Platinum can potentially benefit from recent more positive market commentaries | 10 September

Platinum Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

PLATINUM FORECAST

(Previous week in brackets)

| Platinum USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 955 (1026) | ||||||

| PT Trend | ↓ (↓) | ↓ (↑) | ↓ (↑) | |||

| PT % Risk Weight |

45 (46) | 17 (18) | 25 (66) | |||

| Total PM Portfolio allocation 40% (40%) |

Pt:33% | Ag:33% | Au:33% | |||

Platinum / USD live price

Platinum comment

10 September 2021 close Opportunity knocks if investors shy away. That happens to Platinum again with a very weak close on Friday against dollars, Gold and Silver. Monthly is currently in a stronger downtrend with support coming in at $835. It may happen as medium term weekly and short term daily risk weight also push down still. Metals aren't out of the fire zone yet. Our core position will not change as maintaining precious metals insurance is key in the present unsafe financial arena. We will be adding some Platinum going into Platinum overweight by selling some gold and silver instead. Most probably Monday 13 Sept.

03 September 2021 close Platinum has held a 18 month support line for 4 weeks now. With weekly risk having turned back up we'd be looking for a medium term $1400 level. If the long term bottom was set back in March 2020, we need to see bearish long term divergence before we check an initial top. This must coincide with a new price high at least. No Change.

27 August 2021 close Alternative (social) media with very decent following is starting to look at Platinum. We haven't seen that to the same extend since we created our position. A positive and deserved signal perhaps in what has been a very dull market place of late. Technically Platinum is fairly neutral but the most important reading for a long term hold is the clear break up from a ten year downtrend back in November 2020 which finds support at just under $800.Owners of Platinum should see their investment do very well in a broader skyward metals move.

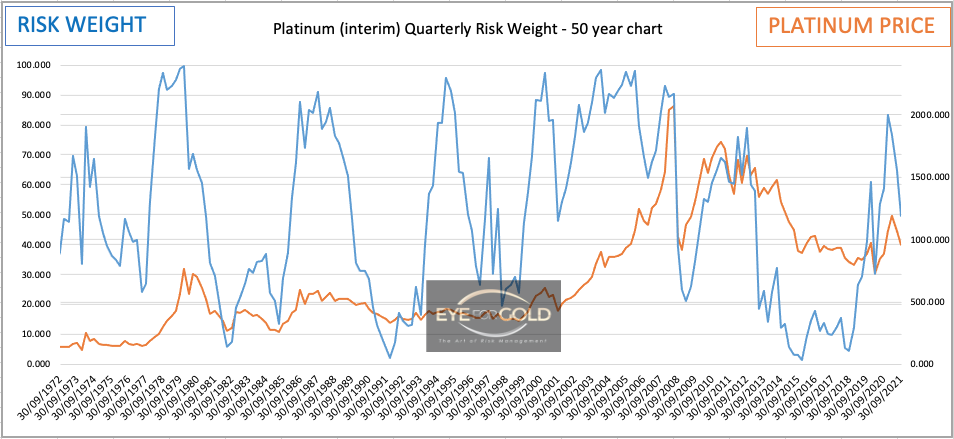

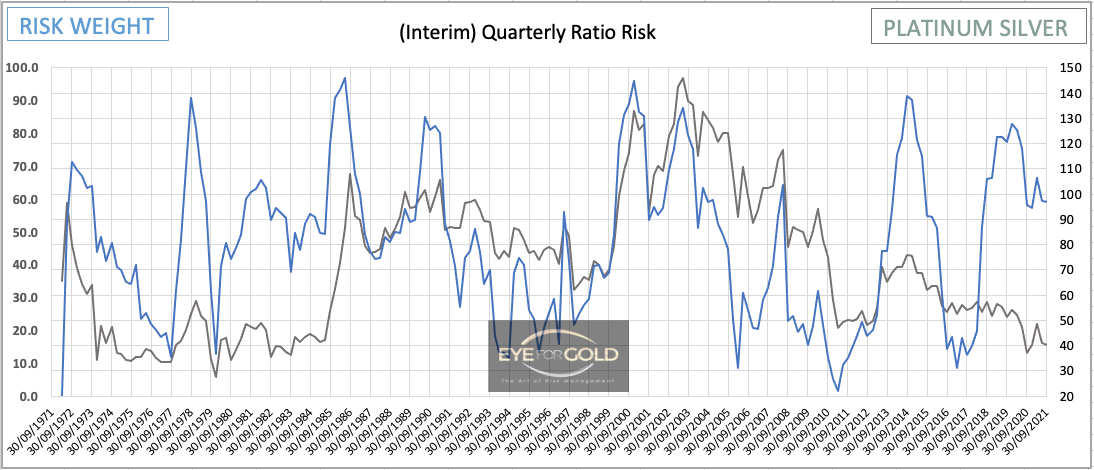

Quarterly risk is still in a downtrend but not conclusive for trading given that risk weight corrected fairly sharply and that reading can so easily turn back up again over the next 6 months. No Change.

GOLD/PLATINUM Ratio Price Risk Trend

(Previous update in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1.8701 (1.7812) |

||||||

| Trend | ↑ (↑) | ↓ (↓) | ↑ (↓) | |||

| % Risk Weight |

47 (45) | 93 (77) | 100 (64) | |||

| Total PM Portfolio allocation 40% (40%) |

Pt:33% | Ag:33% | Au:33% | |||

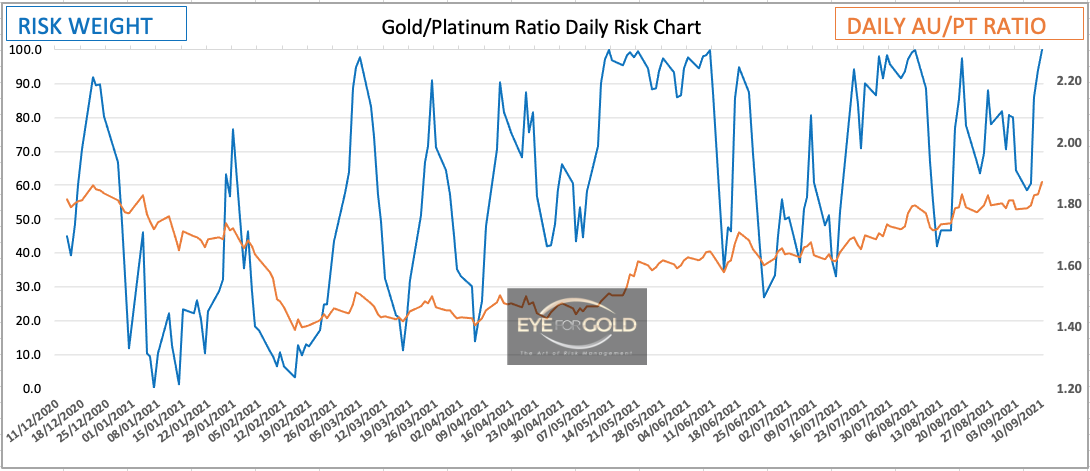

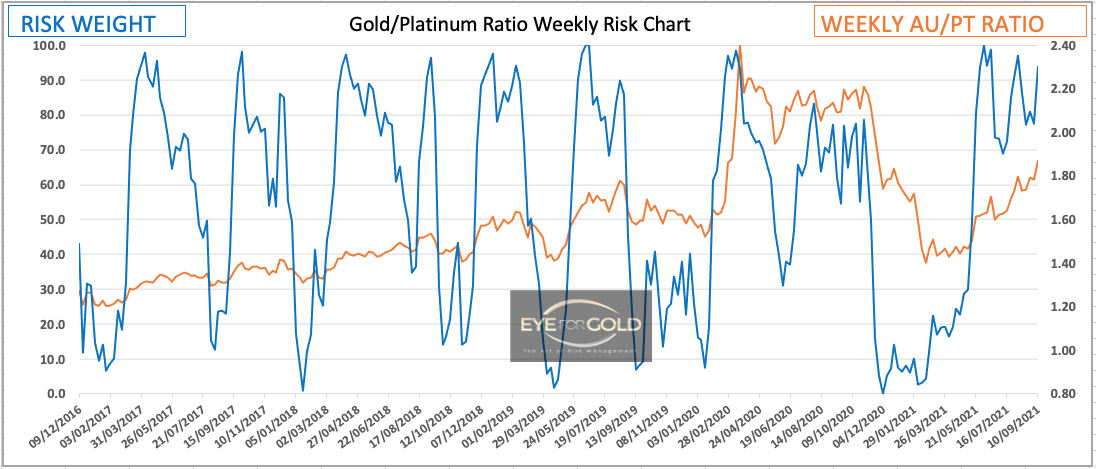

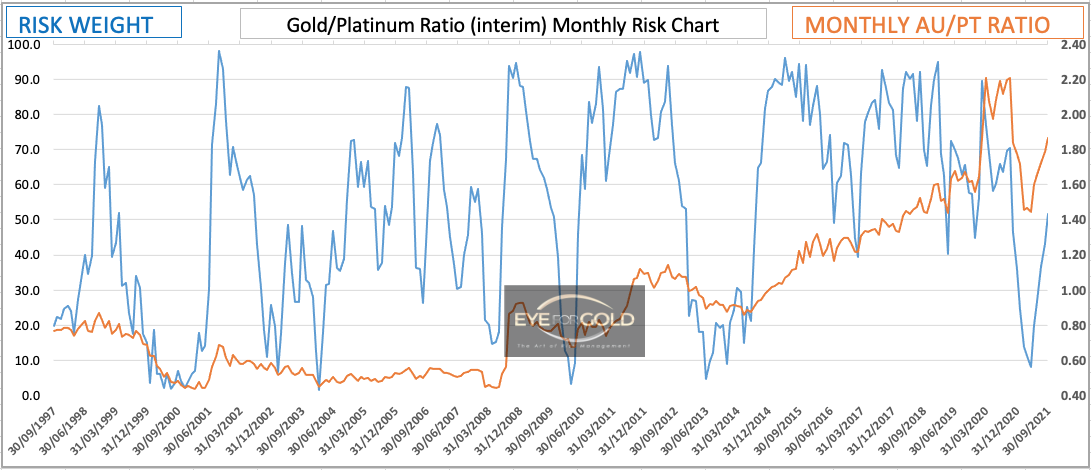

Gold/Platinum Ratio Charts

Against the expected trend Platinum had a poor week once more, but has reached maximun risk which eyes attractive enough to go 5 percent overweight on Platinum versus Gold. This now eyes fairly low risk without removing our basis precous metals insurance cover.

With risk recovering 40% in a straight line from the Gold/Platinum ratio bottom on February 28, 2021, Platinum does not look weak even though the market wants otherwise. We do prefer the opportunity to increase the position somewhat in exchange for Gold and Silver and see what happens in the next few weeks and months.

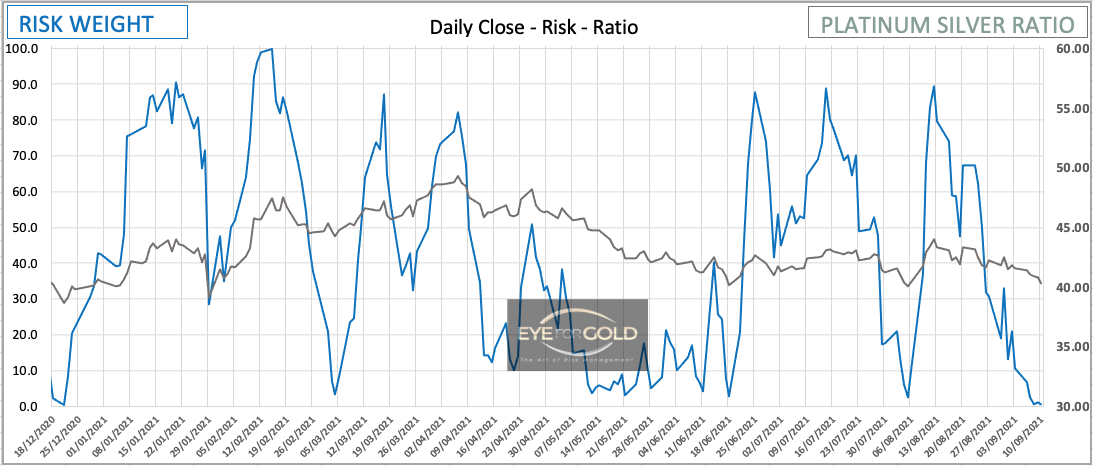

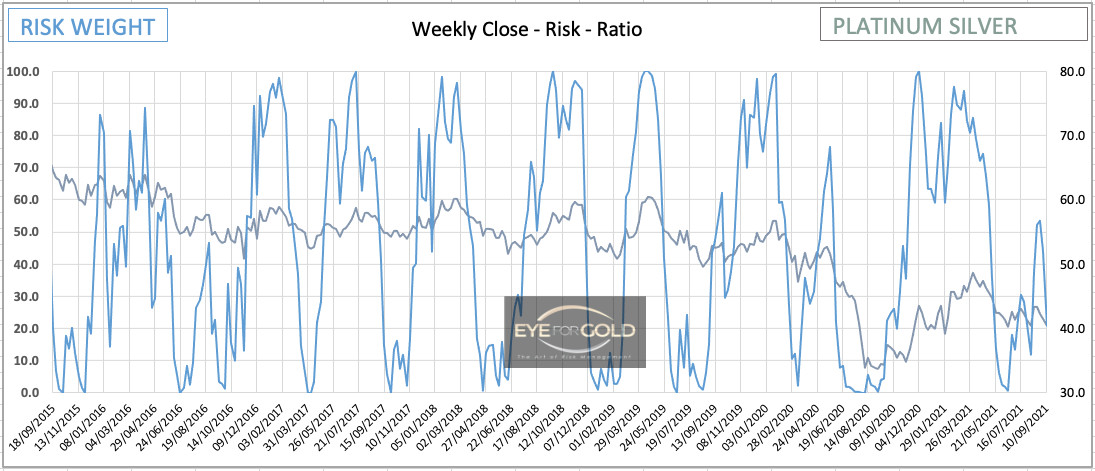

PLATINUM/SILVER Ratio Price Risk Trend

(Previous update in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 40.33 (41.55) |

||||||

| Trend | ↑ (↑) | ↓ (↓) | ↓ (↓) | |||

| % Risk Weight |

47 (51) | 20 (44) | 01 (10) | |||

| Total PM Portfolio allocation 40% (40%) |

Pt:33% | Ag:33% | Au:33% | |||

Platinum/Silver Ratio Charts

Platinum risk weight shows an inverse bullish divergence. Lower risk weight and higher or equal price. Otherwise a similar low risk short term picture to take the opportunity to switch a bit of physical Silver into Platinum.

Monthly is down but has yet to properly move into high risk weight territory to see an alarm dropping onto our position.