Platinum still on target for the next 1600 level | 16 April

Platinum Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

PLATINUM FORECAST

(Previous week in brackets)

| Platinum USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1203 (1198) |

||||||

| PT Trend | ↓ (↓) | ↓ (↑) | ↑ (↑) | |||

| PT % Risk Weight |

82 (82) | 60 (62) | 42 (56) | |||

| PM Distribution Total allocation 30% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Platinum / USD live price

Platinum comment

16 April 2021 close: The steep price drop early in the week halted at the 1150 handle followed by a rally in line with Gold an Silver closing at 1203 on Friday. All time frames are in position to start finishing the major intermediate trend up, initially towards 1500 and then into new highs.

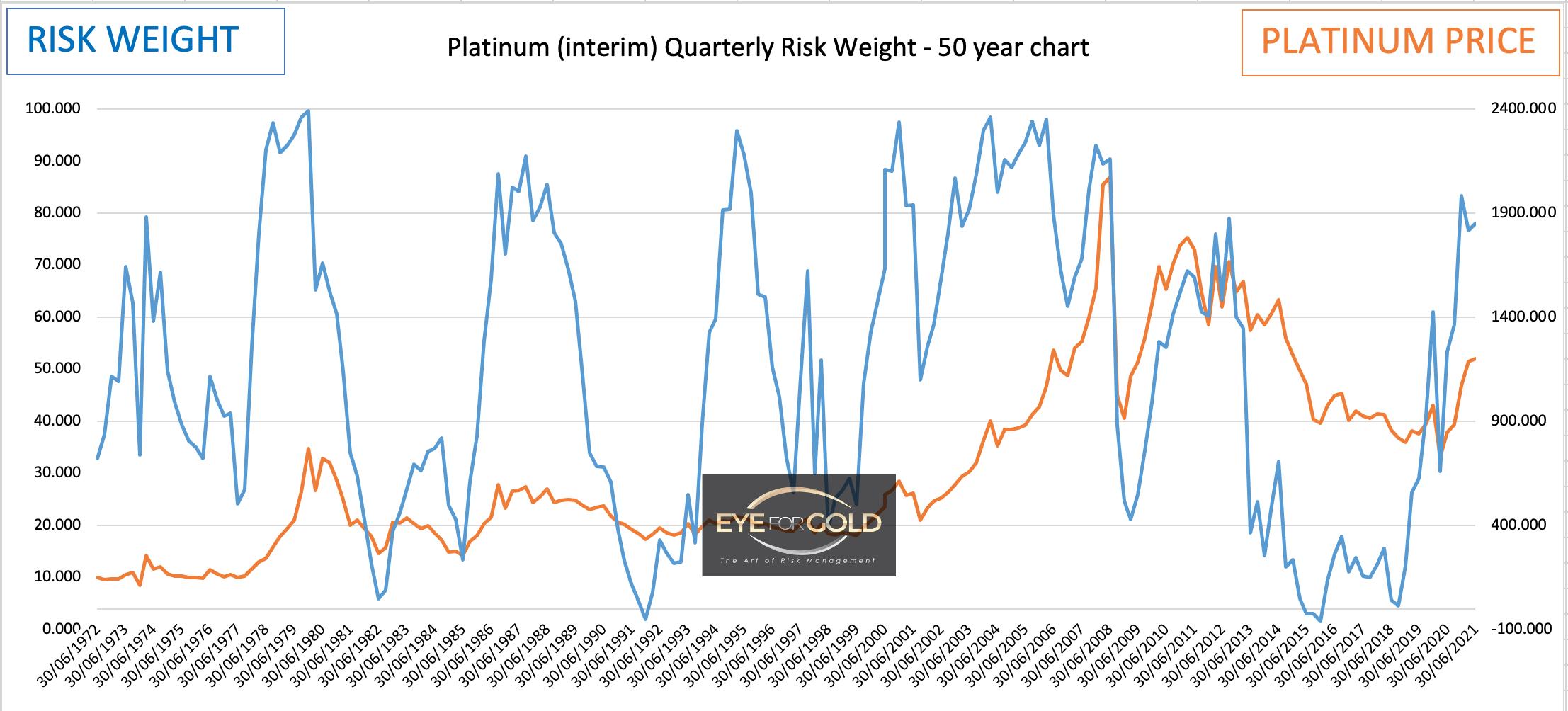

This week have added the Quarterly closing chart for Platinum/USD below. This very long term risk picture is showing an unfinished uptrend where the expectation comparison with gold is similar in that Risk weight of this primary cycle could be in a similar early advance like Gold was in the early years of the 21st century. Several peaks before a final price top is realized. We haven't seen that true long term peak yet.

9 April 2021 close: Admittedly Platinum looks a little shaky right now and traders could play the current down trend with a view to get back on board. All risk weight time scales are down but not decisively enough to call a change to the cycle uptrend that started in March last year at $600. More pressure can be expected in the short term, which could also indicate associated weakness of the other metals. This is just correction time and we can see that investors are generally more focused on the other non-precious metal and faster moving asset classes. No Change.

GOLD/PLATINUM Ratio Price Risk Charts & Analysis

(Previous week in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 147.60 (145.50) |

||||||

| Trend | ↓ (↓) | ↑ (↑) | ↓ (↑) | |||

| % Risk Weight |

10 (9) | 24 (19) | 75 (48) | |||

| PM Distribution Total allocation 30% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Gold/Platinum Ratio Charts

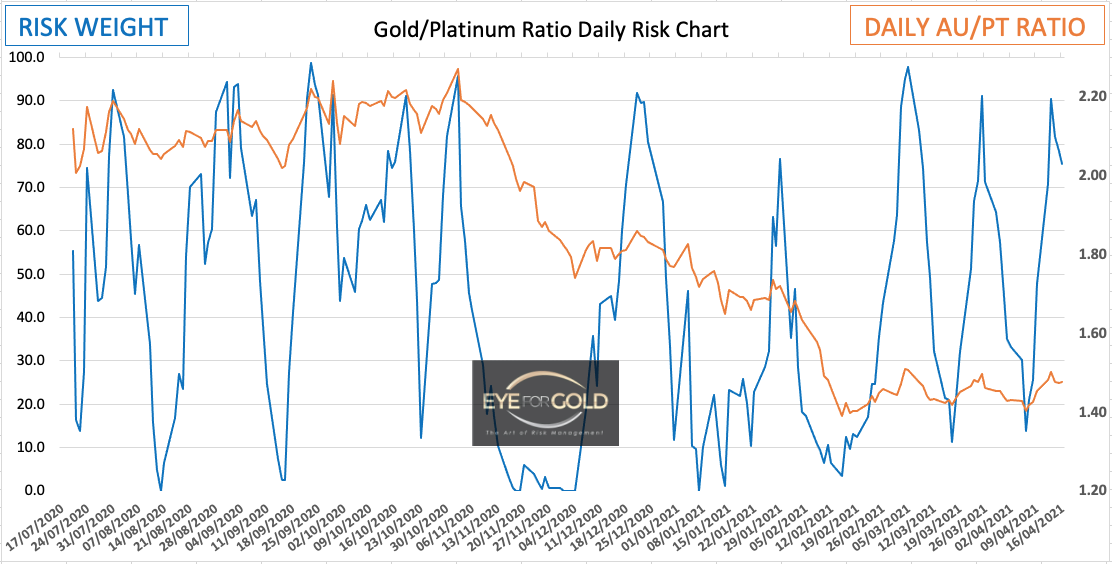

Platinum risk weight on Daily moved sharply higher which is a signal that this market is 'just' correcting or pausing short term. In major cycles, the depth of any price move in the opposite direction is always difficult to predict. For now no reason the consider any kind of reversal of the Platinum trend up vs Gold.

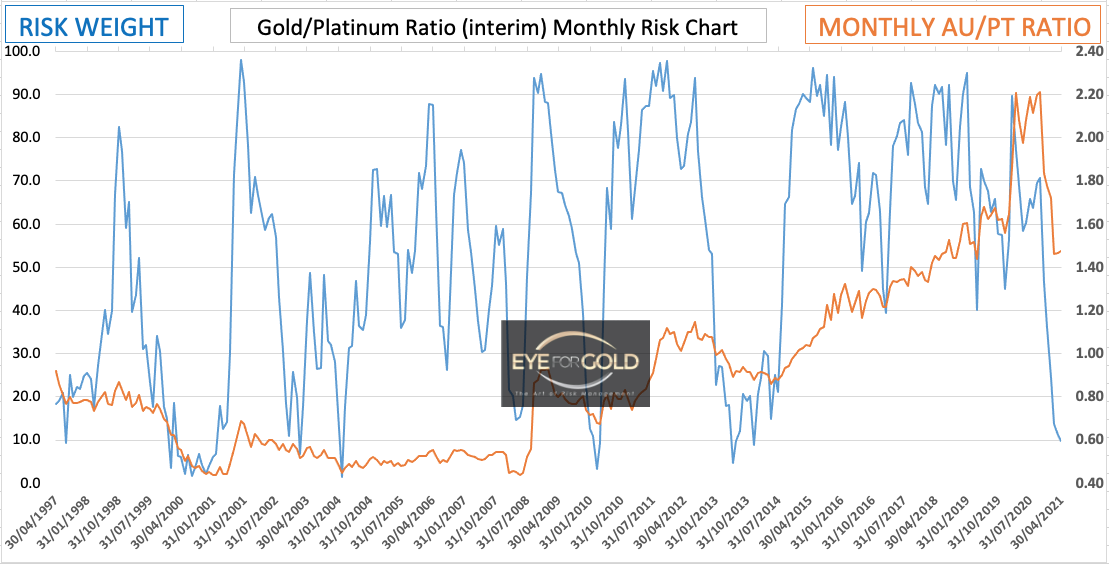

As we can see, since 2016 we have seen many sharp risk weight corrections based on relatively minor price moves. The picture looks similar, but we could experience a slightly longer (a few weeks) correction as the trend is currently up. Daily may keep the lid on though. No change to long term outlook of reaching parity with Gold.

As long as the risk weight trend is down we have to rely on shorter term time scales to determine an exit. As seen in 2013 reaching a risk weight bottom may still push prices down for another 2 or even 3 months. How far down cannot be predicted. Direction is more important than price. We must not 'bottom pick' an investment as long as long term risk trends are down. The objective is parity with Gold which usually means an even larger move, but time will tell.

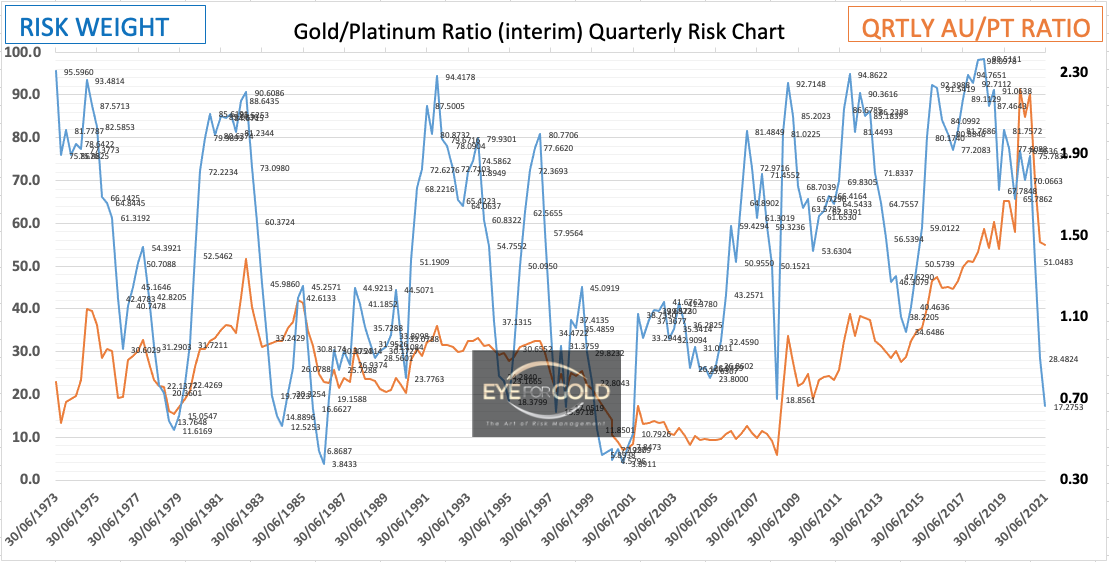

The quarterly risk weigh trend is moving into the low risk range. The trend is still down however and as clearly visible in the chart above from various moves over the past 50 years it could be many quarters before we reach the end of the current GOLD/PLATINUM cycle. If we have to make a prediction which in itself is pretty useless: a minimum of 2 years up to 5.

Gold/Platinum Daily risk weight has turned up and is corrective. A wider a longer sideways range is very possible. NO reason to change the longer term outlook.

Hard to say whether Monthly risk will continue into deeper low risk or start a correction. The most likely scenario in this primary trend closer towards long term equilibrium is a bearish risk divergence between short and long term time scales.