Repeat: Crypto correction may be over, and then it may NOT be | 18 June

BTC Bitcoin Price, Bitcoin Price Risk Analysis

(Previous week in brackets)

| BITCOIN BTC/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 35,570 (35,543) ↓ 5.6% |

||||||

| Trend | ↓ (↓ ) | ↑ (↓) | ↓ (↑) | |||

| % Risk Weight |

70 (70) | 19 (17) | 50 (63) | |||

| Allocation Limit(0%) | Invested | 0% (0%) | ||||

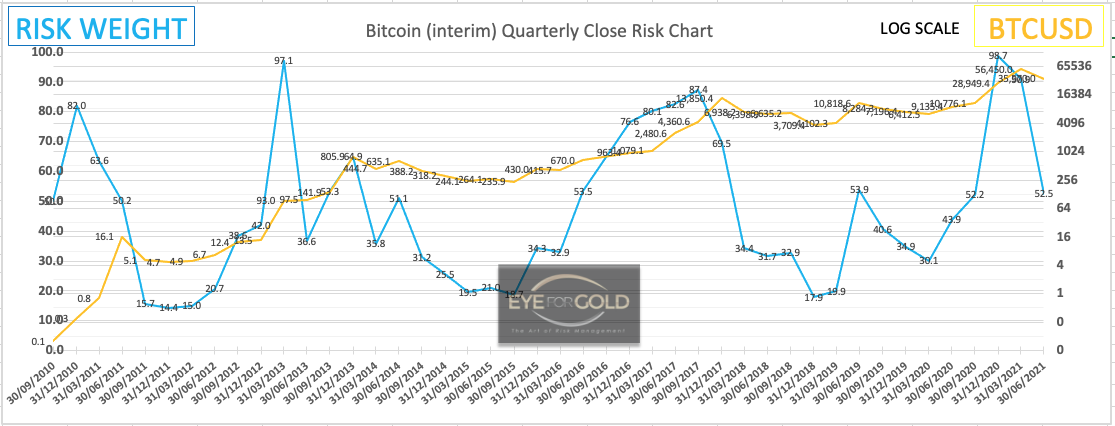

19 June close: BTC still high risk with Monthly trend down from a bearish divergence risk to price reading, Weekly not having completed a full down cycle and Daily in no man's land neutral first trending up last weekend then down again. We stay with last week's strategy where the more likely scenario is a much larger correction before this is finished. Market action remains highly speculative. No Change.

12 June close: As we can see clearly on the daily Bitcoin chart, a wedge formation is developing since 19 May with an apex pointing towards July 13/14 at this moment. Because this consolidation is now part of at least an intermediate level downtrend, your greater risk is for a breakout to the downside withina week's time or so. If that breakout comes the apex location may be close to a bottom. The Monthly long term risk chart remains bearish whilst eekly Medium term still needs to produce a proper indication of an ending larger correction. It is entirely possible that BTC has run its course, for now, from $64,829 on Febr 21 to $29,904 on May 19, but risk is not finished and anything between now and a final confirmation is high risk. Especially for weaker hands who invariably are crushed under the weight of early investor whales that have fully secured portfolio's with a free ride. And by the way, Micro Strategy's Michael Taylor and Tesla's Elon Musk have secured wealth through other smart channels, but their positions too are at high risk in the current climate. Awareness of this risk makes for a more solid less volatile portfolio approach. The entire crypto space actually looks quite similar from a technical perspective. No Change to no investment in BTC.

Bitpanda Pro - BEST Token Price Risk Analysis

(Previous week in brackets)

| Bitpanda - BEST/EUR | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 1.0844 (1.0574) ↓1.5% |

||||||

| Trend | ↓ (↓) | ↓ (↓) | ↑ (↑) | |||

| % Risk Weight |

60 (60) | 21 (28) | 57 (14) | |||

| Allocation Limit(variable) | Invested | 100% (100%) | ||||

BEST token live price

Bitpanda BEST analysis 19June

Our strategy can remain unchanged due to a minimum rewards benefit even though the technical picture is equally unfavourable, like Bitcoin and most other tokens. Bitpanda however is showing strong results making the BEST token a more desired hold in the crypto space. Our market risk with BEST is sub zero, having released in excess of the original investment. We sense that across the entire crypto space more weak hands will be shaken out over the coming months. No change with a view to re-invest some cash into a range of medium to larger crypto tokens as prices drop substantially. Typically tokens from our watchlist.

12 June 2021: Our strategy has been to reduce all of the risk in this core holding by securing enough profit and also selling several months of rewards forward. BEST however is still strong by any standard but also disappointing with a 60% drop from the high. Frankly we could see the entire crypto market drop another 40% or more as market manipulation in this unregulated space is proving extremely profitable.

BEST has suffered from growth pains, as had most exchanges, accompanied by much weaker client service and lack of 'good news'. Maximising human resource in every direction is almost always an issue for fast growing high tech companies. We would hope to see the introduction of a token launch platform which was earlier communicated as part of the underlying growth model for the Bitpanda exchange. Their digital platform however works like a dream and has a very high quality feel. The company is extremely well capitalized and deserves credit from their account holders. The crypto market is far from perfect partly due to a lack of arbitrage opportunities operated from a single platform. This would resolve some of the poor liquidity of many smaller and even larger market cap tokens. Cross blockchain operations of any kind will become a stock odel as several major IT dvelopment companies, including Bitpanda are working on it.

Otherwise no Change to our core holding which now represents 35% of total. BEST is still up 1,100% since its introduction in 2019 and we would expect that any further decline to be greeted by positive news about Bitpanda developments and possible new exchange features that benefit BEST vip clients.

S&P, Stock Indices, Equities, High Risk, No Limits

S&P 500 Standard & Poor's 500 Price Risk Analysis Forecast

(Previous week in brackets)

| Standard & Poor 500 | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 4163 (4246) | ||||||

| Trend | ↓ (↓) | ↓ (↑) | ↓ (↓) | |||

| % Risk Weight |

97 (98) | 86 (93) | 34 (90) | |||

| Max Allocation 20% (20%) | Invested | 0% (0%) | ||||

18 June 2021 close: A 2% correction was tge result of a very high risk reading across time scales the previous week. Revent history makes it almost irrelevant to attempt a forecast for the next few weeks. The chart picture just looks extremely high risk as it has done for so long. If we look at the economic fundamentals only the fact of USdollar being the world's reserve currency may delay the type of demise that is now being looked at by so many equity market investors. For sure, something big is in the making and we can't say when or where. A major event in any one of the favoured asset classes could have a huge ripple effect across all markets in all continents. We stay well away from equity investments to protect our portfolio from undesired fluctuations in this inflationary environment.

11 June 2021 close: The S&P 500 index has again made new high, although the trend is shallowing. In spite of parabolic advances in the past this market seems to be losing interest due to lower volatility and high risk perception. We just wonder how many investors have managed to stay with the uptrend trend that started in March of 2020. This market remains technically high risk and must not therefore be part of a wealth protection portfolio. Maybe day-trading with a vigilant stop loss policy, but hardly worth the trouble. No Change.