Platinum can potentially benefit from recent more positive market commentaries | 27 August

Platinum Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

PLATINUM FORECAST

(Previous week in brackets)

| Platinum USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1012 (1026) | ||||||

| PT Trend | ↓ (↓) | ↑ (↑) | ↓ (↑) | |||

| PT % Risk Weight |

53 (52) | 15 (13) | 50 (43) | |||

| Total PM Portfolio allocation 40% (40%) |

Pt:33% | Ag:33% | Au:33% | |||

Platinum / USD live price

Platinum comment

27 August 2021 close Alternative (social) media with very decent following is starting to look at Platinum. We haven't seen that to the same extend since we created our position. A positive and deserved signal perhaps in what has been a very dull market place of late. Technically Platinum is fairly neutral but the most important reading for a long term hold is the clear break up from a ten year downtrend back in November 2020 which finds support at just under $800.Owners of Platinum should see their investment do very well in a broader skyward metals move.

Quarterly risk is still in a downtrend but not conclusive for trading given that risk weight corrected fairly sharply and that reading can so easily turn back up again over the next 6 months. No Change.

13 August 2021 close Platinum is still the Rolls Royce of Precious metals with the highest weight per ounce or gram of all precious metals at 21,400 KILO per cubic meter (m3). Platinum is much less liquid than gold or Silver and can be used like the other PM's for various industrial applications as well as jewelry. Platinum is the long term play we have been waiting for the past 13 years.

Versus USDollar, Platinum has now fallen back to the bottom of the channel which runs parallel from the bottom in March 2020 to the line drawn between the high of Jan 2020 and the high of Febr 2021. Short movements and corrections aside, Medium term weekly risk weight looks close to a bottom if not already reached last week. Monthly has yet to produce bearish divergence which could be even one year or longer from now. Quarterly risk weight (see chart below) has yet to fulfill a proper top formation. Physical Platinum is a long term hold in its own right. No Change.

GOLD/PLATINUM Ratio Price Risk Trend

(Previous update in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1.7945 (1.7320) |

||||||

| Trend | ↑ (↑) | ↓ (↓) | ↓ (↓) | |||

| % Risk Weight |

44 (38) | 81 (86) | 76 (46) | |||

| Total PM Portfolio allocation 40% (40%) |

Pt:33% | Ag:33% | Au:33% | |||

Gold/Platinum Ratio Charts

Platinum continued under pressure whilst the metals space weakened again the past 2 weeks before recovering last week. The Daily risk picture is showing bearish divergence for gold versus Platinum and risk peaked on Tursday at 1.82. We expect the ratio to be moving lower next week.

The bold comment below applies to this week's close at much as it did two weeks ago. Ratio looks ready for a fresh downward correction again.

Weekly already is showing bearish lower risk weight to higher price divergence which will either follow through with a further decline of the ratio or make a second bearish divergence formation keeping a lid on the possiblity for a major new advance for Gold vs Platinum.

Monthly risk trend is still up with price. Both risk trend and price are showing fairly sharp correction following the 9 months drop from the 2.20 high towards 1.45.

From past experience, risk in monthly time scale should present bullish divergence after such a long stint of Platinum weakness or a fresk risk weight low for a much longer term Platinum correction towards eqialibrium with Gold.

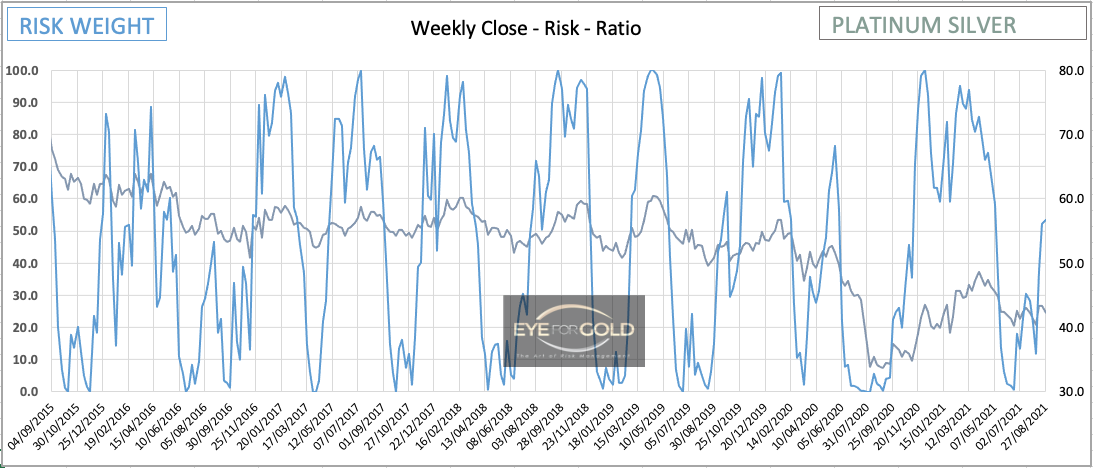

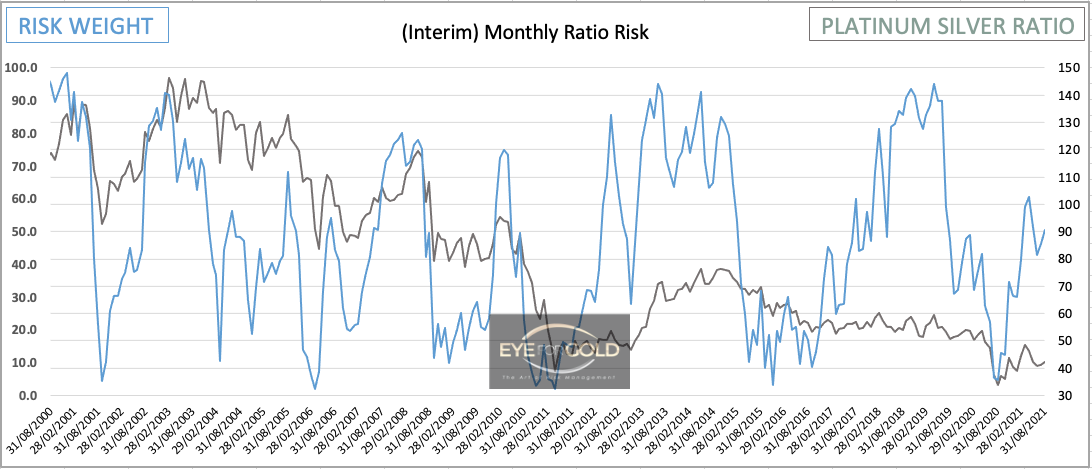

PLATINUM/SILVER Ratio Price Risk Trend

(Previous update in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 42.21 (43.29) |

||||||

| Trend | ↑ (↑) | ↑ (↑) | ↓ (↓) | |||

| % Risk Weight |

50 (47) | 53 (37) | 31 (79) | |||

| Total PM Portfolio allocation 40% (40%) |

Pt:33% | Ag:33% | Au:33% | |||

Platinum/Silver Ratio Charts

A sharp drop in risk during the 2 week consolidation is in favor of Platinum. A new price lowwould show bullish divergence or the market turns positive for PT on Monday or Tuesday

Risk trend in Monthly time scale remains up giving Platinum the benefit of any doubt finding its way towards the long term average closer to 75. Feel is more neutral because risk developed higher without that much of a ratio price change. No change to staying with a balanced Metals portfolio with equal weight between Silver and Platinum.

Qaurterly risk is still working the bullish divergence that developed only after 19 years of Platinum/Silver price history. This is not a tradeable indicator and it can move either direction following sharp shorter term action. Beyond that Platinum remains the favoured metal for now.