Platinum to strongly fluctuate upward | 05 Febr 2021

Platinum Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

PLATINUM FORECAST

(Previous week in brackets)

| Platinum USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1120 (1074) |

||||||

| PT Trend | ↑ (↑) | ↑ (↓) | ↑ (↓) | |||

| PT % Risk Weight |

90 (84) | 82 (80) | 54 (42) | |||

| PM Distribution Total allocation 55% (50%) |

Pt:30% | Ag:40% | Au:30% | |||

Platinum / USD live price

Platinum comment

5 February 2021 close: We expect Platinum to broadly stay ahead of the Gold curve. Primary reason for Platinum to maintain momentum towards a 1:1 ratio with gold, is its exclusiveness in a much thinner market. Critical is to only buy physical. The easiest place to do that for Europeans is by opening an account at the banking licensed Bitpanda crypto exchange. US and Canadian citizens can best use any of the dual custodian encumbered options offering precious metals backed by physical. As we enter 2021 with a massive increase in so many crypto values and Central Banks obliged to continue funding economic shortfalls it probably will not be long before the physical precious metals market is forced to disconnect from the paper market where the 'shorts' reside. Owning physical is absolutely critical. Last week we saw Platinum only shaving a few dollars whilst gold lost $100 and on the brief $30 (+1.7%) Gold rebound close at the end of the week Platinum rallied to close up $45 (+4.1%) from its low. Platinum falls in the category of 'must have exposure' to preserve wealth. Our Platinum long position was entered at an average of just under $900 last year when the Gold/PT ratio was at 2.15. No Change.

January 2021 close: Platinum/USD only just started its long term uptrend in March 2020 and we have yet to get early signals for that trend to change direction. The short term Daily looks to be in the process of diverging against the Weekly and Monthly. The next upturn should confirm this. No Change to our roughly 30% allocation within the total PM space.

GOLD/PLATINUM Ratio Price Risk Charts & Analysis

(Previous week in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 162 (172) | ||||||

| Trend | ↓ (↓) | ↓ (↑) | ↓ (↑) | |||

| % Risk Weight |

16 (25) | 5 (10) | 2 (76) | |||

| PM Distribution Total allocation 55% (50%) |

Pt:30% | Ag:40% | Au:30% | |||

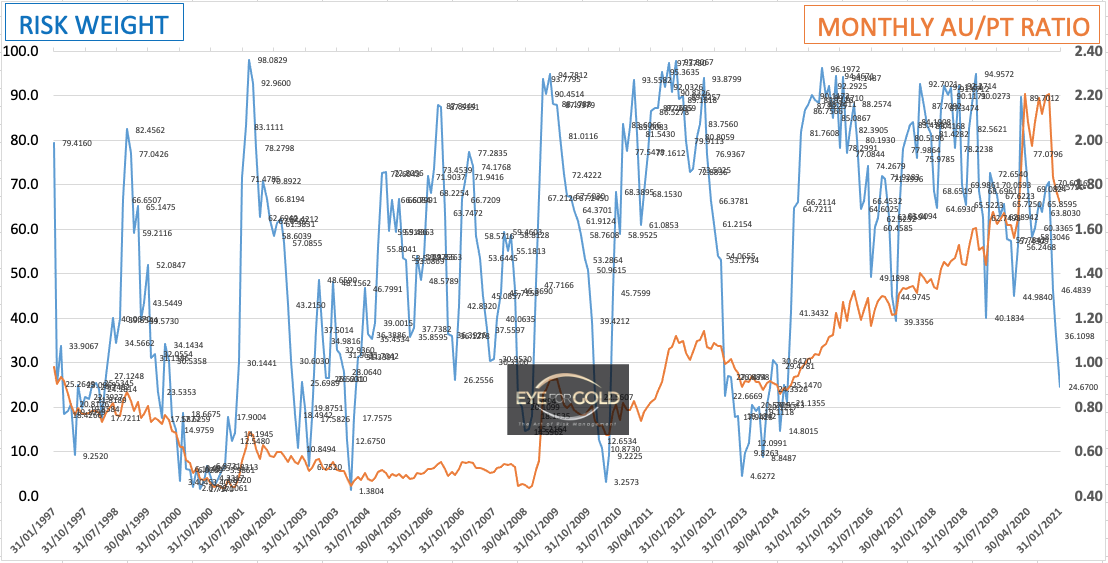

Gold/Platinum Ratio Charts

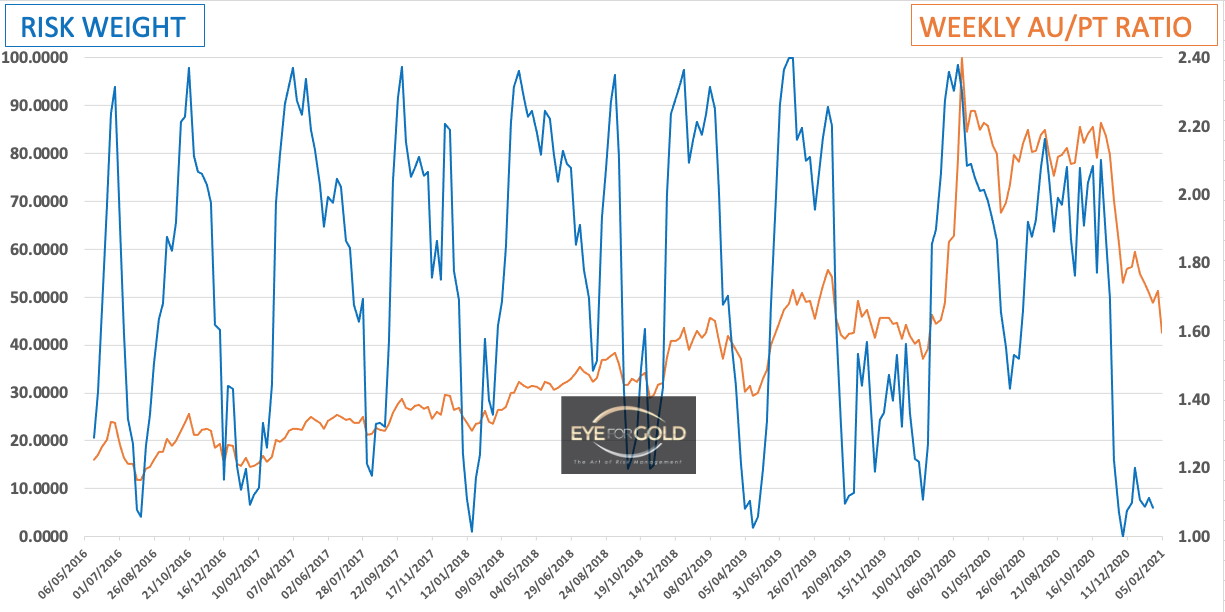

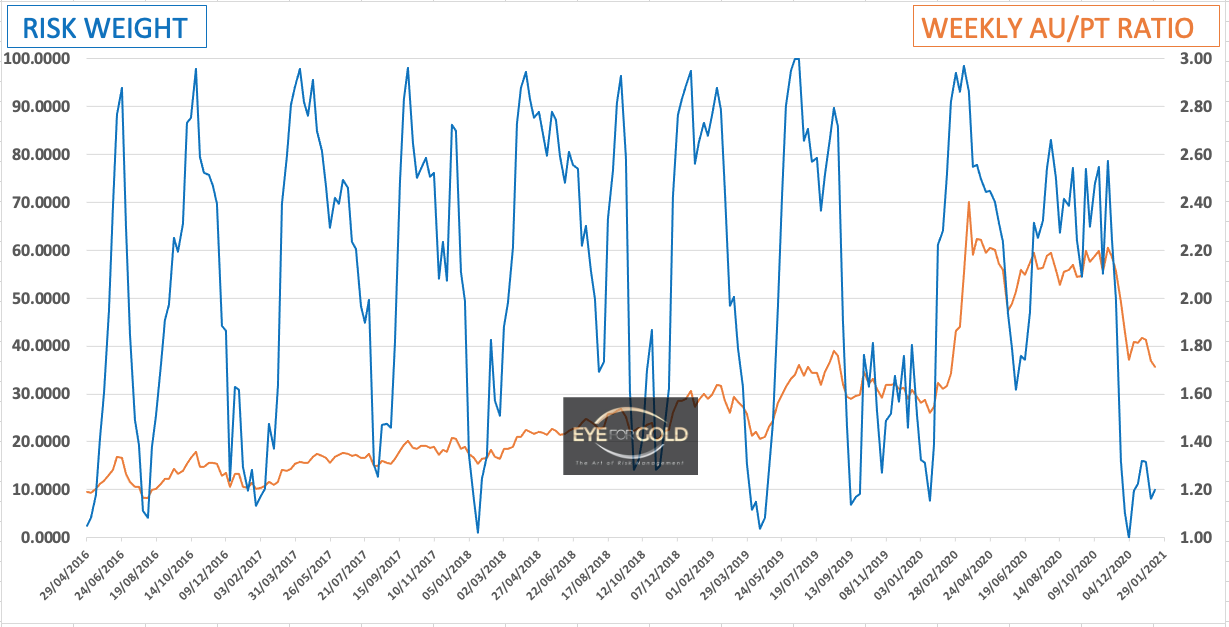

The Gold Platinum ratio quickly proved the bearish divergence position as it rose above 1.70 the week before with risk weight over 70. The ratio dropped hard into oversold on Friday. The current trend is likely to develop a lot more fluctuation in the shorter term Gold/PT ratio time scales and especially if gold starts to finally make that fundamental correction into an unavoidable global currency reset. Silver and Platinum are likely to stay ahead of that upward curve as they will suffer from liquidity in a market with unprecedented demand. Right now it is all crypto, but the precious metals days will come to rebalance the entire currency space. Owning either metal with exception of Palladium, which already run its course, is NOT speculation.

The Weekly timescale also turned further down to close at a risk weight of just 5. Once markets are seriously underway as the Gold/Platinum ratio has, Risk weight is entirely controlled by the Long term time scales. Several weeks of price consolidation with closes in the upper end of the weekly range will be typical driving bearish divergence until our 1:1 target or even much lower has been realized.

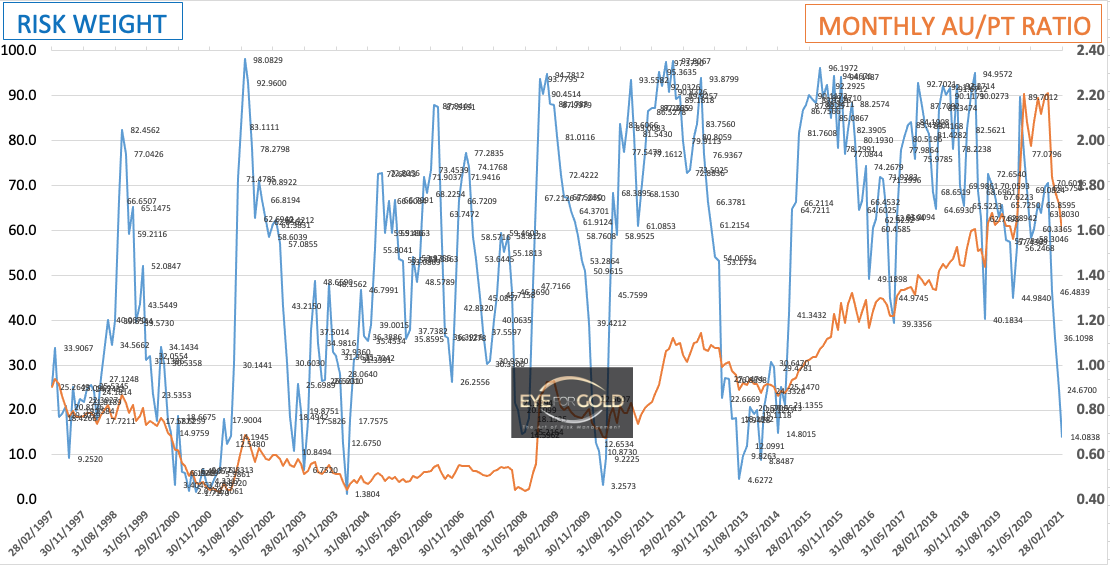

The 6% Gold Platinum drop at the 5 Febr close pushed Monthly risk weight to just 16. The Monthly interim risk is now supported by a Quarterly interim risk still strongly down. If the ratio turns lower during February and finishes relatively high we can expect the downtrend of Gold vs Platinum to continue for longer still as relative risk weight will then create room for further drops.

Gold/Platinum closed the month of January just above 1.70 whilst the short term uptrend looks quite sharp without much of a price change and may lead to early bearish divergence upon turning down. A push higher of the ratio is still possible this coming week.

Due to a higher close the Full month risk weight ended slightly higher and still in a firm downtrend at 24. This confirms our longer term hold in favor of Platinum. We started our Platinum allocation at around 2.15 seeking to hold with an objective closer to 1:1. It cold take many, up to 18, months before we reach this level.

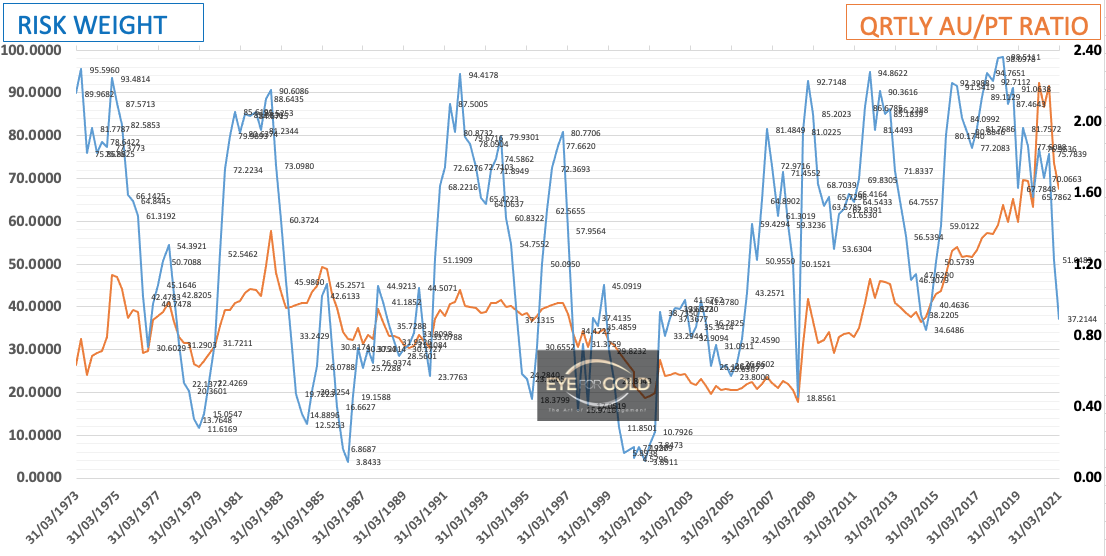

Interim Quarterly risk weight finished January slightly higher than last week. at 43. The current downtrend is strong and we can expect a risk weight of around 20 before a more serious interim correction can be expected. This may be several quarters into the future. The Platinum hold is well portfolio balanced and low risk with Gold and Silver.