Platinum pauses to reverse after 2 weeks of poor performance | 1 November

Platinum Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

PLATINUM FORECAST

(Previous week in brackets)

| Platinum USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1055 (1041) | ||||||

| PT Trend | ↓ (↓) | ↑ (↑) | ↑ (↓) | |||

| PT % Risk Weight |

35 (39) | 67 (50) | 32 (83) | |||

| Total PM Portfolio allocation 40% (40%) breakdown: |

Pt:14% | Ag:14% | Au:12% | |||

Platinum / USD live price

Platinum comment

31 Oct close / 1 Nov 2021 update The Platinum Quarterly risk chart has quickly dropped into a risk level where it may continue its trend upward. We would historically expect risk weight to come into the 90% red area whihc in our opinion will trigger a price move equal to Gold. Monthly risk looks ready to trun bullish again whilst weekly has yet to finsh the uptrend that started from bullish divergence in September. On this 1st November, daily risk has turned bullish follwing the quick price rally today. The overall picture remains positive for Platinum. We did re-allocate some towards silver so these two metals represent about 14% each of the total portfolio.

22 October 2021 close Platinum's stronger performance from the past 2 weeks could not be sustained as we witnessed a few percentage points correction down for Platinum in its ratio against Gold and Silver. The longer term picture however is looking increasingly positive even thouugh monthly risk weight is still down. But Monthly and Quarterly risk have created enough space to turn into a bullish trend again once the 1 year consolidation ends and send Platinum to where it belongs; at least 1:1 against Gold. The current low Platinum price should develop a much larger interest for different and qualified industrial use. As Platinum liquidity is so much lower than Gold, the chances of our long term outlook becoming reality are high. Hence patience for this event to unfold during the coming year(s). No Change.

15 October 2021 close Platinum continued its stronger performance in the precious metals space where outside of precious metals Copper seems to have broken out strongly to the upside. Interestingly the Monthly time interval for Platinum/USD is still down but at a level where it provides so much room for appreciation towards that long awaited equilibrium with gold again. Here too we should expect Monthly risk weight to show bearish divergence, at least once, before we reach a major top in the current primary cycle that started early last year. Based on the current uptrend trend for Platinum in Gold/Platinum and the Platinum/Silver ratios we quietly maintain our present slight overweight physical PT allocation at 16% of total.

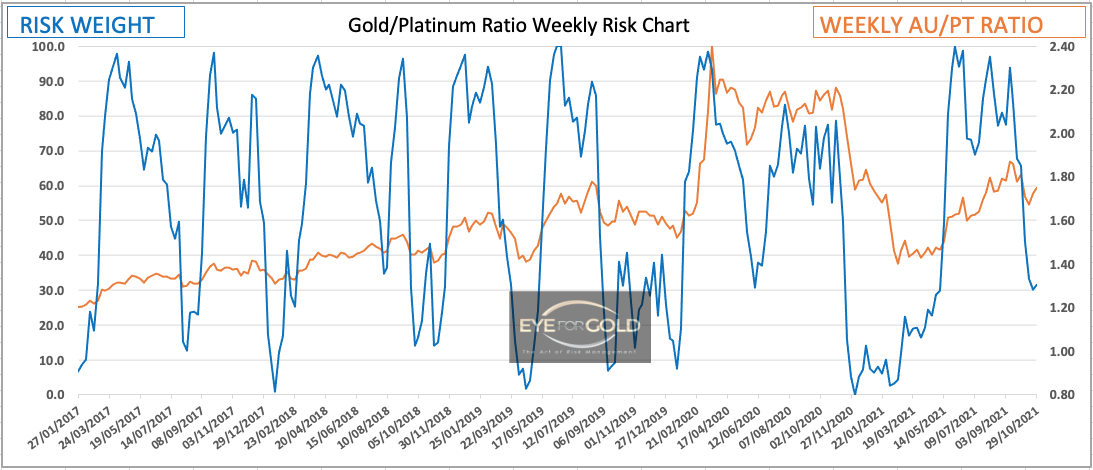

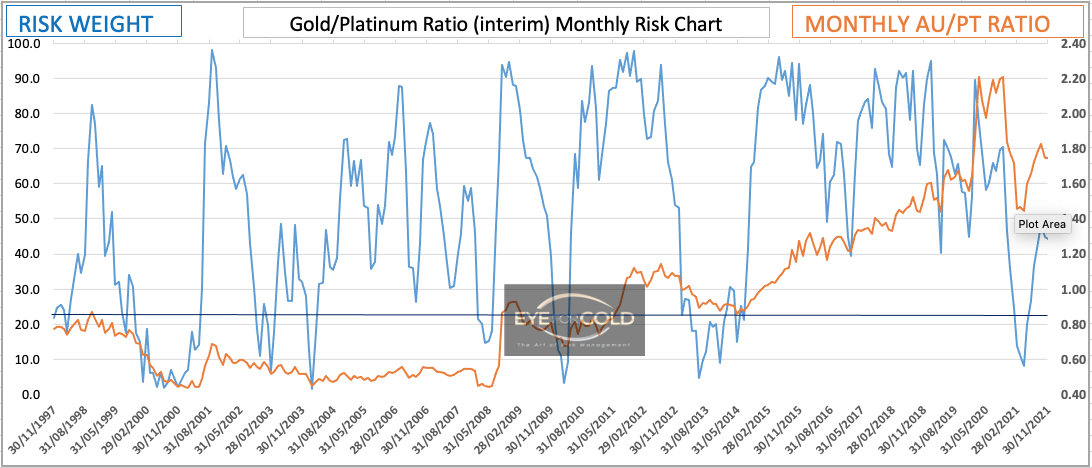

GOLD/PLATINUM Ratio Price Risk Trend

(Previous update in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1.7550 (1.7214) |

||||||

| Trend | ↑ (↑) | ↑ (↓) | ↑ (↓) | |||

| % Risk Weight |

44 (43) | 32 (30) | 84 (33) | |||

| Total PM Portfolio allocation 40% (40%) breakdown: |

Pt:14% | Ag:14% | Au:12% | |||

Gold/Platinum Ratio Charts

Oct 31 close / 1 Nov update Friday's close was also the close for October which following a week of further weakness made the Daily risk weight of the Gold/Platinum ratio shoot up at the close and subsequently turning into a strong downtrend again this Monday Nov 1. The Ratio lost 4$ today at time of writing, dropping from 1.7550 to 1.6870. A drop and close below 1.67 will be a very bearish chart pattern. Risk weight will also turn bearish and indicate a resumption of the major cycle trend that started in March 2020. We forecast that the Gold/Platinum ratio will return to its 50 years average at around 0.87 represented by the horizontal line on Monthly and Quarterly charts below. We maintain a tiny overweight of Platinum amnd Silver versus Gold in the precious metals portfolio.

Oct 22 The Gold/Platinum ratio paused and corrected again finishing in a Daily risk weight uptrend after short term bullish divergence. This is not being confirmed by the longer term time intervals which then decides that we do not react to just short term corrections. The long term outlook is for Platinum to reach 1:1 against Gold, which is a historically sure bet given time. No Change to maintaing PT overweight in our allocation.

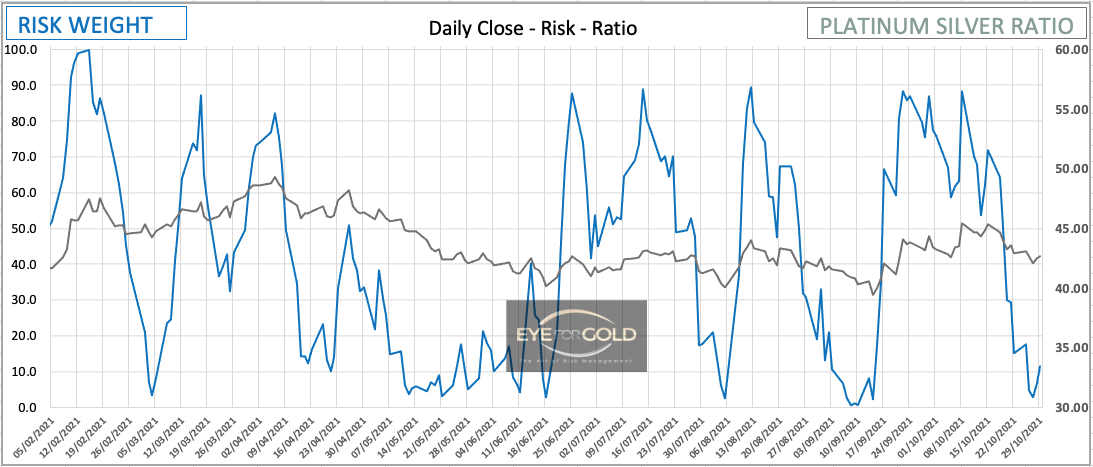

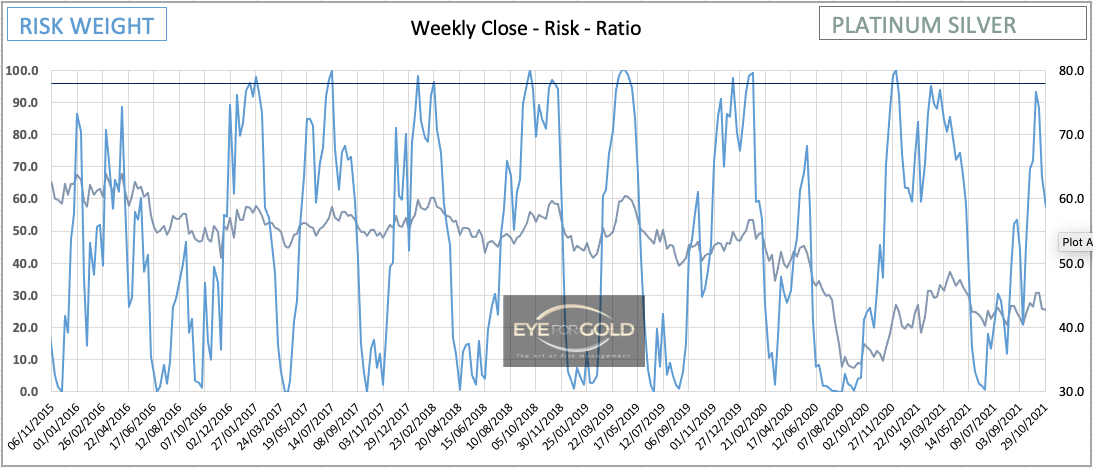

PLATINUM/SILVER Ratio Price Risk Trend

(Previous update in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 42.66 (42.87) |

||||||

| Trend | ↓ (↓) | ↓ (↓) | ↓ (↓) | |||

| % Risk Weight |

55 (58) | 57 (67) | 12 (15) | |||

| Total PM Portfolio allocation 40% (40%) breakdown: |

Pt:14% | Ag:14% | Au:12% | |||

Platinum/Silver Ratio Charts

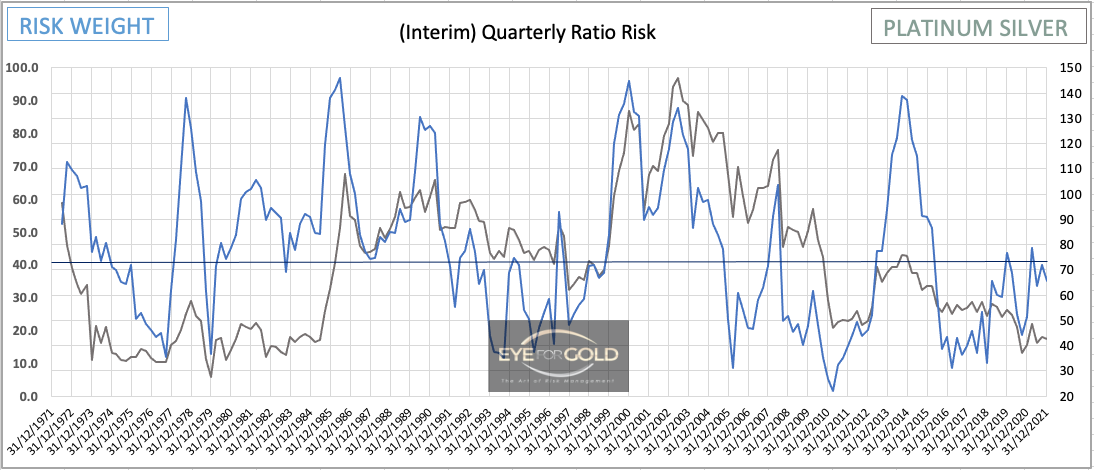

Oct 31 close / 1 Nov update Platinum versus Silver closed weaker in October at 42.66, but rallied strongly on Monday Nov 1 towards 44.30. We have waited to see how the new month would begin. We have rebalanced our precious metals allocation ever so slightly where Silver is now equal to Platinum. The technical print at Friday's close 29 October was somewhat inconclusive although short term indicators with a low risk trend upturn on Daily are in favor of a Platinum rally versus Silver. This actually happened today Nov 1 with some speed where Platinum rallied 4% without much change in Gold or Silver. As all metals will eventually find the same direction on perceived fundamentals we still forecast for Platinum to show more strength against Silver, eventually reaching that 50 years average of around 73 from current 40's handle with many more ups and downs to come.

Oct 22 Silver climbed 5% versus Platinum after a strong mid week Silver rally. Technically tempting to re-adjust the overweight PT with Silver, but our long term outlook should minimise any short term opportunity losses which are hard to trade in the physical precious metals market as full margin switching can be quite expensive. Most time intervals do confirm that this correction against Platinum may last a bit longer. The current ratio of 43.00 is still far below the 50 year average close of just over 73.00. If short term trading the exit from PT overweight would have been triggered mid last week. Now we are looking at a mere short term unrealized opportunity loss. We put our long term position on hold as long as the naked Platinum/USD price remains above 900 or the equivalent in other fiat currency, in our own case the EURO. No Change.