Silver shows good strength | 16 April 2021

Silver Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

SILVER FORECAST

(Previous week in brackets)

| Silver/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 25.92 (25.21) | ||||||

| Trend | ↓ (↓) | ↑ (↓) | ↑ (↑) | |||

| % Risk Weight |

77 (76) | 23 (22) | 86 (58) | |||

| PM Distribution Total allocation 30% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Silver/USD live price

Silver comment

16 April 2021 close: Silver USD was weak on Monday, recovered sharply on Tuesday and kept gaining strongly on strong buying to close at 25.92 after a 26.30 high on Friday. Weekly risk barely turned up but hourly risk is in strong bullish divergence mode versus Daily risk which makes the Silver picture very positive. Hourly is never a leading timescale, so we not be out of the woods yet with silver and for the metal to take a lead we would need to break 30 again. Monthly risk is down at 77% but Weekly is in bullish divergence mode. Our medium term forecast of 37.00 stands as it is a top overhead resistance level from 2012. Otherwise this level also looks to be an arbitrary chart level as even the 2011 49.78 peak should no longer be seen as a major resistance level. If we get there next time, and for a second time in history, that 50 handle level is likely to be blown away very quickly. No change to our 30% Silver allocation within our precious metals portfolio.

9 April 2021 close: Silver USD started a correction in August 2020 after reaching the 30 handle. After the 2nd attempt to beat 30 silver now seems to consolidate this longer correction and may still push a bit lower from the current 25 level. Risk weight is also fairly neutral which is why we reduced our position a little in favor of Gold. One important observation to make with regards to precious metals investing and silver in particular. It is critical to own physical or physically backed metals in an account. Owning physical silver privately is rather cumbersome. The 30 kilo bars would be required and they are best held in a trusted vault and allocated in the buyer's name. The same really applies to Gold. We don't believe anyone will ever again carry physical gold bars or coins around to barter them. Large investors would do best to find a Swiss solution either using the Bitpanda exchange where a 'cold Gold or Silver or Platinum wallet' holding will be 100% backed by physical metal and easy to trade 24/7 using a mobile application or acquire via a trusted intermediary in Switzerland, Liechtenstein or Austria. Bitpanda unfortunately cannot yet onboard US or CAN passports. Just Europeans at this moment. Onboarding always involves the AML compliance procedure as all these trusted intermediaries will always be regulated by the national financial authority.

Silver however remains a solid 'hodl' in the wealth protection portfolio. No Change.

Silver risk analysis

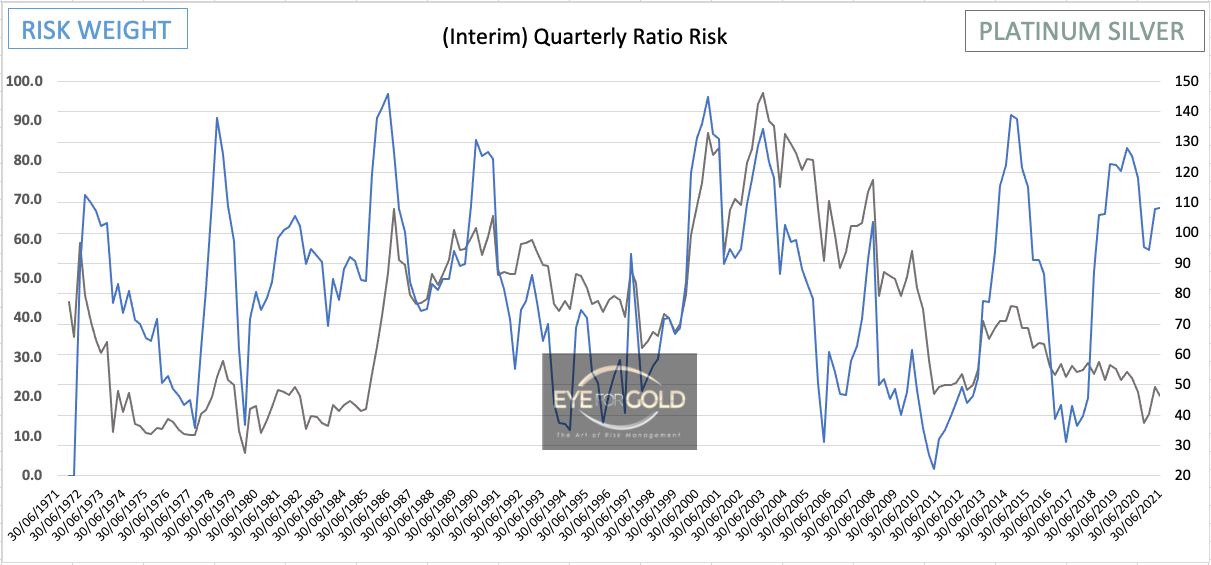

16 April 2021: This Q2 is only a few weeks young, so the picture wouldn't generally change much. It remains quite bullish Long term. Within the PM space Silver simply plays an important role besides its fundamentally strong function as commodity with increasing industrial demand increasing at a rate of near 10% annually into 2021.

9 April 2021: The quarterly risk chart looks bullish with risk weight up and below 80%. It defends our view that we are still in a medium term correction since August 2020. As we are only 10 days into Q2 we may expect the correction to end within this time period and possibly see a strong close to this quarter going into the summer. This doesn't necessarily impact our wealth protection holding.

GOLD/SILVER Ratio Price Risk Analysis

(Previous week in brackets)

| GOLD/SILVER Ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 68.26 (68.76) | ||||||

| Trend | ↑ (↑) | ↑ (↑) | ↓ (↓) | |||

| % Risk Weight |

7 (7) | 50 (48) | 15 (58) | |||

| PM Distribution Total allocation 30% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Gold/Silver Ratio live price

Gold Silver ratio analysis

16 April 2021 close: Some reservation in the Gold/Silver cross. After a strong 12 month long reversal the low risk levels shown in Daily and Monthly risk could mean a longer search for fresh direction between the 2 precious metals. We need to give Silver a few more weeks to give fresh direction. A big rally in metals should be fairly even given this picture although Silver will always be more volatile initially. We still analyse Platinum to remain the stronger metal of the three longer term although it is pausing this month. The Quarterly Gold/Silver chart below show is now right on a 35 year price average based on quarterly close. Risk is already deep at 12% which could mean a further pause this quarter around the current ratio level with a range between the recent 62 low and 72 overhead.

9 April 2021 close: Silver had a slightly stronger week in the cross with Gold. Monthly risk is turning up from 6% but the overall picture from all time scales is the potential development of bearish divergence between short term and long term risk. For that means Silver shouldn't be the outperformer in the metals space until that technical picture is confirmed or otherwise mitigated. We still believe that Platinum will continue in that role with still stronger active divergence from equilibrium. The quarterly Gold/Silver risk chart has barely changed at 12% risk and still strongly down. As the current Gold/Silver Ratio trend is a primary cycle in time, the long term outlook is still for Silver to outperform Gold by some extend or more.

16 April 2021 The stronger decline of Daily risk weight vs Weekly is likely to create bullish divergence confirming last weeks potential of rejoining the primary trend up (for Pt) again this month.

9 April 2021 A correction is underway and we should already expect a resumption of the new primary trend before the end of the month.

16 April Not much change in Weekly risk weight with mild downward pressure. This could easily turn back up and if it does Platinum could see a very independent and 2nd phase strong advanced within the metals space. Risk looks to be in favor of Platinum still.

9 April Hard to predict from a trading point of view. Trend is down from a mild bearish divergence but could just move around with large price corrections up and down. Monthly is leading in a primary cycle with strong uptrend.

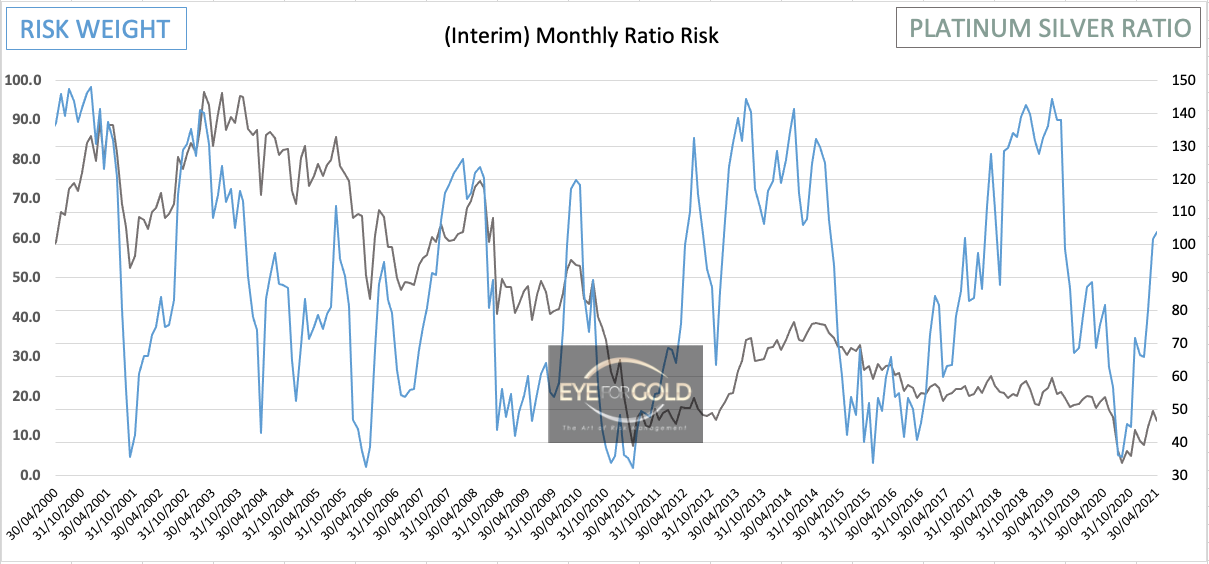

16 April The trend is up and we should see a higher Pt to AG ratio over the next 6 months with a few pause moment along the way where Silver, as it often does, takes a rally lead.

9 April We should expect monthly momentum to drive risk weight into the 80% level. It may take a few months for Platinum to reach that initial higher 60-65 handle chart objective in the Platinum/Silver cross.

16 April The large bullish Risk weight to price divergence if shown on a quarterly chart is unusual and typically is a very bullish signal. We are only early in the 3rd quarter of this fresh Platinum bull trend against Silver. This picture is a lead indication to own a fair balance of Platinum precious metal within the metals portfolio.

9 April Quarterly risk shows a slightly lower print of 69% at the beginning of Q2 which is not an indication. We need to wait for the quarter to develop and finish to get a read of further long term direction. This picture still looks the quarterly trend has not finished with a long term objective of 70+.