Silver hit harder upon metals retracement | 18 June 2021

Silver Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

SILVER FORECAST

(Previous week in brackets)| Silver/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 25.74 (27.875) ↓ 7.6% | ||||||

| Trend | ↑ (↑) | ↓ (↑) | ↓ (↑) | |||

| % Risk Weight | 78 (81) | 72 (81) | 20 (55) | |||

| PM Distribution Total allocation 50% (35%) | Pt:35% | Ag:30% | Au:35% | |||

Silver/USD live price

Silver comment

18 June 2021 close: Monday morning action was halted due to hourly and 4 hourly stop signals, hence no small intended change to our metals portfolio. The consolidation 65-72 handle range that started in February feels like it wants to break south, but short term pressure keeps gold firm relative to silver, for now. Instead we may now be looking to add platinum due to continued weakness which is more likely to end soon as wasa expected since one week.

11 June 2021 close: We are going to add about 10% (30 to 33%) to our silver holding from cash at the start of trading on Monday. This will bring silver back to an equal weighting within the precious metals portfolio. The primary reason is that silver looks to want to breakout against gold again and continue a further route towards historic equilibrium. Silver versus US dollar. Strong uptrend in quarterly supports a feeling of comfort, also against the fundamental risk of higher inflation.

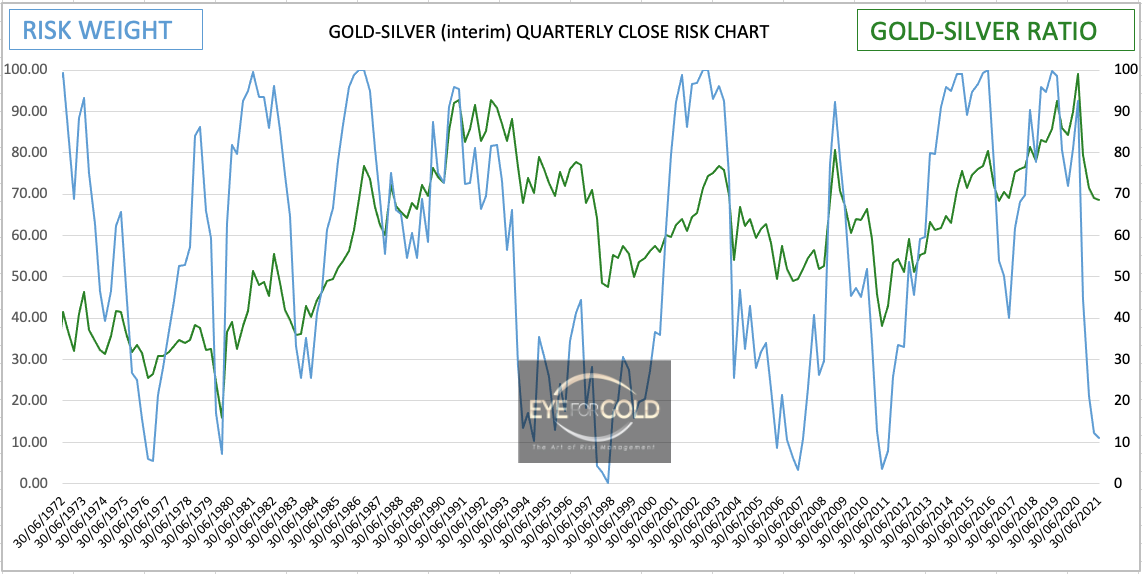

GOLD/SILVER Ratio Price Risk Analysis

(Previous week in brackets)

| GOLD/SILVER Ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 68.31 (67.90) | ||||||

| Trend | ↑ (↑) | ↓ (↑) | ↑ (↓) | |||

| % Risk Weight |

10 (10) | 50 (58) | 58 (73) | |||

| PM Distribution Total allocation 50% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Gold/Silver Ratio live price

Gold Silver ratio analysis

18 June 2021 close: At the close of business on June 18 the Gold/Silver ratio appears to be ready to still push higher whilst longer term signals look for a stronger silver. A potential push towards the 70 handle may develop short term bearish divergence, whilst that same push may have greater magnitude. The better risk approach is to stay neutral and maintain the present balanced mix. We are still looking to add a bit of silver from cash in order to complete an even balance of physical gold and silver.

04 June 2021 close: We call this Gold/Silver market to continue the corrective sideways pattern since the summer of 2020 in the absence of any clear movement. The broader technical picture suggests that the next bigger move may still be down in spite of a low risk Monthly and Quarterly risk weight print. The Daily chart is producing a nice 15 degree upward angle with resistance at around 74.00. This may still be the intermediate objective before silver turns more bullish again versus gold. There is no reason to take a punt in silver at this moment.

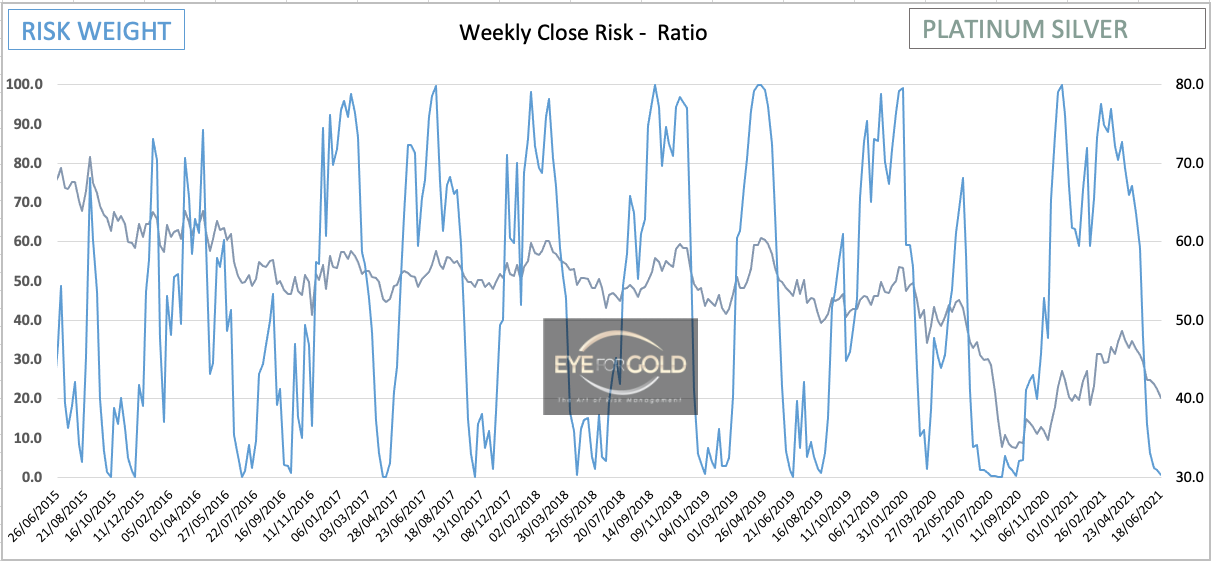

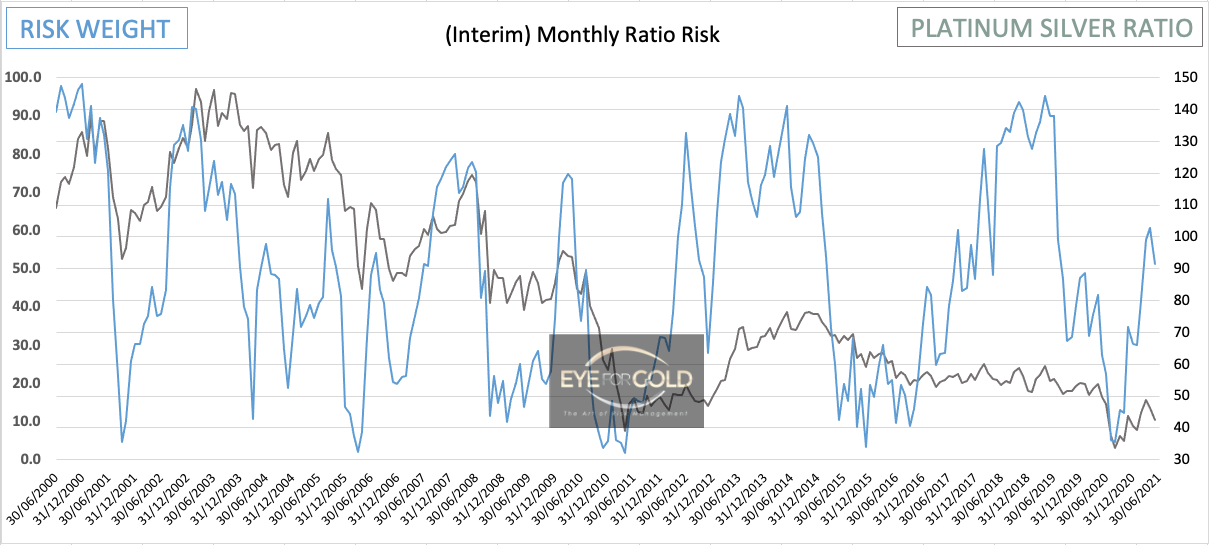

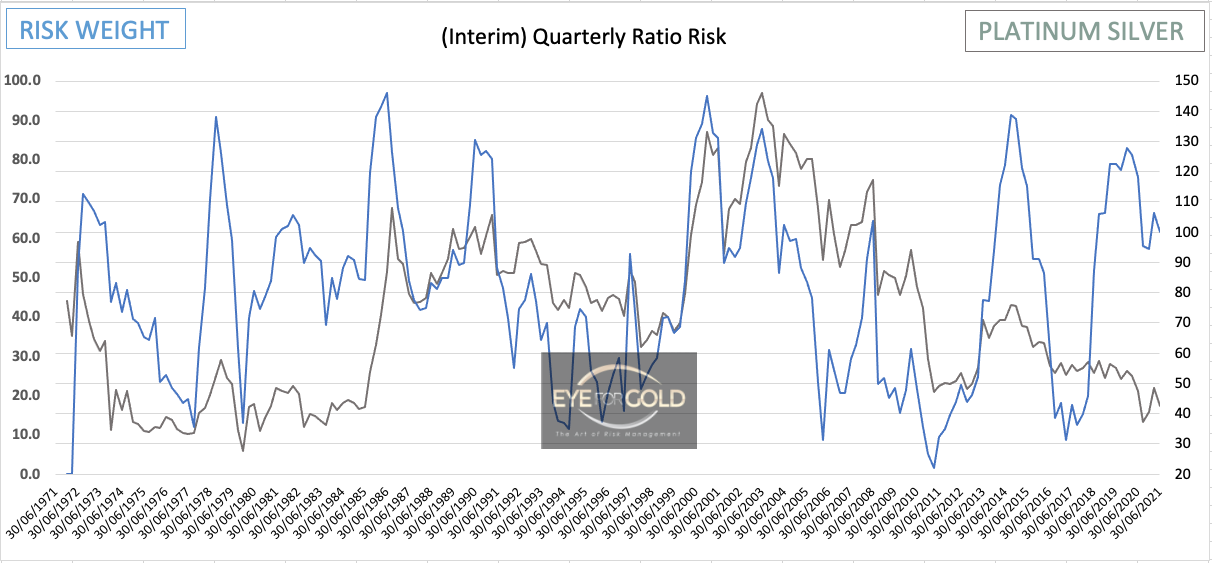

18 June 2021 As the market retraced on unsubstantiated traders fear based on dollar strength Platinum continued to suffer. We only cover the Daily and Weekly chart this week as they tell a technical story of a lower risk Platinum allocation. Essentially a message to just stay with the current position whilst a more speculative position would be to swap some silver for Platinum. The longer term Monthly and Quarterly picture below will be updated again soon as they are not showing a particular change to direction, which is still up for Pt.

11 June 2021 Platinum Silver ratio is now due to returning to the primary uptrend. No Change and no update on the 4 timescale charts below as they show little to no change from last week.

18 June 2021 The Weekly risk weight, like Daily, also dropped to near zero and supports holding Platinum at least equal to Silver. No Change.

04 June 2021 This is an oversold condition and calls for a Platinum/Silver correction up, at least a few weeks towards the end of the June.

04 June 2021 Monthly is likely to resume its uptrend as daily, and weekly, turns up from the recent downward correction.

21 May 2021 No change from last week. Correction developing, waiting for continuation into much higher risk weight levels.

04 June 2021 The Very Long term quarterly Platinum/Silver ratio correction cannot be called a long term turn of trend at this risk level of 60%. Bullish divergence between shorter time scale (daily/weekly) risk weight trends versus quarterly risk needs to be assessed as the market develops further in coming weeks.

14 and 21 May 2021 The current interim quarterly blip is very early in the current cycle an could even last a few months. The Quarterly chart however still needs to finsh to the upside which may involve a spectecular move in favor of Platinum well into 2022.