Silver long term uptrend still solid | 21 May 2021

Silver Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

SILVER FORECAST

(Previous week in brackets)

| Silver/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 27.52 (27.37) | ||||||

| Trend | ↑ (↓) | ↑ (↑) | ↓ (↓) | |||

| % Risk Weight |

77 (77) | 72 (50) | 60 (70) | |||

| PM Distribution Total allocation 50% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Silver/USD live price

Silver comment

21 May 2021 close: Long term Monthly risk weight still waiting to prove typical key data that a top is building. This hasn't even begun without showing extreme high risk weight levels. Same for Quarterly and such event may be years away still, although many asset classes are getting nervous on the back of (too) many influencer comments on social and even mainstream media. For now still a bit up and down. Strong Hold. No Change.

14 May 2021 close: We still cannot tell whether Silver will break out of its range versus gold, but the action last week, inflation numbers and comments from officials are looking very good for the PM space. Silver may finally start to break its consolidation against the USD and start its journey towards our next target of $37.00. No Change.

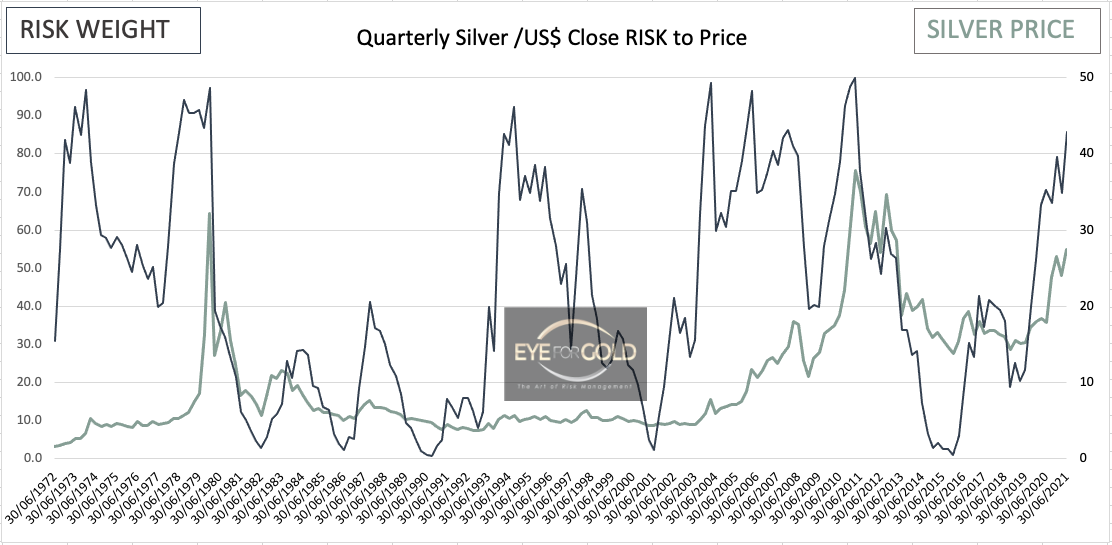

Silver Q risk analysis

21 May 2021: The below chart of course doesn't move much if prices remain static as they have done recently. The trend is up and as we are approaching higher risk weight going into Q3 and Q4 could see the development of the fast move north. This won't be the $100 target as that is more likely to develop at a much later stage.

14 May 2021: Same observation as for last week. Silver should develop some strong price advance as this longer cycle timescale unfolds during the next 9 to 12 months.

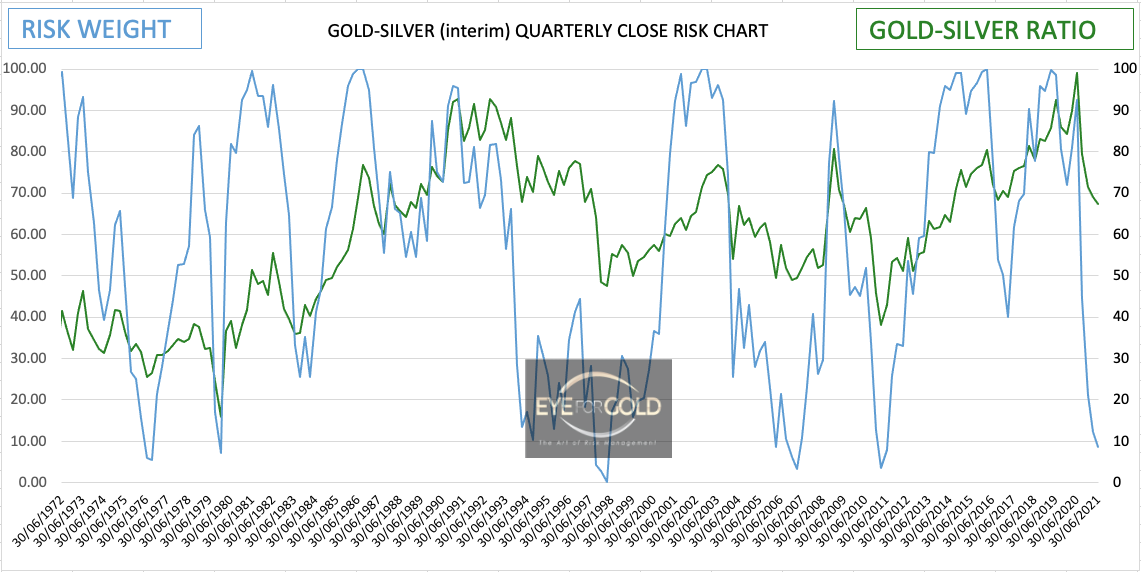

GOLD/SILVER Ratio Price Risk Analysis

(Previous week in brackets)

| GOLD/SILVER Ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 68.10 (67.05) | ||||||

| Trend | ↑ (↑) | ↑ (↑) | ↑ (↓) | |||

| % Risk Weight |

9 (8) | 54 (49) | 73 (25) | |||

| PM Distribution Total allocation 50% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Gold/Silver Ratio live price

Gold Silver ratio analysis

21 May 2021 close: Silver quickly retraced last from an initial rally vs gold and the gold silver ratio appears to be building some bearish divergence in the short and medium term risk weight pattern. As the Long term monthly has yet to finish a proper down trend this price consolidation range may continue a while longer yet. A turn down in the short term time scales may be a next opportunity to increase silver somewhat but even if silver start to strongly outpace gold on the upside, a roughly balanced 1/3 silver allocation in precious metals is low risk protection with medium volatility.

14 May 2021 close: 2 closes below the channel support at 66.31 is reason to switch some gold and perhaps platinum too into silver again as this current silver rally looks potentially very strong and lead the fresh impulse direction for precious metals. If 62.00 breaks there is no strong technical support until 35 year low of 30.45 in April 2011. Let's see what happens the next few days. Buying a bit of silver and probably no more than a fully balanced portfolio between the three core metals.

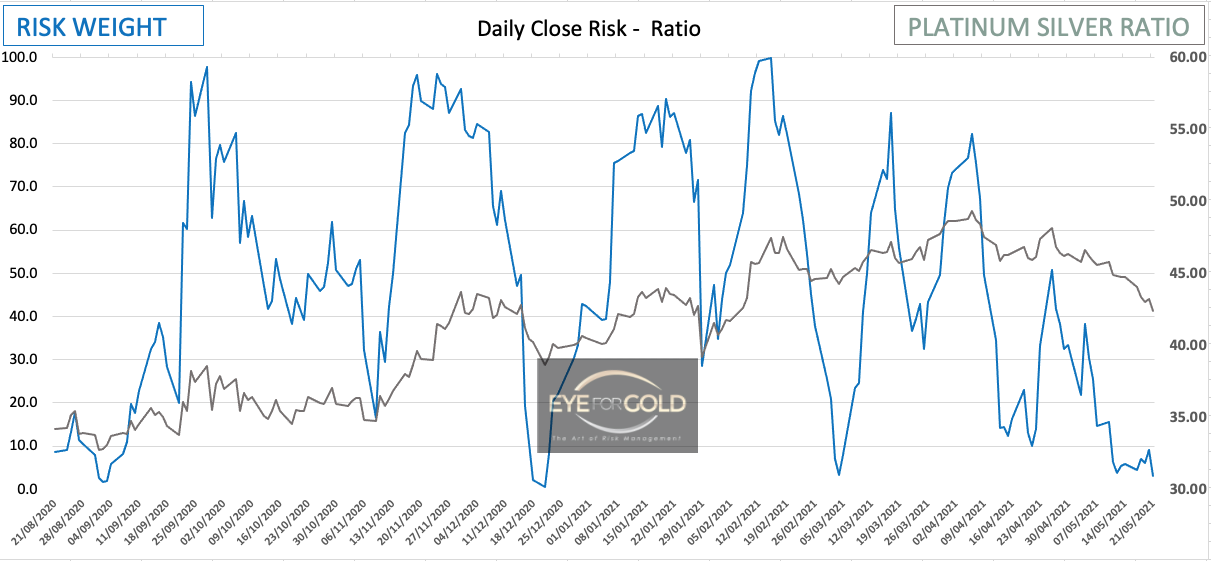

21 May 2021 Daily risk has come crashing down in this correction. Platinum will soon pick up the cycle uptrend that started in March 2020.

14 May 2021 Daily risk weight was up last week, turned down and then turned up again midweek. Short correction may not be finished. Longer term timescales prevail ay this moment.

21 May 2021 An equally sharp correction in weekly risk weight doesn't make a switch to silver very appealing. We just hold Platinum unchanged through this current correction which seems natural.

14 May 2021 A sharp correction is underway that could possibly reach a 50% correction following the 1st advance after the long term bottom in Q3 2020. Risk towards a fresh new low for Platinum seems unlikely. Trend however is down hence a possible smaller switch into Silver if the Gold Silver ratio finds new low ground and just to create a totally equal balance between all pm's.

21 May 2021 No change from last week. Correction developing, waiting for continuation into much higher risk weight levels.

14 May 2021 Correction in interim monthly risk weight following price could last into next month but this longer term trend is still up. Some larger fluctuations are quite likely in the next few weeks but Platinum should follow through on its path to historic equilibrium at a much higher ratio.

14 and 21 May 2021 The current interim quarterly blip is very early in the current cycle an could even last a few months. The Quarterly chart however still needs to finsh to the upside which may involve a spectecular move in favor of Platinum well into 2022.