Silver Weekly risk weight suggests end of 9 months consolidation | 07 May 2021

Silver Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

SILVER FORECAST

(Previous week in brackets)

| Silver/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 27.40 (25.88) | ||||||

| Trend | ↓ (↓) | ↑ (↑) | ↑ (↓) | |||

| % Risk Weight |

77 (76) | 38 (30) | 74 (75) | |||

| PM Distribution Total allocation 30% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Silver/USD live price

Silver comment

7 May 2021 close: The Silver price, at 27.50, sits in the middle of a consolidation triangle that started 9 months ago. Medium and short term indicators suggest a break north for this intermediate cycle that has much more to prove at significantly higher risk levels than currently shown. Our current allocation is comfortable and large enough at just 30% of total precious metals. Hold.

30 April 2021 close: The full correction of Silver that developed since the July 2020 still needs to be confirmed. With Daily risk at a higher risk percentage and turning down, the developing wedge formation may take another few weeks or even months, yet our balanced balanced metals portfolio is considered low risk protection with potential very strong benefits from that protection. Strong Hold.

Silver Q risk analysis

07 May 2021: The current short term rally shows up in the above chart with a slightly higher risk reading and is pointing strongly up. This should develop some strong price advance as this longer cycle timescale develops during the next 9 to 12 months.

30 April 2021: The multi year quarterly cannot really change its direction without a very strong down quarter. This risk chart is in full support of a much stronger medium and long term silver price rally.

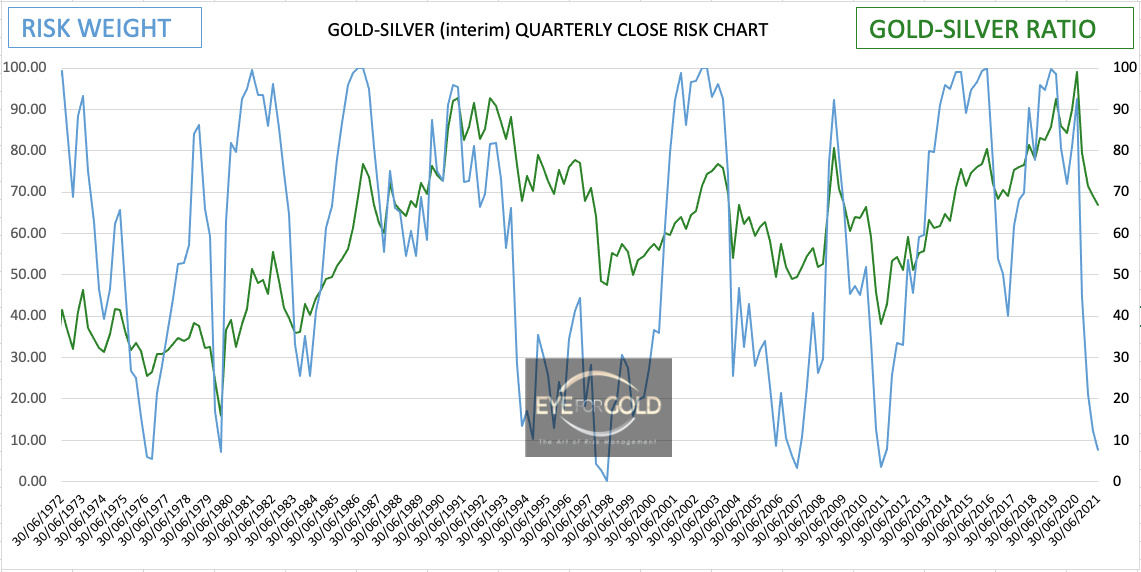

GOLD/SILVER Ratio Price Risk Analysis

(Previous week in brackets)

| GOLD/SILVER Ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 66.58 (68.107) | ||||||

| Trend | ↑ (↑) | ↑ (↓) | ↓ (↑) | |||

| % Risk Weight |

8(7) | 49 (49) | 25 (20) | |||

| PM Distribution Total allocation 30% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Gold/Silver Ratio live price

Gold Silver ratio analysis

7 May 2021 close: The first week of May ended with a 1.5% stronger Silver price relative to gold. Daily risk turned down at lower quartile whilst weekly turned up from being down at the same level. This happens with a lower price if the weekly range that dropped off the 14 week calculation was a serious down week. The picture generally does look sdtronger for silver but with Monthly still in an uptrend at a low risk weight percentage level, this is not a time to go seriously overweight on silver. The relative low risk weight position on the Quarterly chart below also demands a bit of caution although this long term trend is still down. No portfolio change otherwise.

30 April 2021 close: The technical picture hasn't changed and risk weight across time scales has remained very much static. The consolidation in the present range is likely to continue until we see more of a divergence definition.

No Change.

7 May 2021 Daily risk weight could consolidate price a little longer and more pressure on the lower volume platinum space may develop if Silver has another strong advance. Future for the short term risk ratio looks still promising.

30 April 2021 The Daily risk weight chart shows a rapid risk decline without much price change. This is a bullish picture as already indicated last week. The short term indicators give no immediate clue except that the overall analysis stiull calls for a much firmer Platinum/Silver ratio.

23 April 2021 Platinum looks short bullish versus Silver, again.

7 May A specualtive trading risk is for weekly to continue down where price may reach the 40 handle. The risk weight down trend however is fairly sharp with a mild price correction thusfar and no reason to increase risk by trading short term.

30 April Weekly is in a medium risk range down trend and could push the ratio down further, but this mild down trend with little price change leans towards good medium term market support for Platinum vs Silver. Patient Hold.

7 May Monthly risk weight is in a similar position where trend is up with a potential consolidation in the making. Risk weight however is likely to proceed towards the upper risk quartile over the next 6 momnths which be the resulot of an improved platinum/silver ratio.

strong>30 April A price forecast based on this monthly risk weight chart alone is impossible to make. This Month end chart is still showing a strong uptrend which can also pause for a few months. This print typically leads to an advance taking the ratio much higher longer term. Patient Hold.

23 April Interim Monthly still looks strong despite a slightly lower price print on the monthly chart having closed in March on a 6 months high around 50. Trend is up and a long way to go towards equilibrium with an initial target of 60.

7 May Interim PT/AG ratio has dropped slightly. Platinum however, being as the heaviest precious metal and underrated commodity, however should continue to build towards its long term equilibrium. The chart remains bullish unless the trend that started in September 2020 breaks. Not impossible but very unlikely looking at historic price behavior. Outllok is for PT/AG to reach at least the 60 level within a few years.

30 April What makes this chart look bullish for the Platinum/Silver ratio is the fact that the 2016-2019 consolidation caused an unusually sharp bullish divergence. Risk weight versus price performance is hard to predict but we may expect a move towards that higher 60-70 range equilibrium to be reached in 2022 or sooner if shorter term time frames were to build a fresh short term bullish divergence scenario.