Silver USdollar and Gold/Silver ratio risk position 13 August

Silver Price Forecast relative to Long Term Monthly - Medium Term Weekly - Short Term Daily - and Hourly (not shown) data.

SILVER FORECAST

(Previous update in brackets)| Silver/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 23.71 (24.26) | ||||||

| Trend | ↓ (↓) | ↑ (↓) | ↑ (↓) | |||

| % Risk Weight | 66 (68) | 15 (15) | 35 (36) | |||

| PM Distribution Total allocation 40% (50%) | Pt:33% | Ag:33% | Au:35% | |||

Silver/USD live price

Silver comment

13 August 2021 close: Where gold shed nearly 6% during the flash crash on Monday last week, Silver shed over 9% at $22,05, before recovering towards 23.71 during the week. We took the opportunity to add a little bit of Silver to the portfolio and completely balance the current price weight value between the three metals, Gold, Silver and Platinum. So we are now holding approx 33% of each. Our total virtual Metals allocation dropped from 50 to 40% due to the increased value of our BEST crypto holding during the week. We currently run 20% cash available for more metal or crypto if that market corrects further over the next 6 to 12 months.

We cannot exclude that Silver will suffer another blow into the high 21 handle, but we remain positive because the entire consolidation since August 2020 looks more like a correction of the new primary trend that started in March 2020. Our extended Precious metals holding is largely driven by fear of serious turmoil on the world (financial) stage. At some point in time. And if we get it completely wrong our metals will buy the same value goods it has always done.

The stagflation scenario is our preferred expected model to develop with an uneven wealth distribution. Thus our portfolio carries relatively little risk and designed to protect, not expand dramatically. A lean into regulated Crypto is acknowledging the importance of knowledge using ever increasing use demographics data and the quantum leap decentralized finance is making whilst battracting huge numbers of wholesale and retail participants.

Qauterly risk on Silver is currently in what looks like an intermediate downtrend that resembles more the period 2000-2010. So, we may be just at the very beginning of a trend that ultimately leads prices much higher. It is a waiting game now. No Change.

06 August 2021 close: Even though Silver accompanied the other pm's on its downward path right at the end of the first August trading week, real downside risk starts to materialize below $22.00. This would be unexpected and does hurt many late upper 20's handle investors. We still have plenty room to manouver and wouldn't call for additional investment at this level or any level until we see clear evidence that the downtrend is over. Precious metals have been hyped up by many alt media influencers and by now anyone that decided to invest a long time ago will not have an inclination nor the funds to invest more at this time. That would be wrong anyway. Holding on to current investment positions with funds that can afford to be locked away is the smartest risk approach right now. We have just entered the lower half of the consolidation price range and it can easily take a few more months to kickstart the up trend again and that commenced at the Covid scare level in March 2020.

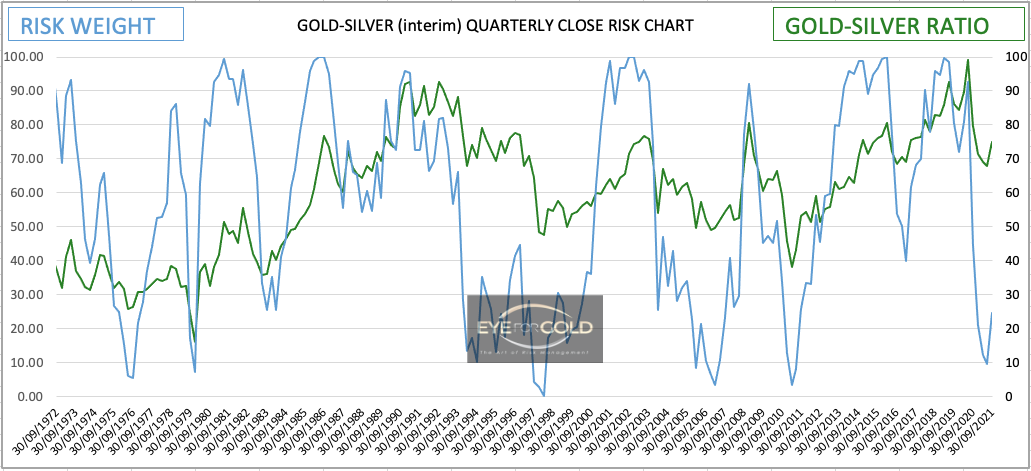

The quarterly risk chart below also indicates a consolidation without having reached any extremes yet.

So, no change to a balanced precious metals position including 30% of physical silver.

GOLD/SILVER Ratio Price Risk Analysis

(Previous update in brackets)

| GOLD/SILVER Ratio | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 74.55 (72.56) | ||||||

| Trend | ↑ (↑) | ↑ (↓) | ↓ (↑) | |||

| % Risk Weight |

17 (16) | 81 (80) | 89 (52) | |||

| PM Distribution Total allocation 40% (50%) |

Pt:33% | Ag:33% | Au:33% | |||

Gold/Silver Ratio live price

Gold Silver ratio analysis

13 August 2021 close: How does Silver perform versus Gold? As we reached the 75 handle on the Gold Silver ratio we have entered and price level that should end the rally withing 5 to 10% of current levels, maybe less. Hence our slight increased allocation to silver this week as Silver traded up from the Monday lows at $23.35. This is part of the Long term hold and now balances our entire metals position at 1/3rd each between Gold, Silver and Platinum. Short and Medium Gold Silver ratio looks reasonably overbought with potential bearish divergence confirmation on the short term horizon. But the uptrend may not be over yet. which means we have do not have a preferred leading metal in the portfolio right now and expect a fairly balanced value over the next few weeks or months. Quarterly Gold/ Silver ratio risk is trending up, but we should expect risk weight to bottom at a much lower level than 10 if we get to see a more serious low price level towards historic equilibrium which is south of 50. No Change.

06 August 2021 close: This week will not update the Platinum Silver ratio as we have reason to believe that sticking with our existing risk strategy should be tempered with.

Gold Silver is also still searching for direction and whilst we previously had a potential signal that the consolidation would perhaps end with silver gaining renewed relative strength, it now looks more likely that the Gold/Silver ratio may finish in the 75 to 80 range. So from a risk prespective, we prefer to stay with the current metals mix holding silver at around 30% of total precious metals. Quarterly is now in an uptrend which looks to be strong although it never went into deep oversold. We would expect this picture to become a corection in the major Silver uptrend versus gold and ultimately finding an equilibrium closer to historic averages well below 50. Increasingly important industrial use should keep demand relatively high for physical silver.