Platinum slows early rally whilst silver bounces with gold slightly higher | 01 October

Platinum Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

PLATINUM FORECAST

(Previous week in brackets)

| Platinum USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 974 (982) | ||||||

| PT Trend | ↓ (↓) | ↑ (↓) | ↓ (↑) | |||

| PT % Risk Weight |

38 (45) | 21 (14) | 56 (62) | |||

| Total PM Portfolio allocation 40% (40%) breakdown: |

Pt:16% | Ag:12% | Au:12% | |||

Platinum / USD live price

Platinum comment

01 October 2021 close Platinum held its own last week whilst Gold and Silver both bottomed and returned to the average weekly price wheras platinum closed slightly lower. Our overweight platinum allocation is the opportunity trade as we still expect Platinum to outperform both Gold and Silver and if it doesn't Platinum will be driven forward on any major rally in Gold and Silver.

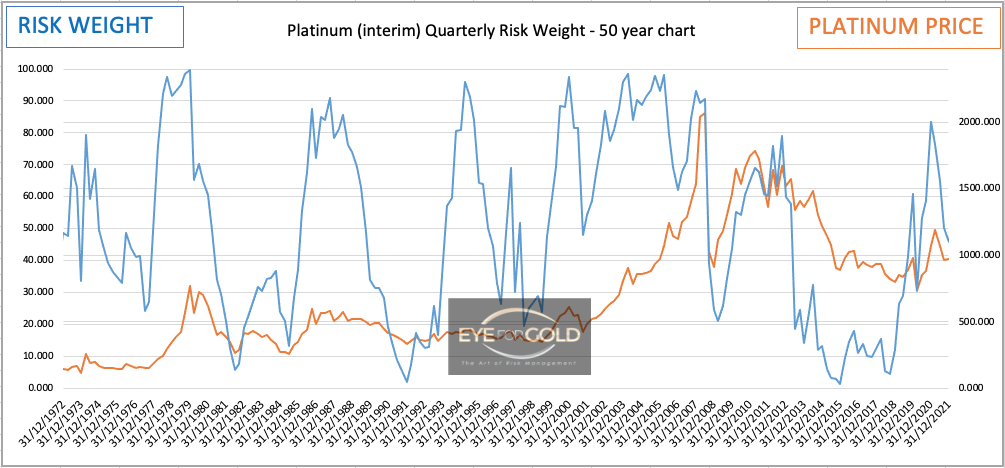

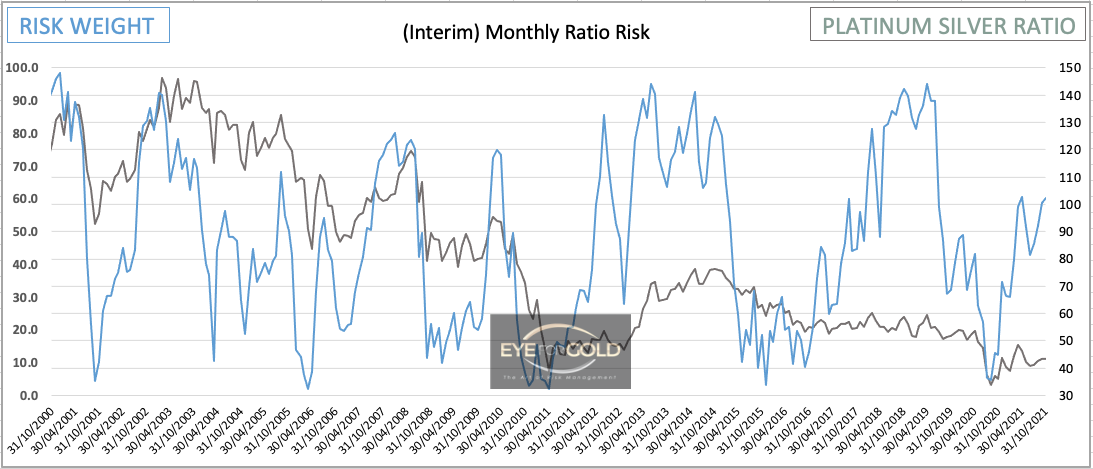

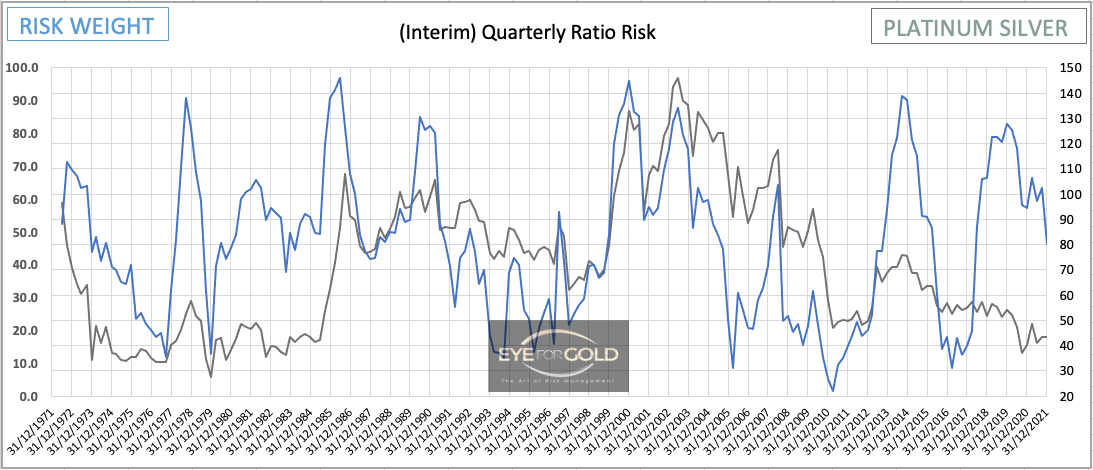

Weekly risk weight appears to start an uptrend from a bullish divergence break (higher risk/lower price) whilst Monthly is already lower risk with price well above the 12 year resistance line. The quarterly risk weight chart looks very bullish with this steep drop in risk weight since earlier this year. This is a long term bullish picture and we seek price equilibrium with gold within a few years.

24 September 2021 close Following a long period of relative weakness Platinum is the first metal to attempt a mild rally in the precious metals space. Last Monday upon Silver turning down sharply, Platinum was driven towards the $900 handle during European evening and US lunchtime. On Tuesday the price recovered towards the previous week's close, then rallying towards the $1000 level mid week. A strong and also expected recovery given the very short term oversold position of Platinum versus Gold and Silver. Our 10% gold and Silver swap into Platinum the previous week ended the week stronger, but as this is an opportunity trade we may push it back to equal weighting again if we get a decent Platinum rally. For now no change because at least two of all longer term risk weight times scales need to show bearish divergence triggered by a much higher price peak than seen in February 2021.

GOLD/PLATINUM Ratio Price Risk Trend

(Previous update in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1.8086 (1.7795) |

||||||

| Trend | ↑ (↑) | ↓ (↓) | ↑ (↓) | |||

| % Risk Weight |

51 (51) | 65 (67) | 38 (18) | |||

| Total PM Portfolio allocation 40% (40%) breakdown: |

Pt:16% | Ag:12% | Au:12% | |||

Gold/Platinum Ratio Charts

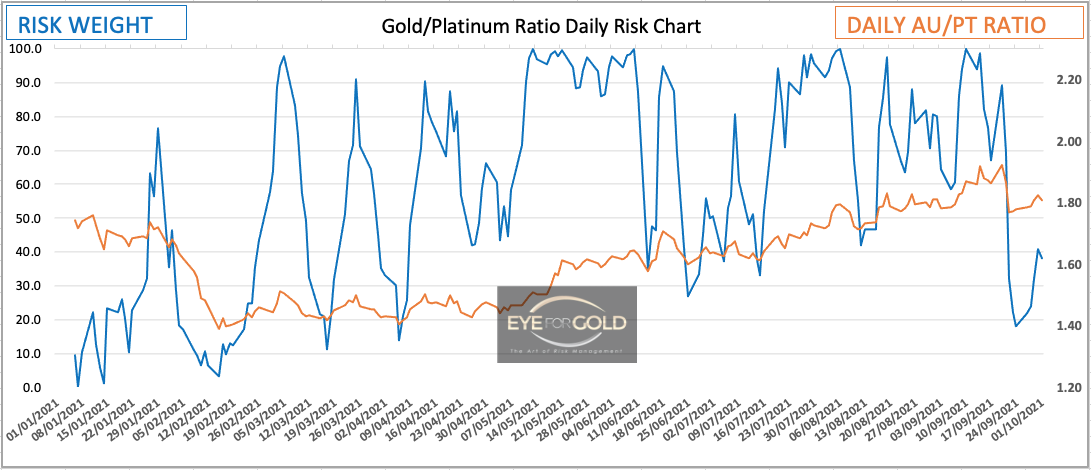

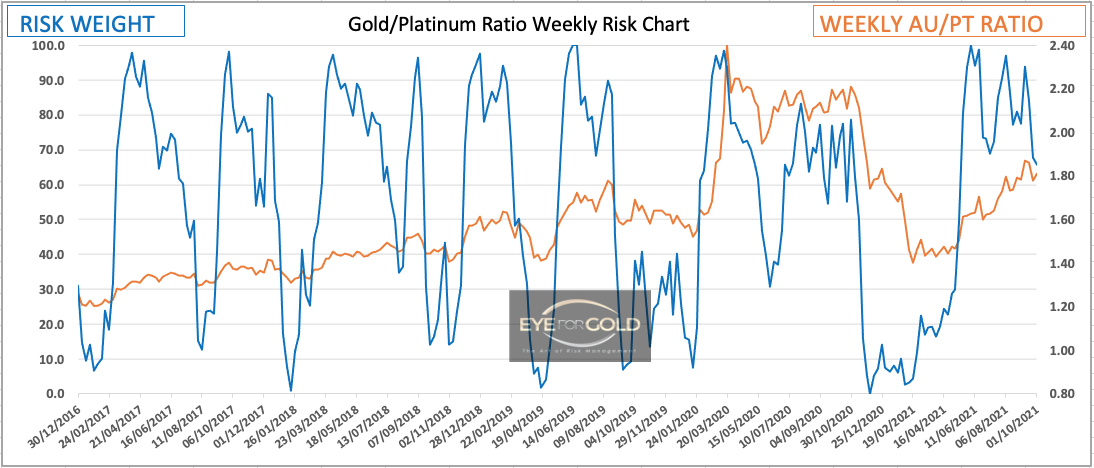

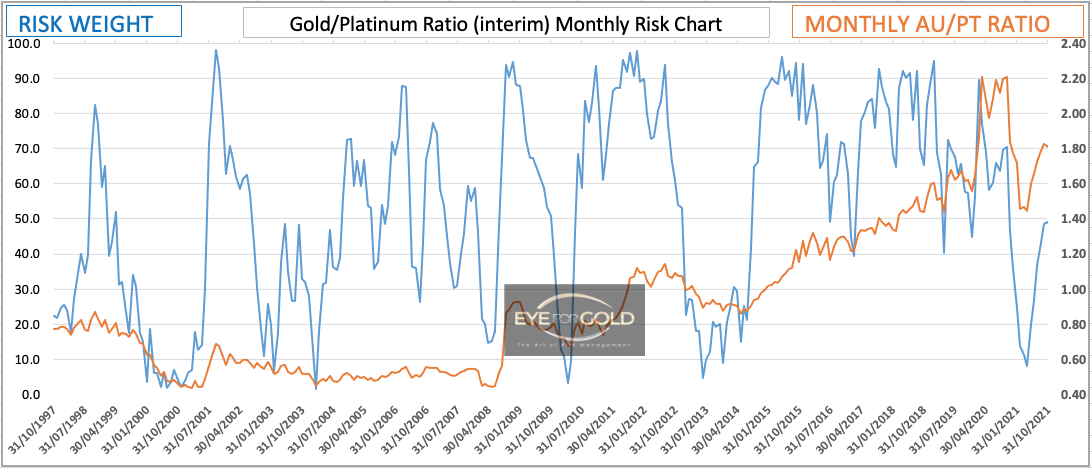

Oct 01 Gold versus Platinum looks weak in terms of risk weight pushing Gold lower versus Platinum in all time scales from Daily to Quarterly. This must become apparent in weeks to come but as always may take time, hence comfortable with the slight overweight Platinum opportunistic allocation. No Change.

Sept 24 Daily risk weight took a dive as Platinum rose about 4% versus gold last week. Medium and Long term risk weight have a great deal more room and time to develop a weaker Gold vs Platinum ratio. Happy to stay with the 10% PT overweight for now.

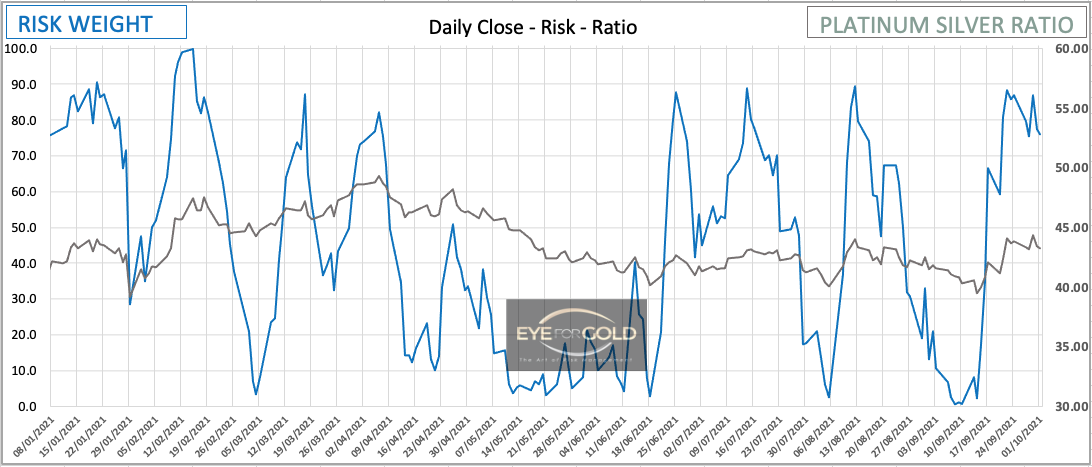

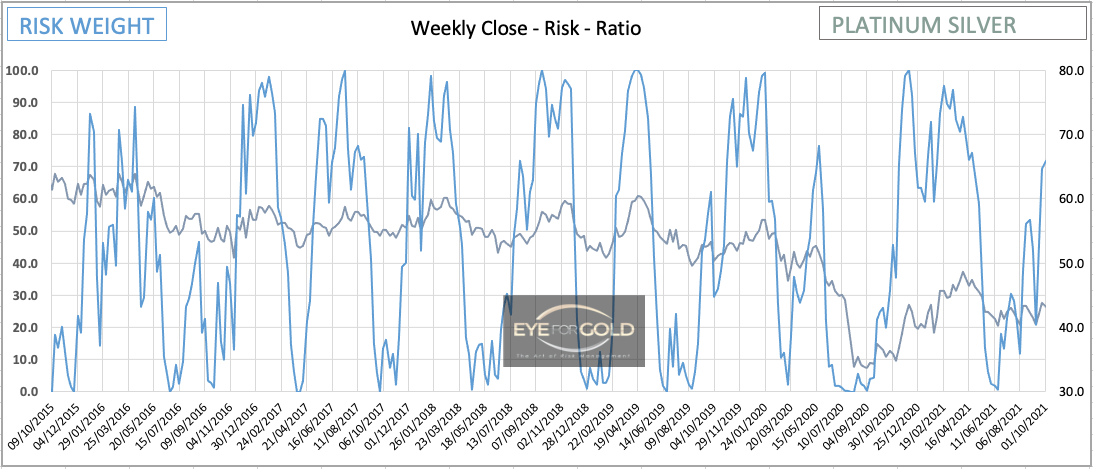

PLATINUM/SILVER Ratio Price Risk Trend

(Previous update in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 43.25 (43.84) |

||||||

| Trend | ↑ (↑) | ↑ (↑) | ↓ (↑) | |||

| % Risk Weight |

60 (60) | 71 (69) | 75 (87) | |||

| Total PM Portfolio allocation 40% (40%) breakdown: |

Pt:16% | Ag:12% | Au:12% | |||

Platinum/Silver Ratio Charts

Oct 01 Except for Daily Platinum which looks weaker versus silver at the close on Friday with risk weight turning down from a higher risk level, the other times scales very much confirm the same outlook as Platinum versus gold. The longer term picture therefore takes priority over short term and should support the price of Platinum against both Gold and Silver during Q4. If the overweight Platinum allocation within the portfolio proves uncertain we will await a general metals rally to possibly make a switch back from profit to equal or overweight gold or silver as dictated by market performance. No Change for now.

Sept 24 Platinum vs Silver also ended the week about 4% higher with a more volatile Silver component during the week. Daily risk weight was pushed up to 90% and may show some correction although the longer term time scales still look suffieciently positive for Platinum to maintain our 10% Platinum overweight.