Platinum can potentially benefit from recent more positive market commentaries | 17 September

Platinum Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

PLATINUM FORECAST

(Previous week in brackets)

| Platinum USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 955 (1026) | ||||||

| PT Trend | ↓ (↓) | ↓ (↓ ) | ↓ (↓) | |||

| PT % Risk Weight |

42 (45) | 15 (17) | 15 (25) | |||

| Total PM Portfolio allocation 40% (40%) |

Pt:40% | Ag:30% | Au:30% | |||

Platinum / USD live price

Platinum comment

17 September 2021 close Last Monday as mentioned in last week's comment we did switch 10% of our Gold and Silver holdings into Platinum. This brings the Gold/Silver allocation to 60% with 30% each and Platinum to 40%.

The precious metals market still looks vulnerable, but serves as critical insurance whilst we attempt to let the balance of the portfolio work harder without much risk as the portfolio still has a large cushion with 15% cash.The current level of Platinum is still or again historically low compared with Gold and Silver. A low risk opportunity to hold medium term.

10 September 2021 close Opportunity knocks if investors shy away. That happens to Platinum again with a very weak close on Friday against dollars, Gold and Silver. Monthly is currently in a stronger downtrend with support coming in at $835. It may happen as medium term weekly and short term daily risk weight also push down still. Metals aren't out of the fire zone yet. Our core position will not change as maintaining precious metals insurance is key in the present unsafe financial arena. We will be adding some Platinum going into Platinum overweight by selling some gold and silver instead. Most probably Monday 13 Sept.

GOLD/PLATINUM Ratio Price Risk Trend

(Previous update in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1.8633 (1.8701) |

||||||

| Trend | ↑ (↑) | ↓ (↓) | ↓ (↑) | |||

| % Risk Weight |

49 (47) | 83 (93) | 67 (100) | |||

| Total PM Portfolio allocation 40% (40%) |

Pt:40% | Ag:30% | Au:30% | |||

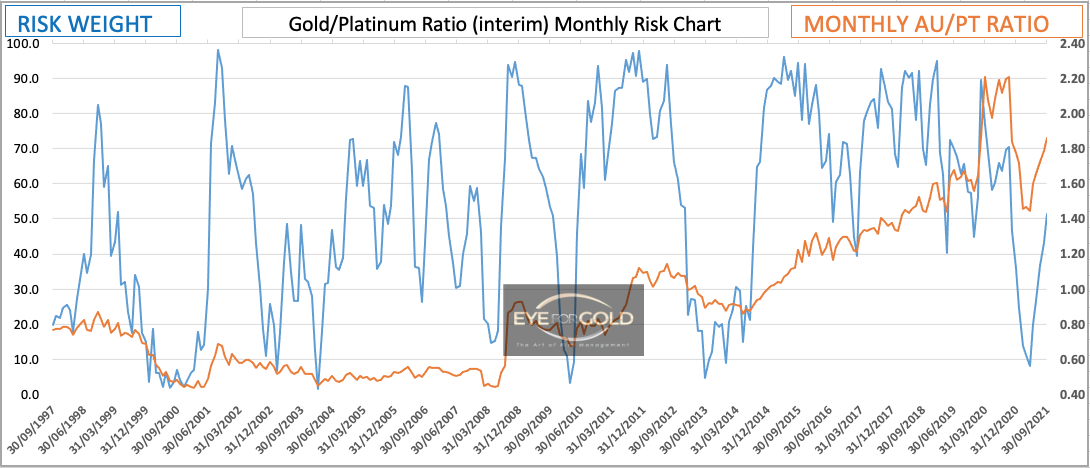

Gold/Platinum Ratio Charts

(Sept 17) Platinum reached a clear short oversold condition last week where we felt a rising opportunity to accumulate a bit more whilst the market is weak. The market has now turned and may consolidate a bit more. The broader picture is waiting for long term signals to first reach serious overbought level for Platinum, which is very possibly many quarters into the future.

(Sept 10) Against the expected trend Platinum had a poor week once more, but has reached maximun risk which eyes attractive enough to go 5 percent overweight on Platinum versus Gold. This now eyes fairly low risk without removing our basis precous metals insurance cover.

(Sept 17) No additioonal comment

(Sept 10) With risk recovering 40% in a straight line from the Gold/Platinum ratio bottom on February 28, 2021, Platinum does not look weak even though the market wants otherwise. We do prefer the opportunity to increase the position somewhat in exchange for Gold and Silver and see what happens in the next few weeks and months.

(Sept 17) No additioonal comment

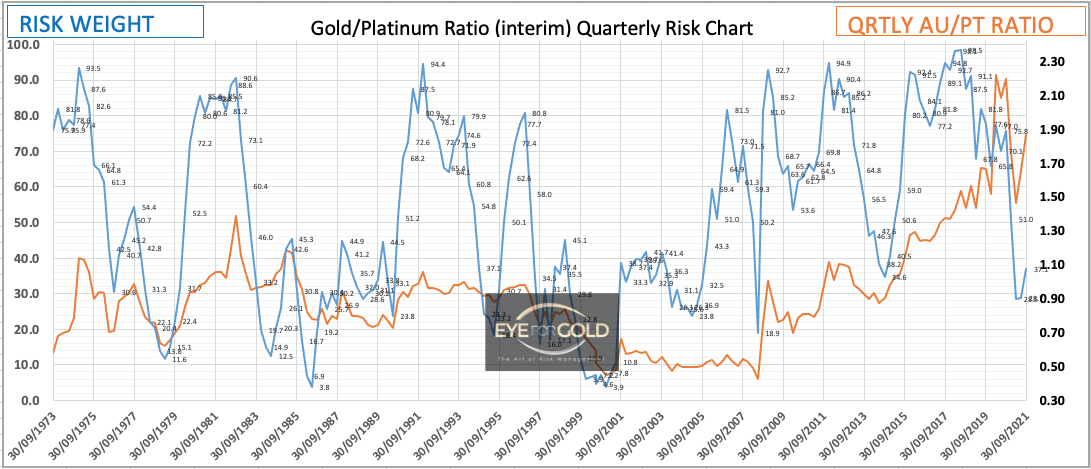

(Sep 10) Quarterly is showing a weak risk weight uptrend correction against a fairly strong nominal price correction in favor of Gold. Wewill need to see a proper bottom in the overall primary downtrend cycle before getting nervous with the position.

PLATINUM/SILVER Ratio Price Risk Trend

(Previous update in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 42.09 (40.33) |

||||||

| Trend | ↑ (↑) | ↑ (↓) | ↑ (↓) | |||

| % Risk Weight |

47 (47) | 45 (20) | 66 (01) | |||

| Total PM Portfolio allocation 40% (40%) |

Pt:40% | Ag:30% | Au:30% | |||

Platinum/Silver Ratio Charts

(Sept 17) The initial further 3% drop against Gold and silver was followed by a much larger correction in the Silver price going into the weekend. The subsequent correction in favor of Platinum did create a sharp risk weight reversal. The result is likely more search for direction before Platinum resumes its uptrend. We have switched 10% of our physical Silver into physical Platinum last Monday Sept 13 and wait for the market to settle down.

The weely risk weight chart shows very similar bullish divergence for Platinum as for Platinum against Gold. This is a key signal to be patient with the new position. Still looking for equilibrium against Silver well above the 60 level.

(Sept 10) Platinum risk weight shows an inverse bullish divergence. Lower risk weight and higher or equal price. Otherwise a similar low risk short term picture to take the opportunity to switch a bit of physical Silver into Platinum.

(Sept 10) Monthly is down but has yet to properly move into high risk weight territory to see an alarm dropping onto our position.