Silver still looks attractive going into 2022

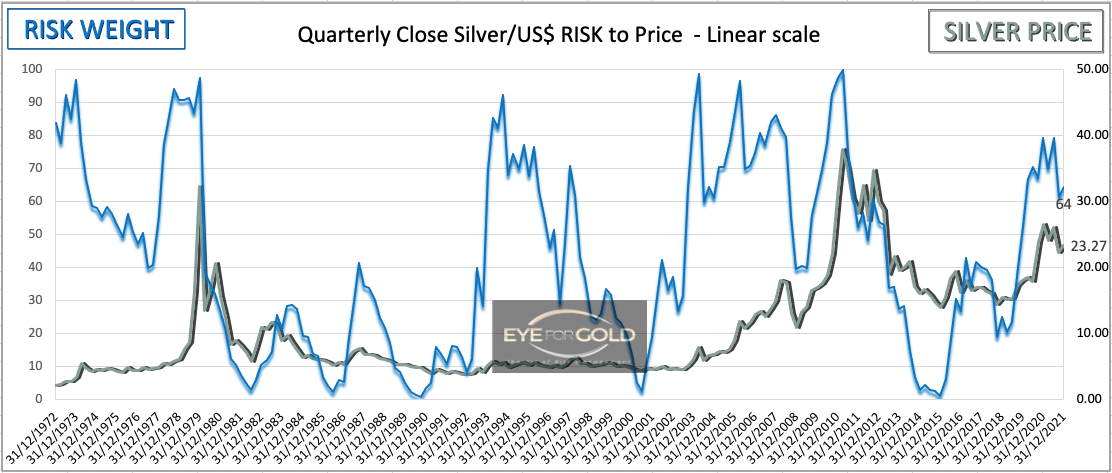

31 December 2021 close: We have released a little bit of Silver in favor of Platinum and in favor of Palladium as both white metals in this Platinum group have very strong and exponentially increasing industrial value in years to come. Recent weakness again offers this opportunity, which may become a longer but worthwhile wait. Silver however remains a key allocation and our position hasn't really gone anywhere since we accumulated, althoug some benefit arose from the deep discount that was created immediately after the March 2020 shakeout against Gold. Silver has ticked up on the quarterly chart which appears to get support from the shorter time intervals. Monthly in particular is still down but at a higher level which often indicates a turn of trend in the making. We believe that the break out from the consolidation between $21 and $30 since June 2020 will be towards the upside. Our further risk weight updates in this blog will be less frequent and only if we see a major need to removing this critically important wealth preservation hedge.

17 December 2021 close: The midweek Silver punishment fed through to the other metals, Gold, Platinum and Palladium. Palladium sold off hardest and also gave a very strong oversold buy signal in literally all time intervals, short to long. Silver also showed deep oversold risk weight and as it lifted off the Wednesaday lows developed a clear bullish divergence in the Daily time frame. The technical picture still supports, and maybe more so today than in recent months, that we MUST hold on to our physical precious metals portfolio where Silver should be shining as industrial demand develops further. Even though quarterly risk isnot giving shorter term direction being in a neutral downtrend, the monthly time interval has used the enture correction to develop a low risk pattern and at a near pivot point turning up again. No Portfolio Change.

03 December 2021 close: The good thing about crypto is that we are rapidly getting used to dealing with strongly fluctuating assets. And the good thing about silver is that its price does not yet reflect the kind of industrial demand that lies ahead in electrification of things or any device that needs protection against oxidation and corrosion. Gold, Platinum and Palladium might be better solutions for high-end industrial products of the same but Silver is relatively (dirt) cheap. This is besides the technical picture which remains positive long term as we have yet to reach the minimum requirement of technical price exhaustion. Our preferred tools haven't show any of that since the super cycle trend resumed in 2015. No Change to our slight overweight silver allocation.

Silver/USD Risk Weight Position relative to Quarterly, Monthly, Weekly and Daily risk weight data

(Previous update in brackets)| Silver/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 23.27 (22.33) | ||||||

| Trend | ↓ (↓) | ↑ (↓) | ↑ (↑) | |||

| % Risk Weight | 22 (20) | 32 (30) | 80 (35) | |||

| Total PM Portfolio allocation 40% (40%) breakdown: | Au:12% | Ag:13% | Pt:15% | |||