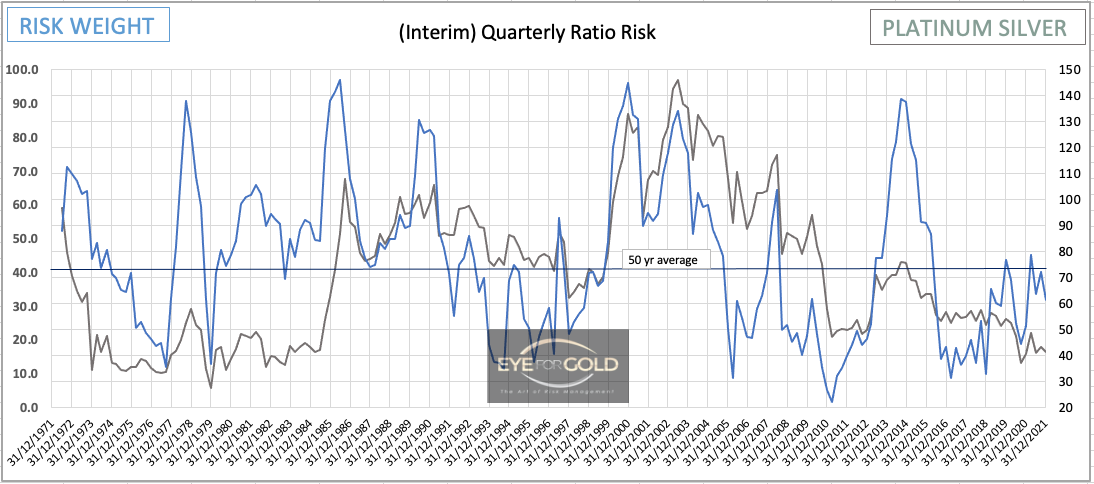

26 November close Platinum industrial properties are improving substantially with new technological applications having been discovered to achieve clean fuel conversion and much less CO2 emission. A simple fundamental reason to hold Platinum as a long term core asset allocation. Otherwise, the Platinum/Silver price ratio technical picture doesn't look too bad either even though short to long time intervals are showing a risk weight downtrend at this moment. But, from short to long all time intervals, Daily, Weekly, Monthly, Quarterly look to be in interim corrective mode waiting for a resumption of the uptrend until we reach much higher % risk weight levels coupled with bearish divergence formations in the longer timeframes sometime in the more distant future. Even though we can never exclude an unexpected new all time low in the Platinum to Silver Ratio, Platinum actually looks pretty solid as the price correction is followed by relatively large risk weight corrections setting up for a fresh rally towards the long term ratio price average.

19 November close The reversal in the Platinum/Silver cross rate wasn't as fierce because Silver also felt more pressure at the end of last week with the Pt/Ag falling just over 2% against Silver compared with the previous week ending Nov 12. As Daily risk weight has also landed in very low risk territory, we would expect Platinum to improve somewhat. No change to equal weight between these two metals in the portfolio and our long term objective of 73 stands.

12 November close The Platinum to Silver price ratio was unchanged at 42.90. Daily risk is down but at this 30+ percent risk level not a major threat to our prediction of eventually reaching that long term average of 73 again. Weekly risk weight has fallen more sharply from a percentage high risk level indicating Silver may soon be running out of steam against Platinum. Monthly risk weight is down but coulds easily resume back into the major uptrend that started in Marc 2020. That primary trend should only end with a bearish Risk weight to price divergence in the Monthly time interval at least. Quarterly too is coming from a bullish divergence position now pausing in favor of Silver. Our preferred portfolio risk perception is to maintain the present insurance distribution and to not further play the Platinum Silver ratio which we only adjusted 2 weeks ago to an equal hold between Silver and Platinum.