Bitcoin takes the lead again

BTC Bitcoin Price, Bitcoin Price Risk Analysis

(Previous week in brackets)

| BITCOIN BTC/USD | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 60,877 (54,962) ↑10.7% |

||||||

| Trend | ↑ (↑) | ↑ (↑) | ↓ (↑) | |||

| % Risk Weight |

68 (65) | 82 (75) | 90 (90) | |||

| Allocation Limit(0%) | Invested | 0% (0%) | ||||

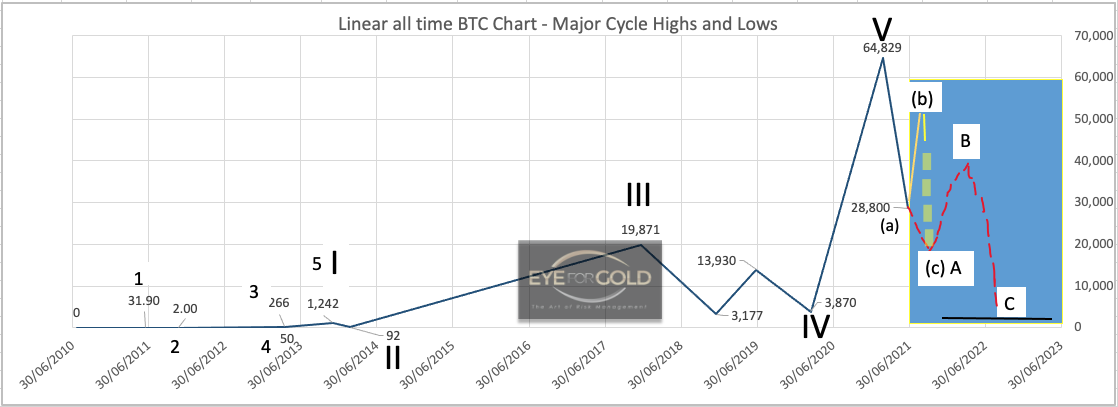

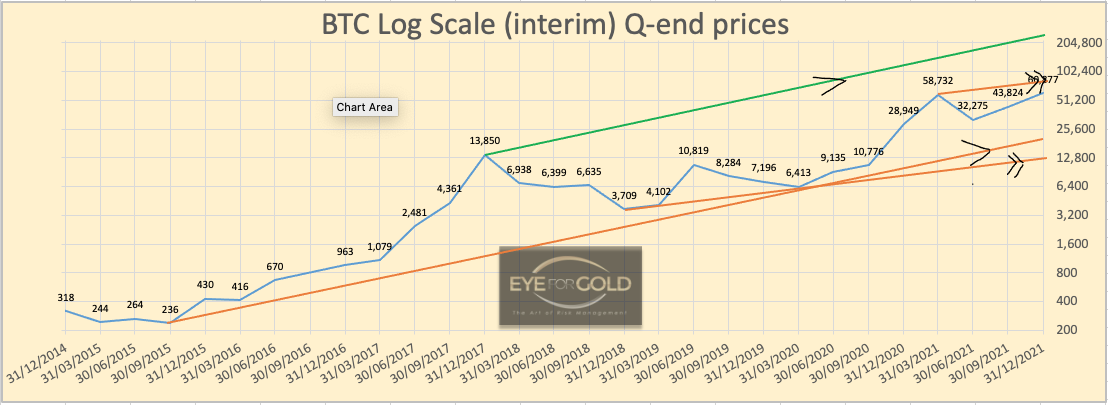

16 October close: On the Total market cap chart both the Weekly and Monthly longer term time intervals will be showing potential bearish divergence if the indicators for those time intervals turn down market turns down (click here for chart). Bitcoin has been star performer lead by a very strong narrative from high powered Crypto influencers. On Friday the SEC in New York approved the first Bitcoin ETF backed by derivative futures, starting Monday 18 October. The news that this was likely to happen sent Bitcoin higher during the week peaking at just under $63k on Friday following the confirmation announcement.

The question is: Buy the Rumour Sell the fact event? We will see on Monday or Tuesday but the technical risk picture remains high although longer term time interval readings are still pointing up. A reversal based on bearish divergence of Weekly and Monthly risk weight could trigger a sharp correction across the crypto space. We still see this as a high potential event and lengthening the correction process that started last April. A new price high and subsequent drop would technically mark this as an irregular top and doesn't change our high risk chart pattern.

It is no denying that Bitcoin with a market cap over 1 Trillion dollars has audibly reached much institutional attention.

No Change.

09 October close: The Bitcoin narrative in alternative media is extremely bullish and we cannot deny that as a result of the current bullish sentiment across the crypto space the trend is technically positive for the BTC digital currency. The problem is that the current trend still appears as a <B> corrective wave that can even make an irregular top (well) above 64,900. If that happens we would expect the crypto market to follow this lead or even overtake this lead. Other currencies in the peer group are also showing strength. Our focus would be more on the larger native development tokens rather than pure crypto currencies simply because risk remains high. Clearly tghe financial industry leaders like Banks and other government supported entities are starting to embrace Bitcoin as a key asset class. We still cannot figure out its wider economic use other than a very small percentage allocation as an unknown insurance vehicle and otherwise as a specualtive entertainment asset. Clearly is has made quite a few million people happy gamblers again over the past few years.

Bitpanda Pro - BEST Token Price Risk Analysis

(Previous week in brackets)

| Bitpanda - BEST/EUR | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 0.7610 (0.7750) | ||||||

| Trend | ↑ (↑) | ↑ (↑) | ↓ (↓) | |||

| % Risk Weight |

28 (28) | 50 (45) | 50 (80) | |||

| Allocation Limit(variable) | Invested | 100% (100%) | ||||

BEST token live price

Bitpanda BEST analysis

16 October 2021 close: Our BEST portfolio is still one of the worst performers in the crypto space. Whilst the position is up over 900% from entry the token still seems to suffer from a large hangover at the Bitpanda broker. As the position is zero nominal risk we are waiting patiently for the correction against the broader market to develop. It doesn't take much for that to happen, but clearly there is nervousness and lack of trust. We still anticipate the fully regulated crypto Bitpanda exchange to be a leading external source for new wave financial products including a token launch platform. This should strongly benefit both Bitpanda native tokens BEST and PAN. And Bitpanda continues to grow strongly without allowing clients outside outside of Europe, it is a matter of time for the tokens to reach new highs. It may take a year or longer and worth the wait to see that trust being built and ensure a strong ROI. In the meantime BEST holders enjoy low risk monthly rewards and more, which is unique in the crypto space. No Change to this long term hold.

08 October 2021 close: Bitpanda's Ecosystem Token BEST still appears to still suffer from a long position that needs unwinding. Because this is typically controlled by the Bitpanda broker the trading platform gives little clue as to where the real price weighing is centered. We briefly reached the 0.80 handle but the market has since fallen back to 0.78 on very little volume. liquidity is an issue until account holders find more trust in this native token. We have been adding a little recently at the 0.71 level as there was still near zero movement whilst the broader market advanced at greater speed. BEST has underperformed by about 50% and looking at the technicals BEST has every chance of catching up even if the broader market stalls. We expect this token to appreciate fairly swiftly again once the interest returns. It doesn't take much demand from 3 million users to unwind any of the existing overhang which we cannot quantify, whilst Bitpanda, as the central token banker and primary market maker, cannot be seen to front run this market. Whilst interest rates remain low and inflation increases with assistance from astronomic gas prices, the wider benefits of owning BEST should ultimate take this token to new highs (> 2.60). Without the recent larger unwinding of positions the 'real' level should be closer to €1.25 per BEST token, not including any positive growth development effects of the company. We remain very patient hodlers.

S&P, Stock Indices, Equities, High Risk, No Limits

S&P 500 Standard & Poor's 500 Price Risk Analysis Forecast

(Previous week in brackets)

| Standard & Poor 500 | Monthly | Weekly | Daily | |||

|---|---|---|---|---|---|---|

| 4474 (4390) | ||||||

| Trend | ↓ (↓) | ↓ (↓) | ↑ (↑) | |||

| % Risk Weight |

92 (90) | 57 (61) | 63 (50) | |||

| Max Allocation 20% (20%) | Invested | 0% (0%) | ||||

15 October 2021 close: S&P rallied again last week with the short term time intervals looking bullish again. Long term risk remains high even though the likelyhood trend of a new high is up again. We aren't alone is leaving the equity market to its hardcore players as the technical picture is too negative and against the principle of keeping portfolio risk low. No Change.

08 October 2021 close: The S&P equities index still remains in a braoder downtrend since the recent 4550 peak. With kicking the monetary can down the road anything can happen in either direction as we know. Equities remain a high risk play also given the many world economic problems that grossly underestimated in our opinion, hence a large risk hedge with precious metals (40%), a solid ITO in place (45%) and about 15% cash in our portfolio. No Change to our longer term S&P outlook.