Silver USDollar risk position for Q3 2021 | 02 July

Silver Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

SILVER FORECAST

(Previous week in brackets)| Silver/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 26.39 (26.07) | ||||||

| Trend | ↓ (↑) | ↓ (↓) | ↑ (↑) | |||

| % Risk Weight | 78 (78) | 52 (62) | 22 (13) | |||

| PM Distribution Total allocation 50% (35%) | Pt:35% | Ag:30% | Au:35% | |||

Silver/USD live price

Silver comment

02 July 2021 close: At the start of this third 2021 quarter The Silver quarterly chart still looks strong. The Monthly chart develops into the narrowing consolidation preparing for the next move which is expected to move up as major trend changes never come with a single move of the same in one direction of the same degree. The 155% increase seen during that first move which lasted 6 months, is a signal that there's more to come. And although silver looks potentially more attractive than the other metals at this moment, there is yet to develop technical evidence for silver to become a WallStreetBets style asset. The Gold Silver ratio is still not in a position to confirm that Silver break out. Thus from a pure risk perspective we would not look to apply a higher allocation to silver. If that break comes or is signalled in advance there is plenty opportunity left in the bag. No Change to our near 1/3rd allocation.

25 June 2021 close: After 10 months of Silver/USDollar consolidation, Silver feels like bottoming soon. Against the USD it looks technically feasible to see one more drop from the Daily flag formation into the lower 25 handle, but the feeling is for Silver to bottom soon for a next major advance into new highs. The Gold Silver ratio supports this view with Gold/Silver ratio looking to break down again for a fresh move towards long term equilibrium. We are again looking to push more into the metals including silver to bring the balance of the 3 prime precious metals to exactly 1/3rd each. No Change for now.

GOLD/SILVER Ratio Price Risk Analysis

(Previous week in brackets)

| GOLD/SILVER Ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 67.32 (67.99) | ||||||

| Trend | ↑ (↑) | ↑ (↓) | ↓ (↓) | |||

| % Risk Weight |

11 (10) | 48 (47) | 48 (72) | |||

| PM Distribution Total allocation 50% (35%) |

Pt:35% | Ag:30% | Au:35% | |||

Gold/Silver Ratio live price

Gold Silver ratio analysis

02 July 2021 close: At the start of July the interim reading is still an uptrend and not particularly conclusive. Weekly trend actually turned up on a pivot whilst the length of the conslidation in the Gold/Silver ratio is still extending. This makes it hard to consider a significant opportunity although the weight of that opportunity looks to be in favor of Silver. Interim Quarterly risk weight (chart below) ticked up but cannot be used for up/down confirmation. We still think that quarterly risk weight will drop into the 5-10% zone and this can still be 6 or 9 months away. Thus, stay put and wait. No Change.

25 June 2021 close: 6 months of consolidation in a 15% max price range has not brought a major bottom in any relevant timescale. Monthly risk trend has traded around 5-10% for much of this year and doesn't appear finished on the downside. Weekly and daily risk weight is still pushing south. A break of the 2021 low sets up for a target towards the 2011 Gold/Silver ratio low of 30.45. Such a break, which requires at least a few days of close below 62.14 would be tempting to add an opportunity trade for Silver and possibly Platinum as well if that ratio to Silver continues to follow our expected pattern. The quarterly risk trend chart below has not finished either as we would expect a bottom closer to 5% which may happen based on a sizeable price move. No Change to our balanced metals portfolio distribution for now.

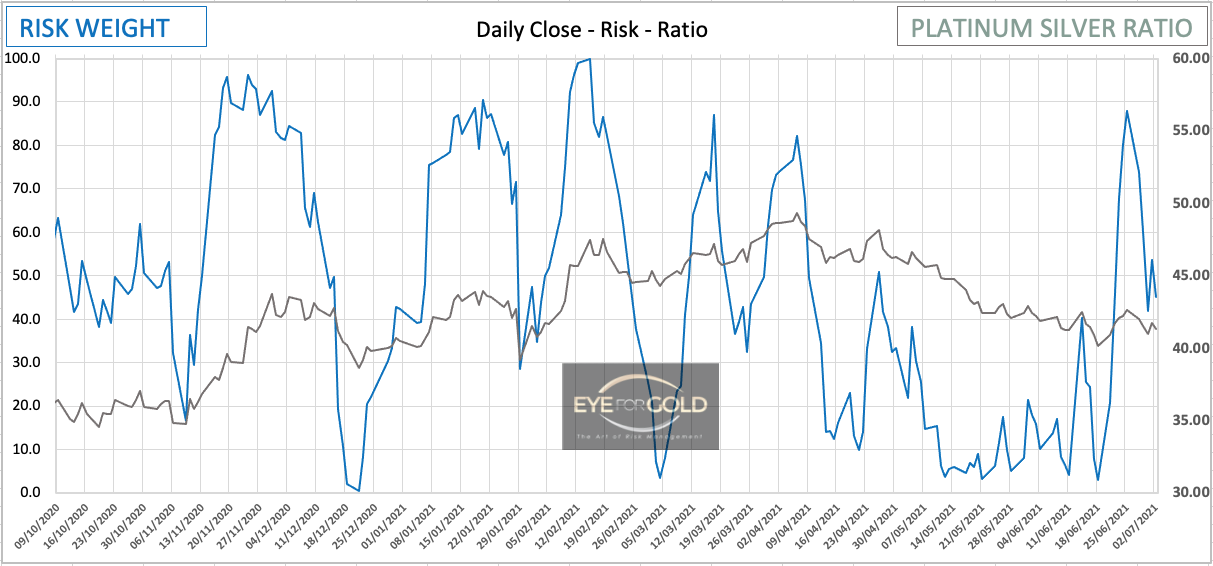

02 July 2021 close: The sizeable drop in risk weight will either lead to bullish divergence (in favor of PT) coupled with a with a fresh ratio low where silver is stronger than platinum, or the ratio will turn up together with risk weight and finish what it started one year ago. Reason to stay on the sidelines and maintain the aexisting allocation.

25 June 2021 Daily Platinum risk raced up against Silver this week on a strong close at 88%. This could mean that Silver is seeking to act more in tandem with Platinum for a while. We still see this ratio turning back up and redeem or break the old average closer to 70.

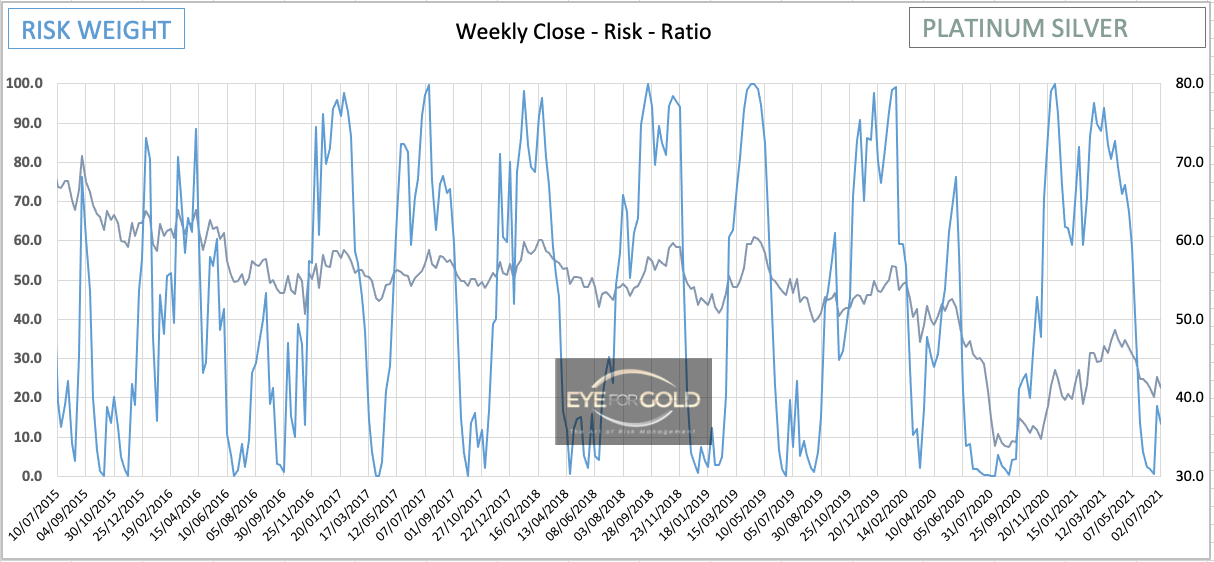

02 July 2021 close: Weekly develops a similar pattern as Daily where a lower ratio may develop bullish divergence in 4 to 6 weeks time or Risk weight can turn up decisively pushing Platinum higher again. Again no reason to seek additional opportunity beyond our current allocation of around 35% of total precious metals.

25 June 2021 We are keeping a manual calculation of risk weight and charts of the Platinum Silver ratio as there is no decent database available with the potential to analyse technical risk like most other asset classes and their ratio's. Besides, 100% physically backed Platinum is easy to trade at very reasonable commissions and storage through the rapidly expanding Bitpanda crypto platform. This ratio Weekly risk was at an extreme oversold position last week and has now moved away from that bottom and trending up again.

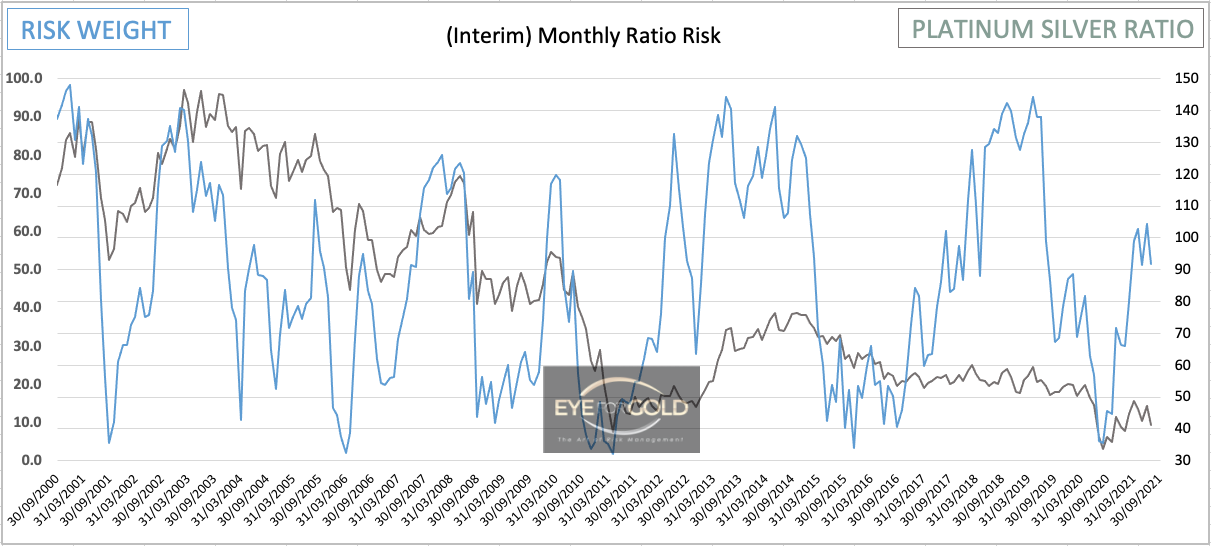

02 July 2021 close: Monthly risk has turned down again at the start of the new month and also looks it may develop bullish divergence. From a price risk perspective, Platinum is still so close to its all time lows versus Silver and so far away from historic equilibrium holding the position and distribution is more likely to be the best and most profitable choice longer term, unless time overrides it with fresh opportunity.

25 June 2021 We are closing in on Month end which will be reported on next week with a view of the new July forward looking risk weight position. With Monthly risk weight now at 48% we would expect to see a much higher percentage risk once this market peaks.

02 July 2021 close: The current downtrend is a very interim type reading on this long term chart, whilst the extreme bullish divergence, not seen before, earlier in the first half of 2021 cannot yet be dismissed as being false. This again means no change and patience to see this market develop in favor of our current allocation. Worst case scenario is that one of the metals strongly outperforms the others, but still drags the others along.

25 June 2021 Quarterly Platinum/Silver ratio risk weight is still pointing down and the more likely scenario is a strong finishing move similar to that in 1985 and 2000. This quarterly risk is merely a guide to what we can expect long term and does not provide any shorter term trading guidance. Just that we need patience to let Platinum run its course.