Platinum USD intermediate forecast is $1600 | 7 May

Platinum Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

PLATINUM FORECAST

(Previous week in brackets)

c

| Platinum USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1249 (1198) |

||||||

| PT Trend | ↑ (↓) | ↑ (↓) | ↑ (↓) | |||

| PT % Risk Weight |

82 (83) | 60 (58) | 68 (60) | |||

| PM Distribution Total allocation 30% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Platinum / USD live price

Platinum comment

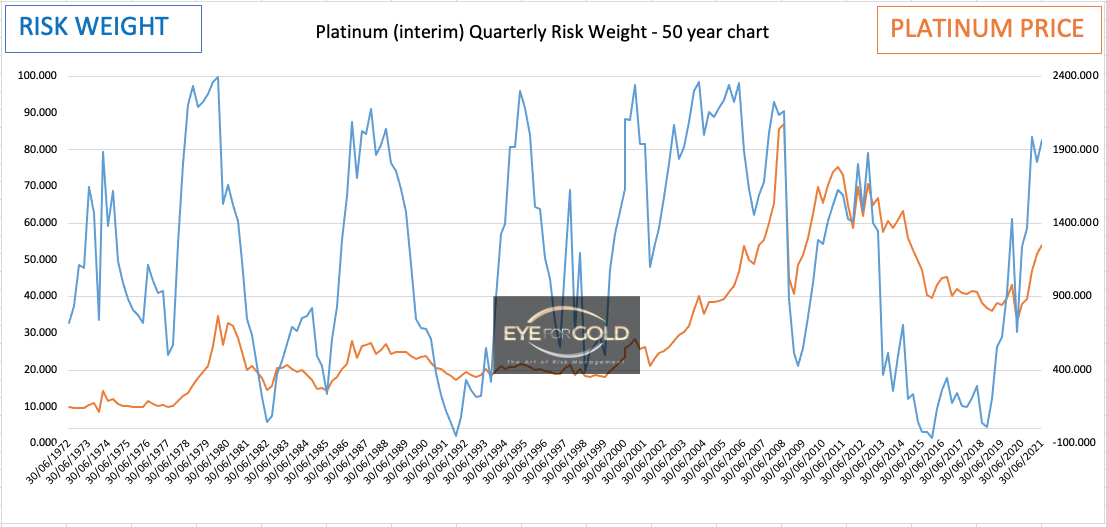

7 May 2021 close: Risk weight turned up marginally in all time scales as platinum followed the precious metals rally during the first week of May. We have yet to see a bearish risk to price development in Medium and long term time scales, which is a condition for getting concerned during a major uptrend cycle, which in the case of Platinum started on March 16 2020 and should last several years.

30 April 2021 close: The Platinum/USD technical picture is different from the Gold/Platinum ratio below which still eyes more favorable for Platinum. Last week ended near the lows and caused all times frames to turn negative. The key indicator is now long term which has not developed technical topping action at a true high risk level. Primary bull cycles typically require such high risk weight percentages. This looks to be many months away still and we may see some relative price erosion versus USD over coming weeks or months. There are no oversold signbal for this pair and Daily looks a bit weak with a risk weight in the 60% range. Comfortable though with the precious metals allocation. No Change.

GOLD/PLATINUM Ratio Price Risk Charts & Analysis

(Previous week in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 146.52 (144.75) |

||||||

| Trend | ↑ (↓) | ↑ (↓) | ↑ (↑) | |||

| % Risk Weight |

10 (9) | 30 (20) | 58 (66) | |||

| PM Distribution Total allocation 30% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Gold/Platinum Ratio Charts

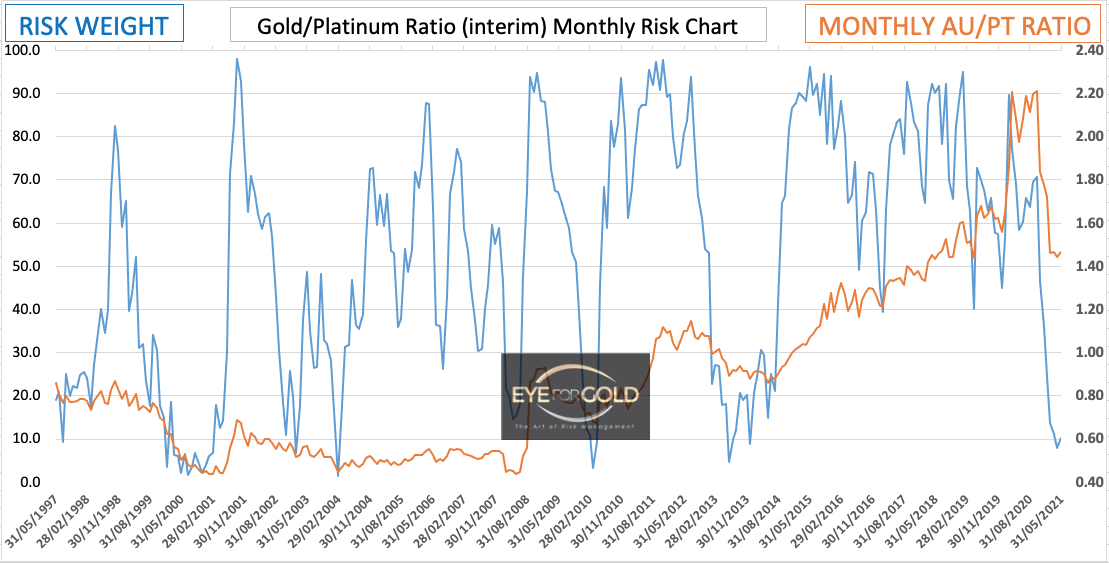

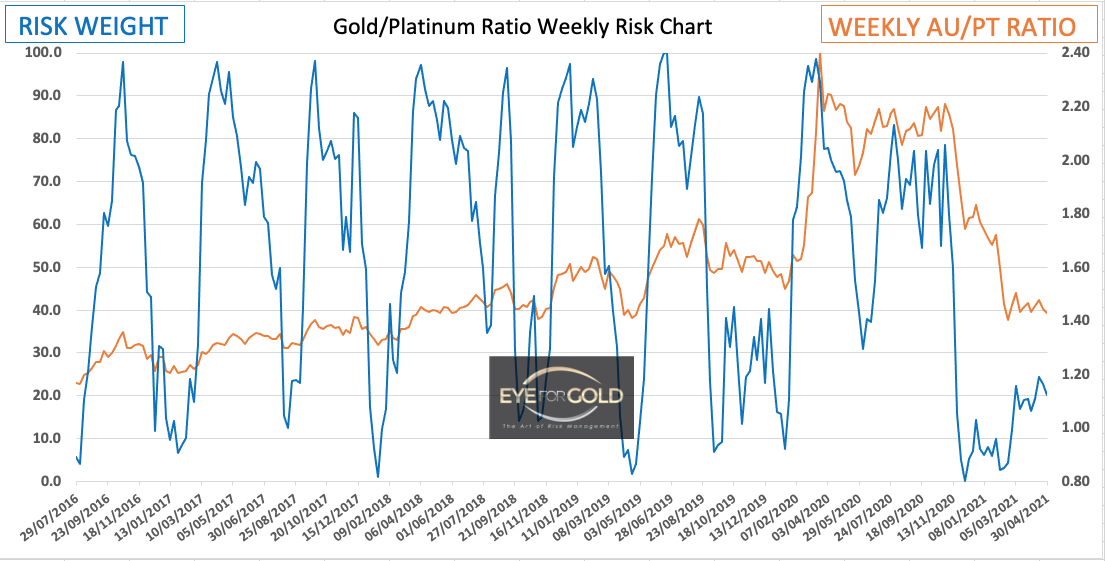

Daily risk weight turned up one week ago, down during the week and ended turning up at a slightly lower risk level. It looks and feels like the 1.40-1.50 consolidation range may continue a while longer. Historically we'd be looking for a deep Daily risk weight level before a more serious reversal can materialize. Downtrend not finished.

On the weekly chart we notice the relative risk versus price as the current sideways pause looks quite tiny whilst risk weight developed a strong upturn. Upward price pressure may continue and lengthen a bit but the outllok is for a resumption of the downtrend within one or two weeks.

The mild correction that has been developing since February has caused this blip up in risk weight which again could easily last a bit longer although we are looking at an interim monthly chart reading. We expect the Gold/Platinum ratio price to fall into the 1.20 to 1.30 range that was recorded in 2015-2016. We are in the early stages of a major reversal cycle trend and that always develops bullish divergence near the end of the cycle before a major potential turn can be expected. That has yet to materialize.

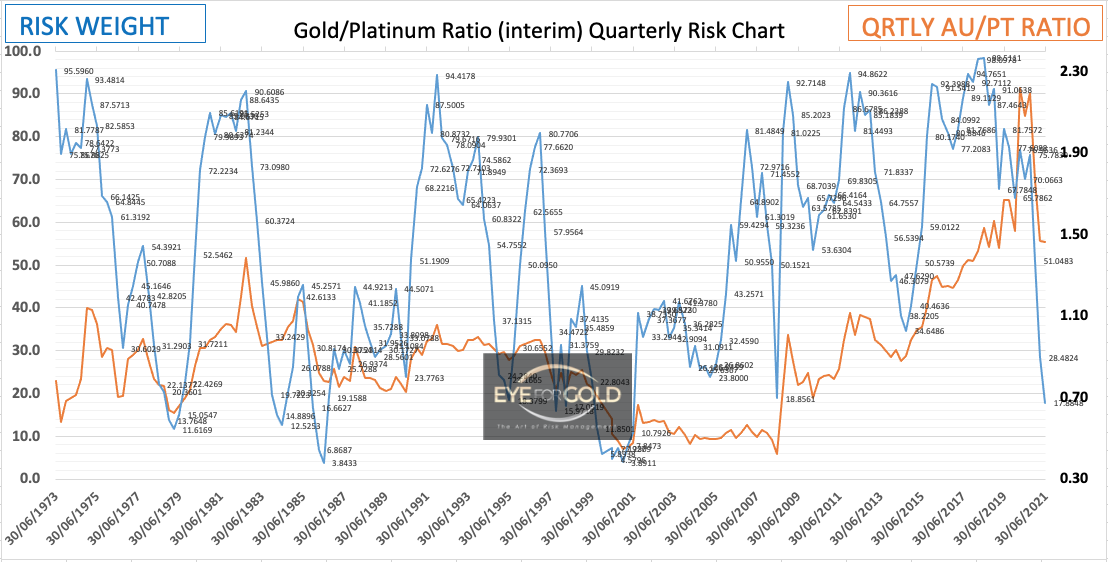

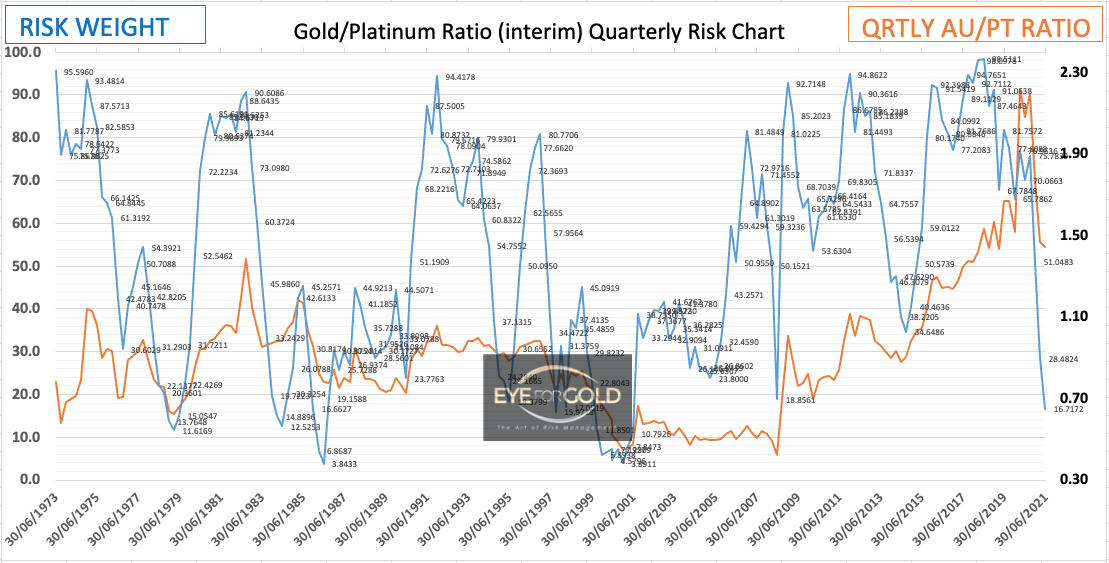

Quarterly Risk weight increased from 16% to 18% this week versus 30 April and versus 28% on March 31. The Quarterly risk trend is strongly downward and needs shorter term time scale confirmation to be broken. We suspect this is many quarters into the future so we stay with the leading long term trend.

The 1.40-1.50 Gold/Platinum consolidation range since February is being extended as the higher risk weight level upturn two weeks ago looks more bullish short term. Daily however is beginning to diverge vis a vis the next weekly time scale putting virtual resistance on the ratio price.

Monthly risk weight level closed 1% above last week and still down for the month. An extended price consolidation could develop a Gold/Platinum correction within the current primary trend of slightly larger magnitude but with Weekly down there is counter pressure. As this is a major platinum price reversal cycle that started in March 2020, Monthly risk would typically diverge into a more bullish pattern before we reach our forecast bottom of closer to 1:1.

Quarterly interim risk weight closed April at 16%. We are now in the first major down cycle since the very long cycle between 1981 and 2008. Now after 13 years of Platinum weakness we should expect this current trend to develop an interim bottom in the next 2 quarters and thereafter a strong and volatile range bound consolidation before this Gold/Platinum ratio drops towards its target subpar price zone. This could be years away still although another Black Swan event may poils the timing of such move. No Change.