Silver price is below expected inflation parity, 5 March 2021

Silver Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

SILVER FORECAST

(Previous week in brackets)

| Silver/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 25.18 (26.62) ↓5.4% |

||||||

| Trend | ↑ (↑) | ↓ (↓) | ↓ (↓) | |||

| % Risk Weight |

53 (51) | 40 (43) | 22 (55) | |||

| PM Distribution Total allocation 50% (55%) |

Pt:35% | Ag:35% | Au:30% | |||

Silver/USD live price

Silver comment

5 March 2021 close: Silver is still some 17% above its long term support at 21.60 established since August 2020 in a broadly 8 dollar price range. If we look at US average silver price and inflation, the current $25/26 Silver price reflects a steady pattern and a minimum expected price level around 2020. The sharp fall of precious metals these past few days looks to come to and end where gold may well be the weakest going forward. Silver also looks weaker versus gold short term. Silver Long term trends, Monthly and Quaterly are still up even though quarterly is stalling in the interim. End of March will tell more about this very long term risk pattern, but the trend is sclearly not finished. The evenly balanced allocation between metals remains the preferred position although we may be looking to shift a bit towards physical platinum in coming weeks if the ratio's provide a bit more direction. The sharper drop on Thursday and friday is also the result of a longer term channel being broken than which is never a strong technical signal. Monthly risk weight is still up and the leading timescale in a long term trend that started one year ago next week. Otherwise no change.

26 February 2021 close: The big Silver squeeze that is keeping so many people's hopes up is the kind of event that may happen for good reason but is unusual and not to be expected to develop like the Dogecoin and Gamestop events. Silver is now consolidating in a wilder range. One week a down trend and the next week up again. If we discard the sharp March 2020 drop, the bottom price range last year was around $18 and Silver is close to 50% up from that level. Silver has come out of the $14-$19 trading range that lasted 7 years. The long term picture from a risk weight perspective is still very positive but we clearly need to accept several of these shorter term price frustrations. Since 2013, we have seen 6 major risk bottoms in deeper oversold ranges. We have yet to see a first major risk top over 90% which is expected at the end of every major cycle. Currently at a neutral 50% level.

Silver risk analysis

5 March 2021: The interim quarterly chart now shows a potential shorter term correction, but the present reading is interim and the actual trend will be set nearer the end of this quarter. This long term uptrend has not finished by a good margin and will experience hurdles along the way. Reason to stay long term positive on Silver.

26 February 2021: The February month end $26.62 Silver tick on 26th Febr, this precious metal has held so much better than anytime during market turmoil of the past 8 of 9 years. Silver has found new life and its use for EV particularly will be providing long term support. Market behaviour suggest some manipulation but not nearly as much as in prior years and relative price stability also suggest very few naked shorts. If there are any in size they are more likely to be backed by physical. There will be shortage of silver in all major Western and Eastern economies, which eventually will push the price much higher. We stay with our forecast of an attempt to drill through $37 technical resistance and probably in 2021. As cost of trading these physical markets is high we just apply patience with our portfolio. The balanced distribution between Au, AG and PT is a low risk approach.

GOLD/SILVER Ratio Price Risk Analysis

(Previous week in brackets)

| GOLD/SILVER Ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 67.13 (64.88) | ||||||

| Trend | ↓ (↓) | ↓ (↓) | ↑ (↑) | |||

| % Risk Weight |

5 (5) | 20 (19) | 55 17) | |||

| PM Distribution Total allocation 50% (55%) |

Pt:35% | Ag:35% | Au:30% | |||

Gold/Silver Ratio live price

Gold Silver ratio analysis

5 March 2021 close: We haven't broken the 62 level which makes it harder short term to reach the lower long term equilibrium level. The first objective has been achieved and given the sharp increase of daily risk weight we must evaluate this short term correction before making a small adjustment to our allocation. The present 67 ratio level is already a 10 years equilibrium which means there is no strong risk argument to strongly favour Gold or Silver, hence no reason the change the present allocation percentage.

26 February 2021 close: The Gold/Silver ratio down trend is slowing down and we should expect a correction of up to 20% from current level at 65, even though Monthly risk is still in a downtrend at around 5% risk weight. Traders should unwind any overweight shorts in the Ratio. The medium term downtrend is not yet finished and can still push the ratio into a fresh new leg towards the 50 handle. A 3 day break of 62 would confirm this. Investors can hold the balanced metals distribution we have been arguing for some time.

The Platinum to Silver ratio

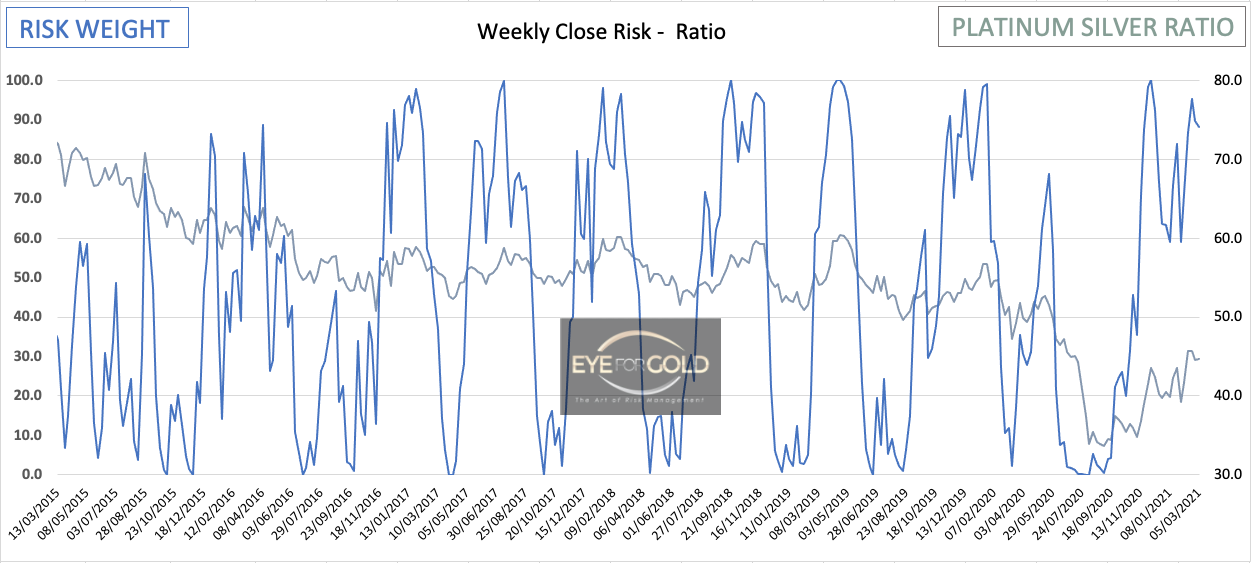

5 March 2021 close: Daily risk weight is now in divergence position having dropped rapidly with much price change. This signal is bullish given our fair expectation for a return towards historic equilibrium between 60 and 70. As we already have a balanced distribution of precious metals, which is a must hold in its own right, we may transfer up to 10 or 15 percent of our Silver allocation into Platinum. But no change for now.

26 February 2021 close: Daily risk weight has turned down rapidly without much price change. This will develop bullish divergence versus weekly and come into line with the Long term (Monthly - Quarterly) uptrends. This indicates potential short term weakness of Silver at least relative to Platinum and also Gold. Platinum should be as good as gold, as it has always been, and Platinum also has more commodity use potential as long as Palladium has double its value. That historic correction will also come one day.

5 March 2021 close: Weekly Platinum/Silver has turned down and may have finished the medium term uptrend with a mild bearish divergence. The long term trend however is still up and Daily risk shows bulloish divergence vs weekly. This technical picture gives preference to a Hold on Platinum and maybe a minor re-allocation in favor of Platinum.

26 February 2021 close: The weekly print appears to be developing some intermedciate bearish divergence. Experience learns that an existing strong Long term uptrend is likely to keep any price pressure to a minimum. Our outlook is for the Platinum/Silver ratio to continue to appreciate towards the 60-70 range.

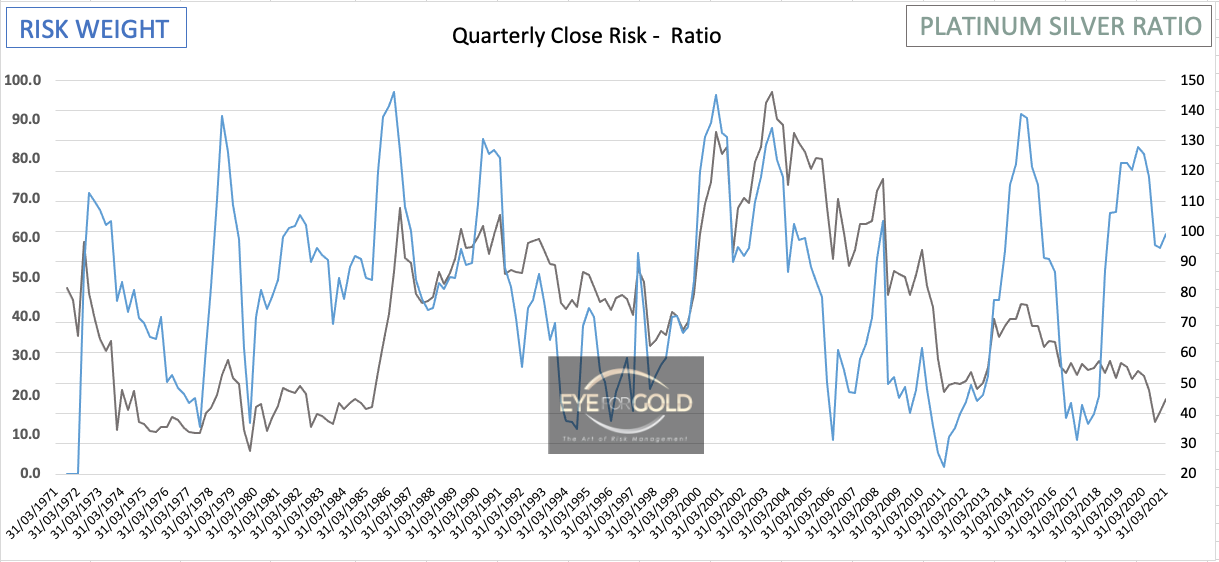

5 March 2021 close: Monthly risk weight is still in the earlier stages of an uptrend towards our forecast range of 60-70. It can take many months before this level is reached. Platinum therefore remains a strong hold within the precious metals portfolio. We actually trade physical platinum via the Bitpanda exchange (not for US and CAN citizens) which is relative price friendly with a BEST holders discount on commissions. Storage fees are 0.5% per annum.

26 February 2021 close: Monthly risk weight is still in the early part of a long awaited advance. We may expect this trend to last several months depending on the speed of this natural correction. This technical picture offers a low risk Platinum 'hold'.

5 March 2021 close: As mentioned last week the quarterly turning up at a much higher level from a low price point is bullish, but me must appreciate the risk of this being a fals signal given the 3 weeks left till end of the quarter. We lean towards a bullish signal because price equilibrium is around 65 which should drive the expcetd Platinum to Silver ratio higher by another 40% from the present 45 level.

26 February 2021 close: The current trend paused in Q4 and turned back up following as lower price point. This is a bullish indicator and quarterly risk weight should be carried into the high 80's at least before we see a more serious correction where Platinum loses some ground versus Silver.