Platinum investors still in doubt | 16 July

Platinum Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

PLATINUM FORECAST

(Previous week in brackets)

| Platinum USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 980 (1049) | ||||||

| PT Trend | ↓ (↓) | ↓ (↓) | ↓ (↑) | |||

| PT % Risk Weight |

50 (65) | 10 (25) | 5 (17) | |||

| PM Distribution Total allocation 50% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Platinum / USD live price

Platinum comment

06 August 2021 close Our platinum allocation has lost further ground but still some 6% above entry level. The position remains on hold as we see no indication for Platinum to suffer as it did early 2020. Even so, the quarterly print below feels similar to the 2000/2001 move leading into a fresh bottom followed by a major advance which ended at $2000+ in 2008. Chart wise, the 2020 bottom is typical for a major longer term bottom besides the historically unusual apathy for Platinum, which is and will always be the hardest precious metal in the universe with a great industrial purpose. It may be that a major purpose, catalyst coverters is seen as a key demand degenerator. The Platinum price however should continue to be very attractive for both jewelry and renewed industrial interest. Daily and Weekly risk weight have dropped into oversold zones whilst Long term Monthly is fairly neutral at 50% risk appraoching a 50% price correction ($947) between the 2020 low and the 2021 high. Platinum too has yet to crack a proper bearish divergence in the medium and long term risk weight scales. Hence no change to our long term hold.

30 July 2021 Platinum performancd has of course been a little disappointing against our forecast but hasn't yet failed. It is still well up from from the mid 2020 investment level and still has a mixed short term outlook. Our objectives to reach long equilibrium against gold and then pass through it are still very much risk on and we confidently stick with our long term physical Pt position.

GOLD/PLATINUM Ratio Price Risk Charts & Analysis

(Previous update in brackets)

| Gold Platinum ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1.7955 (1.7273) |

||||||

| Trend | ↑ (↑) | ↑ (↑) | ↑ (↓) | |||

| % Risk Weight |

38 (36) | 97 (90) | 100 (96) | |||

| PM Distribution Total allocation 50% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

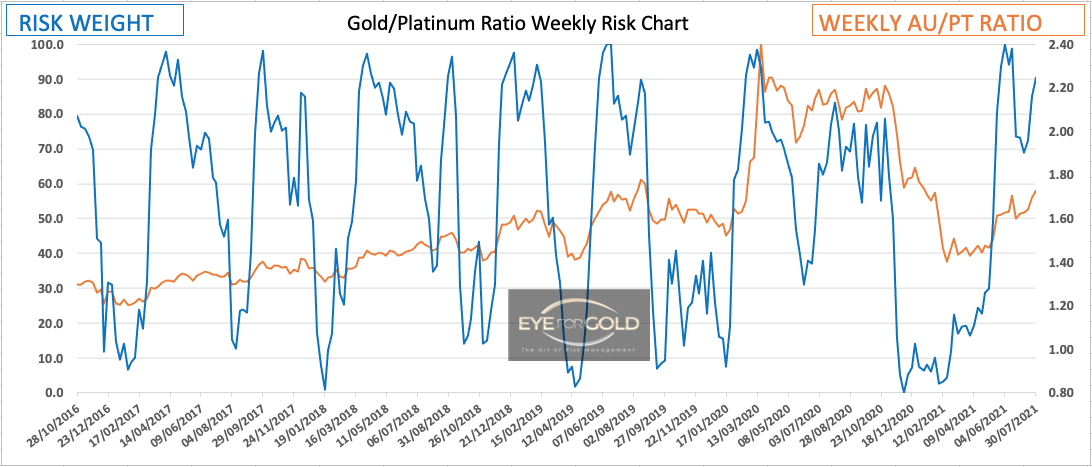

06 August close Our manually kept chart data below will again be updated next week. However as shown above, risk weight in both daily and Weekly time scales has little room for further strength whereas weekly is indicating a very possible strong bearish divergence being developed. As mentioned before finding equilibrium again after the wild ride of the past 15 years can take many months and quarters and everything points towards remaining very confident with our still solid risk management position of 50% precious metals allocation including 1/3rd Platinum.

Gold/Platinum Ratio Charts

The current cross rate is delivering a fairly overbought situation. This could last a bit longer but a return to a weaker Gold/Platinum ratio is very much on the cards.

Monthly is clearly not confirming the stronger shorter term chart reading making monthly a non leading indicator.I.e it could easily turn back down again as a more likely short term and medium term top is confirmed during August.